-

Anticipations of a tug-of-war around a ‘flat to slightly up’ pricing renewal have indeed come to fruition.

-

The programme was hit hard by February’s Kahramanmaraş earthquake.

-

The P&C Re CEO discussed Swiss Re’s P&C appetite and nat cat exposure in the investor presentation.

-

The ratings agency said premium rate increases for specialty lines would be most pronounced in political risk, terrorism and political violence lines because of heightened geopolitical tensions.

-

The pool was launched in July 2022 and is backed by a A$10bn government guarantee.

-

He joins from Allianz commercial where he currently holds the role of senior property underwriter.

-

The mood at the association’s annual meeting is vastly more congenial this year, but challenges remain, particularly around long-tail lines.

-

Barrett was previously senior vice president, P&C specialties at Lockton.

-

Up-to-date building codes could reduce the amount insurers pay in the Caribbean by 18%, according to the risk modeller.

-

With US third-quarter reporting season being well underway, the results so far highlight further runway for the hard property E&S market.

-

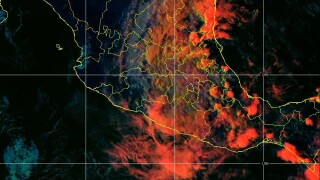

Videos and messages posted to social media show widespread devastation caused by the Category 5 hurricane.

-

Flights had been suspended into Acapulco after the storm rapidly intensified and made landfall at Category 5 strength.