Beazley

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier is looking to latch onto emerging economic trends where it can add expertise.

-

Most segments have grown premiums so far this year, but only three have observed increased rates.

-

The business is pursuing growth in Bermuda in captives, cyber ILS and alternative risks.

-

In mid-morning training, the share price had fallen by 12%.

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

The carrier plans to invest $500mn in capital to establish a presence in Bermuda.

-

Beazley is one of the key leaders in the London marine marketplace.

-

Stephan Simon left BMS in June 2024 after almost three years in the role.

-

The carrier plans to reduce 623’s stamp by around 10% next year.

-

-

Plus, the latest people moves and all the top news of the week.

-

Top line grew across all carriers even as pre-tax profits dipped.

-

The London carrier missed consensus on gross and net premiums for H1.

-

The carrier booked top-line growth of 2% in H1.

-

Rates were down 3.9% across its portfolio in the first half of 2025.

-

The Beazley CUO said geopolitics would determine cyber market pricing.

-

The executive’s career includes a stint as head of cat for CorSo.

-

Beazley, Hiscox and Lancashire all grew in Q1 despite widespread rate decreases.

-

Plus, the latest people moves and all the top news of the week.

-

CEO Adrian Cox said the market could turn on “unexpected events”.

-

Cyber and property experienced the largest price reductions.

-

It is understood that Marsh brokered the tower, which is exposed to claims from a 2024 breach.

-

Ki cut its top line by 8.7%, while Beazley’s smart-tracker expanded to $481mn.

-

The transactional liability-focused MGA's Lloyd’s line is up from £37.5mn to £40mn.

-

Hiscox, Beazley and Lancashire all reported top line growth, but ROEs dipped in an active wind season.

-

Plus, the latest people moves and all the top news of the week.

-

He said that “everyone’s looking for growth”, as the firm has moderated its top line projections.

-

Predicting underwriting conditions for the remainder of the year is ‘challenging’.

-

The London carrier posted an undiscounted combined ratio of 79%, up from 74% in 2023.

-

Lloyd’s CEO pay is lowest compared to major LSE-traded specialty insurers by a considerable margin.

-

Sara Foucher has held roles at RSA, Swiss Re and XL Catlin.

-

Fast Track is led by QBE and backed by Canopius, Arch and Beazley.

-

The executive has also worked for AIG and Ace.

-

The underwriter will report to group CUO Paul Bantick.

-

A spree of new entrants in the cargo market has resulted in recent talent turmoil.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

Some US and European cedants will likely see "specific adjustments" to their programmes.

-

The carrier said an active hurricane season and a global cyber event had not altered its full-year guidance.

-

The Flex consortium will offer up to EUR/$50mn limit.

-

The deal has reduced the carrier’s one-in-250-year cyber loss scenario from $651mn to $461mn.

-

Paul Bantick will continue to oversee the cyber risks division during the search for his successor.

-

Sources said that for reinsurers to meet this demand, they will need to get comfortable analysing and evaluating systemic and aggregate risk.

-

The carbon market is viewed as a potential growth class for insurers.

-

The carrier launched into the political violence market at the beginning of the year.

-

Lancashire was the only carrier to see double-digit growth in insurance revenue for H1.

-

Plus the latest people moves and all the top news of the week.

-

The CEO said he expects cyber rates to start flattening post-loss.

-

The executive argued that Beazley’s performance is the ultimate driver of the insurer’s valuation.

-

Growth was driven by active risk selection, as rating environment begins to moderate, said CEO Cox.

-

In messaging to the market, the cyber insurer described the rating environment as “stable and sustainable”.

-

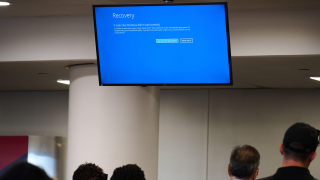

The cyber market should use the latest outage to start decisively taking action on managing cat aggregates.

-

The carrier’s cyber hours clauses and sub-limits will limit exposure, according to the analyst.

-

The current guidance is that Beazley will publish an undiscounted CoR in the low-80s at full year.

-

The incident highlights the aggregation risk around cloud service reliance.

-

A roundup of all the news you need today, including the FCA’s new listing rules.

-

Arch, Axa XL, Beazley, Chubb, Hiscox, Howden, MS Amlin and TMK are participating.

-

Sam Franks will also maintain his current role as head of partner engagement for the region.

-

Lucien Mounier has served for six years as Beazley’s head of Asia Pacific

-

This publication reported in April that Alexandra Barnes had resigned from Beazley.

-

Beazley has two days to amend its complaint, correcting jurisdictional deficiencies.

-

The carrier has also hired Victoria Burnell from Tokio Marine Kiln to join the energy team.

-

Beazley CEO Adrian Cox said that the carrier’s growth rate would slow as market conditions shift.

-

The track record of smart-follow vehicles is still young, but the segment is gaining traction.

-

-

The carrier confirmed a combined-ratio guidance in the “low 80s” for the year.

-

Staff turnover has been elevated in the energy market this year.

-

The short-term disruption of relisting may be justified by the long-term benefits.

-

Christine LaSala will step back from her board membership at the end of this month.

-

The partnership will add more capacity on the platform from April.

-

For the 2022 year of account, the updated forecast remains unchanged.

-

Hiscox, Beazley and Lancashire all delivered one-off capital returns while swerving casualty issues.

-

The carrier reported $1.2bn profit and 71% CoR for 2023.

-

Beazley was one of the first four cyber cat bond sponsors.

-

Beazley also confirmed the appointment of CFO Barbara Plucnar Jensen.

-

Slipstream will be available to marine, cargo and logistics UK clients.

-

Beazley is expected to announce its year-end results on 7 March.

-

-

The MGA previously hired Sara Valentine from Brit to launch in energy.

-

Koscondy will set the global production and distribution strategy of all of Beazley’s cyber business sub-$250mn.

-

Aidan Flynn said that although different markets are expected to move at different speeds, the underlying trend is clear.

-

Growth opportunities at Lloyd’s no longer limited to top underwriting performers, Insurance Insider’s survey shows.

-

Cat losses were within budgets despite high levels of minor events.