-

The consortium will target excess layers, providing $250mn of capacity.

-

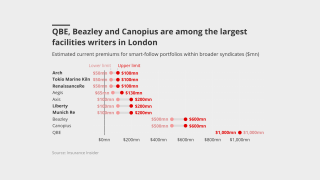

The CEO said smart-follow is a structural evolution of the specialty market.

-

APAC now represents roughly 15% of all Lloyd’s premium.

-

The business has not initiated a sale process, with the wheels not yet actively turning on an exit for Apiary.

-

Prices were 37.4p per £1 of capacity, according to Argenta.

-

Plus, the latest people moves and all the top news of the week.

-

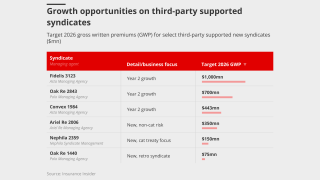

The syndicate is expected to write ~$300mn of business in 2026.

-

Starr’s reinsurance ambitions and embrace of Lloyd’s will be watched closely.

-

How do struggling governments across the globe tackle stagnating economic growth?

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

Brokers may encourage clients to capitalise on falling rates by boosting coverage.

-

The MGU’s second syndicate launch was delayed from January 2025.

-

Private capital providers are being signed down as two strong years have piqued interest.

-

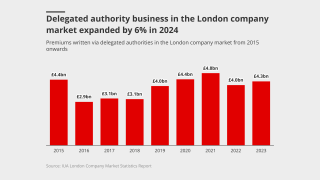

The number of syndicates traded at auction was the highest for a decade.

-

Lloyd’s investment vehicles have been shelved in past years but a strong run of returns is creating interest.

-

Sam Geddes will join Syndicate 1918 next year in an executive leadership role.

-

The company noted tougher market conditions and higher large losses during the year.

-

The traditionally lucrative class has faced a series of challenges in the latest geopolitical crisis.

-

The hire follows the departure of David Martin to GIC Re Syndicate.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The syndicate says it will not set any top-line targets on digital follow strategies.

-

The two lines will add £11mn in planned premium.

-

As two working member vacancies are arising on the Council, a ballot will be held.

-

Plus, the latest people moves and all the top news of the week.

-

IGI’s premium income has almost doubled since it listed in 2020, but how can growth still be achieved in a soft market?

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

Ark has been adding new product lines across its three Lloyd’s syndicates.

-

Differentiating Lloyd’s claims performance could help drive business to the market.

-

Plus, the latest people moves and all the top news of the week.

-

Incumbent Jane Warren will retire at the end of the year.

-

Without flexible mechanisms the Corporation risks suppressing transactions.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

It comes as the MGA expects to write more than $1bn of premium in 2026.

-

The former civil servant joined the Corporation in October 2021.

-

Jo Smart has worked for Torus and Aegis during his two decades in the market.

-

Volante launched Syndicate 1699 in 2021.

-

Inigo CEO Richard Watson said the team is ready for its “second album”.

-

What’s driving the wave of shifting ownership structures in the Lloyd’s market?

-

The upcoming Lloyd’s Lab cohort 16 will include a dedicated Irish theme.

-

Several airlines are understood to have come to market early.

-

Legacy reinsurance deals will be reviewed by the Legacy Review Panel.

-

The Lloyd’s investment business has cut expenses by 54% over the past six months.

-

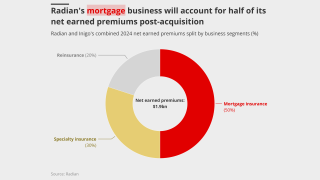

The deal will be watched closely by Radian’s handful of similar peers.

-

The pair hail from Dale Underwriting and Axa XL, respectively.

-

Plus, the latest people moves and all the top news of the week.

-

Small modular reactors are increasingly viewed as a means of meeting surging energy demand.

-

The veteran underwriter said market conditions are still ‘robust’.

-

The Corporation’s chair reiterated its aim to reduce the cost of doing business.

-

The Corporation’s chair laid out plans to make Lloyd’s a preeminent market in the long term.

-

How does Lloyd’s plan to secure its future as a leading global marketplace?

-

Losing senior women creates a knock-on effect as juniors lose role models.

-

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

The US mortgage insurer announced its $1.7bn acquisition of Inigo earlier today.

