North America

-

Marsh is also suing a second tier of former Florida leaders.

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

CEO Greg Case said data centre demand could generate over $10bn in new premium volume in 2026.

-

The company reported no cat losses but saw a jump in attritional losses.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

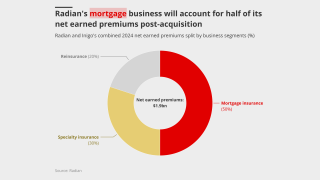

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The broker will join Ron Borys’ financial lines team.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

Everest’s AIG deal meaningfully cuts its primary exposure.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

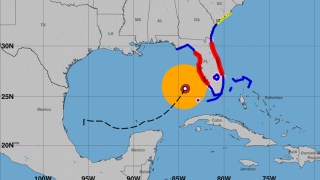

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

APIP is one of the world’s largest property programs.

-

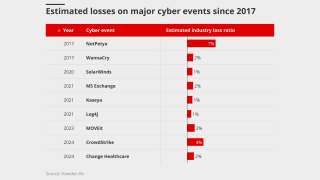

A canvassing of the cyber market suggests the impact will be negligible.

-

The range allows “for information that could emerge beyond what is known today”.

-

The appointments are aimed at offering a clearer team structure.

-

Sources said he will join the reinsurance brokerage next year, after his garden leave expires.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

The company and its main debt provider Ares agreed to relax its debt terms in April.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

Bill Ross has been CEO of the non-profit for 21 years.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Howden is facing fallout from its push into the US retail market via mass hires.

-

The London-based executive will relocate to Daytona Beach, Florida.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

The broker will report to Howden US CEO Mike Parrish.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The facility provides coverage for property, terrorism, energy, construction and utilities risks.

-

The broker’s new business and client services division is targeting $400mn of savings.

-

Earlier this week, the broking house announced a rebrand to Marsh.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

After six years as CFO, Mark Craig is taking on the position of chief investment officer.

-

Brian Church has spent 20 years at Chubb.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

The reshuffle is likely laying the foundations for the eventual succession to CEO Mario Greco.

-

Mike Mulray joins from Everest, where he was EVP president of North America insurance.

-

Trade credit insurers are expected to respond with tighter buyer limits and stricter wordings.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

The governor has yet to sign a pending bill to create a public cat model.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

Plus, the latest people moves and all the top news of the week.

-

Carriers are rethinking the traditional renewal-rights model.

-

Moretti has relocated to California from London.

-

Willis claims at least two $1mn accounts were also unfairly lost to Howden.

-

The broker is understood to manage Brown & Brown’s account at Howden.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

In July, he took the role on interim basis from Laure Forgeron.

-

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

The class offers affirmative coverage for gaps in traditional insurance policies.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Alliant is in the process of moving the ~$1bn of business it places with Howden to other wholesalers.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

The business has been ~70% owned by White Mountains since January 2024.

-

The executive was most recently serving as CRO – insurance.

-

Landa was part of the team lift led by Michael Parrish, who is CEO of the US retail arm.

-

The facility will initially focus on US, Bermudian and European business.

-

She previously served as Hub’s North American casualty practice leader.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Other MGAs in the transactional-liability class are also expanding into the US.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The company will continue its capacity partnership with the MGA until 2030.

-

The tropical cyclone is expected to be named Imelda.

-

Plus, the latest people moves and all the top news of the week.

-

The transaction marks the largest US market entry by a Korean non-life insurer.

-

The executive has been with ASG since it was formed in 2016.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

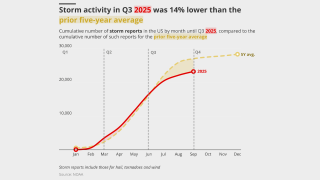

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The executive met with UK colleagues to discuss plans for the US business.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

Age has not been addressed as much as other areas of diversity, the panel said.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

The sidecar will support five programs providing specialty frequency coverages.

-

Her predecessor will become head of US excess casualty and operations.

-

Reinsurer executives stressed that the industry worked hard on setting the right structure.

-

The executive joins from MSIG USA.

-

Insurance Insider reported earlier today of the asset manager’s foray into the MGA space.

-

The MGA is backed by three Lloyd’s syndicates, offering capacity limits of up to $10mn.

-

The deal represents a first entry into the US MGA market for the $1.1tn asset manager.

-

Plaintiffs allege that manufacturers and retailers have broken environmental laws.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

He was appointed CUO of casualty, Americas, in July last year.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The carrier’s US and Europe claims teams will report to Clayden.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Blackstone-style capital seeking to get closer to source is a net negative for reinsurers.

-

Cedants target methods of reducing pressure on earnings as reinsurers chase growth.

-

Cat bonds have outperformed private ILS strategies in the YTD, according to ILS Advisers.

-

Former head of construction Bill Creedon will assume the role of chairman.

-

Bill Bouvier has spent more than three years at the legacy firm in this role.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

The broker’s joint venture with Bain Capital still lacks a CEO.

-

The private ILS segment took losses from LA wildfires and Mid-West severe convective storms in H1 2025.

