Operations/tech

-

PE, more alignment and tech are uncoupling MGAs from traditional market swings.

-

The Lloyd’s Market Association (LMA), setting out its “core asks” for 2026, has said it is expecting the market to achieve multiple peer-to-peer technology adoptions next year.

-

McGill’s Underscore platform will identify eligible risks for Aegis to follow.

-

Plus, the latest people moves and all the top news of the week.

-

Better data validation and stronger claims controls are also key for MGAs.

-

The syndicate was launched at Lloyd’s last year.

-

In this final instalment, we argue that investing in personnel is as critical to success as the tech itself.

-

The payment will cover what the filing called “foregone incentives at his former employer”.

-

Panellists said the sector must communicate its value in language tailored to each client.

-

Panellists agreed a soft market should not dampen product development.

-

Innovation emerged as the critical target for attracting new business to London.

-

Panellists said the industry must be deliberate in setting a strategy for the right outcomes.

-

The executive said the market will be revolutionised by digital technology.

-

Carriers must position themselves as underwriting bifurcates.

-

Liès called for the industry to have a louder voice to promote greater insurance literacy across sectors.

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

An insurability crisis could pose systemic risks that undermine the foundations of finance.

-

Industry-wide initiatives continue to target expanded youth access to the sector.

-

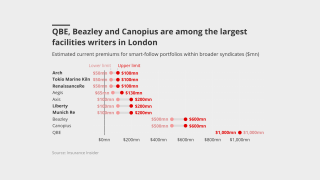

The CEO said smart-follow is a structural evolution of the specialty market.

-

Prices were 37.4p per £1 of capacity, according to Argenta.

-

Plus, the latest people moves and all the top news of the week.

-

Part five in our series looks at how AI can empower brokers to add value as well as speed.

-

Majority shareholder Fosun will continue to hold the remaining 86.7% of shares.

-

The investor has made four new investments post-H1.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The syndicate says it will not set any top-line targets on digital follow strategies.

-

Differentiating Lloyd’s claims performance could help drive business to the market.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Jennings will reunite with Cameron-Williams, who he worked with at BDO.

-

Carriers are rethinking the traditional renewal-rights model.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

Panellists at Insider Progress shared fixes for bias, confidence and culture.

-

The newly united company has set out ambitions to double in size by 2030.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

Susan Langley will look to strengthen global business ties and promote UK growth.

-

The executive has been with ASG since it was formed in 2016.

-

Aon’s Enrico Vanin will lead the platform as CEO.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The market turn may give some staff pause for thought, but reward remains high.

-

Part four looks at how the talent landscape will shift in response to AI introduction.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.

-

This will be the 15th cohort of companies to go through the Lloyd’s Lab.

-

There are concerns that repeated delays could lead to market disengagement with the process.

-

The syndicate will be targeting approximately $50mn of GWP in its first year.

-

Being conservative and stable is the name of the reinsurer’s game.

-

The insurer’s plans for the syndicate were revealed by this publication earlier this year.

-

The former Hannover Re CEO said reinsurers must use alternative capital and tech.

-

Anticipation, motivation and inspiration are central to effective implementation.