-

The governor has yet to sign a pending bill to create a public cat model.

-

Without flexible mechanisms the Corporation risks suppressing transactions.

-

The protection gap must be closed before a public cyber reinsurance scheme is possible.

-

Susan Langley will look to strengthen global business ties and promote UK growth.

-

The executive has been with ASG since it was formed in 2016.

-

The Corporation’s chair laid out plans to make Lloyd’s a preeminent market in the long term.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The assistant treasurer is also due to review the Australian cyclone pool.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

Lloyd’s will keep heritage systems operationally resilient until at least 2030.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

The violations included not using propertly appointed adjusters and failing to pay claims.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

This is the first rate filing to use the recently approved Verisk model.

-

Market leaders Atradius and Coface have both received in-principle approvals for a Lloyd’s syndicate.

-

The carrier cited elevated cat and large-loss activity, including the LA wildfires.

-

The LMA head also praised Velonetic for transparency on Blueprint 2.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

Sources have identified facilities as a different source of rising commissions.

-

The UK carrier will write business that falls in the scope of the FSCS.

-

The reduced fine reflected the PRA view that the breaches weren’t deliberate.

-

Surveys show diversity and inclusivity foster a sense of belonging and increase productivity.

-

Questions remain over regulatory touch, capital requirements and tax benefits

-

The suit claims billions of dollars are being illegally withheld.

-

Airmic has been lobbying the government to introduce a captives framework for years.

-

The strategy is a 10-year plan to drive growth in UK financial services.

-

The PRA will also have to report on turnaround time for new approvals against 10-day and six-week targets.

-

The government is consulting on reforms to the existing regulations.

-

The outcome of the consultation includes a detailed timetable for delivery.

-

State legislation has led to major strides in rate adequacy.

-

The trade body sent an open letter to the UK Chancellor ahead of her Mansion House speech.

-

Claims chiefs are caught between technological advancement and waiting for phase two

-

Cultural transformation, education, and leadership are also essential to creating safe workplaces.

-

The PRA, FCA and Society of Lloyd’s have agreed to the changes.

-

The challenge now is balancing top-line growth with underwriting discipline amid falling rates.

-

The new chair said the market must adapt for 2030 and beyond.

-

The FCA is reviewing how it can simplify regulation for commercial insurers.

-

The measure could have landed insurers with extra tax on US business.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

There are now 14 new companies writing homeowners’ policies in the state.

-

Green hushing is on the rise as Trump rows back on climate initiatives.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

The event was co-hosted by The Fidelis Partnership and IDA Ireland.

-

The £3.7bn deal was announced in December.

-

CEO Caroline Wagstaff called for a “tailored and proportionate” approach to regulation.

-

The association said privacy should be a key consideration in new requirements.

-

The LMA urges use of AI for enhanced decision making but concerns remain.

-

Future claims handlers could be "bionic adjusters” empowered by technology.

-

The increased tariff on China trade could drive up the loss quantum on the SharkNinja recall and others.

-

The Peak Re subsidiary mainly writes US motor and casualty reinsurance.

-

The change reflects the company’s growing profile within the MS&AD group.

-

The majority of the savings are expected to be realised in the retail division.

-

The Lord Mayor told the CRO Summit to stop treating risk as a dirty word.

-

The CEO transition is already visible in messaging on growth as rate change picks up.

-

Delegates welcomed the FCA’s red-tape cut, but said more is yet to come.

-

Lloyd’s CUO said established broker facilities were “big enough”.

-

The platform could help reduce claims-cash holding times by 10 weeks.

-

The CUO noted that market-wide rate change in Q1 was down 3.3%, coming in below plan.

-

The consultation is a “welcome change of approach” from the regulator.

-

Aviva and Direct Line struck the landmark deal in December.

-

Plans include a new definition of commercial customers and lead insurers compliance only.

-

The group said corporations face geopolitical and climate risk.

-

Pushing through technological change and maintaining underwriting results are top of agenda.

-

The proposals consist of supervisory expectations rather than rules.

-

Full Vanguard testing is expected to compete by the end of the year.

-

Risk managers at last week’s Axco summit said interconnected global risks require flexibility.

-

The agency cited SiriusPoint’s recent management moves including lower cat exposure as a driver of the change.

-

Insolvencies caused by the tariffs could also cause increased losses

-

Representatives from the UK broker have been ordered to appear before magistrates on 7 May.

-

Sources expect it to be a couple billion-dollar insurable market.

-

From where to prioritise investing to managing slower growth, there are tough balancing acts ahead.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

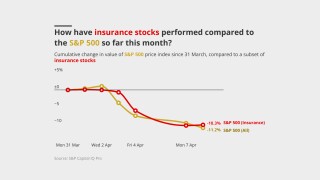

European reinsurers, London market carriers and composites all enjoyed healthy trading.

-

The announcement spurred a quick spike in stock market valuations.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

Swiss Re and Talanx led the gains among listed European carriers.

-

What does the bustling insurance industry of today have in common with the coffee shops of the seventeenth century?

-

CEO responsibilities will be shared by Chris Newman and Tanya Krochta.

-

RBC reports can help regulators identify weakly capitalized companies.

