-

The February Deep Freeze has already pushed cedants to access reinsurance, adding fuel for rate rises later this year.

-

The association said that regulation and culture needed continued improvement and the focus should go beyond high-rise residential buildings.

-

An increased frequency and severity of fires weigh on per-risk covers.

-

Covid-19 losses materially impact the property market, but the marine, aviation and transport segment returns to profit.

-

The industry association reports that about 29,213 claims have been received so far.

-

The New South Wales inundation is the first major flood event in the state in a decade, prompting reinsurance fears.

-

Firm order terms reveal an expectation from cedants of price increases between 5% and 10% on flood covers, in line with pricing momentum from 1.1.

-

Rate rises on wind covers are broadly in the 5%-10% range, running somewhat ahead of quake increases.

-

Aon has said it expects the economic cost of physical damage and business interruption caused by the polar vortex-linked cold snap to “well exceed $10bn”, in an Impact Forecasting report released on Thursday.

-

-

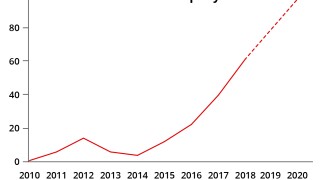

Nat cat and extreme weather claims have become more frequent and severe with hail, heavy rain and wildfires leading to significant losses.

-

Legacy acquirer Darag has agreed to buy SunPoint Holdings, the legacy business founded by Fosun in 2017.