-

Aegis, Beazley and others are among those cutting stamps.

-

The carrier boosted net premiums by 45% and shaved 2 points off its expense ratio.

-

The improved combined ratio was driven by lower losses and expenses.

-

The international segment’s net written premium contracted 5%.

-

Carriers posted weaker top-line results but delivered improved combined ratios.

-

-

The carrier’s overall P&C combined ratio improved by 1.4 points to 91.6%.

-

The reinsurer said discipline was now “equally important as price”.

-

The reinsurer is “well on track” to achieve $4.4bn in net income for the full year.

-

Aspen's GWP increased 0.9% to $1.13bn, as it focuses on “robust cycle management”.

-

P&C GWP grew by 7.1% to EUR26.8bn over the period.

-

The reinsurance loss ratio improved by over 20 points with no notable cat losses for the quarter.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

The carrier attributed the results to a significant fall in major-loss expenditure.

-

The group raised its full-year net income guidance to EUR2.6bn.

-

On a net basis, premiums written were up 4.7% to $641.3mn.

-

The carrier’s top line grew to $1.4bn in the first half of 2025.

-

-

Cyber, mortgage and crop were identified as attractive growth areas.

-

The carrier said nat-cat losses remained “well below” those of prior years.

-

The carrier’s retail division saw premiums increase by 7.3% to $2bn.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

Zaffino said AIG will continue to assess strategic opportunities after the Convex, Onex and Everest deals.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

The carrier anticipates a “favourable” retro renewal at 1.1.

-

The carrier is continuing to reposition its portfolio to drive more consistent returns.

-

The carrier said market dynamics remained robust, with overall pricing healthy.

-

Lack of major cat events could add further pressure on 1 January pricing.

-

Citi and Berenberg believe the carrier is more resilient than in the past.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

CEO Greg Case said data centre demand could generate over $10bn in new premium volume in 2026.

-

The Spanish (re)insurer reported a group net profit of EUR829mn.

-

The broker grew earnings per share by 12.1% during the quarter.

-

Opportunities for profitable growth in cat will be hard to predict, the executive said.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

The company reported no cat losses but saw a jump in attritional losses.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

In insurance, premium growth came from all lines of business except cyber.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

The upgrade reflects consistent outperformance of “higher-rated peers”, S&P said.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

Consolidated NWP reduction was driven by the reinsurance segment, partly attributable to two transactions in Q3 2024.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

The company noted tougher market conditions and higher large losses during the year.

-

The investor has made four new investments post-H1.

-

The broker’s new business and client services division is targeting $400mn of savings.

-

Earlier this week, the broking house announced a rebrand to Marsh.

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

The Lloyd’s investment business has cut expenses by 54% over the past six months.

-

The broker’s headline Ebitda was $20mn, up from $5.6mn in 2023.

-

It said the loss did not reflect the underlying economic performance of the business.

-

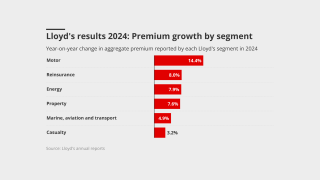

Property remains the dominant line, accounting for nearly 30% of total London premiums.

-

Rachel Turk said product-line facilities had been “under-scrutinised”.

-

Lloyd’s reported reinsurance GWP increased 10.6% to £13.2mn.

-

Gross written premium was up 6% year on year.

-

The ratings agency was presenting its outlook ahead of the Monte Carlo Rendez-Vous.

-

The division reported revenue up 13.3% at A$465.9mn.

-

The Bermudian reiterated its pledge to improve performance.

-

The combined ratio worsened slightly by 0.5 points to 91.6%.

-

The mid-year renewals point to mounting pressure on reinsurance pricing.

-

Top line grew across all carriers even as pre-tax profits dipped.

-

Besides Russia-Ukraine losses, the Air India crash losses totaled $26mn.

-

Nat-cat events triggered A$1.36bn of losses during the year.

-

The overseas division booked a combined ratio of 94% for the quarter.

-

The carrier also reported a slightly improved combined ratio of 94.6%.

-

Net adverse development for the quarter increased 30% year on year to $89.2mn.

-

The London carrier missed consensus on gross and net premiums for H1.

-

The carrier’s profit grew 34% for the year to A$1.35bn.

-

The carrier booked top-line growth of 2% in H1.

-

Rates were down 3.9% across its portfolio in the first half of 2025.

-

The Hannover Re CEO said rate adequacy remains “attractive” overall.

-

California wildfires were the reinsurer’s largest H1 loss, at EUR615.1mn.

-

The carrier cited elevated cat and large-loss activity, including the LA wildfires.

-

The reinsurer chair said the frequency of losses today “will prevent prices from slipping too much.

-

California wildfire losses were partially offset by improved underlying underwriting.

-

The P&C re segment’s combined ratio improved by 12.7 points to 61.0%.

-

The company bolstered casualty reserves by $18mn, mostly from discontinued lines.

-

The carrier reported an increase of 82% in pre-tax income.

-

The move will impact around $50mn of gross written premiums in total.

-

Tokio Marine HCC was below plan on income as the carrier prioritised bottom line.

-

The carrier’s overall P&C combined ratio improved 1.8 points to 91.2%.

-

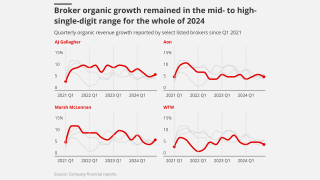

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

The Swiss carrier improved its P&C combined ratio by 1.2 points to 92.4%.

-

Cat losses of $1.5mn, net of reinsurance, were primarily due to severe convective storms.

-

Written premium increased by 31% to $2.41bn as top-line growth brought expense ratios down.

