-

The broker is discussing the potential for "smart frequency solutions" with reinsurers.

-

As a result of mostly flooding, £495mn ($644mn) of losses occurred in the UK.

-

More public-private partnerships are needed to keep cat risk affordable.

-

In Partnership WithJens Melhorn, Head of Property Treaty for EMEA at Swiss Re discusses key reinsurance topics, including global conflicts, natural catastrophe trends, and the growing need for public-private partnerships to keep insurance affordable.

-

Areas with growing demand and complexity include natural catastrophe and cyber, it said.

-

A canvassing of the market showed some bifurcation on the necessity of a government backstop.

-

The carrier highlighted Italian and French hail events in recent years.

-

The Madrid branch will look to begin underwriting primary specialty insurance in 2025.

-

This will not impact Markel International, which will continue to operate out of the UK.

-

Nick Orton said the market is now pricing for non-peak perils, amid some surprise losses.

-

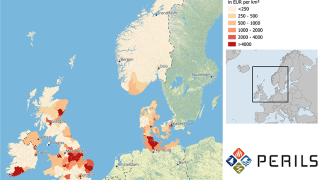

We may be in the midst of US hurricane season, but international catastrophe losses can emerge at any moment.

-

In its first six weeks, Taurus has brokered more than £100mn of UK real estate.