Enstar

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

Luke Tanzer is set to retire after 16 years at the helm of the run-off carrier.

-

The take-private deal was announced in July 2024.

-

Renewable retrospective solutions were a key point during the discussion.

-

The reduction was due to impacts from investments and less favourable PYD.

-

The business, which has ~EUR300mn of book value, is expected to launch a process.

-

Syndicate 609 will cede net loss reserves of approximately $196mn.

-

The transaction mostly covers casualty portfolios of 2021 and prior underwriting years.

-

The carrier’s shares declined over 17% this morning following Q3 earnings and strategic actions.

-

The firm announced Q3 results alongside strategic actions that included an ADC deal with Enstar.

-

James River also amended the convertible preferred equity held by Gallatin Point and closed its strategic review.

-

The take-private is expected to close by mid-2025.

-

The transactions will de-risk all North America middle-market reserves up to 30 June 2024.

-

Plus the latest people moves and all the top news of the week.

-

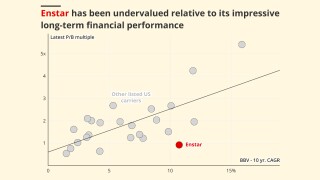

The firm escapes public market distractions and long-term undervaluation, but the low mark will hurt peer companies.

-

The ratings agency said Sixth Street provides flexibility through long-dated capital.

-

The company also announced a $5.1bn take private deal with Sixth Street.

-

She will work on preparations for the take-private deal with Sixth Street before departing.

-

The deal values the business just under its closing price on Friday, at 0.97x book value.

-

The executive replaces interim CEO Paul Brockman, who remains group COO.

-

A roundup of all the news you need today, including Enstar EU’s new CEO.

-

The transaction with Enstar covers $234mn of net Accredited reserves.

-

Berkshire Hathaway and Canada Life Re will provide as much as A$680mn of protection annually.

-

Enstar will provide $430mn of excess cover over ~$1.7bn of underlying reserves.

-

Some 39% of respondents expect deal volumes to increase in the next 12 months.

-

Enstar recorded $280mn of other income in Q1 2023 related to Enhanzed Re.

-

The stable outlook on Cavello Bay mirrors S&P’s view of its parent.

-

The legacy carrier cited the impact of its investment portfolio.

-

Enstar acquired 637,640 shares of James River in Q4 last year valued at nearly $6mn.

-

Insider Brockman will pick up the EU role on an interim basis.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

The San Francisco-headquartered alternative asset manager has invested $183mn in the run-off firm.

-

The legacy giant also disclosed a smaller buyback from Stone Point, with CEO Dominic Silvester also investing an additional $10mn.

-

The seller is facing an uphill struggle convincing its legacy rivals that there is strategic value in the merger deal.

-

The insurer has been working to build a reputation for favorable reserve development after past sins.

-

During the period, the legacy business completed a $1.9bn LPT with QBE and a $245mn LPT with RACQ Insurance.

-

In the wake of Enstar's $5.1bn go-private deal, here's our prior deep dive on the firm.

-

The carrier attributed its results to strong investment returns.

-

The deal includes a diversified book of international and NA financial lines, European and NA reinsurance portfolios, and several US discontinued programs.

-

The Canadian pension fund will retain 9.4% of the carrier’s voting shares.

-

In tandem, the company elevated David Ni as chief strategy officer, Paul Brockman as chief operating officer and Matthew Kirk as chief financial officer.

-

Following the completion of this transaction, Enhanzed Re became a wholly owned subsidiary of the legacy carrier.

-

2022 represented a period of bumper legacy deal-making for the legacy carrier.

-

RACQ will cede net reserves of approximately A$360mn (~$247mn), and Enstar will provide around A$200mn (~$130mn) of cover in excess of the ceded reserves.

-

The deal regards international and North America financial lines, European and North American reinsurance portfolios, and several US discontinued programs.