WTW

-

Court documents provide a window into the ambitious plans.

-

Despite 2025 losses, carriers have not secured desired rate increases.

-

Plus, the latest people moves and all the top news of the week.

-

Guy Carpenter continues to pursue Willis Re and individuals in court.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

The sector also faces a potential $700mn loss from a fatal Indonesian mining catastrophe.

-

GC accused Willis, Lucy Clarke, Jim Summers and John Fletcher of unlawful recruitment.

-

Loss activity in the upstream market remains benign, adding to softening.

-

The executive said the market will be revolutionised by digital technology.

-

James Kelly joins from Besso, having held senior positions at JLT, Lockton and Gallagher.

-

Ed Louth will join Liberty next year after serving out his contractual duties at Willis.

-

The broker’s hiring to date has focused on the specialty segment.

-

Plus, the latest people moves and all the top news of the week.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

The move comes as Michael Creighton is made credit and political-risk director for Africa.

-

Willis Re kicked off its talent acquisition with mass hiring from Guy Carpenter over the summer.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

Willis claims at least two $1mn accounts were also unfairly lost to Howden.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

Chris Eaton and Bill Moret gave their notice last week without specifying their destination.

-

Ex-Western Europe CRB head Alberto Gallego and colleagues left for a Marsh joint venture.

-

Plus, the latest people moves and all the top news of the week.

-

Former head of construction Bill Creedon will assume the role of chairman.

-

The broker’s joint venture with Bain Capital still lacks a CEO.

-

The pair were offered contracts by Willis Re in July.

-

The broker announced the launch of its cross-class facility this week.

-

Placement head Delchar said Gemini will be available across its global book of in-scope risks.

-

The broker has been on an aggressive hiring spree overseen by Lucy Clarke.

-

The airline has exercised a break clause to renew its cover six months earlier.

-

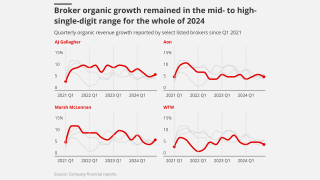

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

AIG leads the all-risks cover and Axa XL is the hull war lead.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

WTW is “particularly interested” in growing markets like wealth management with bolt-on M&A.

-

-

The claim could add pressure to the hull war market after a recent High Court ruling.

-

The broker has recruited from its rival as it looks to launch Willis Re 2.0.

-

The latest hires follow Rob Hale’s move to Willis.

-

The broker made several senior energy hires from Marsh last year.

-

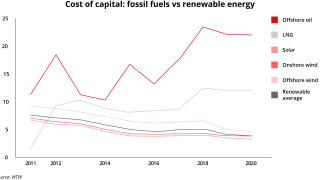

Renewable energy premium written in London and international markets amounts to $2bn.

-

Willis has been adding brokers to its aviation unit in Europe and the US.

-

Willis’ continued reinsurance build-out has targeted London and Bermuda marine and retro specialists.

-

The Atrium-led cover renews after the multi-billion-dollar High Court ruling.

-

Air India has a multi-year insurance arrangement in place.

-

Sources told this publication the hull of the aircraft is valued at $80mn.

-

Brokers across London and Bermuda have handed in their notice to join the start-up reinsurance broker.

-

The Bermuda-based team is led by John Fletcher.

-

The broker is launching a reinsurance arm in partnership with Bain Capital.

-

Saul Nagus is the latest from Marsh’s aviation unit to join WTW.

-

Willis has made a series of aviation hires on both sides of the Atlantic in recent weeks.

-

Plus the latest people moves and all the top news of the week.

-

-

The Willis-brokered coverage also includes the Willis CyXS facility.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier beat QBE to the punch to secure the lead position.

-

The pair add to the roster of aviation-focussed hires at WTW.

-

The hires form part of WTW’s build-out of its US aviation practice.

-

Lucy Clarke said the broking business was resilient in the face of macro challenges.

-

Organic growth was flat on the prior year and in line with Q4 2024 figures.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

Softening in the upstream market has also accelerated beyond expectations.

-

The facility now includes CyXS Plus and CyXS Company.

-

Willis said rising energy demand is creating a revival in the nuclear industry.

-

Larger companies ranked regulatory breach as their top risk.

-

The hire is part of a wider expansion across Willis’s specialty business.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

The broker said the list of perceived obstacles was “fairly damning” for insurers.

-

Q2 renewals will likely signal changes in the reinsurance market, the broker said.

-

The broker has made several recent hires within its marine division.

-

Claims in recent months have brought a period of benign loss activity to an end in the class.

-

Plus, the latest people moves and all the top news of the week.

-

Single-digit organic growth, robust casualty pricing and tapering margins were all key trends.

-

The arrival of Marsh’s Donnelly will "accelerate" US specialty growth, the CEO said.

-

CEO Carl Hess said WTW is entering 2025 with “considerable momentum”.

-

Clarke and Delchar, who were instrumental in building Marsh Fast Track, will lead the launch.

-

The executive will link up again with former colleague Lucy Clarke in Q2.

-

Starr-leads the WTW-placed all-risks cover for American Airlines.

-

Bradley was construction team leader for US casualty at WTW.

-

Heritage and history matter in people businesses, and the storied brand carries real equity.

-

The Willis name, which dates back to 1828, will be used with clients and markets.

-

Simon Delchar will become global head of placement.

-

Tony Simm will report to Garret Gaughan, global head of direct and facultative.

-

Jon Thacker has been at WTW for 20 years, specialising in construction.

-

Adam Garrard will cover his responsibilities on an interim basis.

-

WTW will hold a significant minority stake in the start-up with an option to acquire complete ownership over time.

-

WTW sold Willis Re to Gallagher in 2021 for $3.5bn.

-

The global market is stabilising and softening, and casualty and specialty lines are generally stable, the CEO said.

-

The broker posted a net loss of $1.67bn including pre-tax non-cash losses.

-

Benign claims activity and increased capacity are contributing to “competitive pressures”.

-

The WTW president of risk and broking is the first woman to hold the role in the institute’s history.

-

The broker will take a charge of $1.6bn-$2.1bn relating to the sale.

-

Baudouin is transitioning to a chairman position in Mexico.

-

Construction rates remain stable with some talk of potential softening.

-

The account is among a handful of airlines that have swapped out their brokers this year.

