North America

-

The multi-line solution is aimed at supporting investors, developers and operators involved in the AI boom.

-

Upon closing, the unit will be renamed First Product Protection.

-

The LA wildfires resulted in the largest insured loss of the year, at $40bn.

-

Preeti Gureja has held senior roles at Chubb and AIG.

-

The property insurer has secured significant additional capacity for its FM Intellium unit.

-

The MGA platform has launched more than 20 new vehicles since 2021.

-

The appointments will grow Augment’s programmes operation.

-

Tokio Marine HCC, Chubb, IQUW and BluNiche are also on the tower.

-

Nick Durant helped launched Lockton Re North America in 2019.

-

The unit will be led by Ed Hochberg, global risk solutions leader at Guy Carpenter.

-

Syndicate 3705 adds to the MGA’s roster of capacity providers.

-

Weather events and potential increases in US casualty reserves remain sources of volatility.

-

Zaffino will become executive chair of AIG and retire as CEO by mid-year.

-

Gallagher’s $13.45bn deal for AssuredPartners was completed in August.

-

The move comes after a 200+ person mass team lift from Brown & Brown’s retail business in the US.

-

Ashleigh Edwards will report to group CUO Mark Pepper.

-

This publication exclusively revealed the $1bn deal last November.

-

Reinsurers’ average RoE was 16% as of September 2025.

-

The US CEO said the acquisition will be “truly transformative” for its TL clients.

-

Atlantic’s founders are to become Howden shareholders.

-

The underwriting unit has also rebranded D&O specialist Leopanthera.

-

The president and CEO will also be eligible for up to $50mn in shares.

-

Tom Wakefield says there is scope for opportunistic reinsurance purchases in 2026.

-

The renewal was characterised by abundant capacity and strong competition.

-

The market was unphased by January’s record wildfire loss in Los Angeles.

-

Non-loss impacted major property program rates were down by up to 20% at the renewal period.

-

The pricing battle has been played out but the extent of new demand will only show up in 2026.

-

Jim Hays outlined $90mn in stock losses as Howden called Brown & Brown’s narrative “false and inflammatory”.

-

Verisk entered the agreement to purchase the SaaS platform in July this year.

-

Former Aon employees are barred from using Aon’s confidential information.

-

Price has become a key differentiator in marine and energy.

-

Cedants pursued property renewals “aggressively” amid excess reinsurer capacity.

-

The broker is seeking an injunction, arguing it lost customers to Howden over the weekend.

-

Insurance Insider reflects on the themes that shaped 2025 for the London market.

-

Market participants on programs/MGU business in particular feel there's more capacity than 12 months ago.

-

Insurance Insider reflects on major loss events of 2025 for the London market.

-

Cedants are opting to bank double-digit savings as reinsurers fight for market share.

-

Sources said hundreds of Brown & Brown staff across various offices have left to join Howden US.

-

The US insurer squeezed its retention in a renewal where cat treaty retentions are widely holding steady.

-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

The company named two execs to head global wholesale and commercial.

-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

The parties now have 60 days to file a stipulation to dismiss the action.

-

Justin Camara was EVP and portfolio director for financial and professional liability.

-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

Solutions are being used to fill the gap left by traditional agg markets.

-

The packages contained client lists and records saved as “TOP SECRET” on a former employee’s computer.

-

The insurer plans to automate around 85% of key functions surrounding underwriting and claims processes.

-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

The market is “extremely competitive”, with several launces from MGAs and syndicates expected.

-

PE, more alignment and tech are uncoupling MGAs from traditional market swings.

-

London-based Tristram Prior will transfer to Bermuda to lead the line of business.

-

Approached for comment, Chubb denies that it submitted “an offer” for AIG.

-

The highest portion of losses was experienced in Alberta.

-

The argument for buyers to purchase cyber has never been stronger, yet growth is still lagging.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

According to the Civil Unrest Index, protest activity has soared over the past two years.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

The transaction is expected to close early in the first quarter of 2026.

-

The company had argued the judge missed key info when dismissing the case.

-

Sources said the deal will value the US M&A insurance broker at over $500mn.

-

Baldwin said the $1bn merger with CAC accelerates the firm's specialization plans by at least five years.

-

Next year will mark five consecutive years of insolvency increases.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

Marsh is also seeking expedited discovery in a related talent poaching case.

-

The payment will cover what the filing called “foregone incentives at his former employer”.

-

The industry veteran retired from AIG at the end of last year.

-

The peril has been historically difficult to model compared to others.

-

Paddy Jago was also chairman at Willis Re and North America CEO for P&C at Aon.

-

Habayeb will start next May following Kociancic's retirement.

