-

Munich Re anticipates claims expenditure from winter storm Uri in the triple-digit-million euro range.

-

Aon has said it expects the economic cost of physical damage and business interruption caused by the polar vortex-linked cold snap to “well exceed $10bn”, in an Impact Forecasting report released on Thursday.

-

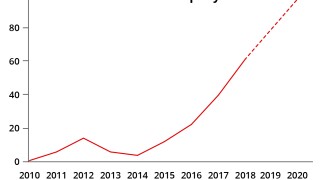

Nat cat and extreme weather claims have become more frequent and severe with hail, heavy rain and wildfires leading to significant losses.

-

The carrier has admitted to errors in select cases but stressed that its $475mn loss figure remains unchanged.

-

The breach at the service provider has the potential to generate losses on cyber programmes bought by individual airlines.

-

The four major developments of the week include:

-

Marsh is the broker for the supply chain financier, with a panel of insurers including Atradius writing a range of risks.

-

Whether the Texas Deep Freeze ends as a $12.5bn, $15bn or $20bn insured loss, it will be a medium-sized cat event that will deal an earnings hit to carriers with exposure to the affected states.

-

The modelling agency said it is still monitoring how factors such as demand surge and mould damage may impact claims.

-

RSA has reported £259mn ($361mn) in Covid-19 losses for 2020, as well as a reduction in premium for the year of £166mn due to the pandemic.

-

The carrier increased US-exposed reinsurance limit by EUR250mn but almost halved its group aggregate.

-

The carrier is “very optimistic” on Japanese and US renewals this year, and outlined plans for growth in various lines and regions.