-

The move comes as Michael Creighton is made credit and political-risk director for Africa.

-

Private capital providers are being signed down as two strong years have piqued interest.

-

The London MGA is considering various options, including a minority investor.

-

The appointments are aimed at offering a clearer team structure.

-

The EUR100mn+ Ebitda firm is courting both PE and trade suitors.

-

The hire will lead the firm’s UK and Europe operations.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Reinsurers are willing to concede on pricing, while cyber interest is on the rise.

-

The financial services growth strategy could be “turbo-charged” by involving brokers, it said.

-

Part five in our series looks at how AI can empower brokers to add value as well as speed.

-

Majority shareholder Fosun will continue to hold the remaining 86.7% of shares.

-

The investor has made four new investments post-H1.

-

EMEA CEO Laurent Rousseau said reinsurance must retain its relevance to investors.

-

Munich Re is among the insurers with a stake in the German carrier.

-

-

The change forms part of a broader leadership reorganisation.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

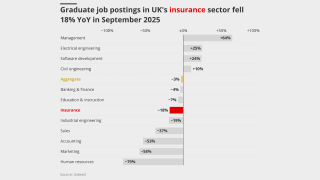

Insurance grad vacancies were down 18% year-on-year in the UK, ahead of a 3% nationwide drop.

-

Jamie Smith joined Arch in 2018, taking on the senior underwriter role in 2022.

-

Debbie Hobbs joined Miller in 2021 from EmergIn Risk.

-

Michael Shen will be succeeded by deputy Camilla Walker.

-

The reshuffle is likely laying the foundations for the eventual succession to CEO Mario Greco.

-

Class actions and third-party litigation funding will drive up losses.

-

The European broker said a London wholesaler is the ‘missing piece’ of its strategy.

-

Manuel Perez will continue in his ongoing role as head of cyber for LatAm.

-

Jennings will reunite with Cameron-Williams, who he worked with at BDO.

-

White will join from Allianz trade, and Summers from Talbot.

-

The reinsurer plans to grow its US business at a higher rate than its non-US business.

-

The carrier has hired José David Jiménez García as managing director for Germany.

-

Scott was most recently head of claims at MGA Geo Underwriting.

-

The Ryan Specialty renewables MGA launched an international arm last year.

-

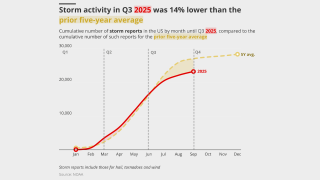

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

-

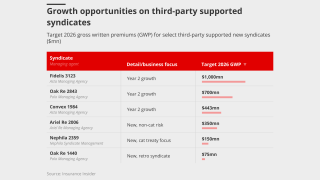

It comes as the MGA expects to write more than $1bn of premium in 2026.

-

The carrier will pay special dividends only in exceptional circumstances.

-

Samir Hemsi was CUO at Westfield Syndicate and sat on the firm’s board of directors.

-

Panellists at Insider Progress shared fixes for bias, confidence and culture.

-

The newly united company has set out ambitions to double in size by 2030.

-

Plus, the latest people moves and all the top news of the week.

-

Julia Graham played a key role in the UK's introduction of captive-friendly regulation.

-

What’s driving the wave of shifting ownership structures in the Lloyd’s market?

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

The protection gap must be closed before a public cyber reinsurance scheme is possible.

-

Other MGAs in the transactional-liability class are also expanding into the US.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

Kantara now holds a majority stake in the MGA, with the rest held by employees.

-

The upcoming Lloyd’s Lab cohort 16 will include a dedicated Irish theme.

-

Legacy reinsurance deals will be reviewed by the Legacy Review Panel.

-

Tom Potter was global casualty underwriting manager for UK & Lloyd’s at Axa XL.

-

The deal will be watched closely by Radian’s handful of similar peers.

-

Small modular reactors are increasingly viewed as a means of meeting surging energy demand.

-

Georges De Macedo will remain within the group as a board member.

-

Aon’s Enrico Vanin will lead the platform as CEO.

-

After losing in the High Court, insurers pin their hopes on the Court of Appeal.

-

The sponsorship deal comes ahead of the Winter Olympics and Paralympic Games next year.

-

The London broker has also recently hired Michael Lohan from Lockton.

-

Global pricing is now 22% below the mid-2022 peak.

-

MGA Amiga Specialty launched in May, with backing from investor BP Marsh.

-

The rating action follows the upgrade of Italy's sovereign rating earlier this month.

-

The broker’s headline Ebitda was $20mn, up from $5.6mn in 2023.

