Reinsurance

-

China Taiping has been identified as the building owner’s insurer.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

The executive argued that injunctions following team lifts were “the industry standard”.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

Court documents provide a window into the ambitious plans.

-

Plus, the latest people moves and all the top news of the week.

-

The London-based MGA will begin underwriting its international book next month.

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

The peril has been historically difficult to model compared to others.

-

Habayeb will start next May following Kociancic's retirement.

-

After a challenging period, the industry is now earning above its cost of capital.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

The Australian insurer is a major cat cedant and had hoped to set up a reinsurance syndicate.

-

GC accused Willis, Lucy Clarke, Jim Summers and John Fletcher of unlawful recruitment.

-

-

Carriers posted weaker top-line results but delivered improved combined ratios.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

The French mutual is one of the first major 1.1 accounts to firm-order.

-

Existing facilities and carrier partners will be transferring from K2.

-

David Croom-Johnson will now focus exclusively on CEO duties.

-

The carrier’s overall P&C combined ratio improved by 1.4 points to 91.6%.

-

The reinsurer said discipline was now “equally important as price”.

-

The reinsurer is “well on track” to achieve $4.4bn in net income for the full year.

-

The executive said that outside of property cat, renewals will be “relatively stable”.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The Aspen exec highlighted the London market’s long-standing reputation for innovation.

-

This publication revealed Volante was in talks with legacy players last month.

-

Rohan Davies joined Markel International 17 years ago as an underwriter.

-

Patrick Tiernan was addressing 400+ delegates at the London Market Conference.

-

P&C GWP grew by 7.1% to EUR26.8bn over the period.

-

The (re)insurer has a higher-than-average Jamaican market share.

-

The group raised its full-year net income guidance to EUR2.6bn.

-

The charity said that improved ecosystems could help protect from disasters.

-

The ILS start-up was founded in January by Hanni Ali and Peter Dunlop.

-

On a net basis, premiums written were up 4.7% to $641.3mn.

-

The carrier’s top line grew to $1.4bn in the first half of 2025.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

-

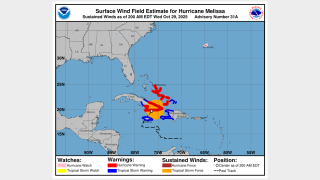

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

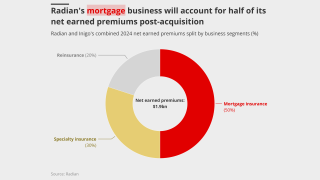

Cyber, mortgage and crop were identified as attractive growth areas.

-

The consortium will target excess layers, providing $250mn of capacity.

-

-

The carrier said nat-cat losses remained “well below” those of prior years.

-

The carrier’s retail division saw premiums increase by 7.3% to $2bn.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

The carrier anticipates a “favourable” retro renewal at 1.1.

-

The carrier said market dynamics remained robust, with overall pricing healthy.

-

The broker’s hiring to date has focused on the specialty segment.

-

YTD disclosed run-off deals total 26, with $1.36bn of gross liabilities transferred.

-

APAC now represents roughly 15% of all Lloyd’s premium.

-

Widespread underinsurance and low exposures will limit losses.

-

Citi and Berenberg believe the carrier is more resilient than in the past.

-

The deal confers a high multiple on Convex and gives AIG re/specialty exposure.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

CEO Greg Case said data centre demand could generate over $10bn in new premium volume in 2026.

-

The Spanish (re)insurer reported a group net profit of EUR829mn.

-

Prices were 37.4p per £1 of capacity, according to Argenta.

-

The broker grew earnings per share by 12.1% during the quarter.

-

The syndicate is expected to write ~$300mn of business in 2026.

-

Opportunities for profitable growth in cat will be hard to predict, the executive said.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

Everest’s AIG deal meaningfully cuts its primary exposure.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

The start-up has struggled to build scale since its 2024 launch and has cut back its 2026 stamp.

-

The upgrade reflects consistent outperformance of “higher-rated peers”, S&P said.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The buy-in can be seen as a “flip” bet on a rebound in appetite for carrier M&A.

-

This publication revealed the move earlier this year.

-

Willis Re kicked off its talent acquisition with mass hiring from Guy Carpenter over the summer.

-

The appointments are aimed at offering a clearer team structure.

-

Sources said he will join the reinsurance brokerage next year, after his garden leave expires.

-

Reinsurers are willing to concede on pricing, while cyber interest is on the rise.

-

The sidecar was launched today by the Bermudian reinsurer and investment firm Carlyle.

-

Sam Geddes will join Syndicate 1918 next year in an executive leadership role.

-

The capital will provide retro cover for life-focused reinsurer Fortitude Re.

-

Majority shareholder Fosun will continue to hold the remaining 86.7% of shares.

-

The hire follows the departure of David Martin to GIC Re Syndicate.

-

EMEA CEO Laurent Rousseau said reinsurance must retain its relevance to investors.

-

The two lines will add £11mn in planned premium.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

The CEO said that IGI’s action within its PI book showed it was ready to walk away from unprofitable business.

-

IGI’s premium income has almost doubled since it listed in 2020, but how can growth still be achieved in a soft market?

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

Rachel Webber was most recently head of non-marine at TransRe.