-

CFC developed and employed the lenders carbon-credit insurance policy with Standard Chartered Bank.

-

Glyn Thoms will be stepping into a newly formed role with a focus on cyber strategy formulation and management.

-

Colin Dutkiewicz has held senior roles at Aon and Swiss Re.

-

The choice to build a reinsurance unit at arm’s length alleviates some financial strain.

-

The two parties are targeting a launch by the end of the year, with scope for WTW to buy the start-up at maturity.

-

It will offer additional capacity to WTW US property clients with a limit up to $25mn.

-

Gavin Hamilton joins from Miller, where he served as European wholesale and South African property lead.

-

A quick roundup of the week’s main stories.

-

The new broking president added that hundreds of Marsh staff would not show up tomorrow at WTW.

-

He joins the firm following the departure of Edward Morgan and Guy Tyler, who have launched an MGA.

-

The broker said achieving profitability “remains challenging” for insurers.

-

CRB NA growth was driven by specialty lines, including natural resources, construction and real estate.

-

WTW has also recruited Marsh’s Thomas Burrows and Rupert Mackenzie recently.

-

The broker raised the low end of its 2024 target ranges for adjusted operating margin and adjusted EPS.

-

Alongside the appointment, Adam Garrard will take on the new role of chairman of risk and broking.

-

Camilla Chiatti and Parry Herbert will also join the team.

-

The moves are the latest in a period of personnel upheaval in the energy market.

-

The executive was head of wholesale and specialty at Aon’s Global Broking Centre.

-

The flurry of London market PVT hiring continues.

-

Darren Howlett was a member of Marsh’s relationship management executive leadership.

-

Burrows is the latest former JLT energy broker to join the team at WTW.

-

The business will be supported by up to $200mn of Lloyd’s and London underwriting capacity.

-

Since 1 January, the market’s potential descent into freefall has been closely watched.

-

Proving war-on-land coverage has been challenging, given the lack of reinsurance cover available.

-

WTW is looking to strategically hire across its business, having rebuilt its team following the failed Aon merger.

-

Cyber physical damage cover has also been added to the facility.

-

Prior to joining WTW, Morrison has held senior roles at Canopius, and AIG.

-

The executive said expansion was driven by retention and new business.

-

CEO Carl Hess hailed a “solid” first quarter of results.

-

High cash-burn, the dearth of available leaders, and weaker market conditions all point to shelving.

-

The US regulator faces litigation from both sides of the climate issue.

-

Dussuyer has also been appointed head of corporate risk and broking France.

-

WTW predicted that ‘meaningful softening’ could creep into energy markets during the year.

-

Increased reinsurance retentions left some insurers with their worst net results in a decade.

-

In his new role, Harrison will report directly to Adam Garrard, global head of risk & broking.

-

Graham Knight will become chairman of natural resources.

-

There were 166 deals over $100mn and 34 deals over $1bn in the first quarter of the year.

-

Hear the latest from the marine market as it weighs up the implications of the bridge collapse in Baltimore. Early indications are the claim could eclipse losses from Costa Concordia, stretching into the billions.

-

WTW said the rise of the risk from health and safety was “surprising”.

-

-

The executive said that adequate rates were encouraging insurers to grow.

-

Welcome to the first episode of Behind the Headlines, a fortnightly podcast hosted by Insurance Insider's senior reporter Sam Casey.

-

WTW and Tysers collaborated with PPL to design and implement the pilot.

-

The facility offers a range of $25mn-$50mn in excess capacity.

-

The facility is backed by a host of Lloyd’s syndicates.

-

The CEO said winning back clients “validated” the broker’s approach.

-

Risk and broking was driven by new business, client retention and rates.

-

The executive will work to grow the broker’s affinity proposition in the UK.

-

Storm Ciarán incurred insured losses of EUR1.9bn, according to WTW’s natural catastrophe report for July to December.

-

Michael Creighton joined WTW in 2019 as an executive director within the financial solutions team.

-

In October 2023, it was announced that Powell was leaving Marsh to join WTW as the broker’s global chief claims officer.

-

Nearly 80% of transportation companies surveyed cited a lack of access to insurance solutions and a lack of data to understand supply-chain risks.

-

The broker said there was a “record level of dry powder” waiting to be deployed.

-

He replaces Mark Stephenson, who is leaving Liberty to join Ardonagh.

-

AIG leads the placement, WTW is the lead broker, with Marsh support, on the JAL account.

-

The broker is hiring in energy following the departure of several downstream brokers for Price Forbes.

-

The brokers will work in the contingency team headed up by Ian Tomlin.

-

The broker said reinsurance capacity has contracted over the past 18 months, and the once-diamond-hard aviation war market has started to soften.

-

WTW also said private equity will continue to dominate the M&A landscape in 2024, with firms sitting on “over $2tn in dry powder” which is ready to deploy.

-

The broker said it anticipated new entrants in the downstream class following a profitable 2023.

-

The senior broker said it will take time for clients to return to the market.

-

The executive joined family-owned Lockton in 2020, as director of energy within the South Florida-based Latin America and Caribbean team.

-

SEC filings show that, in Q3, the activist shareholder liquidated its remaining 508,880 shares in WTW — worth around $120mn at the end of Q2.

-

A-Star offers up to $80mn in additional capacity for D&O liability insurance.

-

WTW conducted a snap poll at the broker's European Insurance Leaders’ Forum in Brussels, canvassing 75 insurance industry leaders from more than 45 companies.

-

The broking executive had a key role in the launch of Marsh’s Fast Track facility.

-

Work is at an exploratory stage, with efforts focused on London specialty and US P&C mid-market expertise.

-

The broker’s Q3 organic growth was driven by specialty lines, including fac financial solutions, natural resources, surety, construction and aviation.

-

WTW said that new staff were ramping up revenue production, following a period of investment in talent.

-

The exercise is understood to involve mainly junior and non-broking staff.

-

The executive was Marsh McLennan’s global chief claims officer and will join WTW early next year.

-

Despite an upswing in deal activity, large deals have continued to see a steady decline in volume that began in 2021.

-

Survey participants said "much work remains post-implementation".

-

Besides reinsurance broking, MGAs and MGUs, affinity is another segment where WTW can scale its operations, the executive noted.

