-

-

The Aventum Group broker is targeting placing £1.1bn of GWP by year end 2026.

-

The company has been buying out Omers’ shares since 2015.

-

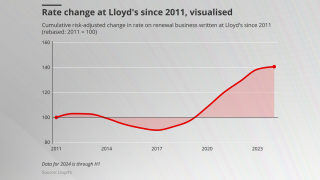

Rates are turning negative, and the balance of power is shifting towards the brokers.

-

The move follows objections from the Singapore government.

-

Aggregates that are featuring in the reinsurance market are not the low-attaching ones of prior years, he added.

-

-

The underwriter worked for Markel for a decade.

-

The Aventum Group broker launched a cargo and stock throughput division earlier this year.

-

Reducing duplication of reporting is key, the association said.

-

Alexander Schlei will succeed Carsten Schulte in his former role.

-

The carrier said its P&C and L&H reserves have been confirmed by independent reviewers.