-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

An insurability crisis could pose systemic risks that undermine the foundations of finance.

-

The ILS start-up was founded in January by Hanni Ali and Peter Dunlop.

-

A New Jersey judge also refused to grant WTW’s request for a restraining order.

-

The loss would be one of the largest ever for mining underwriters.

-

On a net basis, premiums written were up 4.7% to $641.3mn.

-

The hedge fund had significant investment aims for the London market.

-

The carrier’s top line grew to $1.4bn in the first half of 2025.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

Plus, the latest people moves and all the top news of the week.

-

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

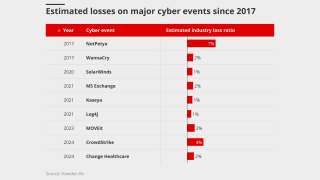

The June 2024 ransomware attack produced claims across many firms.

-

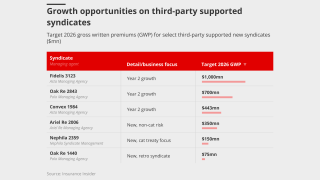

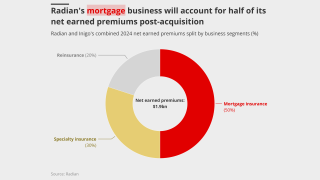

Cyber, mortgage and crop were identified as attractive growth areas.

-

The consortium will target excess layers, providing $250mn of capacity.

-

The carrier said nat-cat losses remained “well below” those of prior years.

-

InsurTech funding was down 7.3% from $1.09bn in the prior quarter.

-

Industry-wide initiatives continue to target expanded youth access to the sector.

-

The carrier’s retail division saw premiums increase by 7.3% to $2bn.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

Zaffino said AIG will continue to assess strategic opportunities after the Convex, Onex and Everest deals.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

The carrier anticipates a “favourable” retro renewal at 1.1.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

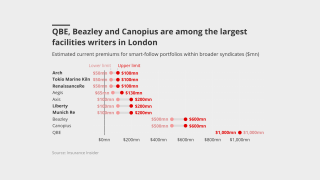

The CEO said smart-follow is a structural evolution of the specialty market.

-

Adeptive co-founder and CUO Jeff Bright will lead the MGU’s US strategy.

-

The carrier is continuing to reposition its portfolio to drive more consistent returns.

-

The carrier said market dynamics remained robust, with overall pricing healthy.

-

Lack of major cat events could add further pressure on 1 January pricing.

-

Marsh is also suing a second tier of former Florida leaders.

-

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

Insight into the state of the insurance M&A market, powered by Insurance Insider’s comprehensive deal database.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

Widespread underinsurance and low exposures will limit losses.

-

Citi and Berenberg believe the carrier is more resilient than in the past.

-

The deal confers a high multiple on Convex and gives AIG re/specialty exposure.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

CEO Greg Case said data centre demand could generate over $10bn in new premium volume in 2026.

-

The energy broker’s career also includes a stint at Price Forbes.

-

Regulators do too little to distinguish between generalists and specialists, he said.

-

The Spanish (re)insurer reported a group net profit of EUR829mn.

-

The business has not initiated a sale process, with the wheels not yet actively turning on an exit for Apiary.

-

Prices were 37.4p per £1 of capacity, according to Argenta.

-

The broker grew earnings per share by 12.1% during the quarter.

-

The syndicate is expected to write ~$300mn of business in 2026.

-

Opportunities for profitable growth in cat will be hard to predict, the executive said.

-

Starr’s reinsurance ambitions and embrace of Lloyd’s will be watched closely.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

The company reported no cat losses but saw a jump in attritional losses.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

-

CEO Brand said he expected to deliver double-digit growth, if “marginally” lower in 2026.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

How do struggling governments across the globe tackle stagnating economic growth?

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The fundraising structure for the deal includes a $600mn Convex debt raise.

-

The broker will join Ron Borys’ financial lines team.

-

-

The broker has more than 20 years’ experience in the energy market.

-

Onex’s own balance sheet will become a 63% owner and AIG takes a 35% stake.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

-

Everest’s AIG deal meaningfully cuts its primary exposure.