-

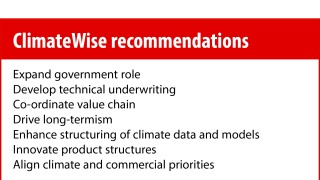

WTW has highlighted that global climate change-related litigation cases have doubled to more than 2,000 since 2015.

-

Coffin will be succeeded by Stuart Ashworth as head of broking & market engagement.

-

The carrier is looking to increase its presence in the marine market segment.

-

And all the other big moves of the week.

-

WTW exploring reinsurance exec recruitment comes at a time of competitive tension in the market.

-

WTW is quietly sounding out market executives for a potential relaunch into reinsurance once its two-year non-compete agreement with Gallagher Re ends in December, this publication can reveal.

-

The broker said that key hires – including Lucy Clarke – would pay off in improved results.

-

The broker said it experienced headwinds from prior-year book sales, inflation and investment costs.

-

Areas of focus should include hiring external talent, securing capital for M&A, speeding up US growth, and answering the reinsurance question.

-

Pat Donnelly has succeeded Lucy Clarke at Marsh, and Adam Garrard at WTW has moved into a chairman role.

-

The report states that in the first months of 2023 as many as 1.5 million person-days were expended on cost-of-living protests in the 10 countries hardest hit.

-

Group head of M&A Andy Wallin will take over reinsurance and capital on an interim basis.

-

Syndicates which began investing early in digital benefit by a 6-point combined ratio outperformance.

-

The scale of the loss has yet to become clear following the blaze on Friday, although the fire is under control.

-

Douglas spent the last decade of his 23-year tenure as head of WTW’s climate and resilience hub.

-

A report from WTW and the Institute of International Finance has found little correlation between companies’ operation emissions intensity and their climate transition value-at-risk.

-

Three months ago, Starboard trimmed its stake by almost 14% to 1,925,491 shares valued at over $470mn from 2,232,209 shares at the end of Q3.

-

The broker described Neuron as an end-to-end trading solution that connects multiple broker and insurer systems together, enabling risks to flow at scale and with common data standards.

-

The broker spent much of his career serving multinational clients.

-

Shares were trading down 6% following the publication of the broker’s Q1 results.

-

The broker reported new business and increased retention in aerospace, financial solutions and natural resources.

-

The WTW D&O liability 2023 survey canvassed directors and risk managers in 40 countries around the world.

-

The move marks a return to growth in fac for the broker after heavy talent attrition during Aon’s attempted takeover.

-

The number of global firms surveyed in WTW’s report that purchased political risk cover surged to 68% in 2022 from 25% in 2019, as the Ukraine war changed the geopolitical outlook.

-

Based in London, Artunduaga has served as Aon’s LatAm network leader. In addition, Chile-based Jose Necochea, Victor Padilla and Andres Claro will move to WTW.

-

The offshore construction market was identified by the broker as being “inherently unprofitable”.

-

Hardening has recommenced in the market, although conditions vary depending on client, according to WTW.

-

WTW’s survey cites regulatory risk, health and safety precautions and bribery and corruption on the list of top D&O risks.

-

WTW said driver shortages continue to force contractors to use younger, often less experienced drivers, potentially putting upward pressure on losses.

-

WTW only gained majority ownership of the India operation last year, meaning it did not transfer in the wider Gallagher acquisition.

-

With brokers shifting to new providers to place certain classes, and competition among e-trading firms intensifying, the placement platform landscape has reached a crucial turning point.

-

The executive spent 19 years as head of Willis Germany and Austria.

-

As Adidas terminated its partnership with Kanye West following his antisemitic tweets, it projected a loss that signalled why insurers should be pushing the need for brand reputation insurance.

-

The executive said the broker stopped receiving client proposals whilst it was set to be taken over.

-

The broker has experienced a resurgence in growth under new leadership and strategy.

-

Plus all the top news and latest people moves of the week.

-

WTW has appointed Pieter Van Ede as global head of trade credit, in a move the broker said demonstrated its commitment to growth in the class of business.

-

According to WTW’s report, countries are “de-aligning” from the West due to the declining influence of the US and its allies.

-

It is understood that Axis and Canopius lead the facility, which considers clients from any industry sector in providing excess capacity.

-

Despite improving returns, inflation and the availability of economically priced nat cat capacity remain the biggest challenges facing the sector.

-

Simon Weaver will be responsible for driving business growth throughout the newly integrated region.

-

Tom Haddrill joins from Lloyd’s, where he spent 11 years, most recently as CEO for Lloyd’s Asia and country manager for Singapore.

-

WTW has been on a hiring spree in the wake of the failed Aon merger, and said France was one of its “most important” markets.

-

The broker has been re-stocking its talent base following staff departures linked to the failed Aon merger.

-

Only D&O and workers’ compensation clients experienced price decreases during Q3, according to WTW.

-

Evan Freely will head up a team of 130 staff specializing in credit and political risk.

-

Mahoney joins from Aon, where he was team leader for US general casualty and energy in London.

-

The Corporate Risk and Broking head of global lines of business said staff and client attrition has been reversed – and cast doubt on predictions of further specialty market hardening.

-

Announcements and interviews at the UN conference have shed light on the tools emerging to help carriers decarbonise their underwriting portfolios.

-

The platform will automate a range of processes across risk submission, risk appetite evaluation, underwriting and pricing for quotation, using a lead algorithm.

-

The product will provide $100mn in cover across eight countries at high risk of tropical cyclones.

-

The project, funded by Agence Française de Développement, was revealed during the G20 Leaders’ Summit in Bali.

-

The broker warned that more insurers will restrict or drop oil and gas business in the coming years.

-

Growth is accelerating at the broker in the wake of a challenging period following the collapse of the Aon merger.

-

The acceleration defied wider sector trends, which has led to slowing growth at other brokers.

-

-

Terry Rolfe joins from Epic Insurance Brokers & Consultants, where she served as aviation practice leader.

-

The executive’s career includes periods at WTW and Marsh.

-

Archie Horne is also joined by his former team: Florence Crowhurst, Harry Findlay and Ben Roe.

-

The brokers are working on finalizing the terms in a written settlement agreement, which could be filed within two weeks.

-

The broker also hired Will Fremlin-Key as global head of mining and metals, and appointed Ahmed Abdel-Gawad as head of natural resources for the CEEMEA region.

-

The broker said the fallout from the Russia-Ukraine conflict was increasing competition for business.

