Operations/tech

-

The insurer plans to automate around 85% of key functions surrounding underwriting and claims processes.

-

PE, more alignment and tech are uncoupling MGAs from traditional market swings.

-

The Lloyd’s Market Association (LMA), setting out its “core asks” for 2026, has said it is expecting the market to achieve multiple peer-to-peer technology adoptions next year.

-

McGill’s Underscore platform will identify eligible risks for Aegis to follow.

-

Plus, the latest people moves and all the top news of the week.

-

Better data validation and stronger claims controls are also key for MGAs.

-

The syndicate was launched at Lloyd’s last year.

-

In this final instalment, we argue that investing in personnel is as critical to success as the tech itself.

-

The payment will cover what the filing called “foregone incentives at his former employer”.

-

Panellists said the sector must communicate its value in language tailored to each client.

-

Panellists agreed a soft market should not dampen product development.

-

Innovation emerged as the critical target for attracting new business to London.

-

Panellists said the industry must be deliberate in setting a strategy for the right outcomes.

-

The executive said the market will be revolutionised by digital technology.

-

Carriers must position themselves as underwriting bifurcates.

-

Liès called for the industry to have a louder voice to promote greater insurance literacy across sectors.

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

An insurability crisis could pose systemic risks that undermine the foundations of finance.

-

Industry-wide initiatives continue to target expanded youth access to the sector.

-

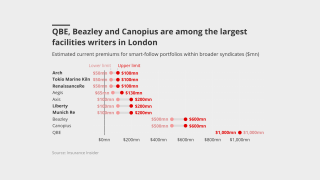

The CEO said smart-follow is a structural evolution of the specialty market.

-

Prices were 37.4p per £1 of capacity, according to Argenta.

-

Plus, the latest people moves and all the top news of the week.

-

Part five in our series looks at how AI can empower brokers to add value as well as speed.

-

Majority shareholder Fosun will continue to hold the remaining 86.7% of shares.

-

The investor has made four new investments post-H1.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The syndicate says it will not set any top-line targets on digital follow strategies.

-

Differentiating Lloyd’s claims performance could help drive business to the market.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Jennings will reunite with Cameron-Williams, who he worked with at BDO.

-

Carriers are rethinking the traditional renewal-rights model.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

Panellists at Insider Progress shared fixes for bias, confidence and culture.

-

The newly united company has set out ambitions to double in size by 2030.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

Susan Langley will look to strengthen global business ties and promote UK growth.

-

The executive has been with ASG since it was formed in 2016.

-

Aon’s Enrico Vanin will lead the platform as CEO.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The market turn may give some staff pause for thought, but reward remains high.

-

Part four looks at how the talent landscape will shift in response to AI introduction.

-

Organisations were challenged to address systemic DEI failure rather than play “word salad” with labels.

-

This will be the 15th cohort of companies to go through the Lloyd’s Lab.

-

There are concerns that repeated delays could lead to market disengagement with the process.

-

The syndicate will be targeting approximately $50mn of GWP in its first year.

-

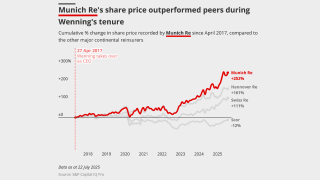

Being conservative and stable is the name of the reinsurer’s game.

-

The insurer’s plans for the syndicate were revealed by this publication earlier this year.

-

The former Hannover Re CEO said reinsurers must use alternative capital and tech.

-

Anticipation, motivation and inspiration are central to effective implementation.

-

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

-

It is understood that CyberCube has been considering a sale of the business.

-

Lloyd’s will keep heritage systems operationally resilient until at least 2030.

-

The LPPC will offer limits of $127.5mn EAR and DSU coverage in the US and Canada.

-

Plus, the latest people moves and all the top news of the week.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

Plus, the latest people moves and all the top news of the week.

-

The update will enable structured data capture early in the placing process.

-

Claude Wade is to step down from his role to address ongoing health issues.

-

Part III of our series looks at where AI is being integrated into underwriting departments.

-

Signature of the exit plan is needed for cutover in 2026.