-

CEO Alex Maloney said Lancashire’s growth was “more measured” amid softening.

-

Natural catastrophe claims remained consistent compared with the prior year.

-

The carrier posted its H1 results earlier today, beating analyst consensus.

-

The loss was driven by nat cats and reserve adjustments in US casualty.

-

The carrier also announced an increased share-buyback programme.

-

The carrier said most lines remained well priced despite increased competition.

-

Prior-year reserve development moved to a $6.3mn charge in Q2 from a $19.3mn release a year ago.

-

The company also purchased $15mn of SCS parametric coverage.

-

The specialty reinsurer also saw several bad investments hit the books.

-

The company has also expanded its relationships with US and UK MGAs.

-

The carrier also benefitted from favourable reserve development in property and A&H.

-

Cat portfolios generally grew, but casualty approaches varied.

-

The reinsurance CoR decreased 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

The Canadian insurer saw property rates dip across its global divisions.

-

The business posted a 95.2% undiscounted combined ratio.

-

Aviation reinsurance reserving issues will also be a broader focus for the market.

-

AJ Gallagher has responded to a request for additional information under the HSR filing.

-

The French carrier’s first-half revenues were driven by 6% growth in P&C.

-

WTW is “particularly interested” in growing markets like wealth management with bolt-on M&A.

-

Specialty casualty now accounts for around 22.2% of its insurance business mix.

-

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The P&C segment posted an 82.5% combined ratio for the quarter.

-

Everest booked $98mn of aviation losses related to the war, which contributed 2.5 points to the consolidated CoR.

-

The Bermudian said its pursuit of SMEs through M&A will provide sustainable improvements to its bottom line.

-

Pricing was “virtually flat” in the second quarter.

-

The CEO said business remains adequately priced in most classes.

-

The carrier is reducing its exposure to quota shares and shifting to XoL.

-

The carrier said market dynamics were shifting due to increased capacity.

-

The loss ratio rose 1.9 points to 53.1%, while the expense ratio ticked up 0.6 points to 28.1%.

-

The carrier had $20mn in reserve releases in the quarter, compared to nil in Q2 2024.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

The broker’s EPS beat consensus at $3.49 for the quarter.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

The reinsurance unit’s combined ratio for the quarter was 94.2%.

-

The property segment reported a CoR of 27.4% for the quarter, down 26.5 points year on year.

-

The carrier’s top line grew to $890m in the first half of 2025.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

The technology will help analyse growing and emerging risks, especially climate change.

-

Total revenues grew 12% due to the contribution from acquisitions.

-

Rates continue to drop as capacity is ample, the broker said.

-

The MGA has been through a remedial exercise under Acrisure’s ownership.

-

The Australian carrier’s nat cat losses are A$200mn lower than its annual allowance.

-

Premium rose across the top 15 P&C risks in 2024.

-

The reinsurance division booked 29% growth for the fiscal year to 30 April 2025.

-

The investor reported a total shareholder return of £101.2mn for 2024.

-

Analysts were interested in the potential for fee income from the retail division.

-

Plus, the latest people moves and all the top news of the week.

-

Eckert said the reinsurance market is still at historically well priced levels.

-

Lloyd’s maverick syndicate produces impressive results, but questions remain over succession.

-

The investment vehicle will publish its full results on 2 June.

-

LA wildfire losses are impacting the 2024 years of account, Argenta noted.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier’s combined ratio improved by 0.7 points YoY to 91.1%.

-

The group reported an 89.7% combined ratio for the quarter.

-

The reinsurer reported EUR2.1bn GWP for the year.

-

The Japanese carrier noted the impact of increasing natural disasters.

-

The company’s parent MS&AD reported group profit of 691bn yen for the year.

-

The carrier benefited from top-line growth and lower adverse PYD.

-

P&C combined ratios were higher than Q1 2024, and wildfires impacted Hannover Re most.

-

The reinsurer’s CFO cited a 1.5% net price reduction year to date.

-

Large natural catastrophe losses totalled $570mn in Q1, driven by the LA wildfires.

-

The carrier’s overall P&C combined ratio improved 0.1 points to 91.8%.

-

The undiscounted combined operating ratio worsened slightly to 96.6%.

-

The Bermudian's first quarter cat losses totalled $333.3mn, compared to $103mn a year ago.

-

The new CEO said recent purchases were designed to protect earnings volatility.

-

New CEO Eckert said Conduit had taken “decisive action” after the LA wildfires.

-

The reinsurer said the LA wildfires would have a “dampening effect” on mid-year renewals.

-

The carrier’s share price dropped 3.6% on its Q1 results.

-

The carrier booked EUR800mn in LA losses in the P&C segment.

-

The reinsurer's group operating income fell by 14% to EUR480.5mn.

-

The carrier incurred claims from LA wildfires and flooding in Queensland.

-

The final month of the year saw an unusually high number of claims.

-

The firm expects to replace the volume with Innovations-channel business.

-

The (re)insurer used alternative capital in the reinsurance coverage.

-

Hamilton also expects rising demand and stable supply for 1 June renewals.

-

Cat losses for the quarter added 3.2 points to the carrier's combined ratio.

-

Q1 adverse reserve development went down to $4.2mn from $5.4mn a year ago.

-

Hamilton reported $150.5mn of net cat losses, partially offset by $9.2mn favourable prior year development.

-

IGI saw opportunities in energy, ports and terminals and marine cargo but remains cautious in long-tail lines.

-

Ark's combined ratio included 25 points of catastrophe losses in Q1.

-

The CEO expects overall P&C pricing to be “stable” through 2025.

-

The carrier booked LA wildfire losses of EUR148mn.

-

Cat losses included $17.5mn from the CA wildfires and other events.