-

Kiran Nayee will be responsible for complex casualty placements for WTW’s D&F clients.

-

New capacity has also entered the wider market over the period, with WTW adding that more is likely to follow in Q3.

-

The unit sits within the broker’s climate and resilience hub.

-

The move represents a return to WTW, where the broker spent the beginning of his career.

-

The CEO said that WTW was making good progress under its strategy but acknowledged there is more to do.

-

Growth was slower than rival brokers, but CEO Carl Hess said investments would bear fruit in H2.

-

Scott Morrison, who has more than 25 years' experience, was co-head of the trade credit excess-of-loss team at Canopius.

-

The news comes after this publication revealed Kerrigan Read is also set for WTW.

-

Luis Maurette, current head of Latin America and head of global sales and client management, will retire on December 31, 2022.

-

Laurent Belhout will become head of France, while André Lavallée takes up the newly created role of head of corporate risk and broking in France.

-

Peru’s state-owned firm Petroperu has said that the broker designated to run its account was chosen as a result of a “technical evaluation”, following local media and Inside P&C reports that WTW had won with the highest bid in the process.

-

Before his appointment, the executive served multiple senior leadership roles within the division across Germany and Northern and Central Europe.

-

Sudhir Modhvadia will be based in London and report to head of facultative Alex Shepherd.

-

Fabien Conderanne most recently held the role of head of financial solutions for Asia Pacific.

-

Victor De Jager will be based in Amsterdam and report to Garret Gaughan, head of D&F, and Anne Pullum, head of Europe and CRB, Europe.

-

Insurers have expressed concerns about hitting the 2023 deadline for the regime.

-

Of the companies surveyed, only 2% did not consider their reputation a standalone risk.

-

It is understood that the account includes oil platforms, crude barrels and 12 vessels, and is one of the largest accounts in the South American country.

-

As momentum builds for greater transparency on ESG and net-zero transitions across the insurance ecosystem, brokers are entering an evolution.

-

The buybacks will be in addition to the $1.3bn remaining on the broker’s current open-ended repurchase program.

-

Wendy Peters’ decision comes in the wake of several senior changes within the WTW PV and terror team.

-

The account consists of 16 airlines and has a total fleet value of $29.7bn.

-

Henry Keville will be responsible for leading WTW’s financial lines programmes for banks, insurance companies, asset managers and other firms in the financial sector.

-

The appointment of Will Jones comes during a time of change for the WTW terrorism and political violence team.

-

Plus this week’s Q1 results and all the top news of the week.

-

The loss of the carrier’s Russian operations is set to create “modest margin headwinds” for the business.

-

The company posted adjusted diluted earnings per share of $2.66, ahead of analyst consensus of $2.50.

-

Thomas Olaynig from Marsh and Aon’s Kilian Manz are replacing Mathias Pahl and Peter Philipp.

-

DM Insurance Broker specialises in bond insurance and surety bonds across a variety of industries.

-

The brokers asked the judge to delay some pre-trial conferences by two weeks as they could obstruct the settlement negotiations.

-

The broker said there was still a “big unknown” around the potential global economic impact of the conflict.

-

WTW forecasts that cyber rates could increase by 100% to 200% for heavily exposed industries.

-

WTW has appointed Aon’s Ed Day to work as head of international property in the broker’s D&F team, which is led by Garret Gaughan.

-

The intermediary said capacity for downstream energy has now returned to 2017 levels.

-

The potential for major deterioration on a 2019 loss could yet prove “devastating” for the market.

-

Joseph Noss was on the G20 Financial Stability Board in Basel, where he focussed on climate financial regulation for the banking, investment and insurance sectors.

-

WTW has appointed Tammy Richardson as Europe regional leader for its insurance consulting and technology (ICT) business, where she will lead a team of more than 500 staff while overseeing the P&L management and strategy.

-

The embattled broker could stand to lose around $50mn in Ebitda as major economies shun Russian trade.

-

Before his promotion, the executive served as WTW’s head of strategy based in London since April 2019.

-

The move follows similar actions taken by Aon and Marsh McLennan.

-

Singh had managed Lloyd’s catastrophe risk appetite prior to joining MS Amlin.

-

The appointment of Sam Joscelyne-Manning follows WTW’s recent hiring of Aon’s Teddie Bailey, who is also joining the broker’s terrorism and political violence team.

-

Teddie Bailey’s resignation comes at a time of significant moves within the terrorism and political violence market.

-

Plus the latest Q4 earnings and all the top news from this week.

-

The CEO outlined areas of the business which needed additional care and attention, while highlighting the need to build a culture of trust between management and staff.

-

Financial results in the fourth quarter were impacted by senior staff departures and lost business.

-

CEO Carl Hess said the results did not fully reflect the near and long-term potential of the firm.

-

Dennerståhl will be based in Stockholm and lead a team of over 80 staff when she joins later this year.

-

The broker joins after a brief spell at Aon, where he was head of EMEA business development.

-

James Excell, the fac leader for sub-Saharan Africa, had worked for WTW for a decade.

-

Lou Smith most recently served as the first chief digital officer at Lloyd’s of London, where she was responsible for delivering the organisation’s strategy for a digital insurance market.

-

Stefan Weda will also take on the role of head of CRB for WTW Netherlands.

-

The brokers will have until early 2023 to settle the case via private mediation or the case will move forward to a jury trial that could last between seven and 10 days.

-

The broker said the last three years of hardening had led to a “substantial technical correction”.

-

Gardner was previously at Marsh for nearly three decades, holding a variety of leadership roles.

-

The unit will be headed by Jo Holliday and house lines of business including contingency and political violence.

-

The change comes as the broker seeks to draw a line under a tumultuous chapter in which the planned takeover of Willis by rival Aon collapsed.

-

In his new role, Steve Powney will report into Willis’ global head of surety, Scott Hull.

-

This year deals will continue to increase but ESG, inflation and supply chain issues bring complexity.

-

Heinicke brings over 25 years of experience in the insurance industry, most recently spending over 11 years at Aon Bermuda.

-

The three new directors that will not seek reappointment take the total board members standing down to five.

-

A judge for the Miami-Dade County Court has ordered Aon and individual defendants in the Miami facultative team poaching case to avoid doing reinsurance brokerage business with the defendants’ former Willis Towers Watson clients.