-

The deal becomes part of a wave of carrier dealmaking.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.

-

Inigo executives told Insurance Insider last year they were weighing up the casualty treaty market.

-

The carrier plans to reduce 623’s stamp by around 10% next year.

-

Property remains the dominant line, accounting for nearly 30% of total London premiums.

-

The business has ramped up its underwriting volume since launching in Lloyd’s last July.

-

Plus, the latest people moves and all the top news of the week.

-

This will be the 15th cohort of companies to go through the Lloyd’s Lab.

-

There are concerns that repeated delays could lead to market disengagement with the process.

-

Lloyd’s has pursued a Big Game Hunting strategy to lure major insurers into the market.

-

The syndicate will be targeting approximately $50mn of GWP in its first year.

-

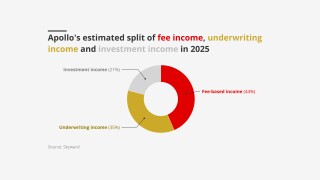

Apollo most recently received in-principle approval for Syndicate 1972.

-

The insurer’s plans for the syndicate were revealed by this publication earlier this year.

-

The reinsurer is moving all its non-cat business to the new syndicate, leaving 1910 focussed on peak cat.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Mark ‘Ollie’ Hollingworth has held his current role at Atrium since 2017.

-

Paul Sandi, head of reinsurance, will serve as active underwriter for the new syndicate.

-

Maintaining underwriting discipline was central to the Corporation's messaging.

-

It was announced this week that the business had agreed to be acquired by Skyward Specialty.

-

Skyward’s acquisition of Apollo will provide access to the London Bridge framework.

-

Rachel Turk said product-line facilities had been “under-scrutinised”.

-

Rönesans covers lines including aviation, energy, engineering and liability.

-

The carrier said the decision reflected its commitment to portfolio discipline.

-

Lloyd’s reported reinsurance GWP increased 10.6% to £13.2mn.

-

The cycle-turn M&A story continues with strategic buyers to the fore.

-

Lloyd’s will keep heritage systems operationally resilient until at least 2030.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

The LPPC will offer limits of $127.5mn EAR and DSU coverage in the US and Canada.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

What happens when a global broker network decides to fill a gap in the London market itself?

-

The news comes after the announcement of CEO Graham Evans’ departure.

-

The carbon-credit insurer has appointed James Morrell head of credit underwriting.

-

Plus, the latest people moves and all the top news of the week.

-

As rate reductions present headwinds, firms are expected to moderate expansion.

-

Simon Clegg will leave Syndicate 609 after 25 years.

-

The London carrier missed consensus on gross and net premiums for H1.

-

Part of the syndicate’s premium for clinical-trial-funding cover will move to Syndicate 1902.

-

The company has recently made several senior changes to its UK and Lloyd’s leadership.

-

The syndicate now predicts a return on capacity for 2021 of between -5% and 5%.

-

Market leaders Atradius and Coface have both received in-principle approvals for a Lloyd’s syndicate.

-

The Lloyd’s carrier is expected to try to claim multiple times under the policy.

-

The family-owned group is embarking on a major international expansion.

-

What does it take to turn a family-run insurance group into a global powerhouse?

-

The carrier reported an increase of 82% in pre-tax income.

-

Duc Tu and Lucy Howard have resigned from Atrium.

-

The carrier also announced an increased share-buyback programme.

-

A limited number of broking staff are also leaving the business, including downstream head Dan Nicholls.

-

Stephane Flaquet replaces George Marcotte, who has been interim COO since September 2024.

-

The LMA head also praised Velonetic for transparency on Blueprint 2.

-

The leadership transition at the syndicate was announced earlier this year.

-

The underwriter was head of financial institutions at LSM for six years.

-

Sources have identified facilities as a different source of rising commissions.

-

The search for a successor to lead Syndicate 1200 is underway.

-

Demian Smith joins from Guy Carpenter.

-

Surveys show diversity and inclusivity foster a sense of belonging and increase productivity.

-

Group CEO Tavaziva Madzinga said it might explore Lloyd’s Names backing in the future.

-

Some 185 credit claims were reported in the market, totalling over $400mn.

-

The Asta-managed syndicate aims to commence underwriting later this year.

-

The exit is by mutual agreement, according to the association.

