-

The US retailer’s acquisition of the UK MGA and broking group will be mutually beneficial, according to executives.

-

The deal is not predicted to have a long-term impact on RenRe’s financial leverage, AM Best said.

-

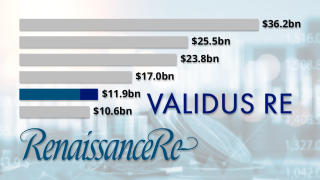

The takeover will push it up two places to rank as the fifth-largest writer of P&C reinsurance by gross premium.

-

The deal represents a 3.41x money multiple for Kentro Capital’s largest single investor.

-

The Bermudian reinsurer launched a public offering of 6,300,000 common shares and anticipates raising around $1.15bn to finance the transaction.

-

The transaction is expected to close in the fourth quarter, subject to regulatory approvals. Financial details were not disclosed.

-

The deal represents RenRe’s third Bermuda consolidation deal following Platinum and TMR.

-

The portfolio comprises of large deductible and guaranteed-cost workers’ compensation policies.

-

Investment bank Macquarie has been retained to advise the legacy firm on the disposals.

-

Tysers Retail Limited was established as a separate entity in the wake of AUB’s acquisition of the broker.

-

Howden Tiger is advising the Bermudian as it seeks to realize value from its portfolio and simplify its story for investors.

-

The PE firm also invests in Markerstudy and previously backed broker Specialist Risk Group.