WTW

-

Despite 2025 losses, carriers have not secured desired rate increases.

-

Plus, the latest people moves and all the top news of the week.

-

Guy Carpenter continues to pursue Willis Re and individuals in court.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

The sector also faces a potential $700mn loss from a fatal Indonesian mining catastrophe.

-

GC accused Willis, Lucy Clarke, Jim Summers and John Fletcher of unlawful recruitment.

-

Loss activity in the upstream market remains benign, adding to softening.

-

The executive said the market will be revolutionised by digital technology.

-

James Kelly joins from Besso, having held senior positions at JLT, Lockton and Gallagher.

-

Ed Louth will join Liberty next year after serving out his contractual duties at Willis.

-

The broker’s hiring to date has focused on the specialty segment.

-

Plus, the latest people moves and all the top news of the week.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

The move comes as Michael Creighton is made credit and political-risk director for Africa.

-

Willis Re kicked off its talent acquisition with mass hiring from Guy Carpenter over the summer.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

Willis claims at least two $1mn accounts were also unfairly lost to Howden.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

Chris Eaton and Bill Moret gave their notice last week without specifying their destination.

-

Ex-Western Europe CRB head Alberto Gallego and colleagues left for a Marsh joint venture.

-

Plus, the latest people moves and all the top news of the week.

-

Former head of construction Bill Creedon will assume the role of chairman.

-

The broker’s joint venture with Bain Capital still lacks a CEO.

-

The pair were offered contracts by Willis Re in July.

-

The broker announced the launch of its cross-class facility this week.

-

Placement head Delchar said Gemini will be available across its global book of in-scope risks.

-

The broker has been on an aggressive hiring spree overseen by Lucy Clarke.

-

The airline has exercised a break clause to renew its cover six months earlier.

-

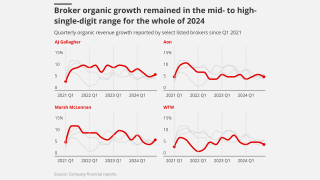

However, group organic growth among public brokers has slowed to pre-pandemic levels.

-

AIG leads the all-risks cover and Axa XL is the hull war lead.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

WTW is “particularly interested” in growing markets like wealth management with bolt-on M&A.

-

-

The claim could add pressure to the hull war market after a recent High Court ruling.

-

The broker has recruited from its rival as it looks to launch Willis Re 2.0.

-

The latest hires follow Rob Hale’s move to Willis.

-

The broker made several senior energy hires from Marsh last year.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

Willis has been adding brokers to its aviation unit in Europe and the US.

-

Willis’ continued reinsurance build-out has targeted London and Bermuda marine and retro specialists.

-

The Atrium-led cover renews after the multi-billion-dollar High Court ruling.

-

Air India has a multi-year insurance arrangement in place.

-

Sources told this publication the hull of the aircraft is valued at $80mn.

-

Brokers across London and Bermuda have handed in their notice to join the start-up reinsurance broker.

-

The Bermuda-based team is led by John Fletcher.

-

The broker is launching a reinsurance arm in partnership with Bain Capital.

-

Saul Nagus is the latest from Marsh’s aviation unit to join WTW.

-

Willis has made a series of aviation hires on both sides of the Atlantic in recent weeks.

-

Plus the latest people moves and all the top news of the week.

-

-

The Willis-brokered coverage also includes the Willis CyXS facility.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier beat QBE to the punch to secure the lead position.

-

The pair add to the roster of aviation-focussed hires at WTW.

-

The hires form part of WTW’s build-out of its US aviation practice.

-

Lucy Clarke said the broking business was resilient in the face of macro challenges.

-

Organic growth was flat on the prior year and in line with Q4 2024 figures.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

Softening in the upstream market has also accelerated beyond expectations.

-

The facility now includes CyXS Plus and CyXS Company.

-

Willis said rising energy demand is creating a revival in the nuclear industry.

-

Larger companies ranked regulatory breach as their top risk.

-

The hire is part of a wider expansion across Willis’s specialty business.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

The broker said the list of perceived obstacles was “fairly damning” for insurers.

-

Q2 renewals will likely signal changes in the reinsurance market, the broker said.

-

The broker has made several recent hires within its marine division.

-

Claims in recent months have brought a period of benign loss activity to an end in the class.

-

Plus, the latest people moves and all the top news of the week.

-

Single-digit organic growth, robust casualty pricing and tapering margins were all key trends.

-

The arrival of Marsh’s Donnelly will "accelerate" US specialty growth, the CEO said.

-

CEO Carl Hess said WTW is entering 2025 with “considerable momentum”.