-

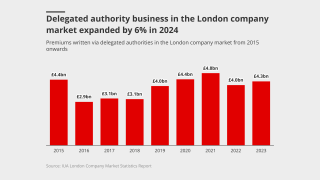

The sector recorded total premiums written in London of £11.9bn in 2024

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

One of the options being explored is setting up a dedicated company for the wholesale vertical.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

CEO Thierry Léger also stressed his intention to repair the carrier’s relations with Covea.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

It is understood that CyberCube has been considering a sale of the business.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The California wildfires showed reinsurers can absorb major cats and remain profitable.

-

What’s next for the reinsurance market as Monte Carlo approaches?

-

The insurer has been under review with positive implications since March.

-

Skyward’s acquisition of Apollo will provide access to the London Bridge framework.

-

Growth in the SME sector could help stabilize the market, however.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The US specialty carrier announced Tuesday that it was buying the Lloyd's business for $555mn.

-

The executive most recently served as head of North American treaty reinsurance.

-

The LPPC will offer limits of $127.5mn EAR and DSU coverage in the US and Canada.

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

Cyber reinsurance supply has continued to outstrip demand during 2025.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

The executive said claims can be a differentiator in a softening market.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

The data modeling firm said losses previously averaged $132bn annually.

-

Signs of discipline indicate a “break” from past boom/bust market cycles.

-

Some 32% of survey respondents expect property cat rates to fall by more than 7.5%.

-

Henrietta Butcher leaves Tysers after decades with the broker.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

James River said the court was right to dismiss the fraud case.

-

Company said defendant ‘distraction’ can’t make up for flimsy arguments.

-

The violations included not using propertly appointed adjusters and failing to pay claims.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

Sources said that the NY-based TL underwriter has retained Piper Sandler to run the process.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

Submission volume is up 10%-20%, according to sources.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

Parrish, now Howden US CEO, and his colleagues said they didn’t violate contracts.

-

Assurex’s global independent broker network pumps $4bn of premium into the London market.

-

Patton Kline succeeds Glod as US aviation and space practice leader.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

Aspen would give Sompo more reinsurance scale, more US premium and a Lloyd’s presence.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

US retailers have various levers to pull to put pressure on potential new competitors.

-

Claude Wade is to step down from his role to address ongoing health issues.

-

Placement head Delchar said Gemini will be available across its global book of in-scope risks.

-

The broker approved a grant of $316mn in equity awards payable in staggered amounts over the coming five years.

-

This is the first rate filing to use the recently approved Verisk model.

-

The company was hit with a data breach on July 16.

-

The CEO said the carrier will prioritise margin over top-line growth.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

Company alum David Murie will lead the new business unit.

-

Layla O’Reilly and Mark Edwards are among the brokers leaving the firm.

-

The estimate covers property and vehicle claims.

-

The executive has worked for JLT Re, Lockton Re, Willis Re and US Re.

-

This publication revealed two years ago that EQT could lodge a $1bn claim.

-

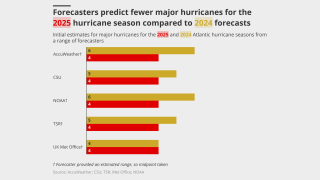

Both organisations still predict an above-average hurricane season.

-

Plus, the latest people moves and all the top news of the week.

-

What does it take to turn a family-run insurance group into a global powerhouse?

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

The forecast has increased since the early July update due to several additional factors.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The company also purchased $15mn of SCS parametric coverage.

-

The specialty reinsurer also saw several bad investments hit the books.

-

The plaintiffs seek a declaration that part of Marsh recruits’ restrictive covenants are unenforceable.

-

CEO David Howden accused rivals of “restricting choice for their own clients”.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

The carrier also benefitted from favourable reserve development in property and A&H.

-

Cat portfolios generally grew, but casualty approaches varied.

-

The reinsurance CoR decreased 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

The suit asserts the raid will cause “incalculable harm” to the broker.

-

The executive joined Navigators in 2010 after eight years at White Mountains Capital.

-

The MGA will initially focus on credit, energy and construction.

-

AJ Gallagher has responded to a request for additional information under the HSR filing.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

A majority of staff not offered jobs at Ryan Re will remain at Markel to manage the run-off.

-

The Miami-based executive assumes the role left vacant by April McLaughlin.

-

DB reiterated that no final decisions have been made regarding a potential deal.

-

The executive was previously head of excess casualty, North America.

-

Q2 saw a steady stream of activity in legacy, but volumes dipped slightly from Q1.

-

The company has struggled in reinsurance, while large claims dragged down D&O results in Q2.

-

WTW is “particularly interested” in growing markets like wealth management with bolt-on M&A.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

-

The firm will target mid-market risks with TIVs of $25mn-$1bn.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

The broker is looking to move as much of the book away from its adversary as possible.

-

The company provides management workflow for residential contractors.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

North American carriers completed the most transactions in the first half of 2025.

-

Surveys show diversity and inclusivity foster a sense of belonging and increase productivity.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

Staff targeted include producers that channel business through Howden’s London wholesale arm.

-

Plus, the latest people moves and all the top news of the week.

-

The former Everest executive has more than 30 years of A&H experience.

-

Property rates declined by 7% globally in the second quarter.

-

Weatherbys Hamilton provides private client, bloodstock and farm coverage.

-

The broker’s planned US talent raid is in keeping with its audacious history.

-

The insurer denies it is responsible for the actor’s legal fees.

-

The impact on the (re)insurance market has been muted due to its strong capital position.

-

The former Lloyd’s CEO is also eligible for a target $5mn annual equity award.

