-

The chief of market performance urged underwriters not to follow the herd.

-

The developments this week thrust culture issues up the agenda for new leadership.

-

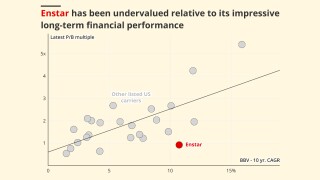

The sector’s recent achievements have flown below the radar, despite huge value creation.

-

Specialised service providers like CDK can pose more frequency risk than global operators.

-

Everest’s AIG deal meaningfully cuts its primary exposure.

-

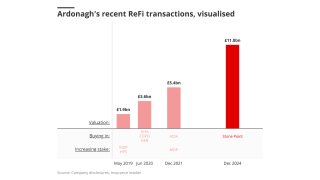

The buy-in can be seen as a “flip” bet on a rebound in appetite for carrier M&A.

-

Without flexible mechanisms the Corporation risks suppressing transactions.

-

The protection gap must be closed before a public cyber reinsurance scheme is possible.

-

The market turn may give some staff pause for thought, but reward remains high.

-

The broker’s joint venture with Bain Capital still lacks a CEO.

-

Aspen would give Sompo more reinsurance scale, more US premium and a Lloyd’s presence.

-

US retailers have various levers to pull to put pressure on potential new competitors.

-

In trying to solve multiple needs, specialty reinsurance opens up complexities.

-

Aviation reinsurance reserving issues will also be a broader focus for the market.

-

Surveys show diversity and inclusivity foster a sense of belonging and increase productivity.

-

The broker’s planned US talent raid is in keeping with its audacious history.

-

There is a growing disconnect between risk and pricing in the class.

-

SRCC exposures are being studied more closely but fixing aggregation issues is a challenge.

-

There is the prospect of fragmented appeals and uncertainties around reinsurance recoveries.

-

The LMA urges use of AI for enhanced decision making but concerns remain.

-

Corporates buying Lloyd’s syndicates face the culture/integration trade-off.

-

While M&S had a cyber policy in place, Co-op and Harrods did not, Insurance Insider revealed.

-

The Lord Mayor told the CRO Summit to stop treating risk as a dirty word.

-

The CEO transition is already visible in messaging on growth as rate change picks up.

-

Pushing through technological change and maintaining underwriting results are top of agenda.

-

Lloyd’s chair Bruce Carnegie-Brown officially hands over to Charles Roxburgh today.

-

The retailer’s partners are looking to join forces to secure better deals.

-

Combating depressed trading on the LSE and a delayed hard market shift has held back the firm.

-

From where to prioritise investing to managing slower growth, there are tough balancing acts ahead.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

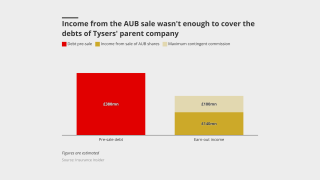

The IGH closure is bitter for employee investors left with nothing – but such investments are inherently risky.

-

Lloyd’s has been likened to a “toothless tiger” in its crackdown efforts.

-

An issue has emerged in diligence, and Howden has a complex consortium to align.

-

Technological delays erode credibility, but the market remains strong.

-

Lloyd’s hopes to protect healthy pricing, but focus is on broader structural market shifts.

-

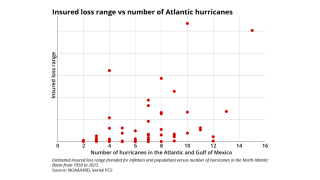

Island appetite remains stable, but early 2025 loss activity has injected fresh uncertainty.

-

Navigating its path to global specialty growth will require operational dexterity.

-

PIB’s broadened sale process is symptomatic of wider investor sentiment around brokers.

-

Lloyd’s entry is a modest start for the London heavyweight but could be the beginning of something bigger.

-

Aviation premiums have been described as “woefully inadequate” considering rising liability losses.

-

WTW’s ownership of Miller may offer a cautionary tale for the US retail-London wholesale group structure.

-

Heritage and history matter in people businesses, and the storied brand carries real equity.

-

It has been a “good” bad renewal for cat reinsurers, with attachments likely to endure in the medium term.

-

The CEO’s accelerated exit could cost momentum, and shortens Tiernan’s odds of succeeding.

-

The strong deal multiple underscores the view of London as a “gateway to the world” for brokers.

-

Rates are turning negative, and the balance of power is shifting towards the brokers.

-

The business will test the market from a position of strength after impressive early profits and robust growth.

-

Surging capacity suggests broker facilities are now refined enough to be a long-term feature.

-

The broker’s US retail foray will throw the cards in the air. Where might they land?

-

Greco will likely remain in place in the medium-term, which could mean major M&A and a Lloyd’s platform.

-

In a decade this market could grow from $5bn to $60bn.

-

The market reacted to the $2.4bn charge in a positive light.

-

London market carriers may be getting competitive, but that is not in itself a bad thing.

-

Signposting the opportunity is one place to start.

-

In line with Milton’s moderate forecast loss, the ILS market reaction will be less influential in post-event dynamics.

-

Capital diversity can only be achieved when there are more options for third-party providers to access.

-

It will take more carriers to rein in income expectations to halt the soft market spiral.

-

With the storm’s losses looking more favourable, questions over rates and gross/net strategies will arise.

-

Brokers will only get more vocal on aggregate or secondary peril if Helene remains a retained loss event.

-

DEI has faced a backlash in the US where companies have pulled back from targets and initiatives.

-

After a strong run, the market needs a chair that will uphold underwriting discipline and delivery on modernisation.

-

The new CEO has owned past challenges and charted a better course, but will need to be relentless in driving change.

-

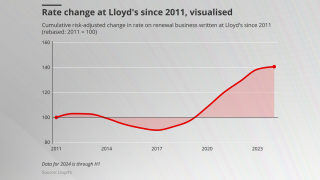

The market remains concerned about managing the pricing slowdown, but a “super cycle” continues.

-

-

The peril is posing an increased risk of loss for the sector.

-

Property underwriters warn of complacency in how quickly margins can erode.

-

Incoming CEO James promises transparency as digital development accelerates outside Lloyd’s.

-

The shift to private market fundraising should be a meaningful boost to this and other initiatives.

-

The firm escapes public market distractions and long-term undervaluation, but the low mark will hurt peer companies.

-

Expectations of what “walking the walk” means for leaders have risen.

-

The new appointee will need to help juggle competing demands.

-

Work to revitalise the French reinsurer just got harder as problems in its life book crashed the share price.

-

Many have argued war exclusions have detracted from discussions of systemic risk in the cyber market.

-

Conditions are coalescing for an uptick in carrier M&A after many subdued years.

-

With topco liquidation looming, there are questions for R&Q and the wider market.

-

The Corporation of Lloyd’s risks its credibility if it doesn't own its mistakes soon.

-

The global nature of cyber means a UK ransomware pay license would have "no material impact" locally.

-

Reinsurers are much better placed to absorb cat losses; insurers are carrying more risk.

-

Capital is looking for opportunities to build international specialty businesses out of EC3.

-

Recent contingency losses reflect a willingness of the market to go looking for premiums.

-

Insurers must take their responsibilities seriously.

-

The hard market has not burst the MGA bubble – and now interest is on the rise again.

-

Since 1 January, the market’s potential descent into freefall has been closely watched.

-

Last week, UNEP launched a multistakeholder forum building on the experience gained from the NZIA.