CORPORATE TRIAL

As a Camelot Network employee we'd like to invite you to take an extended free trial to access Insurance Insider, to demonstrate how our readers get market intelligence on M&A deals, new ventures, losses and renewals that is simply not available anywhere else.

Register here:

-

Gain a competitive advantageHear first about tactical developments like personnel moves, live M&A situations, market-moving losses, line of business withdrawals, key renewals and early stage start-ups

Gain a competitive advantageHear first about tactical developments like personnel moves, live M&A situations, market-moving losses, line of business withdrawals, key renewals and early stage start-ups -

Make better decisionsUnderstand market dynamics in crucial lines of business or for specific businesses, underlining emerging threats and revealing new opportunities

Make better decisionsUnderstand market dynamics in crucial lines of business or for specific businesses, underlining emerging threats and revealing new opportunities -

Act firstReference insight about the long-term forces reshaping the industry

-

Profit from foresightLeverage our analyst team’s calls on various companies within the industry

Profit from foresightLeverage our analyst team’s calls on various companies within the industry

OUR LATEST COVERAGE

Our latest analysis

-

Pryor-White founded Tarian Underwriting, which was sold to Corvus in 2022.

-

In July, he took the role on interim basis from Laure Forgeron.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

The recruits will join from Nephila, Aon and Malaysian Re.

-

Declared events totalling just under A$2bn ($1.3bn) included one cyclone and two floods.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

The carrier is planning a limited relaunch into the UK D&O market.

-

-

A roundup of all the news you need, including OneGlobal’s first acquistion.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Alliant is in the process of moving the ~$1bn of business it places with Howden to other wholesalers.

-

It comes as the MGA expects to write more than $1bn of premium in 2026.

-

The underwriter has worked for Markel in Singapore since 2020.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

A roundup of all the news you need, including Marsh McLennan’s wholesale team launch.

-

The carrier will pay special dividends only in exceptional circumstances.

-

Samir Hemsi was CUO at Westfield Syndicate and sat on the firm’s board of directors.

-

Joel Hodges will run the international business as managing director.

-

Panellists at Insider Progress shared fixes for bias, confidence and culture.

-

The newly united company has set out ambitions to double in size by 2030.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

The former civil servant joined the Corporation in October 2021.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

Jo Smart has worked for Torus and Aegis during his two decades in the market.

-

West Hill Capital is the main investor in the capital raise.

-

Volante launched Syndicate 1699 in 2021.

-

Improved performance and growing investment returns played a role in the upgrade.

-

The aviation market has experienced a run of large losses this year.

-

The business has been ~70% owned by White Mountains since January 2024.

-

A roundup of all the news you need, including the latest Behind the Headlines podcast.

-

Plus, the latest people moves and all the top news of the week.

-

Julia Graham played a key role in the UK's introduction of captive-friendly regulation.

-

Inigo CEO Richard Watson said the team is ready for its “second album”.

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

The executive has worked at Aon for almost two decades.

-

The executive was most recently serving as CRO – insurance.

-

Landa was part of the team lift led by Michael Parrish, who is CEO of the US retail arm.

-

Stephan Simon left BMS in June 2024 after almost three years in the role.

-

A roundup of all the news you need, including Nexus’ W&I withdrawal.

-

The facility will initially focus on US, Bermudian and European business.

-

High capacity is adding to competition in the upstream energy space.

-

The firm offered W&I cover with capacity of up to £16mn per transaction.

-

She previously served as Hub’s North American casualty practice leader.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Stephen Ridgers is leaving his current role as head of construction midcorp at Allianz Commercial.

-

The pair have expanded remits overseeing property and specialty.

-

Other MGAs in the transactional-liability class are also expanding into the US.

-

A roundup of all the news you need, including Acquinex’s US expansion.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

Cyberattack/data breach remains in the top slot.