-

The expansive European broker is targeting Mike Parrish’s team and former McGriff staff.

-

Alcor has also opened an Atlanta office, broadening operations in the US market.

-

BI claims are notoriously difficult to manage and some insurers believe binary coverage can help.

-

Laure Forgeron has worked at the Swiss carrier since 2009 in numerous senior positions.

-

Claims were concentrated in the US, with a significant increase in D&O class actions.

-

-

The technology will help analyse growing and emerging risks, especially climate change.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

Total revenues grew 12% due to the contribution from acquisitions.

-

The suit claims billions of dollars are being illegally withheld.

-

Peter Cordell will join Syndicate 1729 in January.

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

The former Lloyd’s CEO will not make his planned move to Aon.

-

The US accounted for 92% of all global insured losses for the period.

-

US events accounted for more than 90% of global insured losses.

-

State legislation has led to major strides in rate adequacy.

-

Category 4 and 5 storms could become more common and hit further north.

-

The MGA is expected to launch a product-recall portfolio in September.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The MGA will write natural resources professional liability business.

-

Demand and growth opportunities remain ample despite competitive pressures.

-

The weather-modelling agency is predicting a below-normal season.

-

Arturo Pelaez will continue in his managing director role at Brookfield Asset Management.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

Sixth Street and Cornell also bid for the wholesaler.

-

The Bermudian investor already owned a 1% interest in the NY-based MGA platform.

-

The unit will include both ocean and inland marine coverage.

-

The carriers remain in takeover negotiations but have not reached a decision around valuation.

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

The $2.6bn deal provides Ergo with an entry point to the US SME market.

-

The changes affect operations in Switzerland, Bermuda and the US.

-

He was most recently Marsh’s US manufacturing and automotive practice head.

-

The executive brings more than 25 years of insurance experience.

-

The broker has expanded the number of global industry verticals to seven from four.

-

The soft market continued through H1 2025, especially on shared programs.

-

The company resumed work on a public offering in September.

-

Gallagher Re’s Lara Mowery said mid-year renewals marked the “beginnings of capacity” emerging.

-

Cedants were able to “challenge the status quo” with aggregates back on the table, the broker said.

-

The company said the reduction was due to years of steady improvements.

-

Premium rose across the top 15 P&C risks in 2024.

-

Richardson has been with the firm since 2015 and was most recently vice chair and chair of international.

-

The programme’s total limit this year is down $594mn to $1.36bn.

-

The broker noted a “significant variation” in renewal outcomes.

-

The measure could have landed insurers with extra tax on US business.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

There are now 14 new companies writing homeowners’ policies in the state.

-

The broker built out Lockton Re’s US casualty and professional lines treaty book.

-

Green hushing is on the rise as Trump rows back on climate initiatives.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

Goldman will join Ascot next month to take on the newly created role.

-

In North America, the median W&I claim payment in 2024 was $5.5mn, the highest on record.

-

Errors and omissions claims made up 55% of all notifications, continuing a five-year trend.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

Sources said NY-based Lee Equity is seeking to extend its investment in the TPA heavyweight.

-

The platform will capture and standardise data from all submissions, the broker said.

-

SRCC exposures are being studied more closely but fixing aggregation issues is a challenge.

-

The executive previously spent 15 years in a variety of roles at Zurich.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

The executive was formerly the head of cyber solutions, North America.

-

The reinsurance division booked 29% growth for the fiscal year to 30 April 2025.

-

Brokers across London and Bermuda have handed in their notice to join the start-up reinsurance broker.

-

The carrier said it is disappointed with the English High Court’s decision.

-

The documents figure in a potential criminal case against a CCB employee.

-

The trend is expected to be most pronounced in the Middle East, the survey found.

-

The broker is targeting run-rate synergies of $150mn by the end of 2028.

-

In 2024, MGA GWP reached approximately $20bn in Europe.

-

The appointment follows B&B’s acquisition of Accession.

-

The deal multiple is understood to be around 15x adjusted Ebitda.

-

Case added that recently acquired broker NFP has “exceeded” expectations.

-

The reinsurer has also appointed Mehdi Benleulmi as global head of credit.

-

Tovah Grosscurth replaces Sonya Bryson, who has left the commercial lines business.

-

The man is alleged to have conspired with others to falsify LOCs and collateral letters.

-

The merger is on track to close in H2 2025, CEO Pat Gallagher said.

-

The number has expanded by around 40% from an earlier update, sources said.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

The increased tariff on China trade could drive up the loss quantum on the SharkNinja recall and others.

-

The PE firm’s Aaron Cohen said full integration of broking assets is crucial.

-

Eric Seyfried and Glen Manjos are also departing Axis’ cyber and tech unit.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

The executive will remain CEO of reinsurance until 1 September.

-

This year is predicted to be an above-average season, like 2024.

-

The $2.59bn renewal is up 45% from last year.

-

Up to nine million acres of US land are considered likely to burn.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

The company also has $100mn for US hurricane events.

-

Last week, TSR updated its forecast and is now predicting above-average storm activity.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

Most of the losses are attributable to a supercell storm in Texas.

-

A 20% increase in FHCF retention levels sent cedants to the private market.

-

This will allow Ark to write business on surplus line paper and Lloyd’s business.

-

Starr and Axon also are among those exposed to the Marsh USA-placed $40mn line.