-

The carrier reported a below-budget cat experience, despite the California wildfires.

-

Space pricing experienced double-digit increases after the 2023 capacity retreat.

-

Beazley, Hiscox and Lancashire all grew in Q1 despite widespread rate decreases.

-

Meanwhile, gross written premiums grew 8.6% year on year to $985mn.

-

The primary and reinsurance unit CoRs were 103.1% and 98.7%, respectively.

-

The reduction was due to impacts from investments and less favourable PYD.

-

AJG still has $2bn of M&A capacity after the AP and Woodruff Sawyer deals.

-

The remediation process is on track for completion in the fourth quarter.

-

The CUO described the pricing dynamics in the line as “strong and good”.

-

The executive also addressed the impact of the US tariffs.

-

The carrier reported a 3% price reduction across London market business.

-

The carrier estimated its California wildfire loss at $145mn-$165mn.

-

The quarter’s performance was also affected by the Washington, DC aviation disaster.

-

The Bermudian reported net pre-tax cat losses of $49mn, with $32mn attributable to the California wildfires.

-

PartnerRe’s non-life division reported a Q4 underwriting result of $21mn, recovering from a loss of $188mn in the prior-year period.

-

The group reported “robust” growth in property reinsurance premium.

-

The group reported a 19.1% return on opening adjusted tangible book.

-

Cyber and property experienced the largest price reductions.

-

The broker's share price dipped 11% in morning trading after its Q1 earnings missed expectations.

-

The commercial risk and reinsurance units delivered mid-single-digit growth.

-

The California wildfires were the only “relevant event” for the period, the carrier said.

-

The firm said supply and demand was becoming more in balance than at 1 January renewals.

-

Lucy Clarke said the broking business was resilient in the face of macro challenges.

-

Organic growth was flat on the prior year and in line with Q4 2024 figures.

-

The property segment experienced a 113.5-point impact from the California wildfires.

-

Guy Carpenter president Dean Klisura added that Q1 was a record cat bond issuance quarter.

-

The growth figure represents a 5-point deceleration on the 9% reported in Q4 2024.

-

Aegis 1225 jumped from fifth place last year to become the most profitable syndicate of the last decade.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The combined ratio improved by 1.9 points to 94.7%.

-

Growth was driven by Lloyd’s Syndicate 1274 and Antares Re.

-

The carrier laid out its business mix for the newly launched reinsurance syndicate.

-

The first quartile contracted on the back of Beazley 2623’s GWP reduction.

-

Reported income for the year rose 24% to $1.98bn.

-

Alexandra Cliff will take a base pay of £425,000 per annum, compared with Keese’s £550,000.

-

Last year, nearly two-thirds of Lloyd’s syndicates reported a deterioration in combined ratio.

-

The carrier posted significant growth in 2024, with GWP up 30% to $493mn.

-

The combined ratio improved 1.5 points to 90%.

-

GWP increased 24% year on year at the Asta-managed syndicate.

-

The combined ratio improved by 3.2 points, from 80.9% in 2023 to 77.7% in 2024.

-

The company booked profit for the year of £247mn, up 20% on the prior year.

-

The syndicate’s claims ratio worsened due to an “exceptionally active” hurricane season.

-

The syndicate expects £5.8mn-£8.6mn in California wildfire claims.

-

Reinsurance made up 12% of the syndicate’s 2024 GWP.

-

The market took a higher share of hurricane losses and couldn’t cut its acquisition costs.

-

Standfirst: The syndicate reported a strong turnaround despite exposure to major claims.

-

The syndicate achieved a profit despite a “relatively heavy” catastrophe year.

-

Ki cut its top line by 8.7%, while Beazley’s smart-tracker expanded to $481mn.

-

Results were impacted by prior year reserving and an unwind of intragroup reinsurance recoveries.

-

Most of the market’s largest syndicates kept their CoRs below 90% as prices remained adequate.

-

The executive said the market would be updated on progress in late April.

-

MAP’s Christopher Smelt said impact on nationwide programmes will cause risk aversion.

-

Reinsurance and property remained the primary drivers of premium growth.

-

The Corporation’s CFO hailed profitable growth but warned syndicates to maintain discipline.

-

Hurricane Milton was the largest group loss event at EUR290mn for the year.

-

The segment’s underwriting results halved to $532mn in 2024 from $1.07bn in the prior year.

-

CEO Andrew Carrier says the business has strong “forward momentum”.

-

Gard acquired Codan’s global marine and energy portfolio during 2024.

-

The property and specialty insurer reported underwriting profits of $131mn ($170mn).

-

The syndicate reported an undiscounted net combined operating ratio of 77.9%.

-

The Italian carrier posted a record group profit of EUR7.3bn.

-

For the prior-year quarter, the carrier reported a EUR9mn loss.

-

The firm delivered a 22% year-on-year increase in GWP to $1.1bn.

-

The group posted an undiscounted combined ratio of 90.2% during the year.

-

The market improved on attritional losses in 2024 – but slowing rate growth raises queries over top-line momentum.

-

While market underwriting profit slipped 10%, the underlying combined ratio was under 80%.

-

Hiscox, Beazley and Lancashire all reported top line growth, but ROEs dipped in an active wind season.

-

CEO John Fowle said “isolated missteps” had tarnished Atrium’s record.

-

CEO Alex Maloney said the LA fires might prompt some carriers to go more “risk-off”.

-

The carrier reported an undiscounted combined ratio of 89.1%.

-

The reinsurer pegged the market loss at $40bn.

-

The carrier pegged its LA wildfire losses at EUR140mn.

-

He said that “everyone’s looking for growth”, as the firm has moderated its top line projections.

-

Predicting underwriting conditions for the remainder of the year is ‘challenging’.