-

The former Lloyd’s CEO is also eligible for a target $5mn annual equity award.

-

Atradius Syndicate 1864 is expected to begin underwriting next year.

-

Lloyd’s has confirmed the departure of two senior leaders.

-

Plus, the latest people moves and all the top news of the week.

-

Coface Lloyd’s Syndicate 2546 is expected to commence underwriting in 2025.

-

The former Lloyd’s CEO will not make his planned move to Aon.

-

The strategy is a 10-year plan to drive growth in UK financial services.

-

The MGA has secured Lloyd’s paper to write crypto theft insurance.

-

A second syndicate is being explored for “big and bold” new lines

-

Claims chiefs are caught between technological advancement and waiting for phase two

-

Plus, the latest people moves and all the top news of the week.

-

The executive said there was an ‘active cross-sell culture’ across The Fidelis Partnership.

-

How is The Fidelis Partnership choosing to launch into new insurance classes as it rapidly expands?

-

Syndicate 1947 is gearing up to expand its marine reinsurance portfolio.

-

The Cathal Carr-led carrier has been building its team since launching this year.

-

The new roles will oversee property, specialty and credit.

-

The business is one of the first to sell in this round of Lloyd’s M&A.

-

It was announced earlier today that the US wholesaler had agreed to acquire Atrium.

-

Sixth Street and Cornell also bid for the wholesaler.

-

The PRA, FCA and Society of Lloyd’s have agreed to the changes.

-

The deal comes amidst an expected spell of M&A on Lime Street.

-

Plus the latest people moves and all the top news of the week.

-

The Lloyd’s syndicate was one of just a couple of reinsurance start-ups in the current hard market.

-

Gallagher, Marsh and Aon also faced sizeable outstanding premium payments as at Q4 2024.

-

The new chair said the market must adapt for 2030 and beyond.

-

The FCA is reviewing how it can simplify regulation for commercial insurers.

-

Lloyd’s executives have suggested ceded reinsurance syndicates could help London compete in treaty.

-

The managing agency is offering 62p per £1 for 2026 YoA capacity.

-

The international casualty director has worked at Axa XL, Ive and Ardonagh.

-

The business currently works with Hamilton Managing Agency.

-

It has been a volatile week for the marine war market in a period of geopolitical turmoil.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

Lloyd’s chair said attractive returns were the “essential bedrock” of performance.

-

The investment comes amid expectations of a new cycle of deals.

-

The start-up has hired four people to join the division.

-

Some segments are moving faster than anticipated, but overall, it remains a mixed bag.

-

The Lloyd’s business secured a $90mn investment from Alchemy in 2021.

-

The managing agent for Syndicate 609 has been involved in an M&A process this year.

-

Peter Montanaro retired from his role as market oversight director at Lloyd’s in May.

-

Is the huge growth experienced by the MGA sector run out of steam?

-

The former Volante chief is in initial talks with several parties.

-

Who will buy the swathe of PE-backed Lloyd’s firms coming to market over 2025-26?

-

The firm's near-term global strategy includes operations in the UK, US, parts of Europe and Asia.

-

The LMA urges use of AI for enhanced decision making but concerns remain.

-

Plus, the latest people moves and all the top news of the week.

-

The new Lloyd’s chief of market performance also outlined target growth areas.

-

The modeller said the insurance market could be exposed to unexpected aggregations.

-

Jim Meakins is the latest in a slew of talent to exit from the syndicate.

-

Robert Vetch joined the Lloyd’s business as CFO in 2019.

-

Corporates buying Lloyd’s syndicates face the culture/integration trade-off.

-

The campaign will run throughout June.

-

Analysts were interested in the potential for fee income from the retail division.

-

Tiernan’s former role of chief of markets will be split into two new exec team positions.

-

The driver of growth has shifted from rate to volume, as pricing increases tail off.

-

The executive set out his vision for the Corporation after assuming leadership.

-

The outgoing CEO said the market had been restored as a leader during his tenure.

-

Frustration is growing around a promised independent operating model and staff reward.

-

Plus, the latest people moves and all the top news of the week.

-

Lloyd’s maverick syndicate produces impressive results, but questions remain over succession.

-

The investment vehicle will publish its full results on 2 June.

-

The changes are aimed at improving underwriting and operational performance.

-

The Corporation is poised to accelerate its investments in start-ups.