-

The Peak Re subsidiary mainly writes US motor and casualty reinsurance.

-

Burford’s CEO said Chubb is inappropriately using its corporate power.

-

Kestrel stock will begin trading on Nasdaq tomorrow under the symbol KG.

-

Philip Enan joins following 11 years at Chubb.

-

It previously predicted activity slightly below the 1995-2024 average.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

The executive will take the global role alongside his existing US responsibilities.

-

The underwriter has held positions at The Hanover, Liberty Mutual and Zurich.

-

Broker facilities and increased US domestic appetite are accelerating the softening.

-

As with 2024, pricing pressure has been most acute on top layers.

-

Tornadoes have killed at least 32 people in three states.

-

Sources said MarshBerry was retained earlier this year to run the sale.

-

Are intermediaries facing tougher times as the broking supercycle winds down?

-

Michael Brooks, SVP, head of transactional liability, will be taking over temporarily.

-

The programme will succeed the previous buyback launched in 2023.

-

The revision is significantly lower than the $4.5bn October estimate.

-

The exec will lead key initiatives including Aon United, and work closely with NFP.

-

Hussey will take over the role left vacant when Luis Sonville moved to AJ Gallagher late last year.

-

The exec said if he were a carrier CEO, now is the time he would start looking for deals.

-

The executive said secular heightened risk trends would fuel the carrier’s primary expansion.

-

New broker vehicles are setting up amid accelerated softening in D&F.

-

The carrier’s estimated first event limit could increase 16%, to $1.35bn.

-

The company’s upsized public offering priced at $30 per ordinary share.

-

Jacqui Ferrier speaks with Insurance Insider in her first interview since taking the reins.

-

Ark's combined ratio included 25 points of catastrophe losses in Q1.

-

Gallagher Re said rates had softened in 2025 versus the prior two years.

-

The market is also facing potential losses from injuries to NFL stars.

-

Sentiment at the ILS Connect event hosted by Insurance Insider ILS was generally positive.

-

The insurer has not decided whether to sell its Eaton subrogation rights.

-

At his last annual meeting as CEO, Buffett highlighted the importance of Berkshire’s insurance operations.

-

Both Chubb and Zurich will underwrite the risks, with Nico as the sleeping partner.

-

The primary and reinsurance unit CoRs were 103.1% and 98.7%, respectively.

-

AIG, HDI Global and others have settled. Chubb’s fight continues.

-

The Canadian conglomerate’s total cat losses in Q1 reached $781mn, including $692.1mn from the fires.

-

The facility provides up to $100mn in claims-made excess casualty coverage.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

AJG still has $2bn of M&A capacity after the AP and Woodruff Sawyer deals.

-

The remediation process is on track for completion in the fourth quarter.

-

The reinsurer said the market was unprofitable and pricing needed to increase immediately.

-

Its 2025 programme exhausts at $9.5bn excess $1bn.

-

The days of 30%+ growth are probably behind the firm, he said.

-

The executive will oversee Howden Re’s treaty and fac business in Miami.

-

The pair add to the roster of aviation-focussed hires at WTW.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

The hires form part of WTW’s build-out of its US aviation practice.

-

The retailer’s partners are looking to join forces to secure better deals.

-

Ann Field, Matt Moore and David Griffiths have also had promotions.

-

The broker's share price dipped 11% in morning trading after its Q1 earnings missed expectations.

-

His leadership roles included overseeing the firm’s capital solutions group.

-

The commercial risk and reinsurance units delivered mid-single-digit growth.

-

Lucy Clarke said the broking business was resilient in the face of macro challenges.

-

Organic growth was flat on the prior year and in line with Q4 2024 figures.

-

Insolvencies caused by the tariffs could also cause increased losses

-

The sale price represents Elephant’s approximate net asset value.

-

The executive will define strategic priorities and guide global growth.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

Insured losses were the second highest on record for the first quarter.

-

California wildfires had ‘little or no impact’ on property cat pricing at April 1, Dean Klisura said.

-

Guy Carpenter president Dean Klisura added that Q1 was a record cat bond issuance quarter.

-

Fully placed, this would equate to $275mn on the per-occurrence tower and $675mn on agg.

-

Why have reinsurance start-ups remained so rare in recent years, even as underwriting conditions have improved?

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

Meco's 2024 gross written premiums totaled $63mn.

-

Methven joined the MGA in 2002.

-

The UK broker is still in talks with Mubadala about a standalone investment in the business.

-

The InsurTech was part of the fourth cohort at Lloyd’s lab.

-

Alex Amezquita will fill Cahill’s previous position as CFO.

-

From where to prioritise investing to managing slower growth, there are tough balancing acts ahead.

-

It is understood that Marsh brokered the tower, which is exposed to claims from a 2024 breach.

-

Plus, the latest people moves and all the top news of the week.

-

Storms in the UK and Ireland drove losses in the commercial segment.

-

The book of business comprises both personal and commercial lines.

-

The announcement spurred a quick spike in stock market valuations.

-

London-based US excess casualty writers are increasingly looking to attach lower in the tower.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The prediction comes after a highly active hurricane season in 2024.

-

The tariffs could expose insurers to the risk of recession and shrinking income.

-

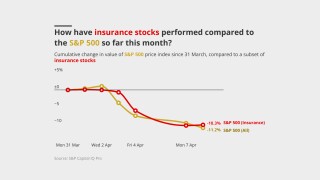

Markets have taken a battering across the globe following the “Liberation Day” announcement.

