-

The former SPA graduates to a full syndicate under Probitas management.

-

The fund has signed up Oliver Hemsley and Peter Montanaro to its board.

-

The CEO is looking to bring in external capital to support a new independent syndicate.

-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

The facility provides solvency support via a fresh equity injection under various scenarios.

-

The deal follows a minority investment from the insurer in the summer.

-

The broking group also increased its euro loan by EUR160mn to EUR1.16bn.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

The ILS start-up was founded in January by Hanni Ali and Peter Dunlop.

-

The hedge fund had significant investment aims for the London market.

-

InsurTech funding was down 7.3% from $1.09bn in the prior quarter.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

The business has not initiated a sale process, with the wheels not yet actively turning on an exit for Apiary.

-

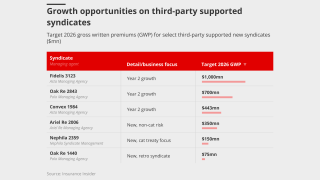

The syndicate is expected to write ~$300mn of business in 2026.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

Private capital providers are being signed down as two strong years have piqued interest.

-

Lloyd’s investment vehicles have been shelved in past years but a strong run of returns is creating interest.

-

It comes as the MGA expects to write more than $1bn of premium in 2026.

-

West Hill Capital is the main investor in the capital raise.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

The sidecar will support five programs providing specialty frequency coverages.

-

From aviation claims to retention challenges, underlying dynamics will take time to play out.