-

The regulator is also aiming to digitise and simplify its authorisation process.

-

CUO Rachel Turk said some syndicates were showing a “mismatch” in ambition and strategy.

-

“We do not have the luxury of time,” he said during the Bermuda Risk Summit.

-

The regulator has scotched plans to publish details of ongoing investigations.

-

“They've been focused on this for more than 10 years,” said Bermuda’s CIT Agency CEO Mervyn Skeet.

-

The company said it now expects the transaction to close in H2 2025.

-

The ratings agency noted “significant” underwriting improvement in 2023-24.

-

In the absence of interim action, the segment could face an “availability crisis”.

-

The carrier has paid $1.75bn on around 9,500 claims filed from the wildfires.

-

Retention levels for reinsurance fell across the different geographies the carrier operates in.

-

The insurer disclosed the estimates as it seeks emergency rate hikes from regulators.

-

The government’s consultation ended on Friday (7 February).

-

The state has seen 11 new entrants into the insurance market, reflecting renewed confidence.

-

Brokers and insurers must obtain informed consent from clients for the commissions.

-

Reinsurers on portfolios with longer-tail liabilities may withdraw.

-

The association has published a six-point plan to lessen red tape on brokers.

-

By March, firms must be able to show they can remain within impact tolerances.

-

The bodies said that the benefits of diversity and scale would help improve coverage.

-

CEO Trevor Carvey said the revision reflected Conduit’s “favourable reception”.

-

Reducing duplication of reporting is key, the association said.

-

The scheme has been pushed back by three months to 31 March 2025.

-

The firm said the UK hub demonstrates its commitment to expanding in Europe.

-

Cybersecurity basics could reduce cyberattack costs by up to ~75%.

-

Insurance will be one of five priority growth opportunities in financial services.

-

The minister highlighted London’s critical mass of expertise and tech innovation.

-

Credit insurers may need to adapt their business mix, client base and types of deals underwritten to stay relevant.

-

The scheme will not be in place for 2025 as government discussions grind to a halt.

-

A canvassing of the market showed some bifurcation on the necessity of a government backstop.

-

The ratings agency said the upgrade reflects an improvement in GIC Re’s balance-sheet strength.

-

Current efforts to battle third-party litigation funding are focused on disclosure.

-

The government flood insurance program now carries $21bn in debt.

-

Changes to the categorisation and oversight of managing agents seek to reduce duplication and thereby cut costs.

-

The cat bond application process will be streamlined to 10 working days.

-

This is the first major update to the misconduct framework since enforcement powers were introduced in 2005.

-

Disproportionate regulation has meant a 40% increase in direct regulatory cost for brokers.

-

Incoming CEO James promises transparency as digital development accelerates outside Lloyd’s.

-

HMRC is understood to be reviewing Lockton’s partnership status.

-

The regulator is considering changes that could penalise some international players.

-

The FCA’s aim is to reduce regulatory costs and increase the competitiveness of the commercial insurance market.

-

The action follows the completed acquisition of Accredited by Onex Partners.

-

What is the purpose of the Underwriting Room in the post-Covid working world? According to Lloyd's Market Association CEO Sheila Cameron, the Room remains the "beating heart" of the London insurance ecosystem, and there is "overwhelming support" to maintain it. In her role at the LMA, Sheila has a unique insight into what is top of the agenda for all 55 managing agents. Tune in to the podcast to get the latest on Blueprint Two, the state of regulation, and leadership diversity.

-

Changing customer categorisation could increase competitiveness.

-

The approval allows Davies to extend its UK broker incubation platform in Europe through Brussels.

-

Many have argued war exclusions have detracted from discussions of systemic risk in the cyber market.

-

The workshops will provide feedback on the logistics of producing and running a set of stylised adverse events.

-

Two-thirds of insurance firms have been challenged about their resilience plans by the regulator.

-

The standard is a ‘step forward’, but cross-company comparisons are difficult.

-

Stef Raftopoulos has been appointed CEO of Coverys London.

-

The Bermuda courts will assess Onex’s lower, revised offer for the fronting unit.

-

Reinsurance sources say the pool targets the wrong aspects of Australian cat losses.

-

The parliamentary candidate said politicians don't take financial services in the City seriously enough.

-

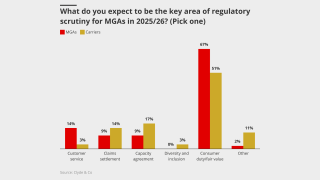

MGAs are looking hard at capacity arrangements for fear of regulatory action.

-

The global nature of cyber means a UK ransomware pay license would have "no material impact" locally.

-

The long-term issuer credit rating on Fairfax Financial Holdings was revised to BBB+ from BBB.

-

Insurers must take their responsibilities seriously.

-

The IUA argued the change would change the mutualisation of risk in the market.

-

Regulation is one of the driving forces for most small brokers to sell.

-

FCA data reveals a worrying drop in new broker authorisations.

-

Such reviews within the sector jumped from one in 2022 to 12 in 2023.

-

The group said proposals could do “irreparable reputational damage” to innocent parties.

-

The market has advanced in sophistication but must tackle talent, tax and diversification issues.

-

A thriving competitive intermediary market is what keeps London fresh.