-

Insurance share prices were resilient amid today’s market meltdown.

-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

Overall market capacity increased by 5.3% year-on-year, the broker reported.

-

An issue has emerged in diligence, and Howden has a complex consortium to align.

-

Willis said rising energy demand is creating a revival in the nuclear industry.

-

The carrier has received 12,300 claims as of 28 March.

-

Sources said the Evercore-run Risk Strategies process has drawn the interest of Brown & Brown.

-

The shares will be purchased via the open market or private third-party transactions.

-

RBC reports can help regulators identify weakly capitalized companies.

-

The executive has managed both casualty and personal lines reinsurance books.

-

Plus, the latest people moves and all the top news of the week.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

The firm also promoted Devin Inskeep to an expanded role as SVP, head of ratings and advisory.

-

Evercore has reached out to a combination of strategics and private equity houses.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

The underwriter will be based in New York and drive underwriting strategy.

-

Markel also announced the appointment of Jon Michael to its board.

-

The executive will remain with the firm as a senior adviser to the CEO until mid-2026.

-

The insurance industry has experienced mounting losses from severe convective storms.

-

The business offers parametric windstorm coverage.

-

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

The carrier was seeking to expand its 1 March-renewing programme.

-

The reinsurer anticipates downward rate pressure to continue over 2025.

-

Island appetite remains stable, but early 2025 loss activity has injected fresh uncertainty.

-

A rebound is expected this year, however, led by strong US activity.

-

“We do not have the luxury of time,” he said during the Bermuda Risk Summit.

-

The company’s syndicate has booked an 87.4% combined ratio for 2024.

-

The MGA is offering lines of $25mn, up from the $10mn limit it was providing until late last year.

-

This year’s coverage will involve $2.94bn of new risk transfer.

-

The offering includes GA, aviation GL and airport and product manufacturers liability.

-

Andrew George will report to president and CEO of Marsh Martin South.

-

These events can also no longer be considered secondary perils, executives said.

-

Some $4.8bn of reinsurance and cat bond limit will come up for renewal in 2025.

-

The company said it now expects the transaction to close in H2 2025.

-

Competition for specialty reinsurance talent remains high.

-

Is the MGA start-up boom here to stay?

-

The London D&F market will shoulder most of the losses.

-

The MGA will be trying to replace the transactional liability capacity in the coming weeks.

-

The group joined Velocity in December and includes James Robertson.

-

The reinsurer pegged the market loss at $40bn.

-

Ascot Underwriting CEO Ian Thompson, who took the helm last summer, discussed emerging headwinds.

-

The programme structure was expanded, but it is unclear what percentage was placed.

-

The group will house a segment for specialty and benefits and another for underwriting.

-

Plus, the latest people moves and all the top news of the week.

-

Changes in business mix towards specialty and improved reserve development offset higher Q4 cat losses.

-

The estimate is based on industry losses in the range of $35bn-$45bn.

-

The carrier has paid $1.75bn on around 9,500 claims filed from the wildfires.

-

The carrier expects the market loss to land at $35bn-$40bn.

-

The transactional liability class faces a string of potential losses, especially in the contingent segment.

-

The MGA will have a broad casualty-focused appetite with Lloyd’s capacity backing.

-

He will have to step down from his non-executive role on the board to take the job.

-

This was Ryan’s second-largest 2024 deal, after its $1.4bn Assure purchase.

-

Plus, the latest people moves and all the top news of the week.

-

The ratings agency has revised Mercury’s outlook from stable to negative.

-

The investors are led by PE firm NMS Capital Group.

-

The traditional R&W product is seeing an increasing number of large losses.

-

The executive will maintain his advisory role with the Ardonagh-owned wholesaler.

-

Jana holds around 109,000 shares and 69,000 call options, at a $307mn total value.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

A higher loss quantum will put a greater burden on retro programmes.

-

Insurers have paid $6.9bn in Southern California wildfire claims in the first four weeks of recovery.

-

The crash is the latest of several losses for aviation insurers in recent months.

-

The loss aggregator has classified the fires as two separate events for reinsurance purposes.

-

The insurance commissioner said the carrier has not shown the need for price increases.

-

Plus, the latest people moves and all the top news of the week.

-

More than 33,000 claims had been filed as of 5 February.

-

The estimate covers property and vehicle claims.

-

Settlements could reduce seized aircraft quantum to the mid-single billions of dollars.

-

The carrier is “extremely well capitalised” to achieve its strategic ambitions.

-

The insurer disclosed the estimates as it seeks emergency rate hikes from regulators.

-

Newer swing products offer an alternative way to deal with escalating awards.

-

Ultimate losses from the Palisades, Eaton and Hurst fires are estimated at $4bn.

-

The LA-based firm estimated gross cat losses in the range of $1.6bn-$2bn.

-

The role at PCS included acting as primary touchpoint for ILS.

-

Its post-tax estimate of $1.3bn is net of reinsurance recoveries.

-

This year's modelled outputs have increased across all return periods.

-

Underinsurance, total loss claims, and high property values have impacted loss estimates.

-

CFP has a $900mn reinsurance attachment point and is still receiving claims daily.

-

The storm is likely to be one of the costliest weather events in Canadian history.

