Fidelis Insurance Group

-

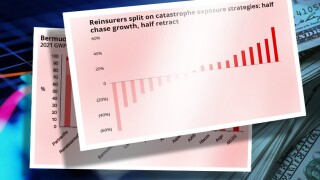

How much capacity is available to meet rising cat reinsurance demands was a key theme throughout this year’s Rendez-Vous.

-

Ratings agencies suggest that carriers must do better on controlling volatility – but diverging risk appetites give the lie to the idea that the industry is walking away from risk.

-

George Green has been a war and terrorism underwriter at Fidelis since March 2021.

-

The decision is in line with the responses from AM Best and Moody’s over the company’s reorganisation plan announced July.

-

The ratings agency said the proposed restructure posed execution risk, but regulatory approval would alleviate short-term uncertainty.

-

Class underwriter for marine hull and war at Talbot AIG, Hugo Lewis, has resigned to take up a position in the marine team at Fidelis, Insurance Insider can reveal.

-

The move follows plans for a restructure of the carrier into a separate MGU and balance sheet.

-

The reorganisation has cleared the first hurdle where many expected it to fall, but the balance sheet IPO was always going to be the harder exercise.

-

The separation into an MGU and balance sheet has released far more value to investors than any other exit could have done.

-

This publication broke the news in March that the Richard Brindle-led underwriting business was working on the radical company separation.

-

The loss comes as rate rises decelerate in the class after several years of compound rate rises.

-

Axa chairs the alliance, while Allianz, Aviva, Generali, Munich Re, Scor, Swiss Re and Zurich are all founding members.

Most Recent

-

Daily Digest: Top news from 18 July

18 July 2025 -

Coverys confirms MGA AEC’s sale to Edge

18 July 2025