Interviews

-

The syndicate says it will not set any top-line targets on digital follow strategies.

-

The CEO said that IGI’s action within its PI book showed it was ready to walk away from unprofitable business.

-

The European broker said a London wholesaler is the ‘missing piece’ of its strategy.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Inigo CEO Richard Watson said the team is ready for its “second album”.

-

From cat losses from wildfires and hurricanes to litigation battles to the shifting commercial insurance landscape — these are the stories that defined our industry in the last 12 months. In celebration of Insurance Insider US Honors Awards, please enjoy our Year in Review video.

-

The Corporation’s chair laid out plans to make Lloyd’s a preeminent market in the long term.

-

The CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

The carrier’s chief buyer urged a partnership approach from reinsurers.

-

While investors recently have favored the “instant gratification” of supporting brokers and MGAs, start-up reinsurer Mereo CEO David Croom-Johnson said he thinks capital will “fall back in love” with balance-sheet companies who deliver consistent profitable results.

-

Being conservative and stable is the name of the reinsurer’s game.

-

Scale is increasingly becoming a differentiator for reinsurance carriers, the broker noted.

-

Earnings covers do not need to equal aggregate reinsurance deals, the broker said.

-

Anticipation, motivation and inspiration are central to effective implementation.

-

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

-

Reinsurance CEO Wakefield said reinsurance structures may evolve for prolonged growth.

-

The CEO said the AHJ acquisition brought a ‘step change’ to Miller’s reinsurance growth.

-

The reinsurer’s new CEO said he sees no need for a radical shift in strategy.

-

The California wildfires showed reinsurers can absorb major cats and remain profitable.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

The executive said claims can be a differentiator in a softening market.

-

Assurex’s global independent broker network pumps $4bn of premium into the London market.

-

The carrier booked top-line growth of 2% in H1.

-

The family-owned group is embarking on a major international expansion.

-

CEO Alex Maloney said Lancashire’s growth was “more measured” amid softening.

-

The carrier posted its H1 results earlier today, beating analyst consensus.

-

The LMA head also praised Velonetic for transparency on Blueprint 2.

-

The company has also expanded its relationships with US and UK MGAs.

-

The CEO said business remains adequately priced in most classes.

-

The firm is currently working with 13 MGAs, including QMetric and Eaton Gate.

-

The insurer is weighing up options including entering new geographies and M&A.

-

A second syndicate is being explored for “big and bold” new lines

-

The executive said there was an ‘active cross-sell culture’ across The Fidelis Partnership.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

The Lloyd’s syndicate was one of just a couple of reinsurance start-ups in the current hard market.

-

The $2.6bn deal provides Ergo with an entry point to the US SME market.

-

The soft market continued through H1 2025, especially on shared programs.

-

Gallagher Re’s Lara Mowery said mid-year renewals marked the “beginnings of capacity” emerging.

-

The executive told this publication he will have more time “to propel” embedded auto MGA In The Car.

-

There has been an uptick in UK retail firms buying cyber after a string of attacks.

-

The carrier’s president Andrew McMellin is aiming to double London market share in the next five years.

-

The executive said the MGA model is here to stay and offers an “immense value”.

-

The firm's near-term global strategy includes operations in the UK, US, parts of Europe and Asia.

-

The new Lloyd’s chief of market performance also outlined target growth areas.

-

The PE firm’s Aaron Cohen said full integration of broking assets is crucial.

-

Chris Jones told this publication his plans for the first six months of his tenure.

-

Eckert said the reinsurance market is still at historically well priced levels.

-

The executive said the industry can continue to grow by embracing emerging threats.

-

The exec said if he were a carrier CEO, now is the time he would start looking for deals.

-

The executive said secular heightened risk trends would fuel the carrier’s primary expansion.

-

Jacqui Ferrier speaks with Insurance Insider in her first interview since taking the reins.

-

The executive criticised the ongoing underrepresentation of women in senior leadership roles.

-

Lloyd’s chair Bruce Carnegie-Brown officially hands over to Charles Roxburgh today.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

Being the “new kid” has created interest in the market, Mereo CEO Croom-Johnson added.

-

TMK is the largest insurer of aviation risks at Lloyd’s by gross written premium.

-

Modified freehold gives syndicates and investors clarity around exit plans.

-

Langley said the London market could benefit from boosting its image at home and abroad.

