Apollo Underwriting

-

Simon Mason will continue to support the business through the upcoming reinsurance renewals.

-

Panellists agreed a soft market should not dampen product development.

-

As two working member vacancies are arising on the Council, a ballot will be held.

-

The deal will be watched closely by Radian’s handful of similar peers.

-

Paul Sandi, head of reinsurance, will serve as active underwriter for the new syndicate.

-

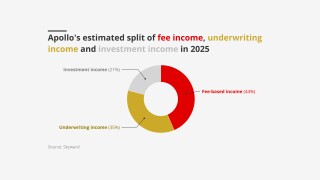

It was announced this week that the business had agreed to be acquired by Skyward Specialty.

-

Skyward’s acquisition of Apollo will provide access to the London Bridge framework.

-

The cycle-turn M&A story continues with strategic buyers to the fore.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

The US specialty carrier announced Tuesday that it was buying the Lloyd's business for $555mn.

-

Coface Lloyd’s Syndicate 2546 is expected to commence underwriting in 2025.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Plus, the latest people moves and all the top news of the week.

-

-

The Lloyd’s business secured a $90mn investment from Alchemy in 2021.

-

Since leaving Hiscox Krefta has founded a consultancy.

-

The product supports investors of early-stage carbon removal projects.

-

Rob Littlemore serves as non-executive director of the Lockton Re International board.

-

The upstream market is now in softening territory, with capacity still abundant.

-

This publication revealed the CNA Hardy active underwriter was joining Apollo last week.

-

It is understood that the executive will work as deputy CUO at the business.

-

The executive will replace David Bendle on his retirement at the end of 2024.

-

Monica Cramér Manhem was most recently CEO at SiriusPoint International.

-

Captive Syndicate 1100, launched in partnership with a “major global client”, will be managed by Apollo.

-

The status was achieved thanks to the MGA’s insurance partner, Apollo Underwriting.

-

The carrier is partnering with Munich Re Syndicate and Tokio Marine HCC.

-

Envelop SPA 1925 was launched at the start of the year with Chris Baddeley as active underwriter, based in London.

-

The company also confirmed earlier reports from this publication that Goldman Sachs would be a leading bookrunner, along with Citigroup, Jefferies and Apollo Global Securities for its ~$4bn H1 2024 IPO in New York.

-

The new syndicate will write cover for African Specialty Risks’ existing lines of business, with plans to enter new markets later.

-

The carrier has added aviation, cargo and terrorism to its initial hull offering.

-

Sompo has begun writing aviation war for the first time, while Apollo has picked its pen back up after a pause.

-

Former pricing actuary Chris Chandriotis will lead the team.

-

After Apollo announced a collaboration marking the latest milestone for algorithmic underwriting-led follow capacity in the London market, Insurance Insider explores how such partnerships can proliferate.

-

The collaboration will involve the algorithmic underwriting of risks with a human in the loop for decision verification and portfolio steering.

-

The carrier is looking to increase its presence in the marine market segment.

-

The new SPA will write cyber reinsurance initially and could progress to writing insurance.