-

Clarke and Delchar, who were instrumental in building Marsh Fast Track, will lead the launch.

-

The executive will link up again with former colleague Lucy Clarke in Q2.

-

Starr-leads the WTW-placed all-risks cover for American Airlines.

-

Bradley was construction team leader for US casualty at WTW.

-

Heritage and history matter in people businesses, and the storied brand carries real equity.

-

The Willis name, which dates back to 1828, will be used with clients and markets.

-

Simon Delchar will become global head of placement.

-

Tony Simm will report to Garret Gaughan, global head of direct and facultative.

-

Jon Thacker has been at WTW for 20 years, specialising in construction.

-

Adam Garrard will cover his responsibilities on an interim basis.

-

WTW will hold a significant minority stake in the start-up with an option to acquire complete ownership over time.

-

WTW sold Willis Re to Gallagher in 2021 for $3.5bn.

-

The global market is stabilising and softening, and casualty and specialty lines are generally stable, the CEO said.

-

The broker posted a net loss of $1.67bn including pre-tax non-cash losses.

-

Benign claims activity and increased capacity are contributing to “competitive pressures”.

-

The WTW president of risk and broking is the first woman to hold the role in the institute’s history.

-

The broker will take a charge of $1.6bn-$2.1bn relating to the sale.

-

Baudouin is transitioning to a chairman position in Mexico.

-

Construction rates remain stable with some talk of potential softening.

-

The account is among a handful of airlines that have swapped out their brokers this year.

-

CFC developed and employed the lenders carbon-credit insurance policy with Standard Chartered Bank.

-

Glyn Thoms will be stepping into a newly formed role with a focus on cyber strategy formulation and management.

-

Colin Dutkiewicz has held senior roles at Aon and Swiss Re.

-

The choice to build a reinsurance unit at arm’s length alleviates some financial strain.

-

The two parties are targeting a launch by the end of the year, with scope for WTW to buy the start-up at maturity.

-

It will offer additional capacity to WTW US property clients with a limit up to $25mn.

-

Gavin Hamilton joins from Miller, where he served as European wholesale and South African property lead.

-

A quick roundup of the week’s main stories.

-

The new broking president added that hundreds of Marsh staff would not show up tomorrow at WTW.

-

He joins the firm following the departure of Edward Morgan and Guy Tyler, who have launched an MGA.

-

The broker said achieving profitability “remains challenging” for insurers.

-

CRB NA growth was driven by specialty lines, including natural resources, construction and real estate.

-

WTW has also recruited Marsh’s Thomas Burrows and Rupert Mackenzie recently.

-

The broker raised the low end of its 2024 target ranges for adjusted operating margin and adjusted EPS.

-

Alongside the appointment, Adam Garrard will take on the new role of chairman of risk and broking.

-

Camilla Chiatti and Parry Herbert will also join the team.

-

The moves are the latest in a period of personnel upheaval in the energy market.

-

The executive was head of wholesale and specialty at Aon’s Global Broking Centre.

-

The flurry of London market PVT hiring continues.

-

Darren Howlett was a member of Marsh’s relationship management executive leadership.

-

Burrows is the latest former JLT energy broker to join the team at WTW.

-

The business will be supported by up to $200mn of Lloyd’s and London underwriting capacity.

-

Since 1 January, the market’s potential descent into freefall has been closely watched.

-

Proving war-on-land coverage has been challenging, given the lack of reinsurance cover available.

-

WTW is looking to strategically hire across its business, having rebuilt its team following the failed Aon merger.

-

Cyber physical damage cover has also been added to the facility.

-

Prior to joining WTW, Morrison has held senior roles at Canopius, and AIG.

-

The executive said expansion was driven by retention and new business.

-

CEO Carl Hess hailed a “solid” first quarter of results.

-

High cash-burn, the dearth of available leaders, and weaker market conditions all point to shelving.

-

The US regulator faces litigation from both sides of the climate issue.

-

Dussuyer has also been appointed head of corporate risk and broking France.

-

WTW predicted that ‘meaningful softening’ could creep into energy markets during the year.

-

Increased reinsurance retentions left some insurers with their worst net results in a decade.

-

In his new role, Harrison will report directly to Adam Garrard, global head of risk & broking.

-

Graham Knight will become chairman of natural resources.

-

There were 166 deals over $100mn and 34 deals over $1bn in the first quarter of the year.

-

Hear the latest from the marine market as it weighs up the implications of the bridge collapse in Baltimore. Early indications are the claim could eclipse losses from Costa Concordia, stretching into the billions.

-

WTW said the rise of the risk from health and safety was “surprising”.