-

Parties will now brief on a request for a preliminary injunction on an expedited timeline.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

Stephenson will start his new role in early 2026.

-

The agency cited moderating premium growth and selective underwriting capacity as factors behind the downgrade.

-

Existing facilities and carrier partners will be transferring from K2.

-

Panellists said the sector must communicate its value in language tailored to each client.

-

MassMutual will retain an 82% stake in the $470bn asset manager.

-

A motion by defendants to dismiss the case was also denied.

-

The latest guide is the first in a two-phase programme with a practical guide to follow.

-

AIG made the shock announcement earlier today that John Neal is not joining the insurer.

-

The ex-Lloyd’s CEO was due to join AIG as president but will not take up the role due to personal circumstances.

-

Panellists said recent M&A has not yet led to transformative change for the market.

-

Liès called for the industry to have a louder voice to promote greater insurance literacy across sectors.

-

The move comes after the withdrawal of a complaint in the Delaware court.

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

The transaction is Davies’ largest strategic M&A addition to date.

-

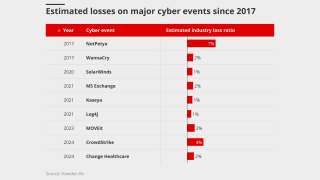

Specialised service providers like CDK can pose more frequency risk than global operators.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

An insurability crisis could pose systemic risks that undermine the foundations of finance.

-

A New Jersey judge also refused to grant WTW’s request for a restraining order.

-

The carrier’s top line grew to $1.4bn in the first half of 2025.

-

The June 2024 ransomware attack produced claims across many firms.

-

Zaffino said AIG will continue to assess strategic opportunities after the Convex, Onex and Everest deals.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Lack of major cat events could add further pressure on 1 January pricing.

-

Marsh is also suing a second tier of former Florida leaders.

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

CEO Greg Case said data centre demand could generate over $10bn in new premium volume in 2026.

-

The company reported no cat losses but saw a jump in attritional losses.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The broker will join Ron Borys’ financial lines team.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

Everest’s AIG deal meaningfully cuts its primary exposure.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

APIP is one of the world’s largest property programs.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

The range allows “for information that could emerge beyond what is known today”.

-

The appointments are aimed at offering a clearer team structure.

-

Sources said he will join the reinsurance brokerage next year, after his garden leave expires.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

The company and its main debt provider Ares agreed to relax its debt terms in April.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

Bill Ross has been CEO of the non-profit for 21 years.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Howden is facing fallout from its push into the US retail market via mass hires.

-

The London-based executive will relocate to Daytona Beach, Florida.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

The broker will report to Howden US CEO Mike Parrish.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The facility provides coverage for property, terrorism, energy, construction and utilities risks.

-

The broker’s new business and client services division is targeting $400mn of savings.

-

Earlier this week, the broking house announced a rebrand to Marsh.

-

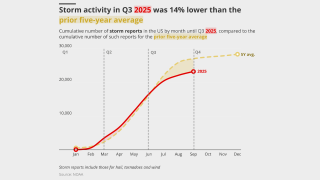

Though wildfire losses are up, total losses are the lowest since 2015.

-

After six years as CFO, Mark Craig is taking on the position of chief investment officer.

-

Brian Church has spent 20 years at Chubb.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

The reshuffle is likely laying the foundations for the eventual succession to CEO Mario Greco.

-

Mike Mulray joins from Everest, where he was EVP president of North America insurance.

-

Trade credit insurers are expected to respond with tighter buyer limits and stricter wordings.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

The governor has yet to sign a pending bill to create a public cat model.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

Plus, the latest people moves and all the top news of the week.

-

Carriers are rethinking the traditional renewal-rights model.

-

Moretti has relocated to California from London.

-

Willis claims at least two $1mn accounts were also unfairly lost to Howden.

-

The broker is understood to manage Brown & Brown’s account at Howden.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

In July, he took the role on interim basis from Laure Forgeron.

-

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

The class offers affirmative coverage for gaps in traditional insurance policies.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Alliant is in the process of moving the ~$1bn of business it places with Howden to other wholesalers.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

The business has been ~70% owned by White Mountains since January 2024.

-

The executive was most recently serving as CRO – insurance.

-

Landa was part of the team lift led by Michael Parrish, who is CEO of the US retail arm.

-

The facility will initially focus on US, Bermudian and European business.

-

She previously served as Hub’s North American casualty practice leader.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Other MGAs in the transactional-liability class are also expanding into the US.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The company will continue its capacity partnership with the MGA until 2030.

-

The tropical cyclone is expected to be named Imelda.

-

Plus, the latest people moves and all the top news of the week.

-

The transaction marks the largest US market entry by a Korean non-life insurer.