-

Kantara now holds a majority stake in the MGA, with the rest held by employees.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

Current backer JC Flowers will retain its holding and the cash will fund a Bermuda acquisition.

-

The vehicle will now cover an E&S program jointly launched with Accredited.

-

New sources of capacity lack the expertise to service rapidly developing clients.

-

Abbas Juma has spent more than seven years at Howden M&A in various senior roles.

-

A roundup of all the news you need, including Abbas Juma's departure from Howden.

-

The upcoming Lloyd’s Lab cohort 16 will include a dedicated Irish theme.

-

The company will continue its capacity partnership with the MGA until 2030.

-

Susan Langley will look to strengthen global business ties and promote UK growth.

-

The BP Marsh-backed MGA launched earlier this year, led by Adam Kembrooke.

-

Howden’s portion of the US retailer’s premium is in particular focus.

-

The underwriter has worked at Hiscox, Lloyd’s, Chubb and Zurich.

-

Legacy reinsurance deals will be reviewed by the Legacy Review Panel.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

Tom Potter was global casualty underwriting manager for UK & Lloyd’s at Axa XL.

-

A roundup of all the news you need, including Helios’ H1 results.

-

The Lloyd’s investment business has cut expenses by 54% over the past six months.

-

Sean McGovern will step down from the role in December.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

From cat losses from wildfires and hurricanes to litigation battles to the shifting commercial insurance landscape — these are the stories that defined our industry in the last 12 months. In celebration of Insurance Insider US Honors Awards, please enjoy our Year in Review video.

-

The pair hail from Dale Underwriting and Axa XL, respectively.

-

The tropical cyclone is expected to be named Imelda.

-

A roundup of all the news you need, including DB’s acquisition of Fortegra.

-

Plus, the latest people moves and all the top news of the week.

-

The transaction marks the largest US market entry by a Korean non-life insurer.

-

Georges De Macedo will remain within the group as a board member.

-

The executive has been with ASG since it was formed in 2016.

-

A roundup of all the news you need, including our aviation analysis.

-

Aon’s Enrico Vanin will lead the platform as CEO.

-

The veteran underwriter said market conditions are still ‘robust’.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The Corporation’s chair reiterated its aim to reduce the cost of doing business.

-

The sponsorship deal comes ahead of the Winter Olympics and Paralympic Games next year.

-

The London broker has also recently hired Michael Lohan from Lockton.

-

Global pricing is now 22% below the mid-2022 peak.

-

MGA Amiga Specialty launched in May, with backing from investor BP Marsh.

-

A roundup of all the news you need, including Miller's latest energy hire.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

The rating action follows the upgrade of Italy's sovereign rating earlier this month.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

The report highlighted the gap between insured and uninsured attacks is widening.

-

The broker’s headline Ebitda was $20mn, up from $5.6mn in 2023.

-

The toll of risk losses sustained by the PVT market this year is mounting.

-

A roundup of all the news you need, including our analysis of the 2025 hurricane season.

-

IAG completed its takeover of RACQ last month.

-

The executive met with UK colleagues to discuss plans for the US business.

-

The change in reinsurance intermediary follows an RFP for the account.

-

Dale Underwriting recently pulled out of standalone offshore energy business.

-

A roundup of all the news you need, including Super Typhoon Ragasa.

-

The major storm is set to move on to mainland China later in the week.

-

The economic loss from the event was around EUR7.6bn.

-

The move comes as the broker rebuilds its Bermuda team.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

A roundup of all the news you need, including our interview with Sir Charles Roxburgh.

-

Plus, the latest people moves and all the top news of the week.

-

The Corporation’s chair laid out plans to make Lloyd’s a preeminent market in the long term.

-

Louis Tucker established and later sold Barbican Insurance to Arch in 2019.

-

Losing senior women creates a knock-on effect as juniors lose role models.

