-

Sources said hundreds of Brown & Brown staff across various offices have left to join Howden US.

-

The US insurer squeezed its retention in a renewal where cat treaty retentions are widely holding steady.

-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

The company named two execs to head global wholesale and commercial.

-

Market sources have also raised the prospect of moving the market beyond bureau reliance.

-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

The Carlyle and Hellman & Friedman vehicle will sell for 1.5x book value.

-

The parties now have 60 days to file a stipulation to dismiss the action.

-

Nearly one-third of 2025’s talent movement was recorded in Q3.

-

-

Pricing in the D&O market is starting to flatten after several years of steep decreases.

-

Clifford’s appointment follows Everest’s $2bn renewal rights sale to AIG.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

As demand rises across the digital asset space for multiple forms of crypto-related insurance, competition is building.

-

The packages contained client lists and records saved as “TOP SECRET” on a former employee’s computer.

-

The insurer plans to automate around 85% of key functions surrounding underwriting and claims processes.

-

London-based Tristram Prior will transfer to Bermuda to lead the line of business.

-

The London carrier has explored how businesses are navigating an era of accelerating risk.

-

Approached for comment, Chubb denies that it submitted “an offer” for AIG.

-

Colette Buckley joins Steven Ridgers, who became Axis head of erection all risks in October.

-

The LMA, FCA and Liiba welcomed the direction of travel but said progress is slow.

-

The executive co-led the US financial institutions business at BHSI.

-

BNP Paribas will take a EUR1.11bn stake in Ageas.

-

The mechanism would work similarly to Flood Re.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

Baldwin said the $1bn merger with CAC accelerates the firm's specialization plans by at least five years.

-

Fears relating to an economic downturn continue to dominate concerns.

-

Next year will mark five consecutive years of insolvency increases.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

Data points to growth in surrogacy and IVF support across the industry.

-

The chief of market performance urged underwriters not to follow the herd.

-

The broker said the A$45-per-share price discussed valued the firm appropriately.

-

The underwriter worked for Nexus for over four years.

-

Jaymin Patel joined Berkley Specialty London in 2021 as senior engineering underwriter.

-

The carrier booked GWP growth of 6% for the first nine months of 2025.

-

Marsh is also seeking expedited discovery in a related talent poaching case.

-

The underwriter will fill a newly created role at AIG.

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

Join senior market leaders for a forward-looking discussion on performance trends, pricing dynamics, M&A signals and risk appetite across both admitted and E&S segments.

-

The payment will cover what the filing called “foregone incentives at his former employer”.

-

The industry veteran retired from AIG at the end of last year.

-

The peril has been historically difficult to model compared to others.

-

Habayeb will start next May following Kociancic's retirement.

-

Parties will now brief on a request for a preliminary injunction on an expedited timeline.

-

Chris Lay will retire from the business in Q1 2026.

-

The improved combined ratio was driven by lower losses and expenses.

-

The international segment’s net written premium contracted 5%.

-

Carriers posted weaker top-line results but delivered improved combined ratios.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

The agency cited moderating premium growth and selective underwriting capacity as factors behind the downgrade.

-

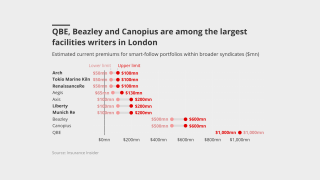

The facility is led by Beazley’s Smart Tracker.

-

Executives also agreed that facilitisation is a structural market change.

-

-

The syndicate aims to write £80mn of programme business in 2026.

-

A motion by defendants to dismiss the case was also denied.

-

The ex-Lloyd’s CEO was due to join AIG as president but will not take up the role due to personal circumstances.

-

Panellists agreed a soft market should not dampen product development.

-

The carrier’s overall P&C combined ratio improved by 1.4 points to 91.6%.

-

Aspen's GWP increased 0.9% to $1.13bn, as it focuses on “robust cycle management”.

-

The BP Marsh-backed MGA launched earlier this year, led by Adam Kembrooke.

-

The MGA began offering US commercial E&S property products in December.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The Aspen exec highlighted the London market’s long-standing reputation for innovation.

-

The executive said the market will be revolutionised by digital technology.

-

Patrick Tiernan was addressing 400+ delegates at the London Market Conference.

-

The carrier now expects to deliver full-year operating profit of ~£2.2bn.

-

The newly established wholesaler is building out its staff base.

-

The move comes after the withdrawal of a complaint in the Delaware court.

-

The underwriter departed Allianz earlier this year.

-

The broker has started hiring in London, taking Tysers D&O specialist Dan Lovett.

-

James Kelly joins from Besso, having held senior positions at JLT, Lockton and Gallagher.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

A New Jersey judge also refused to grant WTW’s request for a restraining order.

-

-

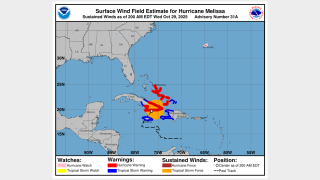

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

The consortium will target excess layers, providing $250mn of capacity.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

Zaffino said AIG will continue to assess strategic opportunities after the Convex, Onex and Everest deals.

-

The CEO said smart-follow is a structural evolution of the specialty market.

-

The carrier said market dynamics remained robust, with overall pricing healthy.

-

Marsh is also suing a second tier of former Florida leaders.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

APAC now represents roughly 15% of all Lloyd’s premium.

-

Widespread underinsurance and low exposures will limit losses.

-

The deal confers a high multiple on Convex and gives AIG re/specialty exposure.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The business has not initiated a sale process, with the wheels not yet actively turning on an exit for Apiary.

-

The company reported no cat losses but saw a jump in attritional losses.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

CEO Brand said he expected to deliver double-digit growth, if “marginally” lower in 2026.

-

The broker will join Ron Borys’ financial lines team.

-

Everest’s AIG deal meaningfully cuts its primary exposure.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

In insurance, premium growth came from all lines of business except cyber.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The MGU’s second syndicate launch was delayed from January 2025.

-

Jason Keen joined Everest in 2022 as head of international.

-

Consolidated NWP reduction was driven by the reinsurance segment, partly attributable to two transactions in Q3 2024.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The Australian broker, which owns Tysers, announced a trading pause.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

APIP is one of the world’s largest property programs.

-

The range allows “for information that could emerge beyond what is known today”.

-

The appointments are aimed at offering a clearer team structure.

-

The EUR100mn+ Ebitda firm is courting both PE and trade suitors.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Total pre-tax favorable prior period development in the quarter was $361mn, up nearly 48% YoY.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Howden is facing fallout from its push into the US retail market via mass hires.

-

The London-based executive will relocate to Daytona Beach, Florida.

-

The syndicate says it will not set any top-line targets on digital follow strategies.

-

Munich Re is among the insurers with a stake in the German carrier.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

The broker will report to Howden US CEO Mike Parrish.

-

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The facility provides coverage for property, terrorism, energy, construction and utilities risks.

-

The report seeks to arm parliamentarians and policymakers with “practical tools”.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

Brian Church has spent 20 years at Chubb.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

The group will join forces with SRG subsidiary Miles Smith.

-

The European broker said a London wholesaler is the ‘missing piece’ of its strategy.

-

Mike Mulray joins from Everest, where he was EVP president of North America insurance.

-

The international division is seeking a new London market manager.

-

The London-based pair will report to commercial risk UK CEO Rob Kemp.

-

Carriers are rethinking the traditional renewal-rights model.