California

-

The governor has yet to sign a pending bill to create a public cat model.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

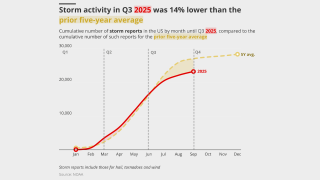

Despite a rocky H1, 2025 insured losses from nat cat events may not surpass 2024 levels.

-

Alliant is in the process of moving the ~$1bn of business it places with Howden to other wholesalers.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

The business has been ~70% owned by White Mountains since January 2024.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

What’s next for the reinsurance market as Monte Carlo approaches?

-

This is the first rate filing to use the recently approved Verisk model.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

The insurer denies it is responsible for the actor’s legal fees.

-

The impact on the (re)insurance market has been muted due to its strong capital position.

-

Up to nine million acres of US land are considered likely to burn.

-

Ark's combined ratio included 25 points of catastrophe losses in Q1.

-

The insurer has not decided whether to sell its Eaton subrogation rights.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

The carrier has received 12,300 claims as of 28 March.

-

Plus, the latest people moves and all the top news of the week.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

Island appetite remains stable, but early 2025 loss activity has injected fresh uncertainty.

-

“We do not have the luxury of time,” he said during the Bermuda Risk Summit.

-

These events can also no longer be considered secondary perils, executives said.