-

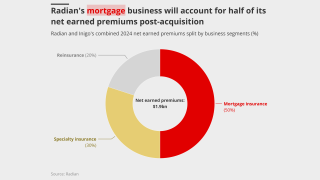

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

The CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

More general issues at recruitment level include drawing from too narrow a pool.

-

The US mortgage insurer announced its $1.7bn acquisition of Inigo earlier today.

-

Alessa Quane will report to Sompo P&C CEO James Shea.

-

The deal becomes part of a wave of carrier dealmaking.

-

A roundup of all the news you need, including Radian’s $1.7bn acquisition of Inigo.

-

The 2024-25 period has been the worst on record for claims, with costs of $775mn+.

-

Inigo executives told Insurance Insider last year they were weighing up the casualty treaty market.

-

The deal marks the latest step in Catalina’s shift from P&C to life run-off.

-

The broker said insurers were facing increasing pressure to improve financial performance in claims.

-

It said the loss did not reflect the underlying economic performance of the business.

-

This publication revealed in February the incident was expected to lead to a major claim.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

A roundup of all the news you need, including a ruling in the High Court aviation appeal.

-

The recent Iumi conference highlighted the impact of waning globalisation and tariffs.

-

A decision in relation to who bears which legal costs will be reached at a later date.

-

The carrier plans to reduce 623’s stamp by around 10% next year.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The combined casualty treaty team has also made a number of hires.

-

Age has not been addressed as much as other areas of diversity, the panel said.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

The sidecar will support five programs providing specialty frequency coverages.

-

Chris Eaton and Bill Moret gave their notice last week without specifying their destination.

-

-

A roundup of all the news you need, including an aviation volte face at Guy Carpenter.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

Her predecessor will become head of US excess casualty and operations.

-

Reinsurer executives stressed that the industry worked hard on setting the right structure.

-

The business has ramped up its underwriting volume since launching in Lloyd’s last July.

-

The executive joins from MSIG USA.

-

The assistant treasurer is also due to review the Australian cyclone pool.

-

Insurance Insider reported earlier today of the asset manager’s foray into the MGA space.

-

The MGA is backed by three Lloyd’s syndicates, offering capacity limits of up to $10mn.

-

The business said it was experiencing strong momentum on the Island.

-

Ex-Western Europe CRB head Alberto Gallego and colleagues left for a Marsh joint venture.

-

The deal represents a first entry into the US MGA market for the $1.1tn asset manager.

-

A roundup of all the news you need, including a new Johns Manville lawsuit.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

The practice group will enhance the company’s existing offerings in E&S.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

The carrier started writing construction in Lloyd’s following the acquisition of Probitas.

-

A roundup of all the news you need, including our Themis exclusive.

-

Plus, the latest people moves and all the top news of the week.

-

Giles has spent more than five years at Themis Underwriting.

-

Losses were primarily driven by personal property lines.

-

He was appointed CUO of casualty, Americas, in July last year.

-

This will be the 15th cohort of companies to go through the Lloyd’s Lab.

-

The tech firm is building a joint stock company with insurers and investors.

-

The new recruit will report to group CUO Ian Houston.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

The Howden MGA established its marine presence in the Netherlands in 2023.

-

A roundup of all the news you need, including BPL’s appointment of Grahame Chilton.

-

The new division will be led by Terry Fitzgerald, who has previously led the finpro portfolio.

-

Chilton founded Capsicum Re, which was acquired by Gallagher in 2020.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The carrier’s US and Europe claims teams will report to Clayden.

-

The platform aims to “bend the loss curve”.

-

The relationship between growth and capital is “symbiotic”, the broker said.

-

Mark Connellan is the latest addition to Bassel Matta’s team.

-

A roundup of the breaking news, C-suite interviews and exclusive insights.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

A roundup of all the news you need, including Atrium's latest aviation hire.

-

Lenders include Morgan Stanley, Permira and Bridgepoint.

-

The carrier’s chief buyer urged a partnership approach from reinsurers.