-

The new coverage marks the first time that sovereign debt repayments have been protected by a parametric catastrophe clause.

-

She will work alongside James Baum in the new position.

-

Chris Strong will work on building out Willis’ environmental risk business and oversee international placement strategies.

-

Tim Rourke was previously head of intermediated insurance and distribution at Willis before landing his new role.

-

The SPAC boom of last year never caught on in London, and the FCA updated rules this summer to boost the UK’s competitiveness.

-

Richard Floyd is to join in 2022, when he will become head of crisis management for Asia.

-

Greg Rector, managing director of Aerosure, will become MD of Willis’ Australasia aviation division.

-

The broker saw several exits from its marine team in the run-up to its aborted merger with Aon.

-

The move follows another recent energy-related departure from Willis, with news that McGill and Partners had hired former upstream energy broker Ian Elwell.

-

Account wins include Swedish steel manufacturer SSAB and iron ore producer LKAB, both won from Aon.

-

The number #3 reinsurance broker still needs to land the integration and fend off poaching from rivals, but it has held the line well and turbulence will lessen.

-

In an interview, the new Gallagher Re CEO noted that his former company had been weighed down by nearly two years of uncertainty, telling this publication: “That stops today.”

-

The group CEO also observed that the Big Three reinsurance brokers do have a competitive moat based on their scale.

-

The deal was struck in the wake of the collapse of Aon and Willis Towers Watson’s merger.

-

The broker has been restrengthening its team after a period of talent flight in the run-up to the failed Aon merger.

-

Hong Kong-based Ben MacCarthy will report to Paul Ward, head of global markets P&C in Asia, and joins on 1 December.

-

Increasing cat costs will drive the focus on modelling and price adequacy, the intermediary said.

-

Gallagher has pushed retention and equity awards unusually far down the organisation as it looks to keep the team intact.

-

The watchdog had been due to announce a decision on a further inquiry by 29 November.

-

Willis Towers Watson has selected Inga Beale, Fumbi Chima, Michael Hammond and Michelle Swanback to join its board of directors.

-

The announcement follows the initial news in August that Willis had entered a non-binding agreement to buy the broker.

-

The executive has spent the majority of his 35-year career with Aon.

-

The broker has spent two decades with the business.

-

The Texas Windstorm Insurance Association (Twia) has recommend hiring Willis Re as broker and Aon to provide catastrophe modelling services, following a review of its arrangements which were previously with Guy Carpenter.

-

Dasan's resignation comes within a period of significant moves across the construction market.

-

The executive will also remain his current role as head of Colombia, it is understood.

-

The transaction was cleared in five out of six jurisdictions – including by US antitrust authorities – and is only pending UK regulatory approval.

-

Ian Fisher joined the Joe Trotti-led team at McGill and Partners during the build-out of the start-up broker in 2019.

-

The profitability metrics were impacted by the $1bn income received following the Aon deal termination.

-

The executive has almost 20 years’ experience, having worked for Aon, AGCS and Marsh.

-

Luke Ware will report to Australasia head Simon Weaver, who is adding Asia to his remit.

-

Willis’ latest InsurTech briefing shows how a small group of InsurTechs are securing the lion’s share of investment via $100mn-plus mega-rounds.

-

William Capel has spent much of his career in southern and western Africa to date.

-

The fac broker is the latest in a stream of exits from Willis.

-

The veteran broker will move to a rival firm after three decades with Willis.

-

Starboard estimates Willis's share price could double in three years and said there is room for margin improvement.

-

Willis Towers Watson’s regional leader for Middle East and Africa (MEA) downstream natural resources William Peilow has resigned, Insurance Insider can reveal, as an exodus from the broker’s fac division continues.

-

Willis Towers Watson has won three new airline clients from Marsh, Insurance Insider can reveal, marking a string of victories for the broker’s global aerospace unit after a period of uncertainty.

-

The climate-transition pathway solution helps insurers identify clients with robust climate-transition plans.

-

The appointment comes soon after the collapse of the merger agreement between the two brokers.

-

Marsh has bolstered its upstream energy division with the appointment of Thomas Burrows from Convex, Insurance Insider has learned.

-

Kate Roy has served as COO for Great Britain and Willis Ltd since 2015 and been involved on the PPL board since the platform’s inception.

-

In an internal memo, the company named a raft of leaders by country and business unit, though many roles also remain unfilled.

-

Alex Shepherd, who joins from ERS Syndicate 1856, will aim to replicate the broker’s “hub approach” in its facultative business.

-

The executive and other ESG experts at the Airmic conference stressed the importance of insuring the transition to net-zero.

-

The agreement ends non-solicitation action against the team of brokers, led by Cameron Roe and chairman Tony Phillips.

-

The broker’s head of corporate risk and broking for GB also said that not all wholesale brokers would survive in the digital world.

-

The competition regulator’s investigation looks to be a procedural matter that will allow the Willis Re saga to conclude.

-

The pair are the latest to exit the facultative department at Willis after a stream of senior departures.

-

The Competition and Markets Authority will investigate whether the deal lessens competition in the UK.

-

Following the collapse of its merger with Aon, Willis Towers Watson is being targeted by activist investors.

-

More than half of deals completed this year exceeded $1bn in value.

-

The broking giant has spent the past eight weeks executing on the strategy it developed for the combined firm.

-

The new hire is to take a role in Miller’s South African fac business.

-

Previously, Hess had earned $650,000 a base salary and was eligible to receive a short-term incentive bonus worth 90% of his annual salary.

-

The brokerage firm said that $4bn increase comes in addition to the $500mn remaining on its existing share repurchase program.

-

The former security chief also highlighted the threat posed by cyber risk to increasingly autonomous ships.

-

The nature of the hire demonstrates the level of competition for top talent in the sector.

-

The new recruit has spent 20 years in investment roles.

-

Nine (re)insurance firms in London took part in the programme for career-break women, organised by diversity and inclusion firm Inclusivity and supported by the Insurance Families Network.

-

Hundreds from the insurance business were among those killed on 9/11, making it one of the hardest-hit industries.

-

Stock analysts raise price targets on Willis shares after execs outline financial goals following the collapse of the Aon-Willis merger.

-

After Willis Towers Watson’s attrition rate rose 22% amid the Aon merger uncertainty, executives are seeking to dial back a talent drain.

-

The broker expects to increase its revenues to $10bn by 2024.