-

The London carrier posted an undiscounted combined ratio of 79%, up from 74% in 2023.

-

The result is 1.1 points ahead of the midrange of a 6.4%-16.4% forecast.

-

Returns on capacity reduced, forecast at 4.4%-14.4%, have settled at 4.6%.

-

Plus, the latest people moves and all the top news of the week.

-

The combined ratio improved by 0.5 points to 75.7%.

-

The company also announced a EUR2bn share buyback.

-

Changes in business mix towards specialty and improved reserve development offset higher Q4 cat losses.

-

The estimate is based on industry losses in the range of $35bn-$45bn.

-

CEO Andreas Berger addressed Swiss Re’s primary aviation exit.

-

The carrier’s CoR improved across P&C, including at commercial lines-focused Axa XL.

-

Conditions in the London market remain attractive according to CEO Aki Hussain.

-

UK and Ireland GI premiums rose 16% over the year.

-

The carrier announced a $175mn share buyback.

-

Cat losses in the quarter totalled $49.1mn, net of reinsurance, of which $37.8mn was from Milton.

-

The carrier will look to grow business outside North America.

-

The carrier expects the market loss to land at $35bn-$40bn.

-

The carrier pegged its claims expenditure for the LA wildfires at EUR1.2bn.

-

The group's reinsurance book was also hit with cat losses during the quarter.

-

The carrier reported $2.8mn of favourable development compared to a $3.3mn charge a year ago.

-

The division reported revenue up 10.4% at A$204.2mn.

-

The conglomerate reported after-tax cat losses of $1.2bn related to Hurricanes Helene and Milton in 2024.

-

Retention levels for reinsurance fell across the different geographies the carrier operates in.

-

The carrier pegged its California wildfire losses at $200mn pre-tax.

-

The carrier said 72% of those losses occurred in personal property.

-

The chairman said the recent events were akin to Andrew, Katrina and the WTC.

-

SiriusPoint’s property book grew 25% in full year 2024.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

The carrier expects to book $100mn-$140mn from the California wildfires.

-

The firm’s core CoR improved 3.2 points to 90.2%.

-

With another year of underwriting profits banked, the ‘Golden Age’ isn’t over yet.

-

The broker reported 12% of organic growth for the year.

-

The international segment’s CoR deteriorated slightly due to increased expenses.

-

Improved underwriting helped absorb claims from the Baltimore bridge collapse and Hurricane Helene.

-

Deteriorating CoRs, GWP growth and fears over wildfire impacts were common themes.

-

The group reported strong underwriting results in all major overseas P&C segments.

-

The Australian carrier disclosed A$426mn in net cat losses during H1.

-

The Dana floods in Valencia resulted in a EUR34mn net impact at group level.

-

The LA-based firm estimated gross cat losses in the range of $1.6bn-$2bn.

-

The company, meanwhile, is bullish on E&S US casualty.

-

The firm pegged industry losses at $35bn-$45bn.

-

Over 2024, four hurricanes added 13 points of cat-loss impact to the combined ratio.

-

Plus, the latest people moves and all the top news of the week.

-

The board intends to issue a dividend of EUR2.70 per share.

-

The company did not take questions on its recently announced business review.

-

The carrier disclosed it will book $1.1bn in net losses from the California fires.

-

The insurer acknowledged additional claims in 2025 would be “reasonably possible”.

-

Single-digit organic growth, robust casualty pricing and tapering margins were all key trends.

-

The specialty insurer reported favorable developments in both its insurance and reinsurance segments.

-

The carrier reported expansion in financial lines and marine.

-

The broker CEO explained talent is what drives organic growth.

-

The group’s revenues expanded by 23% to more than £3bn for the year to 30 September 2024.

-

The arrival of Marsh’s Donnelly will "accelerate" US specialty growth, the CEO said.

-

At 1 January renewals, prices dropped 5%-15% for loss-free programmes.

-

CEO Carl Hess said WTW is entering 2025 with “considerable momentum”.

-

The Bermudian’s wildfire loss estimate was based on an industry loss range of $35bn-$45bn.

-

Aon saw lower rates in reinsurance as capacity outstripped demand.

-

President Andersen said he was optimistic about the 2025 reinsurance market.

-

The broker introduced 2025 guidance for mid-single-digit or greater organic growth.

-

Claims related to California wildfires are "fairly insubstantial" to date, executives said.

-

Organic growth in broking segment Marsh accelerated during the reporting period.

-

The carrier’s Q4 CoR decreased 34.8 pts YoY to 94.2% as it reported favorable prior-year reserve development.

-

The reinsurer is ready to deploy additional capacity following the event, but only if prices are commensurate with risk.

-

The carrier has been reducing its exposure to the area where the wildfires occurred by over 50%.

-

Hurricane Milton brought the firm net losses of $270mn in Q4, while it forecast up to a $750mn wildfire hit for Q1.

-

CEO Jim Williamson said social inflation was a “growing barrier” to a vibrant economy.

-

The (re)insurer recorded a reserve charge of nearly $1.3bn within its casualty insurance book.

-

The insurer will focus on UK regional growth and opportunities in cyber for the coming year.

-

The insurer also added $150mn cat coverage while reducing the total ceded premium for this treaty.

-

Churn is expected to return to the market in 2025 as scrapping of older fleet accelerates.

-

The transaction mostly covers casualty portfolios of 2021 and prior underwriting years.

-

The Aventum Group broker is targeting placing £1.1bn of GWP by year end 2026.

-

The carrier revealed new group financial targets at its Capital Markets Day.

-

The carrier’s lower hurricane exposure was driven by portfolio exits and optimisation.

-

The deterioration was driven by increased operating expenses.

-

The international segment’s net written premium grew 15.8%.