-

The carrier has been exploring launching into P&C organically or via acquisition.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Class actions and third-party litigation funding will drive up losses.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

Plus, the latest people moves and all the top news of the week.

-

The reinsurer plans to grow its US business at a higher rate than its non-US business.

-

Carriers are rethinking the traditional renewal-rights model.

-

Without flexible mechanisms the Corporation risks suppressing transactions.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

In July, he took the role on interim basis from Laure Forgeron.

-

The recruits will join from Nephila, Aon and Malaysian Re.

-

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

It comes as the MGA expects to write more than $1bn of premium in 2026.

-

The carrier will pay special dividends only in exceptional circumstances.

-

Joel Hodges will run the international business as managing director.

-

Volante launched Syndicate 1699 in 2021.

-

Improved performance and growing investment returns played a role in the upgrade.

-

Inigo CEO Richard Watson said the team is ready for its “second album”.

-

What’s driving the wave of shifting ownership structures in the Lloyd’s market?

-

The executive has worked at Aon for almost two decades.

-

The facility will initially focus on US, Bermudian and European business.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

The vehicle will now cover an E&S program jointly launched with Accredited.

-

Several airlines are understood to have come to market early.

-

Legacy reinsurance deals will be reviewed by the Legacy Review Panel.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

After losing in the High Court, insurers pin their hopes on the Court of Appeal.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The Corporation’s chair reiterated its aim to reduce the cost of doing business.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

Despite formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The change in reinsurance intermediary follows an RFP for the account.

-

The economic loss from the event was around EUR7.6bn.

-

The move comes as the broker rebuilds its Bermuda team.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

Plus, the latest people moves and all the top news of the week.

-

Louis Tucker helped establish Barbican Insurance, which was later sold to Arch in 2019.

-

How does Lloyd’s plan to secure its future as a leading global marketplace?

-

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

Inigo executives told Insurance Insider last year they were weighing up the casualty treaty market.

-

The deal marks the latest step in Catalina’s shift from P&C to life run-off.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The combined casualty treaty team has also made a number of hires.

-

The sidecar will support five programs providing specialty frequency coverages.

-

Reinsurer executives stressed that the industry worked hard on setting the right structure.

-

The business said it was experiencing strong momentum on the Island.

-

The practice group will enhance the company’s existing offerings in E&S.

-

Losses were primarily driven by personal property lines.

-

From aviation claims to retention challenges, underlying dynamics will take time to play out.

-

The new recruit will report to group CUO Ian Houston.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

The carrier’s US and Europe claims teams will report to Clayden.

-

A roundup of the breaking news, C-suite interviews and exclusive insights.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

Climate risk challenges conventional underwriting wisdom but also brings new opportunities.

-

Blackstone-style capital seeking to get closer to source is a net negative for reinsurers.

-

Cedants target methods of reducing pressure on earnings as reinsurers chase growth.

-

Bill Bouvier has spent more than three years at the legacy firm in this role.

-

The syndicate will be targeting approximately $50mn of GWP in its first year.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

Scale is increasingly becoming a differentiator for reinsurance carriers, the broker noted.

-

Geopolitical turbulence brings new challenges that primary specialty lines carriers urgently need to address.

-

Being conservative and stable is the name of the reinsurer’s game.

-

Apollo most recently received in-principle approval for Syndicate 1972.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

The broker’s joint venture with Bain Capital still lacks a CEO.

-

The private ILS segment took losses from LA wildfires and Mid-West severe convective storms in H1 2025.

-

The sector recorded total premiums written in London of £11.9bn in 2024

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

The insurer’s plans for the syndicate were revealed by this publication earlier this year.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

The company, however, sets a high bar on making a move.

-

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

-

The pair were offered contracts by Willis Re in July.

-

The former Hannover Re CEO said reinsurers must use alternative capital and tech.

-

Earnings covers do not need to equal aggregate reinsurance deals, the broker said.

-

The carrier M&A cycle has started and reinsurance is a segment where acquisitions work better.

-

Anticipation, motivation and inspiration are central to effective implementation.

-

Reinsurers are ready to draw a line under a worsening claim outlook across the casualty market.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

CEO Thierry Léger also stressed his intention to repair the carrier’s relations with Covea.

-

Stefan Golling also said Munich Re’s appetite for agg covers was unchanged.

-

The reinsurer is moving all its non-cat business to the new syndicate, leaving 1910 focussed on peak cat.

-

Swiss Re forecasts more risk transferring to reinsurance and retro markets in the future.

-

Rafael Diaz, Tiara Elward and Felipe Murcia will join BMS’s LatAm and Caribbean unit.

-

The post-disaster reinsurance start-up model is changing.

-

Excess capacity will sustain softer rates, as organic growth challenges lead to more M&A chatter.

-

Reinsurance CEO Wakefield said reinsurance structures may evolve for prolonged growth.

-

Agency reactions ranged from Fitch revising down its sector outlook to AM Best keeping a positive outlook.

-

Terms are expected to hold, underpinning the stronger recent performance of reinsurers.

-

The CEO said the AHJ acquisition brought a ‘step change’ to Miller’s reinsurance growth.

-

The reinsurer’s new CEO said he sees no need for a radical shift in strategy.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.