Enstar

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

Luke Tanzer is set to retire after 16 years at the helm of the run-off carrier.

-

The take-private deal was announced in July 2024.

-

Renewable retrospective solutions were a key point during the discussion.

-

The reduction was due to impacts from investments and less favourable PYD.

-

The business, which has ~EUR300mn of book value, is expected to launch a process.

-

Syndicate 609 will cede net loss reserves of approximately $196mn.

-

The transaction mostly covers casualty portfolios of 2021 and prior underwriting years.

-

The carrier’s shares declined over 17% this morning following Q3 earnings and strategic actions.

-

The firm announced Q3 results alongside strategic actions that included an ADC deal with Enstar.

-

James River also amended the convertible preferred equity held by Gallatin Point and closed its strategic review.

-

The take-private is expected to close by mid-2025.

-

The transactions will de-risk all North America middle-market reserves up to 30 June 2024.

-

Plus the latest people moves and all the top news of the week.

-

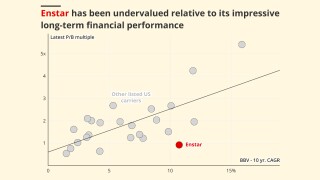

The firm escapes public market distractions and long-term undervaluation, but the low mark will hurt peer companies.

-

The ratings agency said Sixth Street provides flexibility through long-dated capital.

-

The company also announced a $5.1bn take private deal with Sixth Street.

-

She will work on preparations for the take-private deal with Sixth Street before departing.

-

The deal values the business just under its closing price on Friday, at 0.97x book value.

-

The executive replaces interim CEO Paul Brockman, who remains group COO.

-

A roundup of all the news you need today, including Enstar EU’s new CEO.

-

The transaction with Enstar covers $234mn of net Accredited reserves.

-

Berkshire Hathaway and Canada Life Re will provide as much as A$680mn of protection annually.

-

Enstar will provide $430mn of excess cover over ~$1.7bn of underlying reserves.

-

Some 39% of respondents expect deal volumes to increase in the next 12 months.

-

Enstar recorded $280mn of other income in Q1 2023 related to Enhanzed Re.

-

The stable outlook on Cavello Bay mirrors S&P’s view of its parent.

-

The legacy carrier cited the impact of its investment portfolio.

-

Enstar acquired 637,640 shares of James River in Q4 last year valued at nearly $6mn.

-

Insider Brockman will pick up the EU role on an interim basis.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

The San Francisco-headquartered alternative asset manager has invested $183mn in the run-off firm.

-

The legacy giant also disclosed a smaller buyback from Stone Point, with CEO Dominic Silvester also investing an additional $10mn.

-

The seller is facing an uphill struggle convincing its legacy rivals that there is strategic value in the merger deal.

-

The insurer has been working to build a reputation for favorable reserve development after past sins.

-

During the period, the legacy business completed a $1.9bn LPT with QBE and a $245mn LPT with RACQ Insurance.

-

In the wake of Enstar's $5.1bn go-private deal, here's our prior deep dive on the firm.

-

The carrier attributed its results to strong investment returns.

-

The deal includes a diversified book of international and NA financial lines, European and NA reinsurance portfolios, and several US discontinued programs.

-

The Canadian pension fund will retain 9.4% of the carrier’s voting shares.

-

In tandem, the company elevated David Ni as chief strategy officer, Paul Brockman as chief operating officer and Matthew Kirk as chief financial officer.

-

Following the completion of this transaction, Enhanzed Re became a wholly owned subsidiary of the legacy carrier.

-

2022 represented a period of bumper legacy deal-making for the legacy carrier.

-

RACQ will cede net reserves of approximately A$360mn (~$247mn), and Enstar will provide around A$200mn (~$130mn) of cover in excess of the ceded reserves.

-

The deal regards international and North America financial lines, European and North American reinsurance portfolios, and several US discontinued programs.

-

Enstar is conducting due diligence around taking on the rest of the Argo back book.

-

The share purchases take the founder’s stake in the legacy firm to $124mn.

-

The carrier also reported run-off liability earnings of $109mn, or 3.7% in the third quarter of the year.

-

The process has been narrowed, with parties including Catalina and Premia not going forward.

-

Probitas CEO Ash Bathia praised Enstar for its “innovative and bespoke solution to meet our strategic objectives”.

-

The transaction will eliminate Enstar’s direct exposure to cat business and boost its book value.

-

With the addition of roughly 512,000 shares, Enstar’s interest in Argo was valued at ~$62.7mn at the end of June.

-

The exec warned that there would be “more casualties” of underpricing in the legacy market.

