Tysers

-

Several of Henrietta Butcher’s former Tysers colleagues have also moved to Lockton Re.

-

The broker has started hiring in London, taking Tysers D&O specialist Dan Lovett.

-

Under the terms of the offer, shareholders would receive A$45 for each AUB share.

-

The Australian broker, which owns Tysers, announced a trading pause.

-

Rönesans covers lines including aviation, energy, engineering and liability.

-

Henrietta Butcher leaves Tysers after decades with the broker.

-

The division reported revenue up 13.3% at A$465.9mn.

-

Neil Nimmo was CEO and chairman at Lockton International for more than 16 years.

-

The team is led by industry veteran John Lentaigne.

-

Plus, the latest people moves and all the top news of the week.

-

The IGH closure is bitter for employee investors left with nothing – but such investments are inherently risky.

-

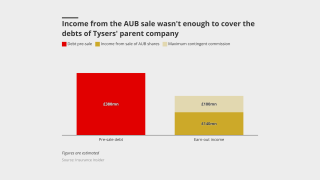

After a two-year delay, more than 100 staff investors will be out of pocket.

-

The promotion comes as the cargo market faces talent turmoil.

-

The division reported revenue up 10.4% at A$204.2mn.

-

Seven team members are set to exit, including team lead Cooke.

-

Steve Jolley has held several CIO roles, including at Ardonagh Specialty, Price Forbes and JLT Group.

-

The executive joined the firm through its acquisition of RFIB.

-

-

In its first full year of AUB ownership, the broker reported a 24% Ebit margin.

-

John Silcock was CEO of entertainment broker Robertson Taylor.

-

The MSC Aries was seized on Saturday by the Islamic Revolutionary Guard Corps.

-

WTW and Tysers collaborated with PPL to design and implement the pilot.

-

The broker’s $47bn DoJ fine had “no material impact” on profits.

-

The 200-year-old firm is not the only one to be caught up in watchdogs’ investigations into corruption and bribery controls.

-

The DoJ also hit rival reinsurance broker Tysers with a $36mn penalty and administrative forfeiture of around $10.5mn.

-

Chief of IRS Criminal Investigation said Tysers had "eroded the process of fair and open competition".

-

The broker was being investigated in relation to suspicions of bribery and corruption with regards to one specific client in the country.

-

AUB Group CEO Mike Emmett will step in as CEO of Tysers on an interim basis.

-

The executive has extensive experience in the reinsurance broking sector both in Asia and London, having worked for Aon Benfield, Cooper Gay and Willis Re in the past.

-

The team will be headed by Tysers’ MD Paul Chapman, joined by Claffey, Freeman and Thornhill.

-

AUB said the placement bookbuild was “significantly oversubscribed” and only allocated shares to existing investors as a result.

-

Tysers Retail Limited was established as a separate entity in the wake of AUB’s acquisition of the broker.

-

The broking CEO set out the London wholesaler’s growth strategy a year on from the AUB takeover announcement.

-

The broker focused on African, North Sea and Latin American business at Primassure and has 30 years’ experience.

-

The broker benefited from new cargo business, higher war rates and a rebounding contingency segment.

-

Insurance Insider reported last year that the bloodstock team had resigned en masse to join Howden

-

It is understood that Tysers’ Latin America head Hugh Powell, who is also a shareholder in the South American operation, has left the UK brokerage.

-

The London wholesaler is ‘performing well’ according to parent AUB Group.

-

It is understood that the executive joined THB Peru in a managing director position.

-

The former Chubb Europe president will replace outgoing chair Peter Haynes.

-

New owner AUB expects the acquisition to deliver A$25mn in synergies.

-

Staff are following their former leaders Mike Godfrey and David Long to the General Atlantic, CDPQ and Hg-backed broker.

-

AUB chief Mike Emmett says the deal is “strategically aligned and financial compelling”.

-

The broker’s revenue rebound was offset by reductions of business in Colombia and Ecuador.

-

Despite the carrier’s profit declining, turnover increased by 15% to £19.2mn.

-

Plus this week’s top carrier results and need-to-know people moves.

-

The deferred structure – and the uncertainty around the size of the pay-outs – will create risk around talent flight for the London wholesaler.

-

The Australian buyer’s deal disclosures reveal details around regulatory probes into the London market wholesaler.