-

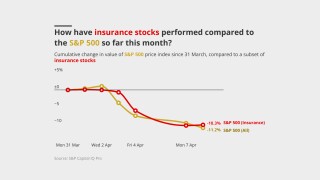

The announcement spurred a quick spike in stock market valuations.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

Swiss Re and Talanx led the gains among listed European carriers.

-

What does the bustling insurance industry of today have in common with the coffee shops of the seventeenth century?

-

CEO responsibilities will be shared by Chris Newman and Tanya Krochta.

-

RBC reports can help regulators identify weakly capitalized companies.

-

The regulator is also aiming to digitise and simplify its authorisation process.

-

CUO Rachel Turk said some syndicates were showing a “mismatch” in ambition and strategy.

-

“We do not have the luxury of time,” he said during the Bermuda Risk Summit.

-

The regulator has scotched plans to publish details of ongoing investigations.

-

“They've been focused on this for more than 10 years,” said Bermuda’s CIT Agency CEO Mervyn Skeet.

-

The company said it now expects the transaction to close in H2 2025.