-

PE, more alignment and tech are uncoupling MGAs from traditional market swings.

-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

All-risks premium increases are now understood to be in the 15% to 20% range.

-

Better data validation and stronger claims controls are also key for MGAs.

-

In mid-morning training, the share price had fallen by 12%.

-

Join senior market leaders for a forward-looking discussion on performance trends, pricing dynamics, M&A signals and risk appetite across both admitted and E&S segments.

-

Willis reports that the mining market has softened at a ‘considerable rate’ this year.

-

The peril has been historically difficult to model compared to others.

-

AI and precise data can enable insurers to innovate policy durations, from annual to transaction-specific, offering more tailored coverage options, said Christina Lucas, Global Market Leader, Insurance, Google Cloud, during an interview at the PwC Insurance Summit.

-

The sector also faces a potential $700mn loss from a fatal Indonesian mining catastrophe.

-

-

The latest guide is the first in a two-phase programme with a practical guide to follow.

-

Aspen's GWP increased 0.9% to $1.13bn, as it focuses on “robust cycle management”.

-

After outsized losses, the (re)insurer still sees opportunity in a softening market.

-

Panellists said recent M&A has not yet led to transformative change for the market.

-

Property growth plans are cooling, but favourable loss trends will increase surplus capacity.

-

Liès called for the industry to have a louder voice to promote greater insurance literacy across sectors.

-

The carrier attributed the results to a significant fall in major-loss expenditure.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

An insurability crisis could pose systemic risks that undermine the foundations of finance.

-

Industry-wide initiatives continue to target expanded youth access to the sector.

-

The carrier anticipates a “favourable” retro renewal at 1.1.

-

The federation, FASE, aims to connect all participants to provide a voice for European MGAs.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

The company reported no cat losses but saw a jump in attritional losses.

-

CEO Brand said he expected to deliver double-digit growth, if “marginally” lower in 2026.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The fundraising structure for the deal includes a $600mn Convex debt raise.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

In insurance, premium growth came from all lines of business except cyber.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

Consolidated NWP reduction was driven by the reinsurance segment, partly attributable to two transactions in Q3 2024.

-

The appointments are aimed at offering a clearer team structure.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

The company noted tougher market conditions and higher large losses during the year.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Brian Church has spent 20 years at Chubb.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

Carriers are rethinking the traditional renewal-rights model.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

Improved performance and growing investment returns played a role in the upgrade.

-

The executive was most recently serving as CRO – insurance.

-

The protection gap must be closed before a public cyber reinsurance scheme is possible.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

Tom Potter was global casualty underwriting manager for UK & Lloyd’s at Axa XL.

-

The tropical cyclone is expected to be named Imelda.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The Corporation’s chair reiterated its aim to reduce the cost of doing business.

-

The market turn may give some staff pause for thought, but reward remains high.

-

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

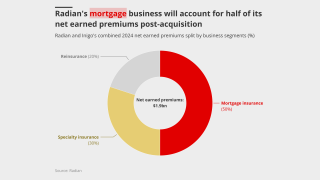

The low degree of overlap between the combining portfolios benefits both parties.

-

How does Lloyd’s plan to secure its future as a leading global marketplace?

-

More general issues at recruitment level include drawing from too narrow a pool.

-

Age has not been addressed as much as other areas of diversity, the panel said.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

Plus, the latest people moves and all the top news of the week.

-

The tech firm is building a joint stock company with insurers and investors.

-

The new recruit will report to group CUO Ian Houston.

-

Chilton founded Capsicum Re, which was acquired by Gallagher in 2020.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The carrier’s US and Europe claims teams will report to Clayden.

-

The platform aims to “bend the loss curve”.

-

A roundup of the breaking news, C-suite interviews and exclusive insights.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Blackstone-style capital seeking to get closer to source is a net negative for reinsurers.

-

Geopolitical turbulence brings new challenges that primary specialty lines carriers urgently need to address.

-

Being conservative and stable is the name of the reinsurer’s game.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

The carrier M&A cycle has started and reinsurance is a segment where acquisitions work better.

-

Anticipation, motivation and inspiration are central to effective implementation.

-

Reinsurers are ready to draw a line under a worsening claim outlook across the casualty market.

-

Swiss Re forecasts more risk transferring to reinsurance and retro markets in the future.

-

The post-disaster reinsurance start-up model is changing.

-

Excess capacity will sustain softer rates, as organic growth challenges lead to more M&A chatter.

-

Agency reactions ranged from Fitch revising down its sector outlook to AM Best keeping a positive outlook.