-

The executive met with UK colleagues to discuss plans for the US business.

-

The change in reinsurance intermediary follows an RFP for the account.

-

The economic loss from the event was around EUR7.6bn.

-

Part four looks at how the talent landscape will shift in response to AI introduction.

-

How does Lloyd’s plan to secure its future as a leading global marketplace?

-

Losing senior women creates a knock-on effect as juniors lose role models.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

The CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.

-

The deal marks the latest step in Catalina’s shift from P&C to life run-off.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The carrier plans to reduce 623’s stamp by around 10% next year.

-

The combined casualty treaty team has also made a number of hires.

-

Property remains the dominant line, accounting for nearly 30% of total London premiums.

-

Her predecessor will become head of US excess casualty and operations.

-

The MGA is backed by three Lloyd’s syndicates, offering capacity limits of up to $10mn.

-

Ex-Western Europe CRB head Alberto Gallego and colleagues left for a Marsh joint venture.

-

The deal represents a first entry into the US MGA market for the $1.1tn asset manager.

-

Plaintiffs allege that manufacturers and retailers have broken environmental laws.

-

Plus, the latest people moves and all the top news of the week.

-

Giles has spent more than five years at Themis Underwriting.

-

From aviation claims to retention challenges, underlying dynamics will take time to play out.

-

He was appointed CUO of casualty, Americas, in July last year.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

The Howden MGA established its marine presence in the Netherlands in 2023.

-

There are concerns that repeated delays could lead to market disengagement with the process.

-

The carrier’s US and Europe claims teams will report to Clayden.

-

The platform aims to “bend the loss curve”.

-

The relationship between growth and capital is “symbiotic”, the broker said.

-

A roundup of the breaking news, C-suite interviews and exclusive insights.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

Lenders include Morgan Stanley, Permira and Bridgepoint.

-

The carrier’s chief buyer urged a partnership approach from reinsurers.

-

Blackstone-style capital seeking to get closer to source is a net negative for reinsurers.

-

Cedants target methods of reducing pressure on earnings as reinsurers chase growth.

-

Lloyd’s has pursued a Big Game Hunting strategy to lure major insurers into the market.

-

New capacity continues to flow into the hull market, despite rating pressure.

-

An M&A senior analyst and M&A underwriter for emerging markets are also set to depart.

-

The syndicate will be targeting approximately $50mn of GWP in its first year.

-

Scale is increasingly becoming a differentiator for reinsurance carriers, the broker noted.

-

Geopolitical turbulence brings new challenges that primary specialty lines carriers urgently need to address.

-

Being conservative and stable is the name of the reinsurer’s game.

-

Apollo most recently received in-principle approval for Syndicate 1972.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

The private ILS segment took losses from LA wildfires and Mid-West severe convective storms in H1 2025.

-

The sector recorded total premiums written in London of £11.9bn in 2024

-

The insurer’s plans for the syndicate were revealed by this publication earlier this year.

-

The MGA has set a "new market benchmark" for non-US primary tax risk, it said.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

-

The former Hannover Re CEO said reinsurers must use alternative capital and tech.

-

Earnings covers do not need to equal aggregate reinsurance deals, the broker said.

-

Reinsurers are ready to draw a line under a worsening claim outlook across the casualty market.

-

The carrier M&A cycle has started and reinsurance is a segment where acquisitions work better.

-

Anticipation, motivation and inspiration are central to effective implementation.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

CEO Thierry Léger also stressed his intention to repair the carrier’s relations with Covea.

-

Stefan Golling also said Munich Re’s appetite for agg covers was unchanged.

-

Swiss Re forecasts more risk transferring to reinsurance and retro markets in the future.

-

Excess capacity will sustain softer rates, as organic growth challenges lead to more M&A chatter.

-

Reinsurance CEO Wakefield said reinsurance structures may evolve for prolonged growth.

-

Agency reactions ranged from Fitch revising down its sector outlook to AM Best keeping a positive outlook.

-

Terms are expected to hold, underpinning the stronger recent performance of reinsurers.

-

The reinsurer’s new CEO said he sees no need for a radical shift in strategy.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Mark ‘Ollie’ Hollingworth has held his current role at Atrium since 2017.

-

Tim Barber joins from QBE Re, where he was head of North America.

-

What’s next for the reinsurance market as Monte Carlo approaches?

-

Heyburn joins from Brit, where he was A&H class underwriter.

-

Rönesans covers lines including aviation, energy, engineering and liability.

-

Lloyd’s reported reinsurance GWP increased 10.6% to £13.2mn.

-

Gross written premium was up 6% year on year.

-

Signs of discipline indicate a “break” from past boom/bust market cycles.