-

The acquisition is still subject to regulatory approval but expected to be completed in the fourth quarter.

-

Reinsurers retained more net income this year, driven by a desire to grow into the hardening market.

-

The CEO said large US retailers and wholesalers may look to enter reinsurance.

-

It is not yet clear if the fund – known for its activist campaigns – will look to take on management in this case.

-

The Willis solution is designed to help companies access insurance as they transition to a low-carbon business model.

-

The broker also announces that Nicolas Aubert is set to leave the company to “pursue new interests”.

-

Outgoing CFO Michael Burwell is to receive a $1mn bonus.

-

Andrew Krasner returns to Willis from AssuredPartners, where he served as CEO for just over six months.

-

The executive was instrumental in overseeing the major turnaround work at Channel, which reported its first profit in a decade in 2020.

-

The brokers have signed a heads of terms and will move towards a full acquisition.

-

The London-based managing director is the latest in a stream of departures from the broker’s facultative division.

-

Proactive price action is enough to keep pace with inflation – for now.

-

The broker has also announced the appointment of Willis’ Dolf Balink.

-

The move comes after major defections to rivals from the firm’s retail broking and reinsurance operations earlier in the year.

-

The Week in 90 Seconds: Cyber hardening; Lloyd’s modernisation; Ardonagh re-fi; business travel pollPlus the latest on pandemic BI payments and all the top news from the week.

-

The executive will head up a 26-strong team, working across all major lines of business.

-

The broker also filed a lawsuit against Goode, Honeycutt, Forst, Rice, Lee and Keenan as individual defendants.

-

The two brokers have also agreed to non-solicitation clauses in their new deal.

-

Earlier today the firm announced that insider Hess will succeed CEO John Haley at year-end.

-

The current head of the investment, risk and reinsurance segment will take the helm in January.

-

The switch confirms a move first reported by Insurance Insider last month.

-

Willis’s sale of its reinsurance arm was the best option it had left – but the loss will have implications for the wider business.

-

The executive also praised Willis Re's management team for pushing for the best outcome for clients.

-

The broker has explained the rationale for its $3.25bn acquisition of Willis Re on an investor call.

-

As earnings season draws to a close, insurers continue to post strong profits following sustained market correction.

-

After the collapse of the Aon-Willis merger, Gallagher has successfully resurrected the deal that will catapult its reinsurance operation into the big league.

-

London-based Brendan Carberry’s hire is part of a surge in recent moves in the product recall class.

-

AJ Gallagher is on the cusp of a deal to acquire Willis Re, and the transaction is likely to be announced imminently, this publication can reveal.

-

Major increase in incentive pool represents an early step from management to shore up its staff base.

-

A judge found no evidence Mike Harden unlawfully solicited colleagues who “did not want to work for an Aon-controlled organisation”.

-

The share price jumped after CEO Haley said during an analyst call that the board was working on his succession plan, as well as signalling that its reinsurance business remains in play.

-

The CEO also pledged revived investment in growth after the Aon deal collapse.

-

The Willis Towers Watson CEO also confirmed the broker will not pay out bonuses contingent on the Aon merger.

-

The broker reported adjusted diluted EPS of $2.66, up 48% on Q2 2020.

-

With a last-minute acquisition by AJ Gallagher on the cards, Willis Re can put the last 16 months of turbulence behind it and come back super-charged.

-

The investment bank said a transaction would stabilise employee retention at Willis Re and allow Willis to pursue buybacks.

-

Sources have said a deal could be signed as soon as the middle of the week, with a valuation higher than the last agreement.

-

Ron Whyte, Willis Towers Watson’s COO of corporate risk and broking (CRB) for Asia is to leave the business next month, this publication can reveal.

-

Julian Samengo-Turner, who was global CEO of fac at Guy Carpenter in the 2000s, is leaving Willis after four years in the role.

-

The firm should trade off maximum possible value for near-term certainty in crystallising shareholder value.

-

Willis Towers Watson will not pay staff bonuses that were contingent on the completion of the Aon merger.

-

Plus this week’s company results and all the top news from the week.

-

Willis’s Quarterly InsurTech Briefing shows investments raised more in H1 this year than the whole of 2020.

-

The disruption of the Aon-Willis deal breakdown could arguably create almost as much of a shake-up of the competitive landscape amongst the second-tier challenger brokers as it will for the two would-be merger partners themselves.

-

The committee will be responsible for seeing through the broker’s four-pronged Aon United Blueprint.

-

A White House press spokesperson said the deal would have led to higher costs for businesses and consumers.

-

The search will need to be rapid and sure-footed to give the firm the best opportunity to address its issues.

-

Willis Towers Watson must act quickly and decisively to either salvage the sale of Willis Re or lock down staff.

-

Wells Fargo insurance analyst Elyse Greenspan said Willis Towers Watson stock “seems very inexpensive” in a note to investors on Monday.

-

The Illinois-based broker said it would also redeem $650mn in 10-year notes that it issued in May.

-

In a statement, Garland argued that the decision will help preserve competition in the insurance brokerage sector in the US.

-

Greg Case said the regulator had a "fundamental misunderstanding" of the industry, and that timing prevented the brokers from going to trial.

-

The broker has also stated plans to invest in “organic and inorganic growth opportunities” over the next three years.

-

Shares in rival broker AJ Gallagher, whose plans to buy several Willis assets at a knock-down price are now highly uncertain, were down by 2.3% at $139.

-

The companies disclosed that Aon will pay Willis the $1bn break fee.

-

The Week in 90 Seconds: Aon and DoJ return to the table; German flooding latest; Aki Hussain profilePlus the latest on UK BI legal wrangling and all the top news from this week.

-

A number of employees have recently resigned from the carrier as high staff displacement continues in the D&O space.

-

Details of potential additional divestitures are closely guarded, but they would likely include P&C broking assets.

-

The DoJ was given a deadline to provide Aon’s lawyers with pertinent evidence collected from third parties during its investigation into the $30bn mega-merger.

-

The merged entity must divest its corporate and commercial short-term insurance broking in the country, as well as offload several global businesses.

-

The brokers have offered to divest Willis’ largest corporate risk and broking clients to Gallagher’s Crombie Lockwood.

-

The competition watchdog has approved the acquisition of Willis Towers Watson by Aon if the latter complies with a ‘substantial set of commitments’, including the divestment of central parts of Willis’s business to Gallagher.