-

LA wildfire losses are impacting the 2024 years of account, Argenta noted.

-

Cincinnati Global entered the cargo market this year.

-

Plus, the latest people moves and all the top news of the week.

-

Trade credit rivals Coface and Awbury are also entering the market.

-

The majority of the savings are expected to be realised in the retail division.

-

Alex Cullen left Atrium last month.

-

The Lord Mayor told the CRO Summit to stop treating risk as a dirty word.

-

Broker facilities and increased US domestic appetite are accelerating the softening.

-

The executive will be global reinsurance CEO and climate solutions chair.

-

The syndicate-in-a-box is the first Lloyd’s syndicate to operate outside London.

-

The CEO transition is already visible in messaging on growth as rate change picks up.

-

Lloyd’s CUO said established broker facilities were “big enough”.

-

The platform could help reduce claims-cash holding times by 10 weeks.

-

The CUO noted that market-wide rate change in Q1 was down 3.3%, coming in below plan.

-

The executive has spent 10 years in a range of roles at the Corporation.

-

Plus, the latest people moves and all the top news of the week.

-

Pushing through technological change and maintaining underwriting results are top of agenda.

-

Patrick Tiernan was announced as the new Lloyd’s CEO earlier today.

-

The underwriter was part of Probitas’ founding team.

-

The CEO-designate will commence his tenure on 1 June.

-

Jacqui Ferrier speaks with Insurance Insider in her first interview since taking the reins.

-

Chance Gilliland spent a decade at Chubb underwriting property binders.

-

Plus, the latest people moves and all the top news of the week.

-

What does it take to stay profitable as the insurance cycle shifts — and why is leadership diversity still lagging in the London market?

-

The new Lloyd’s chair has issued a commencement letter on his first day.

-

Lloyd’s chair Bruce Carnegie-Brown officially hands over to Charles Roxburgh today.

-

The underwriter is taking on a role with Cipriani and Werner.

-

Full Vanguard testing is expected to compete by the end of the year.

-

Co-founder and CUO Jacqui Ferrier has been appointed his successor.

-

As the next generation of Names comes to the fore, advisers urge simplification.

-

Managing director Nick Bacon will also exit this summer.

-

The underwriter is to run a new fine art and specie operation.

-

Fridays in the office will be the toughest nut to crack.

-

Why have reinsurance start-ups remained so rare in recent years, even as underwriting conditions have improved?

-

Delaney has spent the last 14 years at TMK.

-

Trevor Oates will be responsible for ceded reinsurance purchasing.

-

Plus, the latest people moves and all the top news of the week.

-

TMK is the largest insurer of aviation risks at Lloyd’s by gross written premium.

-

The carrier launched with the aim of writing $300mn of business this year.

-

Aegis 1225 jumped from fifth place last year to become the most profitable syndicate of the last decade.

-

ASR launched Syndicate 2454 at Lloyd’s last year.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

The ratings agency said underwriting-cycle management would be key going forward.

-

Modified freehold gives syndicates and investors clarity around exit plans.

-

Elizabeth Wooliston said the immediate concern would be managing ‘value at risk’.

-

Plus, the latest people moves and all the top news of the week.

-

Growth was driven by Lloyd’s Syndicate 1274 and Antares Re.

-

Lloyd’s has been likened to a “toothless tiger” in its crackdown efforts.

-

Ex-Hannover CEO Jean-Jacques Henchoz exited from the reinsurer at the end of March.

-

Recent transactions on the platform include cat bonds from Flood Re and Brit.

-

Plus, the latest people moves and all the top news of the week.

-

The first quartile contracted on the back of Beazley 2623’s GWP reduction.

-

Technological delays erode credibility, but the market remains strong.

-

Alexandra Cliff will take a base pay of £425,000 per annum, compared with Keese’s £550,000.

-

Last year, nearly two-thirds of Lloyd’s syndicates reported a deterioration in combined ratio.

-

The announcement comes after similar launches with Inigo and Atrium.

-

CEOs have been told to stand down resources as wider testing won’t start until October.

-

Insurer appetite for facilities is not just about top line, it is also a hedge against disruption.

-

GWP increased 24% year on year at the Asta-managed syndicate.

-

The combined ratio improved by 3.2 points, from 80.9% in 2023 to 77.7% in 2024.

