-

Brian Church has spent 20 years at Chubb.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

Carriers are rethinking the traditional renewal-rights model.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

Improved performance and growing investment returns played a role in the upgrade.

-

The executive was most recently serving as CRO – insurance.

-

The protection gap must be closed before a public cyber reinsurance scheme is possible.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

Tom Potter was global casualty underwriting manager for UK & Lloyd’s at Axa XL.

-

The tropical cyclone is expected to be named Imelda.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The Corporation’s chair reiterated its aim to reduce the cost of doing business.

-

The market turn may give some staff pause for thought, but reward remains high.

-

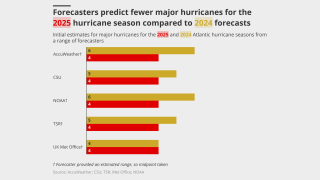

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

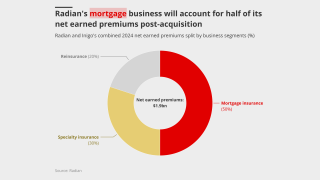

The low degree of overlap between the combining portfolios benefits both parties.

-

How does Lloyd’s plan to secure its future as a leading global marketplace?

-

More general issues at recruitment level include drawing from too narrow a pool.

-

Age has not been addressed as much as other areas of diversity, the panel said.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

Plus, the latest people moves and all the top news of the week.

-

The tech firm is building a joint stock company with insurers and investors.

-

The new recruit will report to group CUO Ian Houston.

-

Chilton founded Capsicum Re, which was acquired by Gallagher in 2020.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The carrier’s US and Europe claims teams will report to Clayden.

-

The platform aims to “bend the loss curve”.

-

A roundup of the breaking news, C-suite interviews and exclusive insights.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Blackstone-style capital seeking to get closer to source is a net negative for reinsurers.

-

Geopolitical turbulence brings new challenges that primary specialty lines carriers urgently need to address.

-

Being conservative and stable is the name of the reinsurer’s game.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

Anticipation, motivation and inspiration are central to effective implementation.

-

Reinsurers are ready to draw a line under a worsening claim outlook across the casualty market.

-

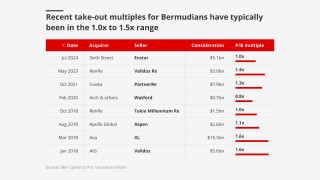

The carrier M&A cycle has started and reinsurance is a segment where acquisitions work better.

-

Swiss Re forecasts more risk transferring to reinsurance and retro markets in the future.

-

The post-disaster reinsurance start-up model is changing.

-

Excess capacity will sustain softer rates, as organic growth challenges lead to more M&A chatter.

-

Agency reactions ranged from Fitch revising down its sector outlook to AM Best keeping a positive outlook.

-

Terms are expected to hold, underpinning the stronger recent performance of reinsurers.

-

The reinsurer’s new CEO said he sees no need for a radical shift in strategy.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

Former Hannover Re CEO Jean-Jacques Henchoz received the Lifetime Achievement award.

-

The executive said claims can be a differentiator in a softening market.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

Plus, the latest people moves and all the top news of the week.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

He succeeds Felix Cassau, who is joining Hannover Re.

-

Aspen would give Sompo more reinsurance scale, more US premium and a Lloyd’s presence.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

She was most recently claims manager at QBE France.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

Besides Russia-Ukraine losses, the Air India crash losses totaled $26mn.

-

Nat-cat events triggered A$1.36bn of losses during the year.

-

The London carrier missed consensus on gross and net premiums for H1.

-

The Hannover Re CEO said rate adequacy remains “attractive” overall.

-

The carrier is the first Fortune 500 company to take a stake in a League Two club.

-

In trying to solve multiple needs, specialty reinsurance opens up complexities.

-

California wildfires were the reinsurer’s largest H1 loss, at EUR615.1mn.

-

Rachel Sabbarton has been promoted to CEO at Lancashire Syndicates.

-

Both organisations still predict an above-average hurricane season.

-

The carrier cited elevated cat and large-loss activity, including the LA wildfires.

-

The company bolstered casualty reserves by $18mn, mostly from discontinued lines.

-

The move will impact around $50mn of gross written premiums in total.

-

The carrier’s overall P&C combined ratio improved 1.8 points to 91.2%.

-

The Swiss carrier improved its P&C combined ratio by 1.2 points to 92.4%.

-

Cat losses of $1.5mn, net of reinsurance, were primarily due to severe convective storms.

-

This publication reported yesterday that Talanx was closing in on the sale.

-

The loss was driven by nat cats and reserve adjustments in US casualty.