-

Parent MS&AD highlighted “strong underwriting fundamentals”.

-

Parent group Talanx reported a 9M operating profit of EUR3.7bn.

-

The P&C combined ratio improved to 94%, while premiums rose by 6.9% to EUR25bn.

-

Cat losses in reinsurance rose 11.1% year over year to $45.1mn, driven by Hurricane Helene.

-

Nat cat pricing is expected to be more or less flat, with rises on loss-affected programmes.

-

The group reported a combined ratio of 91.2 for the period.

-

Improved underwriting results thanks to pricing action were offset by nat cat activity in Canada.

-

The carrier has also completed a review of its L&H unit.

-

The company said it is still on target to achieve $3bn net income for the full year.

-

After one good year, giving back margin now will be “inexcusable”, the executive said.

-

Allianz’s P&C unit booked natural catastrophe claims of EUR646mn over Q3.

-

Cat losses increased 14.6% to $91.6mn, driven by Hurricane Helene and Storm Boris.

-

Ceding commissions remain elevated, but primary rates are improving reinsurer margins.

-

The carrier’s shares declined over 17% this morning following Q3 earnings and strategic actions.

-

The firm announced Q3 results alongside strategic actions that included an ADC deal with Enstar.

-

Hannover Re’s CEO said the market had been disciplined.

-

The reinsurer’s large losses tallied up to EUR1.3bn for the nine-month period to 30 September.

-

In other property, Helene and Milton will assure rates remain attractive, he added.

-

D&O and D&F are also facing increased competition, but property remains price adequate.

-

The carrier said it expected its Milton losses to fall below its EUR500mn ($537mn) Helene loss.

-

Rates are continuing to soften in D&O and cyber, according to CFO Paul Cooper.

-

The carrier’s retail division saw the largest growth at 4.7%.

-

Major-loss expenditure doubled to EUR1.6bn for the quarter

-

The carrier has pegged preliminary pre-tax Milton losses at less than $200mn.

-

Hamilton reported a $30mn-$70mn net estimate for Hurricane Milton losses.

-

Hurricane Milton is estimated to have a net negative impact of $275mn on Q4 results.

-

The company has written over $100mn in gross premium in the US this year.

-

The combined ratio included 17 points of catastrophe losses in the third quarter.

-

The CEO said the property market was in a “super-good place”, and increased competition was inevitable.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

Some US and European cedants will likely see "specific adjustments" to their programmes.

-

The carrier said activity across smaller and mid-sized natural catastrophe and risk events had been “elevated”.

-

The carrier said an active hurricane season and a global cyber event had not altered its full-year guidance.

-

The carrier increased insurance revenue by 16.8% to $1.3bn year on year.

-

Losses were attributed to the Taiwan earthquake and flooding in Middle East and Europe.

-

The results were disclosed in parent company Fairfax’s quarterly earnings.

-

The conglomerate expects pre-tax losses from Hurricane Milton of between $1.3bn-$1.5bn in Q4.

-

The firm is still operating within its catastrophe budget for the year, CEO Scott Egan said.

-

The company has grown its premium base by 12% annually over the last five years.

-

The carrier booked $30.6mn of favourable development in the quarter.

-

Arch is assuming an industry loss related to Helene in the $12bn-$14bn range.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

The company’s reshaping of the book will be substantially completed by year end.

-

The global market is stabilising and softening, and casualty and specialty lines are generally stable, the CEO said.

-

The broker posted a net loss of $1.67bn including pre-tax non-cash losses.

-

Most of the $279mn in cat losses came from the reinsurance segment.

-

The reinsurance CoR rose 12.3 pts to 92.3% following $364mn of cat losses in the quarter.

-

Pre-tax cat losses were $78mn, or 5.8 points on the Q3 CoR, compared to last year’s $42mn, or 3.2 points.

-

The carrier estimated its net Helene and Milton losses at under EUR200mn.

-

The CEO noted, however, that the UK retail market remains a big business growing well.

-

Over the period, the Spanish carrier’s reinsurance segment expanded profit by almost 10% year on year.

-

Liberty Mutual expects $550mn in Helene losses versus Milton’s $250mn-$350mn.

-

The carrier’s estimated pre-tax losses from Milton are $65mn to $110mn.

-

The broker said Europeans are pushing hard for rate or attachment point relief.

-

The broker expanded margins and grew earnings per share by 17% during the quarter.

-

More broadly, the firm is looking at over 100 potential mergers in its pipeline, with ~$1.5bn acquired revenue.

-

The investor backed two further underwriting agencies after the reporting period.

-

The reinsurer said three Canadian loss events in the quarter will lead to similar claim expenditure as Hurricane Helene.

-

Prior to the event, clients were expecting a “very competitive market environment”.

-

CEO John Doyle said global property rates were down 2% versus flat in Q2.

-

Organic growth fell by 1 point quarter on quarter and was down by 5 points from Q3 2023.

-

The company incurred $563mn of total cat losses related to the storm.

-

Arch announced the retirement of CEO Marc Grandisson on Monday, with immediate effect.

-

Lloyd’s is to take a 75% stake in PPL Technologies Group.

-

The vehicle’s GWP increased by 45% to £230mn over the period.

-

-

The marine carrier’s financial result for the period was $25mn.

-

-

The market remains concerned about managing the pricing slowdown, but a “super cycle” continues.

-

The executive said that the market was in a protracted period of stable underwriting and capital.

-

Overall, Lloyd’s H1 market underwriting profit came to £3.1bn, as the CoR improved by 1.5 points to 83.7%.

-

The CFO said defending profitability is the Corporation’s “utmost goal”.

-

GWP was up 6.5% to £30.6bn, a notable slowdown from the 21.9% growth posted in the same period a year ago.

