Validus

-

Additional disclosure following the RenRe acquisition reveals results for both carriers for the nine months to 30 September last year.

-

The deal was announced in late May, with RenRe taking over AIG’s treaty business, including AlphaCat Managers, and all renewal rights to Talbot’s reinsurance treaty unit.

-

The Bermudian’s global property CUO and European chief says it is ready to expand if conditions remain favourable.

-

RenaissanceRe has said it hopes to retain as much as 90% of the Validus Re portfolio, but where are the highest areas of overlap by cedant?

-

Morgan Stanley and Golman Sachs exercised in full their right to buy 945,000 shares in the company.

-

The carrier intends to use the cash raised as part of its consideration for Validus.

-

The deal is the third scale-up buyout for the firm, highlighting the ongoing value of scale in the reinsurance segment.

-

The deal is not predicted to have a long-term impact on RenRe’s financial leverage, AM Best said.

-

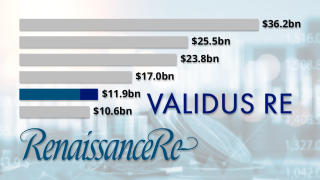

The takeover will push it up two places to rank as the fifth-largest writer of P&C reinsurance by gross premium.

-

The Bermudian reinsurer launched a public offering of 6,300,000 common shares and anticipates raising around $1.15bn to finance the transaction.

-

This came as parent AIG said it had around $6bn of reinsurance limit available for 2023.

-

Brooks had been in his post for almost two years and joined AlphaCat in 2011.

-

Sven Wehmeyer, who will remain as CEO of Validus’s Zurich-domiciled reinsurance arm, replaced Steve Bardill as head of international on 1 June.

-

The diversification benefits and complementary capabilities Validus affords AIG, along with the parent’s move to split its life and P&C operations, factored into the upgrade.

-

His arrival comes in the wake of a series of departures from Validus Re’s specialty reinsurance team.

-

Tom Gregory, Cameron Maffit, Mark Robinson and Patrick Reardon have now started in their new roles.

-

Regional per occurrence deals were also down compared to last year, but Validus lifted its retro cover by $75mn.

-

The carrier will take a smaller line than initial backers PartnerRe and Swiss Re.

-

Ex-Ariel CFO Angus Ayliffe becomes the latest member to join the team, which Jeff Clements will lead.

-

Sources said AIG is offering some staff guaranteed bonuses and stay packages.

-

Manders had been with the company since its launch in 2005

-

Chris Schaper is to step in as CEO of the unit, as Jeff Clements and Chris Silvester depart.

-

The move is likely to be interpreted as succession planning for current CEO Cloutier.

-

The ILS market faces a test to recover position as it loses market share to traditional players.

-

The Bermudian reinsurer intends to file for local authorisation on or after 8 April.

-

Nephila, RenRe and Validus go on the record with this publication on the forthcoming 1 June renewals.

-

Settle in for The Insurance Insider’s 12 days of Insurancemas.

-

Stephen McGill will lead the platform’s underwriting.

-

Validus is also expected to take a $60mn net loss from the Californian events.

-

-

The 2018 conference season has finally come to a close in North America, with the Property Casualty Insurers Association of America’s event in Miami last week bringing the curtain down on this year’s major industry gatherings.

-

The fate of staff affected remains unclear as the Lloyd's carrier follows in the footsteps of Beazley and CNA Hardy.

-

The reinstatement of US sanctions ends Validus’ Iranian marine cover.

-

Corina Monaghan succeeds Jared Kotler, who joined The Hartford in September.

-

Transaction numbers fall 21 percent even as the overall value of deals rises to $42bn.

-

The former Validus executive takes over from Demian Smith following parent Enstar’s decision to end a sale process for the company.

-

The agency also affirmed Validus’ financial strength rating of A (Excellent).

-

Holding an asset because you think someone else will ultimately buy it from you at a higher price is called a “greater fool” thesis.

-

Validus, Nephila and Everest lead reinsurers providing Irma payouts to Citizens.

-

The spate of Bermudian deals pointed to the quality of the carriers, Duperreault said.

-

Reinsurers will keep trying to build scale but dealmaking won’t solve difficulties.

-

Post-merger departures begin from Validus holding company as AIG takes over.

-

CFO Jeff Sangster (pictured) and COO Michael Moore are among the planned departures.

-

The (re)insurer acquired by AIG last week posted a $32.9mn loss for the quarter.

-

Completion of the first major deal under CEO Duperreault hands the buyer businesses including Validus Re, ILS manager AlphaCat and Lloyd’s platform Talbot.

-

The executive was also head of international business development.

-

Bob Eells will be COO of Validus Specialty, Western World and Crop Risk Services.

-

Our analysis looked at the total compensation received by named executive officers.

-

Underwriting opportunities become the focus in Q4 2017 and Q1 2018.

-

The investment yield for Bermudians remained low for 2017, averaging 3.1 percent.

-

Bermuda gross written premium increased by 20 percent to $15.0bn in Q1 2018.

-

A host of companies are bearing the “for sale” sign and the drivers of deal-making remain intact.

-

The Bermuda-based carrier being acquired by AIG also suffered from rising expenses.

-

AIG's takeout of Validus remains a great deal for the target's shareholders. So why would they vote against an executive payout?

-

Validus shareholders clear the takeover by AIG but reject compensation for top executives.

-

Insurance dealmaking in the first quarter hit nearly $28bn when it came to announced deals, but only two transactions comprised the bulk of that amount.

-

Investment returns remained subdued year-on-year for the vast majority of the companies in our analysis, ranging from 1.7 percent to 6.5 percent for the third quarter.