-

He expects the operational hygiene of MGAs to be tightened soon.

-

Recent transactions on the platform include cat bonds from Flood Re and Brit.

-

The broker said that businesses not investing in AI capabilities would be left behind.

-

The MGA’s GWP hit $4.6bn as the CEO labelled aviation all-risks rates “woefully inadequate”.

-

The Corporation’s CFO hailed profitable growth but warned syndicates to maintain discipline.

-

Syndicate 1984 is set to begin underwriting next month.

-

The company’s syndicate has booked an 87.4% combined ratio for 2024.

-

The executive said MGA and broking start-up activity looked set to continue.

-

CEO Alex Maloney said the LA fires might prompt some carriers to go more “risk-off”.

-

The executive said the firm had to focus time and investment on the most meaningful projects.

-

Ascot Underwriting CEO Ian Thompson, who took the helm last summer, discussed emerging headwinds.

-

The executive said the company’s expanding capacity base would make it “more like a marketplace”.

-

Good ESG practices are part of good risk management, the company said.

-

Coverage restrictions in renewables are increasing risk for investors.

-

The insurer will focus on UK regional growth and opportunities in cyber for the coming year.

-

The executive said that the fragmentation of the European market has proved a barrier to entry in the past.

-

Syndicate 1200 CEO Graham Evans says growth will likely slow in 2025 as the market reaches inflection point.

-

The reinsurance market is now in a healthy, stable condition, according to Gallagher Re.

-

The executive said the market would soften during 2025 but would not drop through the floor.

-

Chairman Neil Eckert and CEO Trevor Carvey said the outlook for the market remains "very good".

-

The executive said that capital, tech and algorithmic capabilities would help the structures endure.

-

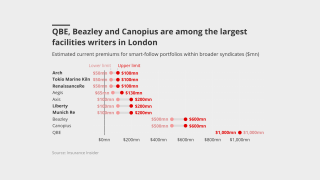

The broker facility is led by Beazley’s Smart Tracker Syndicate.

-

The carrier has undertaken work to give it “optionality” for a public listing, but has no plans to list in the short term.

-

The investment banker said the scarcity of attractive assets made the MGA market “red hot”.

-

CEO Stef Raftopoulos said the company platform will let the operation reach a suitable scale.

-

The carrier is set to start underwriting five new lines of business in the Lloyd’s market.

-

The marine underwriter said the business had grown through taking “very big positions” on programmes.

-

The executive also highlighted SRCC in property treaties as a concern.

-

The carrier is looking to grow its specialty offering across Europe and APAC.

-

Nick Orton said the market is now pricing for non-peak perils, amid some surprise losses.

-

Pockets in the business are still experiencing significant stress, she added.

-

The MGA aims to capitalise on the growth and maturation of the continental MGA sector.

-

The executive said that being in Lloyd’s would help the carrier’s global distribution.

-

The executive explained the Corporation’s ‘elephant hunting’ expansion strategy.

-

Canopius Re CEO Charles Cooper says the growing division will show relevance by taking large lines on limited deals.

-

The firm will split its global combined cat program into two layers.

-

The executive struck a cautious note on the industry’s reserve adequacy for the 2021-23 accident years.

-

The CEO said standardising wordings to drive syndicated distribution could help Lloyd’s grow.

-

In his first interview as Swiss Re CEO, Andreas Berger acknowledged the mistiming of casualty growth, a purist approach on reserving and organisational complexity.

-

Scor is also limiting its exposure in political risk and cyber.

-

The platform hopes to confirm significant partnerships in the near future.

-

The executive said volatile losses made underwriting the class less predictable.

-

The executive said losses in the Middle East had “sent shockwaves” through the market.

-

The new broking president added that hundreds of Marsh staff would not show up tomorrow at WTW.

-

The executive also said there had been a “step change” on culture in the market.

-

The executive said that with a single platform and capital base, the company had few distractions.

-

The executive said that more sophisticated use of data could optimise a portfolio.

-

The Oxbow report found that AI use cases span the entire (re)insurance capability model.

-

InsurX has grown its capacity beyond £100mn after adding D&F to its existing contingency business.

-

The broker said another strong year would drive pressure for “reasonably significant rate reductions” next year.

-

She said potential hurricane activity was just one factor impacting the 2025 outlook.

-

The parliamentary candidate said politicians don't take financial services in the City seriously enough.