-

Cat bonds have outperformed private ILS strategies in the YTD, according to ILS Advisers.

-

Former head of construction Bill Creedon will assume the role of chairman.

-

Bazan Group’s refinery near Haifa was badly damaged by Iranian bombardment in June.

-

While investors recently have favored the “instant gratification” of supporting brokers and MGAs, start-up reinsurer Mereo CEO David Croom-Johnson said he thinks capital will “fall back in love” with balance-sheet companies who deliver consistent profitable results.

-

Lloyd’s has pursued a Big Game Hunting strategy to lure major insurers into the market.

-

New capacity continues to flow into the hull market, despite rating pressure.

-

Bill Bouvier has spent more than three years at the legacy firm in this role.

-

An M&A senior analyst and M&A underwriter for emerging markets are also set to depart.

-

A roundup of all the news you need, including Mosaic’s Lloyd’s syndicate.

-

The syndicate will be targeting approximately $50mn of GWP in its first year.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

Scale is increasingly becoming a differentiator for reinsurance carriers, the broker noted.

-

Geopolitical turbulence brings new challenges that primary specialty lines carriers urgently need to address.

-

Being conservative and stable is the name of the reinsurer’s game.

-

The sector recorded total premiums written in London of £11.9bn in 2024

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

The insurer’s plans for the syndicate were revealed by this publication earlier this year.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

The MGA has set a "new market benchmark" for non-US primary tax risk, it said.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

The vehicle will provide a streamlined route for capital to its client MGAs.

-

A roundup of all the news you need, including the new CEO of Santam syndicate 1918.

-

The company, however, sets a high bar on making a move.

-

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

-

The pair were offered contracts by Willis Re in July.

-

The former Hannover Re CEO said reinsurers must use alternative capital and tech.

-

Pine Walk has grown substantially and is on course to write $1.2bn of premium this year.

-

One of the options being explored is setting up a dedicated company for the wholesale vertical.

-

Earnings covers do not need to equal aggregate reinsurance deals, the broker said.

-

Anticipation, motivation and inspiration are central to effective implementation.

-

Reinsurers are ready to draw a line under a worsening claim outlook across the casualty market.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

-

CEO Thierry Léger also stressed his intention to repair the carrier’s relations with Covea.

-

Stefan Golling also said Munich Re’s appetite for agg covers was unchanged.

-

The reinsurer is moving all its non-cat business to the new syndicate, leaving 1910 focussed on peak cat.

-

The Argenta-backed MGA is already active in the cargo and property classes of business.

-

Swiss Re forecasts more risk transferring to reinsurance and retro markets in the future.

-

Rafael Diaz, Tiara Elward and Felipe Murcia will join BMS’s LatAm and Caribbean unit.

-

Excess capacity will sustain softer rates, as organic growth challenges lead to more M&A chatter.

-

Reinsurance CEO Wakefield said reinsurance structures may evolve for prolonged growth.

-

Agency reactions ranged from Fitch revising down its sector outlook to AM Best keeping a positive outlook.

-

The CEO said the AHJ acquisition brought a ‘step change’ to Miller’s reinsurance growth.

-

The reinsurer’s new CEO said he sees no need for a radical shift in strategy.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

The departure follows an investigation into an “offensive” email sent by Rouse.

-

It is understood that CyberCube has been considering a sale of the business.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Mark ‘Ollie’ Hollingworth has held his current role at Atrium since 2017.

-

Tim Barber joins from QBE Re, where he was head of North America.

-

A roundup of all the news you need, including Generali’s MGA plans.

-

Plus, the latest people moves and all the top news of the week.

-

Paul Sandi, head of reinsurance, will serve as active underwriter for the new syndicate.

-

The California wildfires showed reinsurers can absorb major cats and remain profitable.

-

The insurer has been under review with positive implications since March.

-

It was announced this week that the business had agreed to be acquired by Skyward Specialty.

-

Skyward’s acquisition of Apollo will provide access to the London Bridge framework.