-

Plus, the latest people moves and all the top news of the week.

-

Stephane Flaquet replaces George Marcotte, who has been interim COO since September 2024.

-

The LMA head also praised Velonetic for transparency on Blueprint 2.

-

CEO David Howden accused rivals of “restricting choice for their own clients”.

-

Plus, the latest people moves and all the top news of the week.

-

A majority of staff not offered jobs at Ryan Re will remain at Markel to manage the run-off.

-

In part II of our series, we look at where AI is being integrated into claims departments.

-

The UK carrier will write business that falls in the scope of the FSCS.

-

Surveys show diversity and inclusivity foster a sense of belonging and increase productivity.

-

Plus, the latest people moves and all the top news of the week.

-

Improved book value, a healthy CoR and disciplined underwriting mark the CEO’s time at the helm.

-

Lloyd’s has confirmed the departure of two senior leaders.

-

A look into how the insurance industry is using AI and where practical gains are arising.

-

Plus, the latest people moves and all the top news of the week.

-

The technology will help analyse growing and emerging risks, especially climate change.

-

Claims chiefs are caught between technological advancement and waiting for phase two

-

A representative from the carrier said Nexus is responding “with urgency”.

-

The MGA is expected to launch a product-recall portfolio in September.

-

Claire Janaway is leaving the carrier after 19 years.

-

The insurer has hired Coface’s Hélène Martin to support its expansion.

-

Volante joins capacity providers Allianz and Tokio Marine Kiln.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

Gallagher, Marsh and Aon also faced sizeable outstanding premium payments as at Q4 2024.

-

The new chair said the market must adapt for 2030 and beyond.

-

Lloyd’s executives have suggested ceded reinsurance syndicates could help London compete in treaty.

-

The business currently works with Hamilton Managing Agency.

-

Green hushing is on the rise as Trump rows back on climate initiatives.

-

The awards will be held on 3 September at The Brewery in London.

-

MillerBoost is the latest broker facility to launch in London.

-

The platform will capture and standardise data from all submissions, the broker said.

-

The carrier’s president Andrew McMellin is aiming to double London market share in the next five years.

-

The carrier said the cuts will help it to become a “simpler, digital-led business”.

-

The protection gap is calling into question the relevance of the insurance industry.

-

The deal marks SFMI’s third investment in the group since 2019.

-

Case added that recently acquired broker NFP has “exceeded” expectations.

-

Future claims handlers could be "bionic adjusters” empowered by technology.

-

Ed Short was previously VP, digital partners, at Arch.

-

Corporates buying Lloyd’s syndicates face the culture/integration trade-off.

-

The campaign will run throughout June.

-

Analysts were interested in the potential for fee income from the retail division.

-

The executive set out his vision for the Corporation after assuming leadership.

-

The outgoing CEO said the market had been restored as a leader during his tenure.

-

Frustration is growing around a promised independent operating model and staff reward.

-

Eckert said the reinsurance market is still at historically well priced levels.

-

The Corporation is poised to accelerate its investments in start-ups.

-

The Lord Mayor told the CRO Summit to stop treating risk as a dirty word.

-

The programme will succeed the previous buyback launched in 2023.

-

The platform could help reduce claims-cash holding times by 10 weeks.

-

The exec said if he were a carrier CEO, now is the time he would start looking for deals.

-

The executive said secular heightened risk trends would fuel the carrier’s primary expansion.

-

The group said corporations face geopolitical and climate risk.

-

The executive previously worked at Hiscox and Aviva.

-

Pushing through technological change and maintaining underwriting results are top of agenda.

-

The executive was head of fine art and specie at Miller until February 2025.

-

At his last annual meeting as CEO, Buffett highlighted the importance of Berkshire’s insurance operations.

-

The Nordic operations have capacity provided by Allianz Commercial.

-

Lloyd’s chair Bruce Carnegie-Brown officially hands over to Charles Roxburgh today.

-

Christian Kitchen had been at Travelers since October 2022.

-

Full Vanguard testing is expected to compete by the end of the year.

-

The executive joins from the London Stock Exchange.