-

The fund has signed up Oliver Hemsley and Peter Montanaro to its board.

-

The CEO is looking to bring in external capital to support a new independent syndicate.

-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

The facility provides solvency support via a fresh equity injection under various scenarios.

-

The deal follows a minority investment from the insurer in the summer.

-

The broking group also increased its euro loan by EUR160mn to EUR1.16bn.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

The ILS start-up was founded in January by Hanni Ali and Peter Dunlop.

-

The hedge fund had significant investment aims for the London market.

-

InsurTech funding was down 7.3% from $1.09bn in the prior quarter.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

The business has not initiated a sale process, with the wheels not yet actively turning on an exit for Apiary.

-

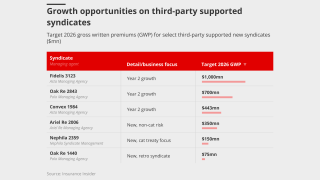

The syndicate is expected to write ~$300mn of business in 2026.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

Private capital providers are being signed down as two strong years have piqued interest.

-

Lloyd’s investment vehicles have been shelved in past years but a strong run of returns is creating interest.

-

It comes as the MGA expects to write more than $1bn of premium in 2026.

-

West Hill Capital is the main investor in the capital raise.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

The sidecar will support five programs providing specialty frequency coverages.

-

From aviation claims to retention challenges, underlying dynamics will take time to play out.

-

The tech firm is building a joint stock company with insurers and investors.

-

The relationship between growth and capital is “symbiotic”, the broker said.

-

Lenders include Morgan Stanley, Permira and Bridgepoint.

-

Blackstone-style capital seeking to get closer to source is a net negative for reinsurers.

-

The syndicate will be targeting approximately $50mn of GWP in its first year.

-

Apollo most recently received in-principle approval for Syndicate 1972.

-

The private ILS segment took losses from LA wildfires and Mid-West severe convective storms in H1 2025.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

The insurer’s plans for the syndicate were revealed by this publication earlier this year.

-

The reinsurer is moving all its non-cat business to the new syndicate, leaving 1910 focussed on peak cat.

-

The post-disaster reinsurance start-up model is changing.

-

It is understood that CyberCube has been considering a sale of the business.

-

Strong CoRs and investment returns supported profitability in H1 2025.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

Assurex’s global independent broker network pumps $4bn of premium into the London market.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The fronting insurer will be able to support MGAs across the 27 EU states.

-

The firm is currently working with 13 MGAs, including QMetric and Eaton Gate.

-

A second syndicate is being explored for “big and bold” new lines

-

The Lloyd’s syndicate was one of just a couple of reinsurance start-ups in the current hard market.

-

Lloyd’s executives have suggested ceded reinsurance syndicates could help London compete in treaty.

-

The company resumed work on a public offering in September.

-

The deal, revealed by this publication in December, values the firm at $14bn.

-

Sources said NY-based Lee Equity is seeking to extend its investment in the TPA heavyweight.

-

The Lloyd’s business secured a $90mn investment from Alchemy in 2021.

-

The managing agent for Syndicate 609 has been involved in an M&A process this year.

-

BP Marsh has subscribed for a 49% shareholding in the start-up MGA.

-

The $2.59bn renewal is up 45% from last year.

-

The Corporation is poised to accelerate its investments in start-ups.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

The programme will succeed the previous buyback launched in 2023.

-

The CEO said Ascot would deploy capital where it sees opportunities.

-

The IPO was announced at the end of April, targeting ~$2.6bn-$2.9bn.

-

The specialty carrier is braving volatile macroeconomic conditions in a second effort to list.

-

Sentiment at the ILS Connect event hosted by Insurance Insider ILS was generally positive.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

Lloyd’s chair Bruce Carnegie-Brown officially hands over to Charles Roxburgh today.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

The carrier is offering shares priced at $29-$31.

-

As the next generation of Names comes to the fore, advisers urge simplification.

-

The fund apparently plans to purchase life insurance policies as investments.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

Being the “new kid” has created interest in the market, Mereo CEO Croom-Johnson added.

-

Due diligence is essential to make sure incubators are backing winners.

-

Modified freehold gives syndicates and investors clarity around exit plans.

-

Trouvaille II raised $580mn for 2025, compared to $325mn in 2024.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

Syndicate 1984 will be backed by Names under a modified freehold arrangement.

-

Some firms are broadening their M&A net in light of PE firms showing more restrained appetite for intermediaries.

-

The investors are led by PE firm NMS Capital Group.

-

Insight into the current state of the insurance M&A market, powered by the Insurance Insider M&A Deal Tracker.

-

The insurer has renewed separate three and five-year arrangements.

-

The business is targeting an enterprise value in excess of $30bn, sources said.

-

The MGA can now put down $200mn lines in the niche aviation war class.

-

The path to Howden’s new era is steep – but the opportunity is vast.

-

In part two of our 2025 outlook, we explore the drivers of carrier M&A and recreating the ESG agenda.

-

The $2bn+ raise would likely rest on the base case of an IPO in the medium term.

-

Certain new and old themes will re-emerge this year as the balance of power shifts.

-

The firm has commenced writing collateralised retro and reinsurance but its rated launch is still pending.

-

The reduction in capacity reflects “strategic adjustments”.

-

The broking business will transfer along with four unknown assets owned by the PE backer.

-

Insight into the insurance M&A market, powered by Insurance Insider’s deal database.

-

The company has exited some transactional liability and commercial D&O business.

-

The Lloyd’s (re)insurer is looking to execute a five-year plan to double GWP to $3bn.

-

The carrier has undertaken work to give it “optionality” for a public listing, but has no plans to list in the short term.

-

The start-up has secured BMA approval as it looks to a 1 January kick-off.

-

Insight into the current state of the insurance M&A market, powered by the Insurance Insider M&A Deal Tracker.

-

The company’s net asset value per share is expected to hit £2.06.

-

Acrisure’s syndicate launched in 2023 with an $84.4mn stamp.

-

Oak Re is being spearheaded by former RenaissanceRe executive Cathal Carr.

-

Carlyle re-launched efforts to find minority investor last June.

-

The Hartford will assume a quota share of Coalition’s UK cyber program.

-

In line with Milton’s moderate forecast loss, the ILS market reaction will be less influential in post-event dynamics.