-

Emerging lawsuits and expanding loss triggers are giving rise to potential claims under a range of policies.

-

Prior-year reserve development moved to a $6.3mn charge in Q2 from a $19.3mn release a year ago.

-

With roughly 200 employees, the South American operations generated over EUR130mn in 2024 GWP.

-

The executive has spent more than three decades in insurance.

-

The company has also expanded its relationships with US and UK MGAs.

-

The new team will be headed by Brown & Brown’s Ed Byrns.

-

The underwriter was head of financial institutions at LSM for six years.

-

Matthew Doherty joined the reinsurer in 2018 as SVP, property portfolio manager.

-

Cat portfolios generally grew, but casualty approaches varied.

-

The reinsurance CoR decreased 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

The executive joined Navigators in 2010 after eight years at White Mountains Capital.

-

A majority of staff not offered jobs at Ryan Re will remain at Markel to manage the run-off.

-

The Miami-based executive assumes the role left vacant by April McLaughlin.

-

Specialty casualty now accounts for around 22.2% of its insurance business mix.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

Everest booked $98mn of aviation losses related to the war, which contributed 2.5 points to the consolidated CoR.

-

The Bermudian said its pursuit of SMEs through M&A will provide sustainable improvements to its bottom line.

-

Pricing was “virtually flat” in the second quarter.

-

The CEO said business remains adequately priced in most classes.

-

The carrier is reducing its exposure to quota shares and shifting to XoL.

-

The loss ratio rose 1.9 points to 53.1%, while the expense ratio ticked up 0.6 points to 28.1%.

-

The carrier had $20mn in reserve releases in the quarter, compared to nil in Q2 2024.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The reduced fine reflected the PRA view that the breaches weren’t deliberate.

-

North American carriers completed the most transactions in the first half of 2025.

-

Surveys show diversity and inclusivity foster a sense of belonging and increase productivity.

-

The reinsurance unit’s combined ratio for the quarter was 94.2%.

-

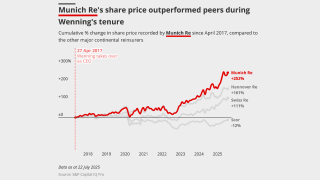

Improved book value, a healthy CoR and disciplined underwriting mark the CEO’s time at the helm.

-

Bridges joins from QBE, where he spent over 17 years.

-

CFO Christoph Jurecka will succeed as management board chair.

-

The medical professional liability firm is targeting further healthcare opportunities.

-

-

The suit claims billions of dollars are being illegally withheld.

-

Airmic has been lobbying the government to introduce a captives framework for years.

-

The US accounted for 92% of all global insured losses for the period.

-

The outcome of the consultation includes a detailed timetable for delivery.

-

In the US, the index fell 6.7% year on year.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The Cathal Carr-led carrier has been building its team since launching this year.

-

Demand and growth opportunities remain ample despite competitive pressures.

-

Arturo Pelaez will continue in his managing director role at Brookfield Asset Management.

-

It is the second deliverable of the FIT Transition Plan Project.

-

The managing agency is offering 62p per £1 for 2026 YoA capacity.

-

The awards will be held on 3 September at The Brewery in London.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

SRCC exposures are being studied more closely but fixing aggregation issues is a challenge.

-

The carrier said the cuts will help it to become a “simpler, digital-led business”.

-

The investment comes amid expectations of a new cycle of deals.

-

Phil Furlong has been made head of underwriting and oversight, a newly created role.

-

Rachel Bardon will also join the board of Compre's Bermuda-based reinsurer Pallas Re.

-

In April, the loss modeller pegged losses at A$2.57bn.

-

Who will buy the swathe of PE-backed Lloyd’s firms coming to market over 2025-26?

-

The firm's near-term global strategy includes operations in the UK, US, parts of Europe and Asia.

-

The reinsurer has also appointed Mehdi Benleulmi as global head of credit.

-

This year is predicted to be an above-average season, like 2024.

-

Markel International has also hired senior underwriter Keely Madden.

-

The hire is the latest in the newly formed carrier’s buildout.

-

The carrier benefited from top-line growth and lower adverse PYD.

-

Large natural catastrophe losses totalled $570mn in Q1, driven by the LA wildfires.

-

The company has settled, or is in the settlement stage, for 80% of the exposure.

-

Specialty reinsurance has experienced high competition for talent.

-

The revision is significantly lower than the $4.5bn October estimate.

-

The reinsurer said the LA wildfires would have a “dampening effect” on mid-year renewals.

-

The carrier will focus on mid-market business outside of Lloyd’s.

-

The reinsurer's group operating income fell by 14% to EUR480.5mn.