-

The executive has been with ASG since it was formed in 2016.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The executive met with UK colleagues to discuss plans for the US business.

-

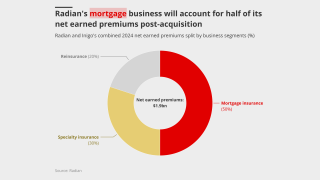

The low degree of overlap between the combining portfolios benefits both parties.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

Age has not been addressed as much as other areas of diversity, the panel said.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

The sidecar will support five programs providing specialty frequency coverages.

-

Her predecessor will become head of US excess casualty and operations.

-

Reinsurer executives stressed that the industry worked hard on setting the right structure.

-

The executive joins from MSIG USA.

-

Insurance Insider reported earlier today of the asset manager’s foray into the MGA space.

-

The MGA is backed by three Lloyd’s syndicates, offering capacity limits of up to $10mn.

-

The deal represents a first entry into the US MGA market for the $1.1tn asset manager.

-

Plaintiffs allege that manufacturers and retailers have broken environmental laws.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

He was appointed CUO of casualty, Americas, in July last year.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The carrier’s US and Europe claims teams will report to Clayden.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Blackstone-style capital seeking to get closer to source is a net negative for reinsurers.

-

Cedants target methods of reducing pressure on earnings as reinsurers chase growth.

-

Cat bonds have outperformed private ILS strategies in the YTD, according to ILS Advisers.

-

Former head of construction Bill Creedon will assume the role of chairman.

-

Bill Bouvier has spent more than three years at the legacy firm in this role.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

The broker’s joint venture with Bain Capital still lacks a CEO.

-

The private ILS segment took losses from LA wildfires and Mid-West severe convective storms in H1 2025.

-

The sector recorded total premiums written in London of £11.9bn in 2024

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

One of the options being explored is setting up a dedicated company for the wholesale vertical.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

CEO Thierry Léger also stressed his intention to repair the carrier’s relations with Covea.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

It is understood that CyberCube has been considering a sale of the business.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The California wildfires showed reinsurers can absorb major cats and remain profitable.

-

What’s next for the reinsurance market as Monte Carlo approaches?

-

The insurer has been under review with positive implications since March.

-

Skyward’s acquisition of Apollo will provide access to the London Bridge framework.

-

Growth in the SME sector could help stabilize the market, however.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The US specialty carrier announced Tuesday that it was buying the Lloyd's business for $555mn.

-

The executive most recently served as head of North American treaty reinsurance.

-

The LPPC will offer limits of $127.5mn EAR and DSU coverage in the US and Canada.

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

Cyber reinsurance supply has continued to outstrip demand during 2025.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

The executive said claims can be a differentiator in a softening market.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

The data modeling firm said losses previously averaged $132bn annually.

-

Signs of discipline indicate a “break” from past boom/bust market cycles.

-

Some 32% of survey respondents expect property cat rates to fall by more than 7.5%.

-

Henrietta Butcher leaves Tysers after decades with the broker.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

James River said the court was right to dismiss the fraud case.

-

Company said defendant ‘distraction’ can’t make up for flimsy arguments.

-

The violations included not using propertly appointed adjusters and failing to pay claims.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

Sources said that the NY-based TL underwriter has retained Piper Sandler to run the process.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

Submission volume is up 10%-20%, according to sources.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

Parrish, now Howden US CEO, and his colleagues said they didn’t violate contracts.

-

Assurex’s global independent broker network pumps $4bn of premium into the London market.

-

Patton Kline succeeds Glod as US aviation and space practice leader.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

Aspen would give Sompo more reinsurance scale, more US premium and a Lloyd’s presence.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

US retailers have various levers to pull to put pressure on potential new competitors.

-

Claude Wade is to step down from his role to address ongoing health issues.

-

Placement head Delchar said Gemini will be available across its global book of in-scope risks.

-

The broker approved a grant of $316mn in equity awards payable in staggered amounts over the coming five years.

-

This is the first rate filing to use the recently approved Verisk model.

-

The company was hit with a data breach on July 16.

-

The CEO said the carrier will prioritise margin over top-line growth.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

Company alum David Murie will lead the new business unit.

-

Layla O’Reilly and Mark Edwards are among the brokers leaving the firm.

-

The estimate covers property and vehicle claims.

-

The executive has worked for JLT Re, Lockton Re, Willis Re and US Re.

-

This publication revealed two years ago that EQT could lodge a $1bn claim.

-

Both organisations still predict an above-average hurricane season.

-

Plus, the latest people moves and all the top news of the week.

-

What does it take to turn a family-run insurance group into a global powerhouse?

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

The forecast has increased since the early July update due to several additional factors.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

California wildfires account for $40bn of the insured loss tally in H1.