-

The casualty-focused MGA was launched in March by Argenta deputy active underwriter and head of casualty Bradley Knight.

-

Sources said that there was still rating adequacy in the market, but that further pricing falls would be unsustainable.

-

Chief of IRS Criminal Investigation said Tysers had "eroded the process of fair and open competition".

-

The bill removes a previous Farm Bill requirement mandating that carriers purchase unlimited catastrophic reinsurance. Instead, companies can purchase “adequate” catastrophic reinsurance.

-

Social inflation continues to prove challenging in the casualty space and is rebounding post-Covid.

-

Deans joins from CNA Hardy, where she was a property underwriter since 2010.

-

The D&O market continues to soften, following several years of substantial rate increases.

-

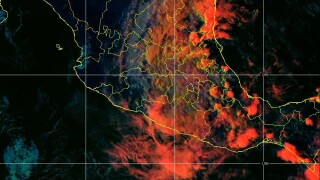

Aon-owned Mexican cat modeler ERN estimated Otis insured wind losses, excluding auto and infrastructure, at $1.2bn-$1.8bn.

-

A-Star offers up to $80mn in additional capacity for D&O liability insurance.

-

There is an increasing focus in the casualty reinsurance space on social inflation and litigation funding trends.

-

The CEO was speaking on the back of the carrier’s Q3 results, where it confirmed it would be returning $169mn to investors by way of a $119mn special dividend and offering up to $50mn in buybacks.

-

The decline marked the sixth consecutive quarter of double-digit pricing declines.