-

In insurance, premium growth came from all lines of business except cyber.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The upgrade reflects consistent outperformance of “higher-rated peers”, S&P said.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Brokers may encourage clients to capitalise on falling rates by boosting coverage.

-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The MGU’s second syndicate launch was delayed from January 2025.

-

Matthew Hogg joined Liberty Specialty Markets in 2010.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

Under the terms of the offer, shareholders would receive A$45 for each AUB share.

-

Jason Keen joined Everest in 2022 as head of international.

-

The buy-in can be seen as a “flip” bet on a rebound in appetite for carrier M&A.

-

Consolidated NWP reduction was driven by the reinsurance segment, partly attributable to two transactions in Q3 2024.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

This publication revealed the move earlier this year.

-

The Australian broker, which owns Tysers, announced a trading pause.

-

The move comes as Michael Creighton is made credit and political-risk director for Africa.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

Private capital providers are being signed down as two strong years have piqued interest.

-

Willis Re kicked off its talent acquisition with mass hiring from Guy Carpenter over the summer.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

APIP is one of the world’s largest property programs.

-

The carrier recently expanded its reinsurance product suite in Bermuda.

-

Plus, the latest people moves and all the top news of the week.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

The range allows “for information that could emerge beyond what is known today”.

-

The appointments are aimed at offering a clearer team structure.

-

Sources said he will join the reinsurance brokerage next year, after his garden leave expires.

-

The EUR100mn+ Ebitda firm is courting both PE and trade suitors.

-

Beazley is one of the key leaders in the London marine marketplace.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

The company and its main debt provider Ares agreed to relax its debt terms in April.

-

The carrier is looking to achieve sustainable growth across its personal lines business.

-

The hire will lead the firm’s UK and Europe operations.

-

Lloyd’s investment vehicles have been shelved in past years but a strong run of returns is creating interest.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Reinsurers are willing to concede on pricing, while cyber interest is on the rise.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

Bill Ross has been CEO of the non-profit for 21 years.

-

The financial services growth strategy could be “turbo-charged” by involving brokers, it said.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

Building on the buzz from our in-person October Insider Progress UK meeting, we’re back with a free follow-up webinar on Tuesday, 11th November 2025 at 15:30 GMT.

-

Part five in our series looks at how AI can empower brokers to add value as well as speed.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

The sidecar was launched today by the Bermudian reinsurer and investment firm Carlyle.

-

The capital will provide retro cover for life-focused reinsurer Fortitude Re.

-

The company noted tougher market conditions and higher large losses during the year.

-

Majority shareholder Fosun will continue to hold the remaining 86.7% of shares.

-

The investor has made four new investments post-H1.

-

The traditionally lucrative class has faced a series of challenges in the latest geopolitical crisis.

-

The London-based executive will relocate to Daytona Beach, Florida.

-

The Boeing cargo aircraft was wet leased by Emirates.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The syndicate says it will not set any top-line targets on digital follow strategies.

-

EMEA CEO Laurent Rousseau said reinsurance must retain its relevance to investors.

-

Munich Re is among the insurers with a stake in the German carrier.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

The broker will report to Howden US CEO Mike Parrish.

-

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

The change forms part of a broader leadership reorganisation.

-

As two working member vacancies are arising on the Council, a ballot will be held.

-

Plus, the latest people moves and all the top news of the week.

-

David Bell has held aviation roles at Marsh, AIG, Gallagher Re and Aon.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

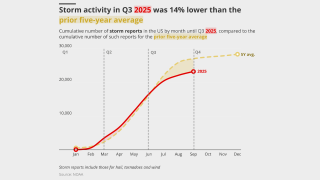

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The facility provides coverage for property, terrorism, energy, construction and utilities risks.

-

The broker’s new business and client services division is targeting $400mn of savings.

-

Earlier this week, the broking house announced a rebrand to Marsh.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

Ark has been adding new product lines across its three Lloyd’s syndicates.

-

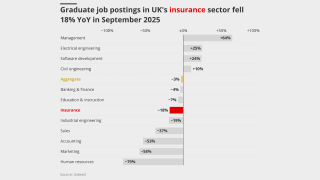

Insurance grad vacancies were down 18% year-on-year in the UK, ahead of a 3% nationwide drop.