-

The carrier was pushed to a net loss of $493mn by mark-to-market losses in its investment portfolio in Q2.

-

The outgoing exec will remain as a board member, while chief strategy officer David Ni will lead the company’s M&A strategy going forward.

-

A strong long-term financial performance and reserve reductions drove the rating revision.

-

The existing $770mn adverse development cover between the two parties has been absorbed as part of the deal.

-

The legacy specialist has faced a downturn in profits following a bumper run of results through 2020 and 2021.

-

The legacy carrier has made huge gains through its hedge fund strategy through 2020.

-

The carrier was buoyed to a set of bumper earnings throughout 2020 following major investment returns.

-

Since joining the company in 2003, Orla Gregory has held increasingly senior roles, rising to acting CFO in September.

-

Enstar plans to use the offering's net proceeds to pay down outstanding debt, as well as finance acquisitions and working capital.

-

The deal is the largest in Enstar’s history and sets Aspen up either for a sale to a strategic buyer or a return to the public markets.

-

Investments in the InRe Fund suffered volatility, leading to net realized and unrealized losses of $285.2mn.

-

Wolf will remain with the company to assist Gregory during a transition period lasting until September 30.

-

The carrier reported book value per share up 8.3% over the first half of the year.

-

The reinsurance contract indemnifies Intact against losses in excess of a £2.6bn retention on losses occurring before the end of 2020.

-

The repurchase deal will see the 16.9% interest held by the Chinese firm bought back, boosting the firm's book value per share.

-

The transfer, which includes most of the Hiscox USA surplus lines broker business, secures coverage of Hiscox reserves valued at $520mn.

-

The result reflected a significant improvement on the prior-year quarter, when the investment book was hit by the pandemic.

-

The legacy specialist advises shareholders to approve the “best practice” board change at the AGM in June.

-

The legacy company chief will also receive a $20,000 monthly housing allowance as he relocates to Bermuda from the UK.

-

The legacy carrier and Stone Point are to invest a combined $45mn in Richard Watson’s start-up.

-

The carrier has posted strong profits over three consecutive quarters after Covid-19 hit the investment book in Q1.

-

The two-layer arrangement includes a 10% retention and involves a premium of just under $1.4bn.

-

The buyer will use the acquisition to expand Arena beyond Belgium and into other European markets.

-

He has held a seat on the company’s board since 2017.

-

Hessing joined the company in September to replace David Atkins, who had been with Enstar since 2003.

-

The agreement follows a share-swap deal between the two companies.

-

An unnamed investment manager posited a Watford bid worth about $21/share around four months before Arch’s eventual $35-per-share takeover agreement.

-

The US carrier has offloaded a tranche of liability business written out of London.

-

Both StarStone and Atrium make underwriting profits after losses a year earlier.

-

The legacy carrier is the first to utilise a recently enacted framework in Oklahoma.

-

Ron Bobman has reiterated his opposition to Watford Re’s management and fiercely criticised the deal.

-

The would-be buyer presses for a non-disclosure agreement with the hedge fund reinsurer to allow due diligence to start.

-

US CEO Paul Brockman will be promoted to group chief claims officer as part of the changes.

-

Enstar, R&Q and Riverstone remain as the Willis-run process heads towards its conclusion.

-

Watford is reportedly evaluating a bid from Arch amid heightened pressure from shareholders to pursue strategic alternatives.

-

Susan Cross becomes an independent director and will serve on the company’s audit and risk committees.

-

Start-up acquirer Marco, Enstar, Riverstone and Premia are still in the running for the assets.

-

The former Hiscox CUO has $300mn of cornerstone backing from the PE firm to make a deal happen.

-

The former AmTrust executive will take over as full CFO at the end of February 2021.

-

The agreement, which will leave Enstar with 26% of StarStone US, fulfills a long-term ambition for Stone Point.

-

The deal sets an exit plan for Stone Point from the Bermuda group’s North Bay entity if that business isn’t reorganised by year-end.

-

News of the review follows last week’s deal to sell the US business to former Validus chief Noonan.

-

The legacy transaction will cover loss development at the carrier's operations, including its E&S business.

-

Enstar will remain a minority investor, with PE capital also drawn from Dragoneer and SkyKnight.

-

The deal, first announced in March, secures Aspen $770mn in cover for losses in excess of $3.8bn, as well as $250mn in excess $4.8bn.

-

The results were impacted by an unrealised investment loss of $612.6mn.

-

The carrier has agreed to reinsure legacy business underwritten by Zurich from 1 October 2015 to 30 September 2018.

-

The Bermuda company says its ADC deal with Enstar is bearing fruit.

-

Aspen is the latest to pass the risk of unfavourable reserve development on to reinsurers.