-

The executive has also worked for Guy Carpenter during her 20-year career.

-

The state has seen 11 new entrants into the insurance market, reflecting renewed confidence.

-

But cat bonds are experiencing negative secondary market price movement.

-

Bolding will focus on aligning Gallagher Securities with Gallagher Re.

-

The carrier disclosed it will book $1.1bn in net losses from the California fires.

-

The carrier has been reducing its presence in the state since 2007.

-

The carrier’s Eaton Fire loss would be a retained net loss hit.

-

The underwriter has worked at Axis for a decade.

-

Derrick Easton has led Willis’s US ART team since joining the company in 2015.

-

The arrival of Marsh’s Donnelly will "accelerate" US specialty growth, the CEO said.

-

CEO Carl Hess said WTW is entering 2025 with “considerable momentum”.

-

The Bermudian’s wildfire loss estimate was based on an industry loss range of $35bn-$45bn.

-

President Andersen said he was optimistic about the 2025 reinsurance market.

-

The broker introduced 2025 guidance for mid-single-digit or greater organic growth.

-

The broker added reinsurers remain cautious on US casualty risk.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier has around $2.5bn-$4bn of reinsurance cover specifically for California risk.

-

Organic growth in broking segment Marsh accelerated during the reporting period.

-

The MGA has faced high claims activity on its energy liability book, fuelled by social inflation.

-

The Floridian also expects to report its “best earnings quarter” for Q4 2024.

-

The figure does not include specie or auto losses.

-

The nationwide carrier ranked sixth for multi-peril California homeowners' insurance in 2023.

-

The carrier is restructuring the business into three segments.

-

Munich Re and Berkshire Hathaway are among the major providers to large California cedants.

-

The carrier also has a $500mn excess $2.4bn aggregate protection.

-

The company received over 10,100 home and auto claims as of January 27.

-

Compared with its initial figure, CatIQ’s latest estimate has increased by 40%.

-

The homeowners’ carrier has secured Floir approval.

-

The California fires will test post-2018 treaty revisions – and reinsurers’ nerves.

-

Guy Carpenter said personal-lines exposure would account for 85% of the aggregate loss.

-

Fitch said 1Q wildfire losses could add 6% to 10% to Mercury’s CoR.

-

The industry loss number has increased threefold from an initial $5bn pick.

-

The total includes fire and smoke damage plus living expenses for evacuees.

-

The executive will replace retiree Michael Miller.

-

The fire started Wednesday morning and is currently 0% contained.

-

Disclosures show the insurer has roughly 4,300 homeowners’ policies in effect in fire-impacted zip codes.

-

Most carriers paid more in homeowners’ claims than they collected in premiums.

-

The broker said disaster data can attract more risk capital.

-

The pool services a number of public authorities in California.

-

Severe convective storms accounted for 41% of last year’s insured loss load.

-

In the food and beverage market, rates are falling by an average of 3%-4%.

-

The carrier can claim separately for the Palisades and Eaton fires if necessary.

-

The carrier has received more than 3,600 claims from LA wildfires.

-

There are many unknown factors including insurance gaps, high-value property and damage to critical infrastructure.

-

The estimate has reduced slightly since the modeler’s last update in October.

-

The anticipated portion ceded to reinsurance may reach the mid-to-high single-digit billions, it added.

-

This will be the most expensive fire in the state’s history, it said.

-

A $30bn industry loss would use one-third of Big Four’s 2025 cat budgets.

-

The reinsurance attaches at $7bn, unchanged for the past two years.

-

Sources say the Fair Plan is under-reserved, leading to the possibility of member assessment.

-

The members’ agent said 2024 will still be a profitable year for Lloyd’s.

-

The carrier is the largest writer of homeowners’ multi-peril in the state.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

The 2024 loss figure exceeded that of the previous record of C$6.2bn in 2016.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

Utilities have faced major liabilities for their involvement in starting wildfires.

-

Investigators are homing in on the likely causes of the incidents.

-

It has been a “good” bad renewal for cat reinsurers, with attachments likely to endure in the medium term.

-

The number of structures damaged may put the event on par with the fires of 2017 and 2018.

-

Sources say 2025 could be as costly for wildfires as the $20bn-loss years of 2017-18.

-

Total economic and insured losses are “virtually certain” to reach into the billions.

-

AM Best said it expects insured losses from the California wildfires to be “significant”.

-

This could see it surpass the 2017 Camp Fire, which cost around $12.2bn.

-

Moody’s also expects losses in the billions of dollars.

-

Six wildfires are now burning in SoCal, with the Palisades fire being the largest.

-

Six fires now cover more than 27,000 acres across Southern California.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

The fast-moving blazes have prompted evacuations across the city.

-

More than 4,000 acres are burning as thousands evacuate.

-

The path to Howden’s new era is steep – but the opportunity is vast.

-

In the US, pricing fell by 6.2% at the major renewal.

-

The $2bn+ raise would likely rest on the base case of an IPO in the medium term.

-

The executive has also worked for AIG and Ace.

-

The multi-day weather outbreak caused widespread damage from Texas to the Carolinas.

-

Reinsurer appetite largely outweighed demand at 1 January.

-

An 11th-hour softening has driven discounts into double-digit territory on some deals.

-

The broker said demand grew more slowly than reinsurer appetite.

-

A California ruling could set an important precedent as other courts consider similar cases.