-

The executive said Lloyd’s was the “best place” to underwrite emerging risks.

-

The CEO also discussed the need for portfolio diversification.

-

Carter said technology is creating more of an imperative to diversify the future insurance workforce.

-

The broker said there was an opportunity to take advantage of competition to improve outcomes for clients.

-

LMG's latest London Matters report reveals that UK capital has lost ground to the US and Bermuda in some lines.

-

The carrier has ambitious growth plans for its rebranded Munich Re Specialty segment.

-

O’Shea outlined growth ambitions and managing leadership transitions at the MGA in a wide-ranging interview.

-

The carrier is also considering a potential casualty treaty market entry.

-

CEO Luke Tanzer talked about the expansion drive as the legacy firm reported a 14.3% RoE for 2023.

-

The CEO was speaking after the carrier posted a $503mn profit in 2023.

-

The MGA was founded by Natasha Attray, James Dodd, James Fletcher and Charles Turnham.

-

The firm launched late last year in the US with a $250mn capital injection, and has also acquired a UK platform.

-

The executive was speaking on the Behind the Headlines podcast.

-

The unit will target Northern European M&A within the next six months.

-

The MGU is exploring additional third-party capital relationships.

-

Vivek Syal will become CUO of Tokio Marine Kiln in April.

-

As the interim CEO prepares to hand on the role, a major restructure is ahead.

-

Existing taxes could be lowered under a potential new structure.

-

The Bermudian posted 18.5% top line growth in its first year as a public company.

-

Continued geopolitical and climate uncertainty will hold up pricing.

-

Lloyd’s is now an attractive environment for entrepreneurs, the CEO said.

-

The firm’s growth focus for 2024 will be in property D&F.

-

The LMG chair also discussed the need for tailored regulations.

-

The executive said that adequate rates were encouraging insurers to grow.

-

Pravina Ladva, Swiss Re's group CDTO, sets out experiments the carrier is conducting with generative AI.

-

Instead, the firm’s core segments reported $13.5mn in full-year cat losses.

-

The firm will have more flexibility around talent compensation and M&A activity.

-

The MS Re CEO said 1 January oversubscription levels on cat were not notable.

-

The CEO speaks on portfolio remediation and the future of the lead-follow model.

-

In its first year under new ownership and after setting up its own managing agency in 2022, the Lloyd’s syndicate is looking at ways to leverage its infrastructure.

-

The platform is adding a contract builder component that would smooth adoption of the new MRC v3 contract.

-

The CEO emphasised that while trading conditions are favourable for the specialty segment, the company would make the decision to go public based on its own merit rather than market timing.

-

Any firms that struggle to communicate on the new platform will be charged “translation fees” in the long term.

-

Hamilton is seeing additional opportunities on the casualty reinsurance front as other players pull back, given the loss activity stemming from 2019 and prior years.

-

The positive results in Q3 are starting to form a “track record” of improvement as the carrier moves away from “a place of underperformance”, the executive told this publication.

-

After moving into the rank of fifth-largest reinsurer, following its acquisition of Validus, RenRe said it would continue to take a leading role in the regional cat space and expected to be more able to trade through market cycles.

-

Clearer wordings for cyber cat risk would also help foster the development of the more capital-efficient event XoL reinsurance market in cyber, Kessler said.

-

Aon’s three-year plan will allow the firm to go “further faster” in serving clients with increasingly complicated needs, as well as creating additional operating leverage that will create the opportunity for Aon to deploy capital more broadly, CEO Greg Case told this publication.

-

The Bermudian’s global property CUO and European chief says it is ready to expand if conditions remain favourable.

-

The minister stated that it is time for insurers to step up and increase their risk appetites and reduce prices in response to the reforms.

-

The executive said the broker was primed to take advantage of sector tailwinds, and continue attracting talent.

-

The Corporation’s chairman said Lloyd’s has “earned the right to grow” and wants to drive competitive progress on ESG goals.

-

The Duncan Dale-led business has reached an ‘inflection point’ where a large, aligned capital provider is advantageous, executives say.

-

Hurricane Idalia is a reminder of the new normal cat environment and that reinsurers must continue to ensure they do not pick up attritional losses, the company’s P&C head said.

-

The chairman stressed that his new start-up will focus on the liability side of the balance sheet not the asset side – in distinction to the hedge fund re model.

