Header

Your dedicated content hub

Fuel a smarter strategy with our actionable market intelligence

Lockton News

Lockton news from Insurance Insider

Competitor news

Competitor news

Competitor news

-

Insurer results and 1.1 reinsurance renewals will shape the trajectory of 2026.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

The recruits will join from Nephila, Aon and Malaysian Re.

-

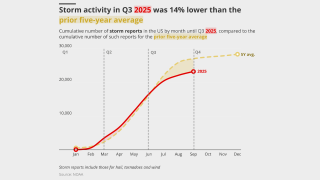

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

The aviation market has experienced a run of large losses this year.

-

The executive has worked at Aon for almost two decades.

-

Cyberattack/data breach remains in the top slot.

-

Susan Langley will look to strengthen global business ties and promote UK growth.

-

Plus, the latest people moves and all the top news of the week.

-

The toll of risk losses sustained by the PVT market this year is mounting.

-

The change in reinsurance intermediary follows an RFP for the account.

-

The broker said insurers were facing increasing pressure to improve financial performance in claims.

-

This publication revealed in February the incident was expected to lead to a major claim.

-

Chris Eaton and Bill Moret gave their notice last week without specifying their destination.

-

Reinsurer executives stressed that the industry worked hard on setting the right structure.

-

Ex-Western Europe CRB head Alberto Gallego and colleagues left for a Marsh joint venture.

-

The practice group will enhance the company’s existing offerings in E&S.

-

Plus, the latest people moves and all the top news of the week.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

The platform aims to “bend the loss curve”.

-

Cat bonds have outperformed private ILS strategies in the YTD, according to ILS Advisers.

-

Former head of construction Bill Creedon will assume the role of chairman.

-

Bazan Group’s refinery near Haifa was badly damaged by Iranian bombardment in June.

-

Scale is increasingly becoming a differentiator for reinsurance carriers, the broker noted.

-

The broker’s joint venture with Bain Capital still lacks a CEO.

-

The pair were offered contracts by Willis Re in July.

-

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

-

Reinsurance CEO Wakefield said reinsurance structures may evolve for prolonged growth.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The California wildfires showed reinsurers can absorb major cats and remain profitable.

-

What’s next for the reinsurance market as Monte Carlo approaches?

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

The deal is part of Gallagher’s ongoing Asia-Pacific investment strategy.

-

Strong CoRs and investment returns supported profitability in H1 2025.

-

Company said defendant ‘distraction’ can’t make up for flimsy arguments.

-

The broker is in hiring mode in specialty after numerous brokers departed for Willis Re.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

The reinsurance veteran joined Aon nearly 20 years ago from Cooper Gay.

-

Paul Jeroen van de Grampel drove Aon's M&A and litigation solutions proposition.

-

The broker said it was achievable to place a $2bn vertical limit in the London market.

-

Parrish, now Howden US CEO, and his colleagues said they didn’t violate contracts.

-

The broker announced the launch of its cross-class facility this week.

-

Patton Kline succeeds Glod as US aviation and space practice leader.

-

A key hearing in the poaching case is set for 4 September in New York.

-

US retailers have various levers to pull to put pressure on potential new competitors.

-

Bartlett is the latest in a series of talent moves in the construction market.

-

Placement head Delchar said Gemini will be available across its global book of in-scope risks.

-

The broker approved a grant of $316mn in equity awards payable in staggered amounts over the coming five years.

-

The broker has been on an aggressive hiring spree overseen by Lucy Clarke.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The airline has exercised a break clause to renew its cover six months earlier.

-

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

AIG leads the all-risks cover and Axa XL is the hull war lead.

-

The broker said that there could be a flattening of rate decreases in the hull market in 2026.

-

The plaintiffs seek a declaration that part of Marsh recruits’ restrictive covenants are unenforceable.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

The suit asserts the raid will cause “incalculable harm” to the broker.

-

Alistair Lester joins from Aon, where he has worked for the past eight years.

-

Plus, the latest people moves and all the top news of the week.

-

AJ Gallagher has responded to a request for additional information under the HSR filing.

-

WTW is “particularly interested” in growing markets like wealth management with bolt-on M&A.

-

-

Andrew Laing succeeds Rupert Moore, who will become reinsurance CEO for Asia Pacific.

-

The claim could add pressure to the hull war market after a recent High Court ruling.

-

The broker is looking to move as much of the book away from its adversary as possible.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

In part II of our series, we look at where AI is being integrated into claims departments.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

The facility was previously for commercial risk clients.

-

The broker has recruited from its rival as it looks to launch Willis Re 2.0.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

Staff targeted include producers that channel business through Howden’s London wholesale arm.

-

The broker’s EPS beat consensus at $3.49 for the quarter.

-

Property rates declined by 7% globally in the second quarter.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

The impact on the (re)insurance market has been muted due to its strong capital position.

-

The former Lloyd’s CEO is also eligible for a target $5mn annual equity award.

-

The expansive European broker is targeting Mike Parrish’s team and former McGriff staff.

-

Atradius Syndicate 1864 is expected to begin underwriting next year.

-

A look into how the insurance industry is using AI and where practical gains are arising.

-

Plus, the latest people moves and all the top news of the week.

-

Claims were concentrated in the US, with a significant increase in D&O class actions.

-

The broker said the appointments are designed to drive growth.

-

The technology will help analyse growing and emerging risks, especially climate change.

