-

The carrier will continue to write the business from Bermuda and the US.

-

Syndicate 4321 will operate as a consortium led by Syndicates 623 and 2623, providing capacity for companies that meet ESG criteria.

-

Marco’s launch marks the latest RITC syndicate to set up at Lloyd’s, following Compre’s move to establish a vehicle under an Apollo turnkey at the beginning of the year.

-

Figures from the International Underwriting Association’s most recent report shed some light on the movement.

-

Global insurance firms’ efforts to help clients cut carbon emissions are detailed in the report.

-

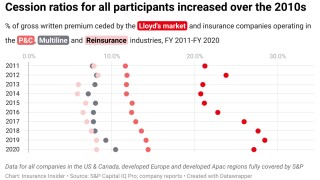

Analysis of financial data shows that the last decade has seen a marked increase in the proportion of premiums ceded by carriers in all sectors.

-

The Lloyd’s investment vehicle had raised £53mn in March to invest in further acquisitions of Nameco capacity.

-

Mark Cooper has been appointed as head of its UK branch, David Jackson as senior underwriting manager, and Kirstie Keate as underwriting manager.

-

Roshni Lillies was head of international casualty treaty for SiriusPoint.

-

Other industry executives recognised on the night included Ark CEO Ian Beaton, Lloyd’s CFO Burkhard Keese and Howden CEO David Howden.

-

This will be the first syndicate in a box in the Gulf Co-operation Council – an economic union between states in the region.

-

The PPL board has finally chosen a partner to deliver the NextGen platform, opting for a build option with Deloitte Digital.