-

Sébastien Bardy joins from Allianz to lead the firm’s financial scale-up.

-

The carrier is looking to take a lead position in energy-transition risks.

-

City firms have introduced perks of extending working from home periods and half days in summer.

-

Plus, the latest people moves and all the top news of the week.

-

Insight into the state of the insurance M&A market, powered by this publication's deal database.

-

The reinsurance veteran joined Aon nearly 20 years ago from Cooper Gay.

-

The executive will buy reinsurance for HDI and Talanx’s corporate unit.

-

Rates are bottoming out, but ample capacity is still preventing a hardening market.

-

The firm has also updated the loss-calculation engines of existing Jeannie tools.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

This publication first reported deal talks last week.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

Paul Jeroen van de Grampel drove Aon's M&A and litigation solutions proposition.

-

Submission volume is up 10%-20%, according to sources.

-

He succeeds Felix Cassau, who is joining Hannover Re.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

The division reported revenue up 13.3% at A$465.9mn.

-

Equidad earlier sold its soccer team to group of US investors that includes actor Ryan Reynolds.

-

Plus, the latest people moves and all the top news of the week.

-

Assurex’s global independent broker network pumps $4bn of premium into the London market.

-

What happens when a global broker network decides to fill a gap in the London market itself?

-

The broker said 2026 will bring a “cautious but deliberate” aviation reinsurance environment.

-

This publication revealed yesterday that Sompo is currently in negotiations with Aspen.

-

-

She was most recently claims manager at QBE France.

-

Bartlett is the latest in a series of talent moves in the construction market.

-

The deal comes amid heightened interest in German distribution assets.

-

The combined ratio worsened slightly by 0.5 points to 91.6%.

-

The mid-year renewals point to mounting pressure on reinsurance pricing.

-

The deal was announced last month.

-

The update will enable structured data capture early in the placing process.

-

Placement head Delchar said Gemini will be available across its global book of in-scope risks.

-

The carbon-credit insurer has appointed James Morrell head of credit underwriting.

-

Part III of our series looks at where AI is being integrated into underwriting departments.

-

Signature of the exit plan is needed for cutover in 2026.

-

Top line grew across all carriers even as pre-tax profits dipped.

-

The move is a retaliation to Howden’s US retail launch.

-

The broker has been on an aggressive hiring spree overseen by Lucy Clarke.

-

Matthew Budd has over 30 years’ claims experience and previously worked for Talbot and XL.

-

The CEO said the carrier will prioritise margin over top-line growth.

-

Covea had requested a stay in the proceedings.

-

The P&C division booked a combined ratio of 81.1% for the first half of 2025.

-

The carrier also reported a slightly improved combined ratio of 94.6%.

-

The insurer has substantially expanded its marine team in recent years.

-

Layla O’Reilly and Mark Edwards are among the brokers leaving the firm.

-

The Hannover Re CEO said rate adequacy remains “attractive” overall.

-

Steven Crabb will become deputy chairman on the insurance solutions division.

-

The company has recently made several senior changes to its UK and Lloyd’s leadership.

-

The carrier is the first Fortune 500 company to take a stake in a League Two club.

-

In trying to solve multiple needs, specialty reinsurance opens up complexities.

-

California wildfires were the reinsurer’s largest H1 loss, at EUR615.1mn.

-

This publication revealed two years ago that EQT could lodge a $1bn claim.

-

Rachel Sabbarton has been promoted to CEO at Lancashire Syndicates.

-

Tom Hester joined the broker in 2018 as SVP.

-

Philip Dalton succeeds partner Colin Hasler, who has retired after a 42-year career.

-

The reinsurer chair said the frequency of losses today “will prevent prices from slipping too much.

-

Plus, the latest people moves and all the top news of the week.

-

The P&C re segment’s combined ratio improved by 12.7 points to 61.0%.

-

What does it take to turn a family-run insurance group into a global powerhouse?

-

The transaction is expected to close later this year.

-

The carrier’s overall P&C combined ratio improved 1.8 points to 91.2%.

-

The Swiss carrier improved its P&C combined ratio by 1.2 points to 92.4%.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

This publication reported yesterday that Talanx was closing in on the sale.

-

Natural catastrophe claims remained consistent compared with the prior year.

-

With roughly 200 employees, the South American operations generated over EUR130mn in 2024 GWP.

-

A limited number of broking staff are also leaving the business, including downstream head Dan Nicholls.

-

Stephane Flaquet replaces George Marcotte, who has been interim COO since September 2024.

-

The new team will be headed by Brown & Brown’s Ed Byrns.