-

Nicholas Lyons plans to champion the London market's expertise on cyber and climate risk, and discuss ideas for a consolidated systemic risk pool.

-

Chairman and CEO Jean-Jacques Henchoz sees affordability of insurance becoming a politicised issue, while discussions on preventive measures remain on the sidelines.

-

The reinsurer’s new CEO said demand is to outstrip supply as cedants grow and exposures expand.

-

Some 15 months on from the property reinsurance exit, he said the firm continued to reserve the right to reshape the portfolio.

-

Arch Re CEO Maamoun Rajeh says renewals need to be more like performance reviews: telegraphed with no surprises, as there is no upside to late games of “chicken”.

-

WTW has highlighted that global climate change-related litigation cases have doubled to more than 2,000 since 2015.

-

Insurance's GWP decline was driven by a couple of programs that were underperforming, while reinsurance's deceleration was driven by a deliberate slowdown in the mortgage book.

-

The commercial insurance CEO said carriers must communicate on the reasons for ongoing rate increases as the market bifurcates.

-

A “little flurry” of new capacity helped the mid-year renewals as reinsurers pushed to deploy at the last chance for 2023.

-

Lorraine Harfitt also discussed the Funds at Lloyd’s capital squeeze, and the prevailing mindset keeping women from CEO positions in the Lloyd’s market.

-

Joe Gordon also reiterated plans to switch off PPL’s older Ebix Europe platform later this year, claiming some participants see friction with brokers “when it’s not there”.

-

The US retailer’s acquisition of the UK MGA and broking group will be mutually beneficial, according to executives.

-

The broker’s UK CEO said the current rating environment is ‘eminently supportable’ for London carriers.

-

The fac-focused reinsurance unit expects to expand into treaty over the next year and attract additional talent to boost its operations.

-

Sean McGovern, chair of the London Market Group, outlined why it is critical for the trade body’s outreach programme to build the market’s talent pipeline and attract data science expertise.

-

The wholesaler’s new chief said owners Cinven and GIC have “long-term ambitions” for Miller now it has “regained its mojo”.

-

Mark Cloutier set out Aspen’s plans for top-line 2023 growth in the range of 10%, and a continued strategy of pursuing rate rather than exposure growth in property cat.

-

The broking CEO set out the London wholesaler’s growth strategy a year on from the AUB takeover announcement.

-

The broker’s international chairman said that without an influx of new capacity, the market will remain disciplined.

-

MS Amlin Syndicate 2001 – one of the largest in the Lloyd’s market – reported a combined ratio of 99.9% for 2022.

-

The executives said the P&I market needs to be “very careful” about underwriting conditions.

-

Gard’s best underwriting results in 15 years was driven by the “extraordinary” lack of large losses in its commercial marine and energy business last year, according to CEO Rolf Thore Roppestad.

-

The executive said the carrier had sufficient “dry powder” to expand in hard market conditions.

-

The executive said the low claims of 2022 and the large losses of 2021 were anomalous.

-

The MGA’s international platform hopes to bring in MGA underwriters looking for US expansion.

-

John Thompson, Graham Kilby, Richard Peers and Russ Nichols will take the top jobs.

-

The PRA’s Charlotte Gerken has set out the regulator’s initial thinking on tracking inward investment to the London market, among other measures, to implement its new economic growth duty.

-

The Lloyd’s carrier’s CEO said the market must now ‘climb out of the rehabilitation phase’.

-

With PPL just two weeks from launching its twice-delayed Next Gen placing platform, new CEO Joe Gordon has stressed the importance of a migration this year to a completely rebuilt system and its potential as a rich data hub for the market.

-

In an interview with this publication, the CEO admitted the transition “took longer than any one of us would have wanted”.

-

CEO Nick Cook said the company also plans to invest in an international MGA strategy and a capital advisory unit, with 149 hires budgeted this year.

-

Beazley’s $45mn first-time cyber cat bond offered all-perils coverage, though some expected early deals to start with limited scope.

-

Group CFO and incoming president of insurance Jeremy Noble has told Inside P&C that the insurance operation is where Markel sees the most upside potential.

-

The Canopius MGA has reached $130mn of premium, but is moving to secure third-party support to scale up further.

-

Fidelis chairman Richard Brindle said a shift towards named cat perils and away from complex structures is underway, but that carriers need more unity between inwards and outwards teams to navigate the harder market.