-

The treaty underwriter is set to run an MGA within the group.

-

The executive stepped down from Oneglobal in July after five years leading the firm.

-

The Swiss carrier appointed a new global energy head earlier this week.

-

Heyburn joins from Brit, where he was A&H class underwriter.

-

Rachel Turk said product-line facilities had been “under-scrutinised”.

-

Former Hannover Re CEO Jean-Jacques Henchoz received the Lifetime Achievement award.

-

Rönesans covers lines including aviation, energy, engineering and liability.

-

The carrier said the decision reflected its commitment to portfolio discipline.

-

A roundup of all the news you need, including Lloyd's results and London personnel moves.

-

Lloyd’s reported reinsurance GWP increased 10.6% to £13.2mn.

-

Gross written premium was up 6% year on year.

-

Lloyd’s will keep heritage systems operationally resilient until at least 2030.

-

Growth in the SME sector could help stabilize the market, however.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The US specialty carrier announced Tuesday that it was buying the Lloyd's business for $555mn.

-

The executive most recently served as head of North American treaty reinsurance.

-

The executive has worked at RFIB, Benfield and Guy Carpenter during his 30-year career.

-

The LPPC will offer limits of $127.5mn EAR and DSU coverage in the US and Canada.

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

A roundup of all the news you need, including CFC’s appointment of Jane Poole as CFO.

-

Jane Poole will succeed Michael Grist, who exits after nearly 16 years.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

The executive said claims can be a differentiator in a softening market.

-

CEO Tom Wakefield said property cat supply is “materially outpacing demand”.

-

Donna Swillman is currently a senior underwriter at Axa XL.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

Farnworth will also chair the carrier’s audit committee.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

Signs of discipline indicate a “break” from past boom/bust market cycles.

-

Some 32% of survey respondents expect property cat rates to fall by more than 7.5%.

-

The ratings agency was presenting its outlook ahead of the Monte Carlo Rendez-Vous.

-

The deal is part of Gallagher’s ongoing Asia-Pacific investment strategy.

-

Strong CoRs and investment returns supported profitability in H1 2025.

-

A roundup of all the news you need, including Gallagher Re’s H1 reinsurance report.

-

Sébastien Bardy joins from Allianz to lead the firm’s financial scale-up.

-

The underwriter has over 20 years' experience in the construction insurance sector.

-

The deal ends Livingbridge’s two-year attempt to sell the UK broking/MGA platform.

-

The carrier is looking to take a lead position in energy-transition risks.

-

A roundup of all the news you need, including Bain’s acquisition of Jensten.

-

Henrietta Butcher leaves Tysers after decades with the broker.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

James River said the court was right to dismiss the fraud case.

-

Company said defendant ‘distraction’ can’t make up for flimsy arguments.

-

The violations included not using propertly appointed adjusters and failing to pay claims.

-

Sources said the team is led by Martin Soto Quintus and is mostly based in Chile.

-

The broker is in hiring mode in specialty after numerous brokers departed for Willis Re.

-

A roundup of all the news you need, including further Sompo/Aspen news.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

Plus, the latest people moves and all the top news of the week.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

The reinsurance veteran joined Aon nearly 20 years ago from Cooper Gay.

-

The executive will buy reinsurance for HDI and Talanx’s corporate unit.

-

A roundup of all the news you need, including Jeremy Goodman’s exit from Aon.

-

The broker has a longstanding trading relationship with US retailer Alliant.

-

The firm has also updated the loss-calculation engines of existing Jeannie tools.

-

Angus Hampton, meanwhile, has been promoted to head of casualty in place of Mario Binetti.

-

Sources said that the NY-based TL underwriter has retained Piper Sandler to run the process.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

What we do

Real-time intelligence sourced and written by independent journalists drawing on an extensive network of senior sources

Authoritative analysis of company strategy and key sector developments, produced by a team of certified financial analysts