Howden

-

The parties now have 60 days to file a stipulation to dismiss the action.

-

Pricing in the D&O market is starting to flatten after several years of steep decreases.

-

The broking group also increased its euro loan by EUR160mn to EUR1.16bn.

-

Rowan Douglas steps down as Howden climate risk CEO, stays on as senior adviser.

-

Clive Strickland previously worked at Gallagher, where he had been a partner since 2020.

-

Mark Wood chairs Howden Asia Pacific and Howden Private Wealth, and is deputy chair of UK&I.

-

The transaction is expected to close early in the first quarter of 2026.

-

Sources said the deal will value the US M&A insurance broker at over $500mn.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

Marsh is also seeking expedited discovery in a related talent poaching case.

-

Parties will now brief on a request for a preliminary injunction on an expedited timeline.

-

A motion by defendants to dismiss the case was also denied.

-

The move comes after the withdrawal of a complaint in the Delaware court.

-

A New Jersey judge also refused to grant WTW’s request for a restraining order.

-

Marsh is also suing a second tier of former Florida leaders.

-

The broker will join Ron Borys’ financial lines team.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

APIP is one of the world’s largest property programs.

-

The London MGA is considering various options, including a minority investor.

-

Plus, the latest people moves and all the top news of the week.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

Howden is facing fallout from its push into the US retail market via mass hires.

-

The broker will report to Howden US CEO Mike Parrish.

-

After six years as CFO, Mark Craig is taking on the position of chief investment officer.

-

Manuel Perez will continue in his ongoing role as head of cyber for LatAm.

-

Plus, the latest people moves and all the top news of the week.

-

Willis claims at least two $1mn accounts were also unfairly lost to Howden.

-

The broker is understood to manage Brown & Brown’s account at Howden.

-

-

Alliant is in the process of moving the ~$1bn of business it places with Howden to other wholesalers.

-

Landa was part of the team lift led by Michael Parrish, who is CEO of the US retail arm.

-

She previously served as Hub’s North American casualty practice leader.

-

Abbas Juma has spent more than seven years at Howden M&A in various senior roles.

-

Howden’s portion of the US retailer’s premium is in particular focus.

-

Plus, the latest people moves and all the top news of the week.

-

Global pricing is now 22% below the mid-2022 peak.

-

The executive met with UK colleagues to discuss plans for the US business.

-

The change in reinsurance intermediary follows an RFP for the account.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

The Howden MGA established its marine presence in the Netherlands in 2023.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

Company said defendant ‘distraction’ can’t make up for flimsy arguments.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

The broker has a longstanding trading relationship with US retailer Alliant.

-

Parrish, now Howden US CEO, and his colleagues said they didn’t violate contracts.

-

Plus, the latest people moves and all the top news of the week.

-

The broker said 2026 will bring a “cautious but deliberate” aviation reinsurance environment.

-

A key hearing in the poaching case is set for 4 September in New York.

-

US retailers have various levers to pull to put pressure on potential new competitors.

-

Bartlett is the latest in a series of talent moves in the construction market.

-

The move is a retaliation to Howden’s US retail launch.

-

Layla O’Reilly and Mark Edwards are among the brokers leaving the firm.

-

The repricing on the broker’s $3.1bn term loan will save an estimated $8mn per year.

-

Plus, the latest people moves and all the top news of the week.

-

The plaintiffs seek a declaration that part of Marsh recruits’ restrictive covenants are unenforceable.

-

CEO David Howden accused rivals of “restricting choice for their own clients”.

-

Group CEO David Howden says: ‘Our doors are open’.

-

The suit asserts the raid will cause “incalculable harm” to the broker.

-

Plus, the latest people moves and all the top news of the week.

-

The broker is looking to move as much of the book away from its adversary as possible.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

Staff targeted include producers that channel business through Howden’s London wholesale arm.

-

Plus, the latest people moves and all the top news of the week.

-

The broker’s planned US talent raid is in keeping with its audacious history.

-

The expansive European broker is targeting Mike Parrish’s team and former McGriff staff.

-

Dual’s Luke Browne will join Consilium Risk Solutions.