-

Rachel Webber was most recently head of non-marine at TransRe.

-

Jamie Smith joined Arch in 2018, taking on the senior underwriter role in 2022.

-

The executive has run the MGA platform since its 2017 inception.

-

Debbie Hobbs joined Miller in 2021 from EmergIn Risk.

-

Michael Shen will be succeeded by deputy Camilla Walker.

-

Differentiating Lloyd’s claims performance could help drive business to the market.

-

The report seeks to arm parliamentarians and policymakers with “practical tools”.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

After six years as CFO, Mark Craig is taking on the position of chief investment officer.

-

Brian Church has spent 20 years at Chubb.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

The reshuffle is likely laying the foundations for the eventual succession to CEO Mario Greco.

-

The group will join forces with SRG subsidiary Miles Smith.

-

Class actions and third-party litigation funding will drive up losses.

-

The European broker said a London wholesaler is the ‘missing piece’ of its strategy.

-

Mike Mulray joins from Everest, where he was EVP president of North America insurance.

-

Trade credit insurers are expected to respond with tighter buyer limits and stricter wordings.

-

Manuel Perez will continue in his ongoing role as head of cyber for LatAm.

-

Neil Ross was also appointed CUO for the broker’s MGA.

-

The international division is seeking a new London market manager.

-

Jennings will reunite with Cameron-Williams, who he worked with at BDO.

-

The London-based pair will report to commercial risk UK CEO Rob Kemp.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

The governor has yet to sign a pending bill to create a public cat model.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

White will join from Allianz trade, and Summers from Talbot.

-

The reinsurer plans to grow its US business at a higher rate than its non-US business.

-

Carriers are rethinking the traditional renewal-rights model.

-

Moretti has relocated to California from London.

-

Willis claims at least two $1mn accounts were also unfairly lost to Howden.

-

The broker is understood to manage Brown & Brown’s account at Howden.

-

Incumbent Jane Warren will retire at the end of the year.

-

The carrier has hired José David Jiménez García as managing director for Germany.

-

Scott was most recently head of claims at MGA Geo Underwriting.

-

Without flexible mechanisms the Corporation risks suppressing transactions.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

The Ryan Specialty renewables MGA launched an international arm last year.

-

Pryor-White founded Tarian Underwriting, which was sold to Corvus in 2022.

-

In July, he took the role on interim basis from Laure Forgeron.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

The recruits will join from Nephila, Aon and Malaysian Re.

-

Declared events totalling just under A$2bn ($1.3bn) included one cyclone and two floods.

-

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

The carrier is planning a limited relaunch into the UK D&O market.

-

-

The class offers affirmative coverage for gaps in traditional insurance policies.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Alliant is in the process of moving the ~$1bn of business it places with Howden to other wholesalers.

-

It comes as the MGA expects to write more than $1bn of premium in 2026.

-

The underwriter has worked for Markel in Singapore since 2020.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

Samir Hemsi was CUO at Westfield Syndicate and sat on the firm’s board of directors.

-

Joel Hodges will run the international business as managing director.

-

Panellists at Insider Progress shared fixes for bias, confidence and culture.

-

The newly united company has set out ambitions to double in size by 2030.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

The former civil servant joined the Corporation in October 2021.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

Jo Smart has worked for Torus and Aegis during his two decades in the market.

-

West Hill Capital is the main investor in the capital raise.

-

Improved performance and growing investment returns played a role in the upgrade.

-

The aviation market has experienced a run of large losses this year.

-

The business has been ~70% owned by White Mountains since January 2024.

-

Plus, the latest people moves and all the top news of the week.

-

Julia Graham played a key role in the UK's introduction of captive-friendly regulation.

-

Inigo CEO Richard Watson said the team is ready for its “second album”.

-

What’s driving the wave of shifting ownership structures in the Lloyd’s market?

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

The executive has worked at Aon for almost two decades.

-

The executive was most recently serving as CRO – insurance.

-

Landa was part of the team lift led by Michael Parrish, who is CEO of the US retail arm.

-

Stephan Simon left BMS in June 2024 after almost three years in the role.

-

High capacity is adding to competition in the upstream energy space.