-

The GWP total marked an 18% year-over-year increase from $145bn in 2022.

-

Plus the latest people moves and all the top news of the week.

-

The carrier’s profit fell 22.2% year on year during the six-month period.

-

The syndicate posted GWP of $317mn for the first half of the year.

-

Scor disclosed L&H troubles while Swiss Re continued reserving for US casualty.

-

Return on capital employed hit 13% last year as the cost of capital fell to 8%.

-

Positive cat experience impact of $600mn was offset by $500mn in property and specialty reserves.

-

The P&C Re CoR came in at 84.5%, a 10.2-point YoY improvement.

-

In its first full year of AUB ownership, the broker reported a 24% Ebit margin.

-

The Australian carrier grew premium income by 11% to A$16.4bn.

-

The improvement was attributed to growth in new business and inflation-related price adjustments.

-

Nat cat events triggered A$1.23bn of losses during the year.

-

The carrier also reported more difficulty than anticipated in realizing the value of collateral following the defaults.

-

The carrier’s single largest P&C loss was German flooding at EUR120mn.

-

The reinsurance segment reported cat losses of $43.2mn versus $15.2mn in Q2 2023.

-

The losses were driven by events in property D&F, particularly tornadoes.

-

The carrier said the global commercial market was “highly attractive".

-

Clemens Jungsthöfel said Hannover Re was sticking with its first-quarter approach.

-

Insurance contract written premium increased by 23% to $1.84bn.

-

Lancashire was the only carrier to see double-digit growth in insurance revenue for H1.

-

German floods were the carrier’s largest H1 loss, at EUR120mn.

-

The subsidiary’s financial result swung from loss to profit for the period.

-

Plus the latest people moves and all the top news of the week.

-

The international business grew premiums by 12.5% over the period.

-

The carrier unveiled major spending on overseas growth initiatives.

-

Natural catastrophe claims increased by 0.5 percentage points in the first six months of 2024.

-

Albo cited rate increases, improved terms and conditions and line size management among cedants.

-

The CEO said the carrier’s hurricane exposure has remained static in the last few years.

-

The CEO said he expects cyber rates to start flattening post-loss.

-

The reinsurer also said it expected no significant impact from the CrowdStrike losses.

-

The executive argued that Beazley’s performance is the ultimate driver of the insurer’s valuation.

-

Allianz’s group profits were up on stronger investment results.

-

The carrier's combined ratio in P&C operations rose slightly to 93.6%.

-

CEO Alex Maloney hailed the results as the “best ever half-year performance” for the carrier.

-

Growth was driven by active risk selection, as rating environment begins to moderate, said CEO Cox.

-

Its combined ratio stayed under 80%, which may give it room to outperform on annual targets.

-

The Bermudian booked net favorable reserve development of $1.6mn.

-

The firm’s exposure to US SCS was almost exclusively related to a non-renewed homeowners’ program.

-

Cat losses were lower year-on-year but other risk losses were recognised.

-

Hiscox posted a H1 London market combined ratio that worsened by 3.7 points to 86.9%.

-

IGI’s reinsurance unit lifted underwriting profits but short-tail specialty dropped year-on-year.

-

Hussain said the firm’s exposure to the CrowdStrike losses was “immaterial”.

-

Hiscox said in its big-ticket businesses, “positive market conditions have persisted”.

-

Cat losses added 8.4 points to the combined ratio.

-

Improved underwriting and investment results lifted the group’s international performance.

-

Geico more than tripled U/W profits due to higher average premiums per auto policy and lower claims frequency.

-

The company recorded an undiscounted CoR of 93.9% in Q2.

-

Group deputy CEO Frédéric de Courtois said the issue of inflation is “mostly behind us".

-

The results were disclosed in parent company Fairfax’s quarterly earnings.

-

At group level, Axa’s underlying earnings improved by 4% to EUR4.2bn.

-

Q2 2023 PYD had included reserve releases in connection with the LPT to Compre.

-

This follows the insurer reporting $56.4mn of losses from intellectual property business in Q2.

-

In November, the company said it aimed to reach the goals between 2024-2026.

-

Total pre-tax cat losses for the quarter grew sixfold YoY to $135mn.

-

The slowdown was based on a conviction of “higher likelihood of frequency events” this year.

-

The carrier continued to expand in property and specialty, especially non-cat exposed business.

-

The results were impacted by cat events and reserve strengthening in US casualty.

-

The reinsurance segment LR reflected 10 points of cat activity, up YoY from 6.7.

-

The company did not book any changes in its prior period reserve development.

-

Léger confirmed that his move to lead the L&H unit will not be permanent.

-

The P&C segment posted an 86.9% combined ratio for the quarter.

-

The company also announced a $5.1bn take private deal with Sixth Street.

-

US-listed brokers and carriers have generally continued to produce strong growth even in a transitioning market.

-

President Eric Andersen said non-malicious cyber risk was “front of mind” for clients.

-

Organic growth was in line with WTW and Marsh McLennan, which both posted 6% underlying expansion.

-

The carrier booked a EUR41mn impact from Brazilian flooding.

-

CRB NA growth was driven by specialty lines, including natural resources, construction and real estate.

-

The broker raised the low end of its 2024 target ranges for adjusted operating margin and adjusted EPS.

-

The property CoR improved by 9.1 points, while casualty and specialty’s fell 5 points.

-

The carrier purchased an additional $150mn of cover.

-

-

The executive said challenging loss cost trends were contributing to rate rises.

-

Earnings per share were up 10%, while the margin expanded by 1.3 points.

-

Work to revitalise the French reinsurer just got harder as problems in its life book crashed the share price.

-

The negative L&H result was driven by reserve updates.

-

The negative L&H result was driven by reserve updates.