-

Concern over rate adequacy remains, but reinsurers are delving deeper into data rather than walking away.

-

The reinsurance veteran joins from Artex Risk Solutions.

-

Everest is in the process of transforming its ILS offering.

-

Overall, reinsurers accepted that rate cuts were still leaving them with strong margins.

-

The company has been buying out Omers’ shares since 2015.

-

The state insurer is budgeting for an extra 43% of overall coverage in 2025-26.

-

TSR anticipates that next year will see an ACE value of 129 compared with the 30-year norm of 122.

-

The state reinsurer of last resort discussed options for 2025 reinsurance buying strategy.

-

James Drinkwater is to serve as vice chair and executive chairman at Amwins Global Risks.

-

It estimated insured losses from nat cats on track to exceed $135bn in 2024.

-

-

The carrier attributed the intensification of storms this season to climate change.

-

WTW sold Willis Re to Gallagher in 2021 for $3.5bn.

-

The executive is currently Asia Pacific CEO.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

The 2024 hurricane season stayed within predictions for high activity but lacked market-moving events.

-

The Class B notes on the carrier’s debut deal attach at $500mn of losses.

-

The loss figure has increased 200% from the initial number provided in October.

-

The broker’s US retail foray will throw the cards in the air. Where might they land?

-

CEO Mario Greco said his future retirement had nothing to do with bringing the plan forward.

-

The broker will be using Verisk US agricultural risk models.

-

This year’s top-line growth will be a decade-high.

-

The floods add to an already historic loss tally for Canada in 2024.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

Twia’s SCS losses in Q1-Q3 2024 have been more than double the budgeted amount.

-

The partnership is Fidelis Insurance Group’s first third-party capacity deal.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

The storm caused major damage to one of the drinks company’s warehouses in Tennessee.

-

The carrier’s Q3 net income will be around $100mn, far below consensus.

-

The D&F market now expects 2025 renewals to be flat to down 5%

-

The carrier increased specialty premium by 39% by the nine-month mark.

-

Funding has reached $3.2bn over the first three quarters, 7% less than in 2023.

-

The firm will provide an update on 22 November to avoid holiday season.

-

The broker said the casualty segment is approaching an “inflexion point”.

-

The results were disclosed in parent company Fairfax’s quarterly earnings.

-

The estimate implies a roughly $15bn homeowners’ industry loss from the hurricane.

-

The figures imply first-layer reinsurance recoveries for Helene.

-

The firm has helped underwriting businesses secure $3.5bn in capital.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

In line with Milton’s moderate forecast loss, the ILS market reaction will be less influential in post-event dynamics.

-

The carrier is looking at a $600-$900mn hit from hurricanes Debby, Helene and Milton.

-

Richard Mangion spent almost two years as CFO at Bridgehaven.

-

The firm still expects to deliver positive net income for Q3 2024.

-

Assuming Munich Re takes roughly a 3% market share of hurricane losses suggests a ~$20bn industry loss for Helene.

-

Axa XL Re has hired former Swiss Re executive Greg Schiffer as its North America CEO, effective from 11 November.

-

The company said $13bn-$22bn will come from wind damage.

-

CEO of WTW’s Corporate Risk and Broking for North America, discusses the transformation in operations, diversity, and talent strategy.

-

Randy Fuller, Head of North America Property at Guy Carpenter, discusses market stability, hurricane impacts, and the evolving role of claims professionals on October 1st, 2024.

-

Organic growth fell by 1 point quarter on quarter and was down by 5 points from Q3 2023.

-

A canvassing of the market showed some bifurcation on the necessity of a government backstop.

-

HCI is estimated to incur a net expense of $125mn for Milton in Q4 2024.

-

Most of the insured loss was attributable to wind.

-

Sweeney was most recently VP at Vantage Risk, as part of a team responsible for the US financial lines business.

-

The bulls expect around $20bn-$30bn in Milton losses, with the bears anticipating $40bn-$50bn.

-

The estimate includes private cover for residential, commercial and industrial property.

-

RMS will issue its final loss estimates for Milton later this week.

-

With the storm’s losses looking more favourable, questions over rates and gross/net strategies will arise.

-

Milton made landfall near Siesta Key yesterday, leaving 2.7 million homes without power.

-

On Wednesday, the model had suggested a mean figure at $25.3bn.

-

A more residential-skewed loss would impact Lloyd’s carriers in treaty where market share is lower.

-

The event has spared (re)insurers the more extreme scenarios that were under discussion earlier this week.

-

Milton made landfall south of Tampa Bay at Category 3 on Wednesday night.

-

The cost to the NFIP is likely to be a “mid to high single-digit-billion impact”.

-

The hurricane has destroyed hundreds of homes and left more than 2.7 million homes without power in Florida.

-

Setting aside the storm’s greater potential insured loss scale, the flood risk implies greater exposure.

-

The NHC storm track predicts landfall below Sarasota, south of Tampa Bay.

-

Paul spent five years at Gallagher Re in addition to 10 years at Guy Carpenter.

-

The aviation market is currently experiencing high levels of competition.

-

The NHC is predicting storm surge, exacerbated by the tide, as high as 15ft for Tampa Bay.

-

A hurricane warning has been issued for the east coast of Florida.

-

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

Milton is expected to move north of the Yucatan Peninsula today and cross the eastern Gulf of Mexico by Wednesday.

