Chaucer

-

Jo Smart has worked for Torus and Aegis during his two decades in the market.

-

The Miami-based executive assumes the role left vacant by April McLaughlin.

-

The insurer is weighing up options including entering new geographies and M&A.

-

Chance Gilliland spent a decade at Chubb underwriting property binders.

-

The executive will oversee Howden Re’s treaty and fac business in Miami.

-

The announcement comes after similar launches with Inigo and Atrium.

-

Alex Nelson will work as head of power and renewable energy at the carrier.

-

The carrier has appointed Ivan Sit to head up the operation.

-

A significant amount of new capacity has flowed into the political violence and terror market in recent months.

-

The executive will take up her role on 1 January 2025.

-

Chris Cane and Jaime Hunwicks join from Talbot, Jonathan Bint from Chaucer and Molly Ashcroft from Axis.

-

The underwriter has spent a decade at Chaucer.

-

The executive worked with Artificial Labs on Chaucer’s underwriting platform.

-

The executive will join the company next month, reporting to CUO Nicola Stacey.

-

The executive will replace David Bendle on his retirement at the end of 2024.

-

The terrorism product, led by Chaucer, will offer an initial line size of $100mn.

-

Casper was launched last year by Argenta deputy active underwriter Bradley Knight.

-

-

Combined ratios have improved as prices rise and investments return to profit.

-

The launch is Chaucer’s first foray into the class.

-

Alexander Baker was a senior PV, war and terrorism underwriter at Axa XL.

-

She replaces Mark Walker, who moved last year to become head of national business for the UK.

-

Milner was appointed CEO of Aspen UK in 2020 and has held a number of senior roles within the market.

-

Prior to his resignation, Stubbs held the role of deputy class underwriter at Chaucer Group.

-

The carrier said the decision was the culmination of a “series of strategic portfolio adjustments”.

-

Mallen previously spent over 10 years at Chaucer, most recently as a US casualty reinsurance underwriter.

-

The carrier is looking to grow its direct underwriting capabilities, focussing on the offshore wind market.

-

Insurance Insider explores how insurers can manage the dual, polar-opposite pressures of a litigious anti-ESG movement and net-zero climate activism.

-

The hires come as part of a restructure of the marine and energy segment of the business.

-

The carrier is hiring in its energy team following the resignation of natural resources head James Brown.

-

The London market businesses face potential fallout as Vesttoo investigates collateral inconsistencies.

-

The underwriter has worked at the carrier for almost 20 years and has a background in specialty reinsurance.

-

Chaucer joins RSA, Liberty and Axa in the quota share arrangement.

-

There is stiff competition in the renewables space as carriers look to establish positions in a growth market.

-

He steps into the role vacated by Richard Harries, who will retire at the end of the month after more than 26 years at the carrier.

-

Group CFO Rob Callan will take on the role of group interim CEO while Chaucer looks for a successor.

-

Andrew Pearce joins following a 16-year tenure at the consulting firm.

-

Simon Tighe is taking on the group ESG position in addition to his role as group head of investments and treasury at Chaucer.

-

Signatories of the UN’s PSI must abide by four key principles, including embedding insurance-related ESG issues into decision-making.

-

The underwriter will work out his notice period at Chaucer, which remains active in the natural resources class.

-

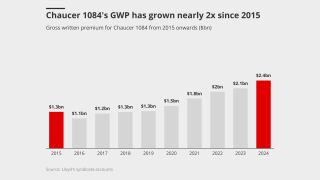

Syndicate 1084 reported an overall profit of $16.6mn compared to $129mn in 2021, as net incurred losses increased by just over $227mn.

-

The longstanding Chaucer underwriter left when the carrier exited the FI market last year.

-

Intellectual property coverage is seen as a growth market for traditional insurers.

-

The products are designed to protect against instances of purchased carbon credits failing to materialise.

-

Announcements and interviews at the UN conference have shed light on the tools emerging to help carriers decarbonise their underwriting portfolios.

-

Jodie Major worked for Chaucer’s financial institutions team, and the carrier has recently exited the market.

-

The carrier has also exited the downstream energy and financial institutions markets in recent weeks.

-

The move is the second recent class-of-business exit, with the business also having withdrawn from downstream energy.