-

The protection gap must be closed before a public cyber reinsurance scheme is possible.

-

She previously served as Hub’s North American casualty practice leader.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Stephen Ridgers is leaving his current role as head of construction midcorp at Allianz Commercial.

-

The pair have expanded remits overseeing property and specialty.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

Kantara now holds a majority stake in the MGA, with the rest held by employees.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

Current backer JC Flowers will retain its holding and the cash will fund a Bermuda acquisition.

-

New sources of capacity lack the expertise to service rapidly developing clients.

-

Abbas Juma has spent more than seven years at Howden M&A in various senior roles.

-

The upcoming Lloyd’s Lab cohort 16 will include a dedicated Irish theme.

-

Several airlines are understood to have come to market early.

-

The company will continue its capacity partnership with the MGA until 2030.

-

Susan Langley will look to strengthen global business ties and promote UK growth.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The BP Marsh-backed MGA launched earlier this year, led by Adam Kembrooke.

-

The underwriter has worked at Hiscox, Lloyd’s, Chubb and Zurich.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

Tom Potter was global casualty underwriting manager for UK & Lloyd’s at Axa XL.

-

The Lloyd’s investment business has cut expenses by 54% over the past six months.

-

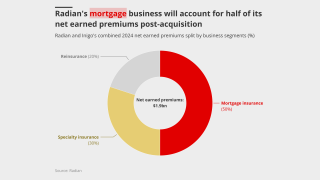

The deal will be watched closely by Radian’s handful of similar peers.

-

Sean McGovern will step down from the role in December.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

The pair hail from Dale Underwriting and Axa XL, respectively.

-

The tropical cyclone is expected to be named Imelda.

-

Plus, the latest people moves and all the top news of the week.

-

Small modular reactors are increasingly viewed as a means of meeting surging energy demand.

-

The transaction marks the largest US market entry by a Korean non-life insurer.

-

Georges De Macedo will remain within the group as a board member.

-

The executive has been with ASG since it was formed in 2016.

-

Aon’s Enrico Vanin will lead the platform as CEO.

-

After losing in the High Court, insurers pin their hopes on the Court of Appeal.

-

The veteran underwriter said market conditions are still ‘robust’.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The Corporation’s chair reiterated its aim to reduce the cost of doing business.

-

The London broker has also recently hired Michael Lohan from Lockton.

-

Global pricing is now 22% below the mid-2022 peak.

-

MGA Amiga Specialty launched in May, with backing from investor BP Marsh.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

The market turn may give some staff pause for thought, but reward remains high.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

The report highlighted the gap between insured and uninsured attacks is widening.

-

The broker’s headline Ebitda was $20mn, up from $5.6mn in 2023.

-

The toll of risk losses sustained by the PVT market this year is mounting.

-

IAG completed its takeover of RACQ last month.

-

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The executive met with UK colleagues to discuss plans for the US business.

-

Dale Underwriting recently pulled out of standalone offshore energy business.

-

The major storm is set to move on to mainland China later in the week.

-

The economic loss from the event was around EUR7.6bn.

-

Part four looks at how the talent landscape will shift in response to AI introduction.

-

The move comes as the broker rebuilds its Bermuda team.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

Plus, the latest people moves and all the top news of the week.

-

The Corporation’s chair laid out plans to make Lloyd’s a preeminent market in the long term.

-

Louis Tucker helped establish Barbican Insurance, which was later sold to Arch in 2019.

-

How does Lloyd’s plan to secure its future as a leading global marketplace?

-

Losing senior women creates a knock-on effect as juniors lose role models.

-

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

The CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

More general issues at recruitment level include drawing from too narrow a pool.

-

The US mortgage insurer announced its $1.7bn acquisition of Inigo earlier today.

-

Alessa Quane will report to Sompo P&C CEO James Shea.

-

The deal becomes part of a wave of carrier dealmaking.

-

The 2024-25 period has been the worst on record for claims, with costs of $775mn+.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.

-

The broker said insurers were facing increasing pressure to improve financial performance in claims.

-

It said the loss did not reflect the underlying economic performance of the business.

-

This publication revealed in February the incident was expected to lead to a major claim.