-

GC Access was launched last year to match carriers and MGAs and help them plan new ventures.

-

The keenly anticipated antitrust showdown has now been scheduled for November 18.

-

Aon will have to wait until November at the earliest to argue the case in Federal Court for its $30bn merger with Willis Towers Watson.

-

The Commerce Commission has extended its review of the merger by another six weeks.

-

Reinsurance rate increases are tapering off, but the recent influx of capacity will not cause pricing to “fall off a cliff” thanks to continuing market discipline, according to Willis Re’s James Vickers.

-

The broker noted slowing price increases across most lines as stronger capacity, low cat losses and improved results take effect.

-

The forfeiture of the account follows a series of deals moving in the other direction, including Airbus.

-

Public-private partnerships such as state-backed reinsurance pools can also enable a more “proactive” approach to climate innovation, the organisation said.

-

Marsh claimed Aon is trying to ‘flip the narrative’ from its poor management decisions and uncertain future in its response to the suit.

-

Aon’s legal team said it was concerned that the proposed timetable could kill off the deal before the trial begins.

-

The deal was approved by regulators on the proviso of the disposal, as well as other divestitures already agreed.

-

The CCCS has identified competition concerns around executive pay consulting services.

-

The intermediary says the partnership puts Willis at the forefront of the ‘digital insurance revolution’.

-

Plus the lowdown on CFC’s syndicate capacity and all the top news from the week.

-

“We are not about to let [the] delay…compromise the deal”, says Latham & Watkins lawyer Dan Wall.

-

The Willis veteran becomes the latest fac executive to depart, following the recent exits of Alf Garner and Antonio Tosti.

-

The broker joins after the launch of the trade credit, surety and political risk unit under Phil Bonner.

-

The appointment follows the departure of Richard Spencer to marine war MGA Vessel Protect.

-

We examine what could happen to the reinsurance broking unit should the Aon-Willis merger fall through.

-

The parties will likely look to deliver a carve-out of large P&C and health benefits broking in the US to target a DoJ settlement.

-

Aon and Willis were taken by surprise by the lawsuit, a CTFN report claims.

-

Plus, a detailed look at the FCA’s BI claims data and all the most popular news from this week.

-

Carriers also reported premium expansion and improved solvency during the quarter.

-

The CEO said that his company was ‘wide open’ to absorbing additional assets to satisfy regulators’ concerns.

-

Shares in AJ Gallagher and Willis Towers Watson held broadly stable after the announcement from the US Department of Justice.

-

The investment bank’s analysts suggested that staff and clients may leave as a result of uncertainty, during a prolonged US lawsuit over the Aon-Willis mega merger.

-

Inside P&C gives a blow-by-blow account of the regulator's antitrust complaint against the mega deal.

-

The broking houses also said they "remain fully committed to the benefits of [their] proposed combination".

-

The move from the US regulator represents the biggest threat to the mega-merger since it was announced in March last year.

-

The US Department of Justice’s antitrust concerns around the Aon-Willis merger have not been fully addressed by the brokers’ recent spate of divestment plans.

-

Staff displacement at Aon and Willis is increasing as the brokers move towards completion of their mega merger.

-

The news follows the agreement to sell several assets to AJ Gallagher, including Willis Re.

-

The new accounting framework is being brought in to replace current GAAP reporting measures.

-

The broker has offered to sell its group pharma purchasing and claims audit services in a bid to get the greenlight for its Willis takeover.

-

Plus the implications of the X-Press Pearl sinking and all the top news from this week.

-

The account move follows Airbus decision to switch to the independent broker earlier this week.

-

The deal is designed to assuage the Department of Justice’s concerns over the Aon-Willis merger.

-

The US government reportedly has around 20 attorneys at work in case it decides to sue to block the deal.

-

The unit will be run by head of accident and health Ian Tomlin.

-

The start-up broker has also won Rolls-Royce, Dassault and Embraer over the last year.

-

The Commerce Commission has delayed its decision for the third time.

-

The merging brokers have also agreed a two-year non-compete agreement on transferring Willis business.

-

The combination still needs sign-off from US, EC and other international authorities.

-

The Week in 90 Seconds: A guide to Gallagher-Willis; Florida renewal look-ahead; Two offshore lossesPlus the insurers on-risk for the Colonial Pipeline cyber attack and all the week’s top news.

-

The CEO says the transaction accelerates AJG's strategy in Europe by five years.

-

The $3.57bn side deal is contingent on the closing of the bigger merger, which itself needs approval from regulators including the European Commission and Department of Justice.

-

The business looks well placed to succeed if it can keep retention in check and reinvest to build broader capabilities.

-

The AJG CEO vowed to invest in Willis Re assets while stressing the quality and security of the team.

-

The merger partners are working towards a third-quarter completion after a side-deal they say addresses EC concerns.

-

Aon and Willis have been in talks with AJ Gallagher over a sale of assets the broking houses must make to gain approval for their pending merger from antitrust regulators.

-

The report says a final decision on the structure of the deal has yet to be made.

-

The Capitol Forum says EU competition chief Margrethe Vestager is on board with the remedies.

-

The deal could be signed later this week or at the weekend, sources said.

-

The yardstick will allow insurers and financial institutions to assess companies’ transition plans against the 2015 Paris Agreement.

-

The regulator had previously set a 27 July deadline after the merger partners offered divestments to secure regulatory approval.

-

CEO Greg Case says the broking union offers greater opportunities than when the deal was first announced.

-

Aon-Willis, CFC's new Lloyd's syndicate, Talbot's contingency retreat and more.

-

Net income leapt by 140% whilst margins expanded across all business segments.

-

About $2.55bn was raised across 146 deals between January and March, with both numbers the highest since record began in 2012.

-

With a sale of the remedy assets to AJG not yet agreed, the firms will have to choose their words carefully this week.

-

European regulators are not expected to demand additional concessions of the deal partners.

-

The move comes as Aon and Willis race to receive regulatory approval for their merger.

-

EC documents do not give details of individuals, but said the ringfenced team ranges in seniority.

-

The ACCC had initially said it would wrap up its investigation into the competitive implications of the merger by May 27.

-

Plus in-depth analyses of the accident and health and airlines markets.

-

The larger broker says it lost more than $6.5mn in revenue after leaders “solicited” colleagues and clients.

