For once in Monte Carlo, property catastrophe risk has stepped out of the limelight, although the emergence of (likely) Hurricane Francine on Tuesday is a reminder of lurking perils.

There are some potential fracture points in cat-market conversations around the issue of frequency vs volatility and the balance of risk sharing between insurers and reinsurers.

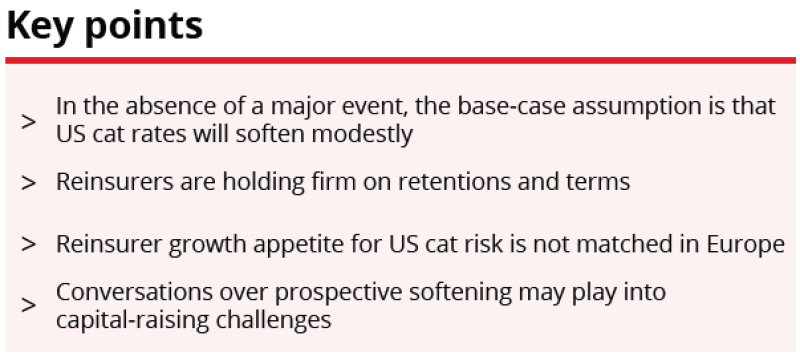

Some brokers ramped up their language around the need for reinsurers to take back more risk, while reinsurers generally held firm on their view that higher retentions have returned them to their true role.

However, many saw these skirmishes as an exercise in rhetoric and suggested that – in the absence of a major cat loss – the market is aligned on expecting mild rate-softening in US cat risk, with more reticence around give-backs to terms and conditions of coverage.

With RoEs on cat-treaty books in the ballpark of 30%, reinsurers believe there is some room to give up rate while still making a margin that compensates for volatility.

Many point to the number of years when they failed to meet their cost of capital as a requirement for returns to remain particularly elevated in benign loss years.

However, there are regional differences. Reinsurers are in risk-on mode for well-priced US cat – and here there may be a test of abilities to continue growing while maintaining discipline as over-subscriptions on placements rise in 2025.

The same is not true in Europe, where reinsurers feel pricing for loss-affected cedants did not go nearly far enough. There are pockets where insurers last year did not pay up in full or escaped the scale of retention hikes elsewhere. Mid-sized cat losses in Germany and late loss creep on Italian losses from last year will spur reinsurers to be more disciplined.

Despite the gap in broker/reinsurer talking points on taking back lower-volatility risks, some reinsurers are willing to offer aggregate or higher-risk deals – albeit not old-style earnings-protection deals. However, the current pricing gap between their supply and what buyers are willing to pay is highlighted by Allstate’s mid-year failure to place an aggregate deal.

While the supply/demand situation is generally balanced, some market observers lamented the fact that discussions around rate-softening in 2025 might further impair new capital entry or lead investors to take some cash off the table at year end.

There is no perception of a shortage of capacity, but, at the same time, the lack of recent start-ups and the prolonged fundraising challenges for those bringing new capital to market show that incumbent capital is where it’s at for 2025.

Cat-bond market supply will be boosted by around $2.5bn in maturities over H2, according to data from Insurance Insider ILS. If new bond issuance fails to keep pace with the furious volumes completed over H1, this could provide some softening competitive tension.