-

Total revenues grew 12% due to the contribution from acquisitions.

-

Coface Lloyd’s Syndicate 2546 is expected to commence underwriting in 2025.

-

The latest hires follow Rob Hale’s move to Willis.

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

The former Lloyd’s CEO will not make his planned move to Aon.

-

The broker made several senior energy hires from Marsh last year.

-

The US accounted for 92% of all global insured losses for the period.

-

Continued Apax and Carlyle support will give PIB time to differentiate its business.

-

US events accounted for more than 90% of global insured losses.

-

Apax and Carlyle will continue to back the broker consolidator.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

Willis has been adding brokers to its aviation unit in Europe and the US.

-

The availability of capacity remains the market’s key driver, the broker said.

-

Rates continue to drop as capacity is ample, the broker said.

-

Clients are increasingly using captives because of uncertainty around long-term capacity commitments.

-

Gallagher, Marsh and Aon also faced sizeable outstanding premium payments as at Q4 2024.

-

The broker’s fac reinsurance division will encompass around 70 staff, it is understood.

-

The claim hits the downstream market following a loss-hit start to the year.

-

He was most recently Marsh’s US manufacturing and automotive practice head.

-

The executive brings more than 25 years of insurance experience.

-

The broker has expanded the number of global industry verticals to seven from four.

-

The soft market continued through H1 2025, especially on shared programs.

-

Gallagher Re’s Lara Mowery said mid-year renewals marked the “beginnings of capacity” emerging.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

Premium rose across the top 15 P&C risks in 2024.

-

The broker noted a “significant variation” in renewal outcomes.

-

Willis’ continued reinsurance build-out has targeted London and Bermuda marine and retro specialists.

-

The facility, backed by six global cyber insurers, offers limits of as much as EUR5mn.

-

The Atrium-led cover renews after the multi-billion-dollar High Court ruling.

-

The platform will capture and standardise data from all submissions, the broker said.

-

Air India has a multi-year insurance arrangement in place.

-

This publication revealed his exit from MS Re last month.

-

Henk Bijl joins from Aon, where he has worked for the last 25 years.

-

Coverage has broadened while limits have increased, the broker said.

-

The executive was formerly the head of cyber solutions, North America.

-

Working out ROI on sponsorship deals is difficult, but the sport is beloved by insurance brands.

-

Sources told this publication the hull of the aircraft is valued at $80mn.

-

Brokers across London and Bermuda have handed in their notice to join the start-up reinsurance broker.

-

The documents figure in a potential criminal case against a CCB employee.

-

The Bermuda-based team is led by John Fletcher.

-

Case added that recently acquired broker NFP has “exceeded” expectations.

-

The broker is launching a reinsurance arm in partnership with Bain Capital.

-

The merger is on track to close in H2 2025, CEO Pat Gallagher said.

-

Saul Nagus is the latest from Marsh’s aviation unit to join WTW.

-

Muñoz was also Aon Re chairman for the Latin American region.

-

The executive will remain CEO of reinsurance until 1 September.

-

Most of the losses are attributable to a supercell storm in Texas.

-

Marsh McLennan canvassed finance directors and sales leaders across a range of sectors.

-

The executive will also continue as MD overseeing Caribbean fac.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

Willis has made a series of aviation hires on both sides of the Atlantic in recent weeks.

-

The executive will be global reinsurance CEO and climate solutions chair.

-

The broker replaces Louise Nevill, who is joining Axa XL as CUO for specialty.

-

Plus the latest people moves and all the top news of the week.

-

Renewable retrospective solutions were a key point during the discussion.

-

Their next destination remains unknown.

-

The exec will lead key initiatives including Aon United, and work closely with NFP.

-

Sources suggested that the multiple could be as low as the 13x range as valuations reset.

-

Insider On Air: Our Webinars & Podcast Channel

Behind the Headlines Podcast

-

In partnership with M&A ServicesJoin Insurance Insider, in partnership with M&A Services, for a free webinar 10:30 EDT/15:30 BST on Sept. 24

-

In Partnership With MarkelJoin Insurance Insider for a free webinar, in partnership with Markel, 10:30 EST/ 15:30 GMT, Nov 5

-

In Partnership With VeriskJoin Insurance Insider, in partnership with Verisk, for a free webinar at 10:30 EDT/15:30 BST on 29 September

From our other titles

From our other titles

From our other titles

From Insurance Insider ILS

Cat bond market yields hit 9.43% in September: Plenum

The figure comprises 5.48% of insurance discount margin and 3.96% of risk-free rate.

From Insurance Insider US

‘We’re holding ourselves accountable’: CA insurance commissioner Lara

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

From Insurance Insider US

Claims frequency in physicians medmal starting to creep up: Doctors president

Despite tort reform, physicians’ insurers are struggling with the same loss inflation challenges as other liability peers.

From Insurance Insider

CNA Hardy names Booth head of specialty as Berman departs

Ariel Berman joined the company as head of specialty in 2023.

From Insurance Insider US

Ascendex launches with plans for 5-7 programs in two years

Altamont Capital MD Sam Gaynor said the goal is to have fewer programs that can each grow to a significant size.

From Insurance Insider ILS

Hannover Re outlines ILS plans as Ludolphs to retire at end of 2026

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

Insurance Insider US provides robust insights, sharp analysis and exclusive news on the London and global (re)insurance markets.

Insurance Insider ILS provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.