-

The expansive broker now employs over 450 people in Japan, after launching there in 2024.

-

The executive told this publication he will have more time “to propel” embedded auto MGA In The Car.

-

Richardson has been with the firm since 2015 and was most recently vice chair and chair of international.

-

Shuker was CEO of A-Plan when Howden acquired the firm in 2021.

-

The Lloyd’s business secured a $90mn investment from Alchemy in 2021.

-

The broking CEO was honoured for services to the insurance industry.

-

Working out ROI on sponsorship deals is difficult, but the sport is beloved by insurance brands.

-

Howden recently expanded in South America with the takeover of Contacto and Innova Re.

-

In 2024, MGA GWP reached approximately $20bn in Europe.

-

The driver of growth has shifted from rate to volume, as pricing increases tail off.

-

A 20% increase in FHCF retention levels sent cedants to the private market.

-

The broker called on carriers to expand coverage into new specialisms.

-

The syndicate-in-a-box is the first Lloyd’s syndicate to operate outside London.

-

The executive will oversee Howden Re’s treaty and fac business in Miami.

-

The broker said the burgeoning class of business was still finding its stride.

-

The UK broker is still in talks with Mubadala about a standalone investment in the business.

-

The facility will provide capacity from a tracker unit, as well as quotes using Ki technology.

-

The 1 April renewals are the key date for Japanese treaty.

-

An issue has emerged in diligence, and Howden has a complex consortium to align.

-

Caution around economic volatility wrought mixed outcomes in specialty re.

-

Sources said the Evercore-run Risk Strategies process has drawn the interest of Brown & Brown.

-

The London D&F market will shoulder most of the losses.

-

There has been plenty of talent churn in the transactional risks space lately.

-

Plus, the latest people moves and all the top news of the week.

-

The broker CEO explained talent is what drives organic growth.

-

The group’s revenues expanded by 23% to more than £3bn for the year to 30 September 2024.

-

WTW’s ownership of Miller may offer a cautionary tale for the US retail-London wholesale group structure.

-

Earlier this month this publication revealed Howden’s $2bn+ fundraising talks with Mubadala to fund a US deal.

-

CEO McManus vows broker “will not be silent” over “unlawful” competitor behaviour.

-

The pool services a number of public authorities in California.

-

The new European A&H business will be led by Samia Baliad, who joins the company from Axa.

-

Innovation will become more important to sustain strong results absent pricing tailwinds.

-

The path to Howden’s new era is steep – but the opportunity is vast.

-

The $2bn+ raise would likely rest on the base case of an IPO in the medium term.

-

Reserves are likely to be set following initial court rulings this year.

-

Attachment points are unlikely to return to pre-correction levels any time soon.

-

The broker has placed Rethink staff under consultation, sources said.

-

The brokers will focus on cross-border, high hazard risks.

-

Thomas Kroely will initially focus on supporting the broker’s European expansion.

-

Cybersecurity basics could reduce cyberattack costs by up to ~75%.

-

The broker’s US retail foray will throw the cards in the air. Where might they land?

-

The cyber solution is backed by Mosaic, Chubb and Liberty Specialty Markets.

-

The pair will report to Imea CEO Julian Samengo-Turner.

-

The broker will join the marine liability team within the new Ken Syndicate 3832.

-

The loss ends a spell of benign claims activity in the downstream segment.

-

The smart-follow unit was launched as part of Howden’s HX in 2020.

-

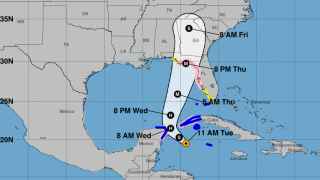

In the best-case scenario, a Big Bend-landing storm could cost $3bn-$5bn, Howden Re said.

-

Construction rates remain stable with some talk of potential softening.

-

The executive has held senior alternative capital roles at Aon and Guy Carpenter.

-

The CEO said the broker can now hold its own “with any client, anywhere”.

-

The duo will be reunited with former colleague Tim Martin.

-

The July downtime will increase relevance, demand and innovation for the market.

-

He will focus on the London and US markets, including the placement of consortia and binders.