-

Losses at StarStone narrowed as the carrier cut premiums while Atrium profits were up 90 percent.

-

The move is the latest in a string of deals with companies including BorgWarner, Zurich and Munich Re.

-

The legacy insurer said that its investment reflects a belief that the business is “considerably undervalued”.

-

The carriers claim in a lawsuit that Maiden wrongfully stopped paying claims in late 2018.

-

The stock-performance-related plan comes as the carrier extends Dominic Silvester's contract, and those of the president and COO, by three years.

-

Business was quietly placed up for sale with Credit Suisse advising in H1.

-

Investment income and an improved performance at StarStone lift the group result.

-

Liabilities involved are associated with asbestos and environmental claims.

-

The executive is understood to have teamed up with former colleagues Harris and Hernon.

-

The transaction has now received regulatory approval and has closed.

-

Investment income increases, while the group’s non-life run-off operations and Lloyd’s business Atrium post an improved performance.

-

The completion of the agreement follows a prior extension of the deal deadline.

-

The deal was expected to close by the end of June.

-

Myron Hendry move recently served as EVP and chief platform officer for XL Catlin, now Axa XL.

-

Global specialty insurer StarStone reported $51mn of adverse development

-

The global insurer launched a process last year to dispose of the runoff portfolios.

-

The legacy carrier and ART Bermuda will each assume a 50 percent quota share of construction defect losses incurred by Amerisure.

-

StarStone generates a loss to its majority owner of $159mn after its management team is restructured.

-

The agreement replaces a previous arrangement relating to Maiden Re reserves.

-

Enstar assumes reinsurance reserves of £650mn through the transactions.

-

The Enstar unit will continue to provide capacity to the MGA and transfer renewal rights to an airlines and products book to the buyer.

-

The insurer’s new £500mn legacy sell-off brings into focus the £55bn reserve pot on Lime Street.

-

The carrier is exploring a deal for around £500mn of reserves, with Enstar considered favourite for this as well as the smaller Doré book.

-

The London market pair are negotiating with Abu Dhabi royals about a joint venture.

-

The transaction liability entry follows the carrier’s construction market expansion.

-

The second legacy transaction for the AmTrust quota share book is still pending approval.

-

The formation of the $470mn P&C and life reinsurer was announced last week.

-

Bermuda-based Enhanzed Re will assume both non-life and life risk.

-

Enstar has completed its previously announced $200m investment in AmTrust.

-

The offering of preferred shares will be underwritten by Wells Fargo, Morgan Stanley and JP Morgan

-

AM Best finally removed Maiden’s “A-” rating, and said it expects lower premiums from AmTrust in future

-

The legacy firm will create a Cayman Islands-based entity capitalized with up to $500mn under the agreement.

-

Idea that Catalina could look to derail Enstar LPT with injunction also dismissed by sources.

-

Maiden Holdings' recent struggles continued with its third quarter results highlighting yet further losses.

-

Enstar partnered with the Stone Point-managed Trident V funds to contribute the additional capital.

-

StarStone's combined ratio remains above 100%.

-

The former Validus executive takes over from Demian Smith following parent Enstar’s decision to end a sale process for the company.

-

The agreement for the casualty facultative reinsurance business comes after up-for-sale Maiden struck deals with Enstar and TransRe.

-

Enstar and Catalina have made approaches to buy the remainder of Maiden.

-

The spike occurred after this publication reported Maiden’s board had retained Bank of America Merrill Lynch to run a formal sales process for the company.

-

The executive replaces Demian Smith, who recently left the Enstar- and Stone Point-owned specialty insurer.

-

The duo will continue as owners of their active underwriter businesses.

-

The run-off book is said to hold around $500mn in reserves.

-

The two parties are understood to be nearing an agreement on the sale of £1.6bn of Zurich’s legacy UK employers’ liability exposures.

-

With the recent push from Lloyd’s to remediate the market’s ailing profitability, it’s widely expected that the legacy market will see greater reinsurance-to-close (RITC) deal flow in the months to come.

-

Maiden shares drop again after tumbling earlier in the week following M&A details.

-

The $25mn cover will attach once Enstar has absorbed $100mn of adverse claims development on the $1.3bn run-off book it agreed to acquire last week.

-

Assets have failed to attract the reserve prices set by Enstar and Stone Point amid a challenged operating environment for the live businesses.

-

The Insider 50 contracted marginally last week as most companies in the index stagnated

-

The deal will also see $1.3bn of legacy reinsurance liabilities sold to the run-off acquirer.

-

The quarterly results reveal an underwriting deterioration at Atrium and StarStone.