-

We may be in the midst of US hurricane season, but international catastrophe losses can emerge at any moment.

-

Guy Carp is advising the specialty insurer as it seeks to draw a line under adverse development from its historic program book.

-

As the carrier looks to provide liquidity to its PE backers, it is examining a range of paths to reshuffle the investor base.

-

The dispute has arisen due to a mismatch in the provision of infectious disease cover between Petroperu’s policy with local fronting carrier Mapfre, and the policy between Mapfre and its facultative reinsurers.

-

The executive will also remain his current role as head of Colombia, it is understood.

-

The appointments come after the shock departure by former president of North America for reinsurance Tim Ronda, who left late last month to become president of rival intermediary TigerRisk.

-

Guy Carpenter’s US facultative leader steps down after just eight months.

-

The executive joined Vantage on Monday, after spending the last 10 years at Axa XL.

-

The executive is leaving his role as global head of broking at Willis to take on a major role at Aon, in the aftermath of the mega-merger collapse.

-

Julian Samengo-Turner, who was global CEO of fac at Guy Carpenter in the 2000s, is leaving Willis after four years in the role.

-

Lockton Latin America and Caribbean has tapped Daniel Court from BMS to head financial and professional lines across the region, this publication understands.

-

The wholesaler could have an enterprise value of upwards of $7bn when it goes public.

-

Fresh departures also include Ana Maria Rivera, a global sales and solutions leader in LatAm.

-

Nagamine joins from troubled reinsurer IRB Re Brasil, where his remit covered reinsurance to the oil and gas industry and the international market.

-

The hires are latest move in a recruitment drive by Lockton in LatAm.

-

The news follows the reinsurer’s announcement that the executive would step down from his role at the end of April.

-

Miami-based Moreno spent 13 years at AIG as an energy underwriter, before becoming a regional energy leader at Willis in 2016.

-

Hessing joined the company in September to replace David Atkins, who had been with Enstar since 2003.

-

It follows earlier efforts by excess cyber insurers to introduce sub-limits during Q4.

-

The insurer is also said to have scaled back its cession percentage to between 25%-30%, with final signings still being determined.

-

US president Nick Davies, SVP Sean Quigley and COO Adam Finkle leave the business.

-

The portfolio of InsurTech partnerships will now be overseen by the company’s specialty businesses in the US and UK.

-

Sources said AIG is offering some staff guaranteed bonuses and stay packages.

-

Banking sources are divided on whether AIG is likely to be able to find a buyer for its life arm.

-

The executive had been in the role since 2017 and previously managed the insurer’s global upstream energy book.

-

The PE house and the London market wholesaler will submit bids in just over a week.

-

The reinsurance start-up could list on the London Stock Exchange in November.

-

Liability account move is latest development in ongoing reinsurance buying overhaul.

-

The executive moves over in what is likely to be interpreted as preparation for an orderly CEO succession.

-

Chris Schaper is to step in as CEO of the unit, as Jeff Clements and Chris Silvester depart.

-

The MGA, which writes on paper from Accident Fund Insurance Company of America, uses AI in its underwriting process.

-

The appointment follows McElroy’s elevation to global CEO of general insurance at the carrier.

-

The airline has said that it does not expect a total loss to the $200mn policy with the aircraft repairable.

-

Just under 20 tons of cocaine was seized from the MSC Gayane by US authorities last July.

-

Arrivals include energy product leader Carlos Vinicius Simonini and placement head Marcelo Daniel.

-

Sources say the carrier’s group head of cyber Paul Miskovich has left his post.

-

John Forney succeeds incumbent GeoVera CEO Kevin Nish.

-

Sources predict Lloyd's will be the executive’s first platform, with £200mn a likely target stamp.

-

Far Horizons Capital is also suing JP Morgan for misrepresenting the reinsurer’s prospects when it was founded.

-

Sirius’ ownership and governance structure still creates scope for progress to signing to be complicated.

-

The senior underwriter will lead a new cargo operation at the carrier, sources say.

-

Enstar will remain a minority investor, with PE capital also drawn from Dragoneer and SkyKnight.

-

CEO Macia said the closure was "not a criticism of our technology, team or mission".

-

Strikes, riots and civil commotion wordings in US property policies leave both the US and London markets open to potentially significant losses.

-

The move is the latest among large private equity houses to consolidate programmes and leverage buying power.

-

Members will work with the existing integration leadership team.

-

Cedant buys a cat programme excess $550mn, but also has significant inuring reinsurance.

-

The Exor chief reaffirms his long-term commitment to the reinsurer in an internal memo.

-

The Axis founder told this publication the business has also fallen short on governance standards.

-

The InsurTech, which AIG opted to put into run-off, had projected premium income of $50mn in 2020.

-

Upstream energy is unaffected by the pullback.

-

Sources also named sector stalwarts Stone Point and Aquiline as potential sources of start-up capital.

-

Tracy Dolin warns there is a potential for insolvencies if BI bills get through.

-

Broker report models optimistic, moderate, severe and extreme outcomes from pandemic.

-

Insurance carriers and private equity firms have been approached over the last few weeks to gauge their interest in the business.

-

The veteran underwriter previously held executive roles at Qatar Re and Emirates International.

-

The insurer files a counterclaim insisting the law firm’s policies do not cover its Covid-19 BI claims.