-

Luke Bennett has worked at the broker for nearly a decade and prior to that worked at Marsh.

-

With around 50 members of staff across the business, the divestiture is not expected to significantly alter the competitive landscape.

-

Fresh departures also include Ana Maria Rivera, a global sales and solutions leader in LatAm.

-

The US regulator has proposed Willis sells its San Francisco and Houston CRB businesses, and its Bermudian insurance broking arm.

-

The broker aims to cut emissions by at least half by 2030.

-

The number four broker is seeking to acquire both Willis Re and the European insurance broking businesses.

-

The account is the largest manufacturer’s account in the aviation market and is currently brokered by Willis.

-

The move follows the brokers’ submission of a remedies package last week to allay competition concerns.

-

A New York court has ruled that the names of two clients who are friends with a broker who has left Willis Re to join rivals TigerRisk can be published.

-

Further details of the proposed remedies to the European Commission are revealed.

-

The move follows Willis’ explorations of sales of Willis Re and European units.

-

The Competition and Consumer Commission of Singapore launches a public consultation over the proposed merger deal.

-

The potential sale of Willis Re to AJG would push Gallagher Re into the big leagues – but make little impact on the wider market.

-

Capacity above a certain limit remains unavailable, with coal and oil sands industries affected especially.

-

Offshore construction business can attract rates of up to 75%, compared with 5% rises in exploration and production.

-

The resignation comes as Willis moves towards completion of the mega merger with rival Aon.

-

This week, we revealed that Aon/Willis Towers Watson are looking to separately divest a block of Willis' European businesses and Willis Re, as they work to get their mega merger approved by regulators in the face of competition concerns.

-

It is understood that the ~$300mn fac business will be packaged along with the treaty unit.

-

The broker’s international chairman noted shifting attachment points on wind deals and reshaped aggregate covers.

-

The largest of the businesses, Gras Savoye, has been seen as one of the jewels in the crown at Willis.

-

The potential disposal may help to alleviate competition concerns within the French market.

-

The Aon president said insureds will begin to “test” carriers and brokers on price.

-

The tally so far comes in far below the broker’s year-ago estimate of $80bn for a twelve-month lockdown.

-

Plus the latest executives on the move and all the top news from the week.

-

William Monat launched the broker’s transactional risk unit in Chicago and previously led two MGAs in the space.

-

According to the Capitol Forum, antitrust regulators will consider the deal's impact on the world’s fourth largest insurance broker AJ Gallagher

-

The broker adds a mandate worth $10mn in premium after its Bristow Helicopter win.

-

Reinsurance is one of the areas of the combination that is drawing heightened regulatory scrutiny.

-

The marine hull and war underwriter will rejoin former colleague Chris Goddard, who launched the start-up last year.

-

The four major developments of the week include:

-

EU antitrust regulators will warn Aon that its $30bn bid to acquire Willis Towers Watson may hurt competition in the broking marketplace, according to a Reuters report.

-

United Airlines’ all-risks policy could face liability claims, while the Pratt & Whitney policy could see a partial grounding claim.

-

The new arrival will also be financial lines manager for Denmark and Norway.

-

Market sources report an uptick in competition to secure accounts as clients sought optimum deals in a challenging market.

-

The merger may cause price increases or reduced service levels for major insurance buyers.

-

Event definitions were also tightened at renewals, the broker said.

-

Sources have emphasised that such pauses are a routine part of the Phase II review process.

-

Margins expanded in three of four business units, including by 200 bps in corporate risk and broking, but contracted by 37 bps overall.

-

Michael Burwell, Gene Wickes, Carl Hess and Joseph Gunn will each receive a payment for staying with the business until the deal closes.

-

Executives reiterate the mid-single expansion guidance announced in March, despite growing organically by 1% in 2020.

-

Of the largest insured losses from single events last year, the top eight occurred in the US.

-

In a joint submission, the intermediaries argue that the deal will not reduce market competition in New Zealand.

-

Business COO James Platt will take on the role until the expected closing of the broker’s merger with Willis Towers Watson.

-

Companies with strong brands still fall down on “traditional success criteria”, the InsurTech head says.

-

Aon’s decision on its post-deal reinsurance leadership shows it has moved past tactics of its Benfield-era integration.

-

The broker warns that some carriers are seeking to limit cover in response to the attack.

-

The account with one of the world's leading helicopter providers is worth about $15mn in annual premiums.

-

Bloomberg Law reports that a settlement would bring litigation in Virginia and Delaware to a close.

-

The broker says the London and European renewables markets achieved profitability in 2020.

-

Economic headwinds combine with high valuations to create greater impetus for intermediary sales.

-

Sources warn further unrest is possible and anticipate rising demand for SRCC and even full political violence cover.

-

This publication looks at 10 issues that will shape the industry in the year ahead, from rate sustainability to start-up progress to the post-Covid recovery.

-

The new recruit will report to Fabien Conderanne, who leads the line of business across Asia Pacific.

-

The broker’s 1st View report said rate change may have disappointed some reinsurers but remediation focused on specific stressed pockets of business.

-

The appointment comes after mass resignations in the Latin American team earlier in the year.

-

The milestone was set out in a combined all-staff townhall as the firms look forward to an H1 close.

-

The team from the Climate Policy Initiative advises organisations on market exposure to low-carbon transitions.

-

Rates for listed companies continue to rise between 200%-400% amid hard market conditions.

-

The new vehicle has hired ex-Aon Benfield UK chief David Ledger as non-exec chair.

-

David Bangs joins from Willis Re Singapore where he worked for more than 15 years.

-

Joint research finds that remote working has challenged the London market’s ability to innovate commercially.

-

At a Reuters event, Willis’ Aubert agrees that assuming older employees would find the transition hardest was a mistake.

-

The follow-only syndicate has carved up most of its 2021 capacity among leading Lloyd’s intermediaries.

-

By filing this week, the merger partners may yet escape the clutches of the UK’s Competition and Markets Authority.

-

The European Commission sets a provisional deadline of 21 December for the review.

-

Purchasing the analytics firm will help Willis meet growing demand for climate change services.

-

The departures include LatAm chairman Tony Phillips and upcoming CEO Cameron Roe.

-

The exec was speaking after the broker was acquired by Cinven and GIC in a multi-hundred million deal.