-

US and international operations, as well as global reinsurance, all posted double-digit organic growth.

-

Interest is growing in third-party capital, captives and private debt.

-

The investor reported a total shareholder return of £41.7mn for 2023.

-

The result was driven by significantly improved claims experience across severity bands.

-

Major deals include a $1.3bn loss portfolio transfer with SiriusPoint.

-

The carrier’s combined ratio improved by 1.4 points YoY to 91.8%.

-

The club’s net combined ratio dropped by 2 points to 93% for the year.

-

The investment vehicle reported a profit before tax of £22.7mn.

-

The legacy specialist’s total comprehensive income also returned to the black.

-

The undiscounted combined operating ratio increased slightly to 95.8%.

-

Combined ratios improved all around thanks to better pricing and a benign cat quarter.

-

The group's P&C segment reported top-line expansion of 6.2% over the period.

-

MS Re reported a net profit of $366mn, which was hailed as a “watershed” for the company.

-

The carrier banked a $575mn prior-year reserve charge in fiscal Q4.

-

The unit booked rate increases and the reversal of Ukraine and Covid-19 losses.

-

The marine carrier reported a ‘benign’ P&I claims environment.

-

The CEO said Scor is still on track to hit a full-year 87% combined ratio.

-

The carrier reported 1 April price increases of 3.2%.

-

CFO John Dacey said the carrier had concluded it was not the “best owner” for iptiQ after a strategic review.

-

The carrier reported rate increases of 5% across its P&C portfolio.

-

P&C re and CorSo reported improved net profits and combined ratios for the quarter.

-

The carrier is confident of “clearly exceeding” its group net-income forecast of EUR1.7bn for the year.

-

Property and specialty led the carrier’s expansion, with growth in casualty more modest.

-

Premium income was down due to lower volume in financial lines and alternative risk transfer.

-

After an unexpected charge in Q4 last year, the carrier feels “very comfortable” with its reserving position.

-

At group level, Hannover Re's operating income grew by 15% to EUR558.1mn.

-

Along with D&F, Fidelis is looking to grow in marine construction and aviation.

-

The carrier said nat-cat claims were running in line with plan assumptions.

-

The carrier also reported a $16mn satellite loss during the quarter.

-

The company’s results come less than two months after announcing its Lloyd’s syndicate.

-

These cedants could offer the firm access to support their casualty and specialty lines as well.

-

The bridge disaster added 6.3pts points to the company’s overall CoR in Q1.

-

The bridge collapse added 9.8 points to the consolidated quarterly CoR.

-

CFO Christoph Jurecka declined to give a loss estimate for the Baltimore Bridge loss.

-

The carrier reported a P&C re net result up 44% to EUR1.8bn.

-

-

The insurance arm’s CoR declined 4 points to 89.3% on lower cat losses.

-

Enstar recorded $280mn of other income in Q1 2023 related to Enhanzed Re.

-

-

The primary casualty book was down by “some 26-odd percent from the prior year”.

-

In certain classes like energy or cat, AIG switched “a bit” to XoL from quota share.

-

The CEO said the carrier had identified several areas in its portfolio as having room to grow.

-

The carrier shifted away from quota share in a bid to control cat volatility.

-

The carrier said it remains on track to hit a mid-80s combined ratio at the end of FY 2024.

-

The carrier said rating in the London market came in ahead of expectations.

-

The GWP gain was driven by an 11.2% increase in the insurance top line and 11.8% in reinsurance.

-

The Bermudian has been reducing exposure in Florida for almost a decade.

-

This publication revealed that the firm is working with Jefferies on the sale of its A&H MGA Armada.

-

From here on out, insurers will likely have to rely on the strength of their individual stories.

-

Property rates remain adequate, although price increases are tailing off.

-

The legacy deal comes one year after a $1.3bn LPT with Compre covering several lines.

-

The property CoR improved by 13.7 points, while casualty and specialty’s deteriorated by 6.7 points.

-

There was no material development on long-tail casualty lines across all years, he said.

-

The company plans to grow exposure for June 1 and July 1 renewals.

-

The reinsurance segment's loss ratio reflected 3 points for the event.

-

The firm booked $85mn of pre-tax cat losses, primarily driven by the Baltimore Bridge collapse.

-

The carrier confirmed a combined-ratio guidance in the “low 80s” for the year.

-

Aon’s CEO said the business was formerly “very underweight” in the middle market.

-

The broker announced yesterday it had completed its $13bn acquisition of NFP.

-

The group expects that its full-year forecast can be "exceeded significantly”.

-

The executive said expansion was driven by retention and new business.

-

The carrier’s reinsurance segment doubled its net result to EUR67mn.

-

CEO Carl Hess hailed a “solid” first quarter of results.

-

There is a high likelihood the property claim will be subrogated.

-

The carrier increased its top line by 35% to $1.1bn.

-

The carrier’s Q1 P&C re combined ratio is around 75%.

-

The US casualty market was “challenging”, the executive said.

-

The Q1 figure represents a 2-point acceleration on the 7% reported in Q4 2023.

-

The carrier reported a combined ratio of 89.6% for the year.

-

The market also outperformed various indices including the MSCI World.

-

R&Q Legacy will book adverse development of ~23% of net reserves for the year.

-

This year’s analysis of profitability and volatility also includes an alternate view over five years.

-

In a departure from 2022 trends, fourth-quartile firms grew the slowest of all syndicates in 2023 at 8.1%.

-

Ariel and Blenheim were among eight syndicates moving into top underwriting quartile in 2023.

-

The syndicate’s total recognized gains were up to £61mn, from £28mn in 2022.

-

The syndicate reported a combined ratio of 101.2% in 2023.

-

Growth in property income was offset by a reduced share of finpro business.

