Enstar

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

Luke Tanzer is set to retire after 16 years at the helm of the run-off carrier.

-

The take-private deal was announced in July 2024.

-

Renewable retrospective solutions were a key point during the discussion.

-

The reduction was due to impacts from investments and less favourable PYD.

-

The business, which has ~EUR300mn of book value, is expected to launch a process.

-

Syndicate 609 will cede net loss reserves of approximately $196mn.

-

The transaction mostly covers casualty portfolios of 2021 and prior underwriting years.

-

The carrier’s shares declined over 17% this morning following Q3 earnings and strategic actions.

-

The firm announced Q3 results alongside strategic actions that included an ADC deal with Enstar.

-

James River also amended the convertible preferred equity held by Gallatin Point and closed its strategic review.

-

The take-private is expected to close by mid-2025.

-

The transactions will de-risk all North America middle-market reserves up to 30 June 2024.

-

Plus the latest people moves and all the top news of the week.

-

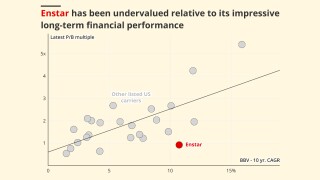

The firm escapes public market distractions and long-term undervaluation, but the low mark will hurt peer companies.

-

The ratings agency said Sixth Street provides flexibility through long-dated capital.

-

The company also announced a $5.1bn take private deal with Sixth Street.

-

She will work on preparations for the take-private deal with Sixth Street before departing.

-

The deal values the business just under its closing price on Friday, at 0.97x book value.

-

The executive replaces interim CEO Paul Brockman, who remains group COO.

-

A roundup of all the news you need today, including Enstar EU’s new CEO.

-

The transaction with Enstar covers $234mn of net Accredited reserves.

-

Berkshire Hathaway and Canada Life Re will provide as much as A$680mn of protection annually.

-

Enstar will provide $430mn of excess cover over ~$1.7bn of underlying reserves.

-

Some 39% of respondents expect deal volumes to increase in the next 12 months.

-

Enstar recorded $280mn of other income in Q1 2023 related to Enhanzed Re.

-

The stable outlook on Cavello Bay mirrors S&P’s view of its parent.

-

The legacy carrier cited the impact of its investment portfolio.

-

Enstar acquired 637,640 shares of James River in Q4 last year valued at nearly $6mn.

-

Insider Brockman will pick up the EU role on an interim basis.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

The San Francisco-headquartered alternative asset manager has invested $183mn in the run-off firm.

-

The legacy giant also disclosed a smaller buyback from Stone Point, with CEO Dominic Silvester also investing an additional $10mn.