-

According to the Civil Unrest Index, protest activity has soared over the past two years.

-

The reinsurer is offering pricing incentives to members to reintegrate cover.

-

IGI’s premium income has almost doubled since it listed in 2020, but how can growth still be achieved in a soft market?

-

Plus, the latest people moves and all the top news of the week.

-

The class offers affirmative coverage for gaps in traditional insurance policies.

-

West Hill Capital is the main investor in the capital raise.

-

Continental composite carriers aim to smooth volatility with new initiatives.

-

Plus, the latest people moves and all the top news of the week.

-

The toll of risk losses sustained by the PVT market this year is mounting.

-

Bazan Group’s refinery near Haifa was badly damaged by Iranian bombardment in June.

-

The start-up aims to bind its first risk in Q4 2025.

-

Plus, the latest people moves and all the top news of the week.

-

The underwriter has worked for RiverStone, Advent, Lloyd’s and AIG.

-

SRCC exposures are being studied more closely but fixing aggregation issues is a challenge.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier’s president Andrew McMellin is aiming to double London market share in the next five years.

-

Western insurers do not insure Iranian risks, with the country subject to sanctions.

-

The new Lloyd’s chief of market performance also outlined target growth areas.

-

The modeller said the insurance market could be exposed to unexpected aggregations.

-

The product protects insureds outside of warzones from conflict-related cyberattacks.

-

A survey from the carrier looked at the political risk and violence concerns of companies.

-

Several insurers and MGAs have launched into the class of business over the past year.

-

Personnel movement has been high in the PVT class as new capacity enters the market.

-

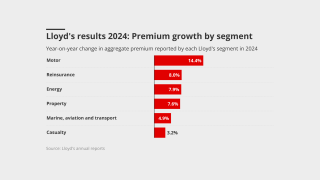

Reinsurance and property remained the primary drivers of premium growth.

-

The terrorism pool has shifted its programme from facultative to an XoL arrangement.

-

Probitas is set to grow by around 40% this year.

-

The political violence market is in a competitive stage thanks to an influx of capacity.

-

It is understood that supporters include Munich Re and Brit.

-

As 2024 draws to a close, we reflect on the events of the year for the London market.

-

Swiss Re has retreated from its “escalation clause” for the Middle East.

-

Jelle Ouwehand joined Arch from Marsh, where he was a senior terrorism, PV and war broker.

-

A significant amount of new capacity has flowed into the political violence and terror market in recent months.

-

Chris Cane and Jaime Hunwicks join from Talbot, Jonathan Bint from Chaucer and Molly Ashcroft from Axis.

-

The political violence market has seen a flurry of new entrants in recent months.

-

Contrary to expectations that US casualty would dominate the conversations, Milton took the spotlight.

-

Geopolitical conflict could expose the global economy to $14.5tn in losses.

-

Many insurers have cut back lines in Lebanon, although larger insured sums are at stake in Israel.

-

The business recently hired former Occam PVT underwriter Nicholas Stevens.

-

The underwriter has spent a decade at Chaucer.

-

PVT business has been attracting new capacity after recent rate increases.

-

Plus the latest people moves and all the top news of the week.

-

The PVT market has seen a recent spike in staff movements, as new capacity enters the space.

-

The peril is posing an increased risk of loss for the sector.

-

The carrier launched into the political violence market at the beginning of the year.

-

The short-tail buildout will feature lines including political violence and marine.

-

QBE has “effectively stopped writing new business” in response to its New Caledonia loss.

-

Police and civil authorities will likely pick up most costs.

-

New capacity and increased competition is bringing rating levels under pressure.

-

Riots erupted in the Pacific Island territory last month over electoral reforms.

-

Dominic Kirby’s departure follows that of PV head Henry Gillingham and casualty treaty head Stuart Dale.

-

The flurry of London market PVT hiring continues.

-

The PVT team will be part of a new crisis management unit under Luke Powis.

-

The underwriter has been with Westfield since November 2020.

-

The underwriting head has worked in the London market for 25 years.

-

The broker has also placed a new cyber facility.

-

Israel exposure has thrown inwards-outwards PV coverage mismatches to the fore again.

-

Both Schlesinger and Sandford will report to Matt Humphries, head of crisis management.

-

She joined the carrier as an underwriting assistant over 11 years ago.

-

Swiss Re is among reinsurers to have the right to limit coverage if conflict widened.

-

The broker said there was a ‘disparity’ in market response to war in the Middle East.

-

Environmental activism and terrorist activity are also set to rise.

-

Insured losses from civil unrest have risen over the last decade to total $7bn in 2020-23.

-

Competition among insurers is rising as new carriers enter the market.

-

Providing coverage will remain “very tricky” in the near term.

-

Talbot has lost a trio of PV underwriters to Ark in recent months.

-

Alexander Baker was a senior PV, war and terrorism underwriter at Axa XL.

-

Talbot is rebuilding its PV team after a December Ark and Chaucer raid.

-

Mosaic has also added CNA Hardy’s Emily Humphreys to its PV team as part of the deal.

-

Clayton will join the carrier’s global credit and political risks team, reporting to James Wilson, head of credit and political risks.

-

Key market participants hailed the narrowing of the gap between PV insurance and reinsurance, however said that more still needs to be done to fix the market.

-

Insurance competition remains vibrant in some of the segments that remain most exposed to persistent risks highlighted by the flagship World Economic Forum report.

-

The PV market is facing yet another battle with reinsurers as they continue to restrict coverage, tighten definitions and exclude geographies.