-

The syndicate's GWP increased from £51.6mn in 2022 to £141.9mn.

-

The syndicate posted a combined ratio of 84.6% and GWP of more than £1.2bn.

-

Work is still to be done on the investor proposition, expenses, and navigating a waning pricing cycle.

-

The group-level CoR worsened 4.7-points in the quarter, coming in at 89.4%.

-

CFC noted that growth moderated amid increased competition in cyber.

-

The syndicate reported profit up 44.7% to $153mn for the year.

-

The executive said Aviva and Fidelis had endorsed the market’s turnaround.

-

-

Atrium reserved £264.5mn for potential claims resulting from leased aircraft in Russia.

-

The syndicate recorded GWP of £705.1mn in 2023.

-

Active underwriter Smelt said competitors’ ‘blanket’ approaches are creating opportunity.

-

The underwriting loss came in at £88mn, as reserve strengthening reached £189mn.

-

Combined ratios have improved as prices rise and investments return to profit.

-

The syndicate’s GWP reached £1.44bn in 2023, a 7% increase on 2022.

-

Primary casualty, aviation and motor classes were outliers in a bumper year for the market.

-

The Lloyd’s CFO said returns needed to remain high due to investor fatigue.

-

Pro-forma income hit $1.9bn for the year, alongside pro-forma Ebitda of $695mn.

-

The carrier reported an undiscounted combined ratio of 76.2% for the year.

-

-

The unit’s combined ratio worsened by 1.6 points.

-

The Goldman-backed consolidator branched out into MGAs this year.

-

The MGU is exploring additional third-party capital relationships.

-

Hard-won profitability has given carriers room to salt away reserves.

-

Marine and energy results normalised after a ‘staggeringly good’ 2022.

-

The reinsurer’s solvency ratio currently stands at 269%.

-

The carrier has also recruited Swiss Re’s Thorsten Steinmann.

-

Property, PV and energy lines are driving the carrier’s growth, offsetting long-tail declines

-

The 'particularly strong' result is due to minimal cat loss activity.

-

The Bermudian booked lower cat losses and lower adverse development in Q4.

-

For the 2022 year of account, the updated forecast remains unchanged.

-

The result was a profitability turnaround of £300mn.

-

The syndicate improved its net loss ratio by 15.9pp to 54.2%.

-

The carrier said it had also experienced a healthy start to 2024.

-

The company posted a record group profit of EUR6.9bn.

-

The Lloyd’s chief of markets argued that unmet demand and latent risk will keep rates increasing.

-

The carrier reported $1.2bn profit and 71% CoR for 2023.

-

CFO said rate discipline needed to remain to offset prior-year losses.

-

Syndicate 6104 closed its 2021 year of account with a profit of 4.1%.

-

The carrier announced a £300mn share-buyback programme.

-

Beazley was one of the first four cyber cat bond sponsors.

-

Beazley also confirmed the appointment of CFO Barbara Plucnar Jensen.

-

The Bermudian booked $6.5mn of cat losses, or 1.8 points on the CoR.

-

In August 2023, Lancashire announced it was planning to launch in the US.

-

The firm also reported GWP of $913mn, a 35% YoY increase.

-

The firm reallocated from short-tail lines amid social inflation concerns.

-

The company proposed a dividend of EUR1.8 per share for 2023.

-

The carrier reported an undiscounted combined ratio of 82.6% in 2023.

-

The deals cover 42% of the carrier’s casualty reserves.

-

-

The London-listed carrier announced a $150mn share buyback.

-

The (re)insurer’s Q4 CoR rose 15.2 points to 81.4% on satellite failure, D&F losses.

-

Opportunities for profitable growth remain in 2024, the agency said.

-

The carrier’s top line grew by 6.5% to $164.9mn during the quarter.

-

Losses were driven by the Viasat-3 satellite failure, the Sudan conflict and D&F events.

-

ERS 218 reported a 3.4% return on its £48mn capacity.

-

Managing agents submitted audited returns to Lloyd’s yesterday.

-

It also highlighted loss deterioration on its 2015-2018 casualty books.

-

The carrier announced a capital repatriation plan of EUR3.5bn.

-

The carrier has reported that full limits remain on all insurance cover.

-

He praised 2023 insurance results as other sectors were a “disappointment”.

-

Excluding TransRe, the group’s losses declined by $509mn last year.

-

-

The P&C segment reported a 71% increase in underlying earnings.

-

Beazley is expected to announce its year-end results on 7 March.

-

At the group level, Zurich reported its highest-ever return on equity.

-

Instead, the firm’s core segments reported $13.5mn in full-year cat losses.

-

The carrier will prioritise underwriting profits over growth in 2024.

-

The firm said “respect” for reinsurance is at a high.

-

The Bermudian achieved a 72% CoR and an improved investment result.

-

Consolidated underwriting income shrank 36.6% YoY to $36.7mn.

-

The legacy carrier cited the impact of its investment portfolio.

-

The broker’s $47bn DoJ fine had “no material impact” on profits.

-

The marine insurer said it fulfilled all mutual P&I renewal targets.

-

The Australian carrier has a full-year natural peril budget of A$1.09bn.

-

The international business grew premiums by 17%.

-

The carrier booked a fourth-quarter combined ratio of 88.3%.

-

The group’s net profit leapt six-fold to $3.2bn for the year.

-

CEO Grandisson described Arch as "bullish" in its prospects for 2024.

-

During the quarter, it booked $137mn in cat losses versus $34mn a year ago.

-

Its property cat aggregate cover renewed with improved coverage.

-

Mapfre recorded a net result of EUR677mn, a 20% increase on the year prior.

-

Sompo International booked an adjusted profit of $860mn for its fiscal Q3.