-

In the first part of this series, we explore how smart-followers are mixing up their strategies.

-

The company booked profit for the year of £247mn, up 20% on the prior year.

-

The syndicate’s claims ratio worsened due to an “exceptionally active” hurricane season.

-

The syndicate expects £5.8mn-£8.6mn in California wildfire claims.

-

Reinsurance made up 12% of the syndicate’s 2024 GWP.

-

Cat losses from Helene, Milton and the Oklahoma tornadoes will fall within expectations.

-

The market took a higher share of hurricane losses and couldn’t cut its acquisition costs.

-

Standfirst: The syndicate reported a strong turnaround despite exposure to major claims.

-

Plus, the latest people moves and all the top news of the week.

-

The syndicate achieved a profit despite a “relatively heavy” catastrophe year.

-

Ki cut its top line by 8.7%, while Beazley’s smart-tracker expanded to $481mn.

-

Results were impacted by prior year reserving and an unwind of intragroup reinsurance recoveries.

-

Most of the market’s largest syndicates kept their CoRs below 90% as prices remained adequate.

-

The executive said the market would be updated on progress in late April.

-

MAP’s Christopher Smelt said impact on nationwide programmes will cause risk aversion.

-

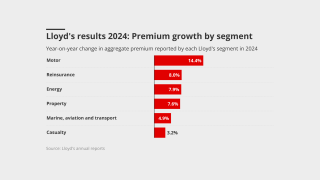

Reinsurance and property remained the primary drivers of premium growth.

-

The MGA’s GWP hit $4.6bn as the CEO labelled aviation all-risks rates “woefully inadequate”.

-

The Corporation’s CFO hailed profitable growth but warned syndicates to maintain discipline.

-

Syndicate 1984 is set to begin underwriting next month.

-

Stuart Cheers-Berry was delegated underwriting authority controller at PoloWorks.

-

The binder will provide capacity for international fac property, power and onshore energy.

-

The proportion of women in lead underwriting roles still trails other leadership positions.

-

Syndicate 1984 will be backed by Names under a modified freehold arrangement.

-

Plus, the latest people moves and all the top news of the week.

-

Lloyd’s hopes to protect healthy pricing, but focus is on broader structural market shifts.

-

The Corporation said pricing within aviation was “almost certainly inadequate”.

-

CUO Rachel Turk said some syndicates were showing a “mismatch” in ambition and strategy.

-

The syndicate reported an undiscounted net combined operating ratio of 77.9%.

-

The Corporation saw improvements across all three leadership levels.

-

Opportunities for insurance in transition-related activity “incredible”.

-

The market improved on attritional losses in 2024 – but slowing rate growth raises queries over top-line momentum.

-

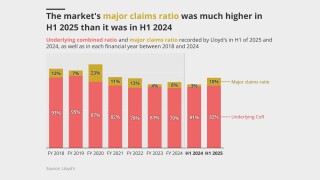

While market underwriting profit slipped 10%, the underlying combined ratio was under 80%.

-

-

Followers will automatically support primary or excess Inigo quotes.

-

The executive spent a brief period at Wakam in a capital and reinsurance role.

-

The executive said the firm had to focus time and investment on the most meaningful projects.

-

The transition will take place immediately, with Anthony Baldwin set to leave next month.

-

North America is likely to be the most financially impacted by the scenario, Lloyd’s said.

-

Ascot Underwriting CEO Ian Thompson, who took the helm last summer, discussed emerging headwinds.

-

The result is 1.1 points ahead of the midrange of a 6.4%-16.4% forecast.

-

Returns on capacity reduced, forecast at 4.4%-14.4%, have settled at 4.6%.

-

The insurer has participated on McGill and Price Forbes facilities, as well as Amwins.

-

Plus, the latest people moves and all the top news of the week.

-

The niche auto underwriting cell was the first to launch on the MGA platform.

-

Lloyd’s CEO pay is lowest compared to major LSE-traded specialty insurers by a considerable margin.

-

Montanaro will remain at Lloyd’s as an adviser until the end of May.

-

Lloyd’s entry is a modest start for the London heavyweight but could be the beginning of something bigger.

-

Hickman has previously held roles at RSA, LV and Axa.

-

Last year, Patrick Tiernan issued a warning to syndicates to properly manage their DA portfolios.