WTW and Bain Capital’s forthcoming reinsurance broking launch will neatly sidestep some of the difficulty the broker faces in building a new treaty broking business – but that doesn’t mean it will be plain sailing.

This publication revealed this week that WTW has teamed up with the private equity house on a joint venture that will bring WTW back to reinsurance broking.

The move comes almost three years after WTW opted to sell its reinsurance business to AJ Gallagher for $3.25bn as a result of its own failed sale to Aon.

The plan to create a joint venture independent of, but strongly tied to, WTW will lessen the Herculean task of building a reinsurance broker from scratch – but the job will still be a tough one.

The benefits of an arm’s length approach

As this publication has explored, WTW faces major challenges in re-entering reinsurance – particularly in a market where there are no suitable M&A targets.

Some of those challenges were specific to building a reinsurance operation within the company, rather than at arm’s length, however.

Sources have previously estimated the cash burn to start up a full-service reinsurance broker at $150mn if done well.

This hefty upfront cost would strain WTW’s cashflow and drag on its earnings. That would be especially challenging when WTW is still in the process of rebuilding investor confidence following the Aon merger collapse.

The tie-up with Bain, however, helps to alleviate this problem. The PE house will bear most of the upfront cost of the build, with WTW as the minority investor in the venture. It is likely, once the business reaches maturity, that WTW will buy Bain out. In this way, WTW shifts the costs of the start-up to its deep-pocketed partner while still reaping the benefits later.

A compelling offer to staff – but a competitive talent market

One advantage of the joint venture model is that it will create a relatively independent reinsurance business, rather than a unit within a large corporation – and that could be a more attractive prospect to both a potential CEO and production talent.

Prospective staff will be attracted by the opportunity to join a reinsurance operation that benefits from WTW’s retail influence, and yet work with reasonable autonomy. Another major pull for potential staff will be the incentivisation to entrepreneurialism through equity offers vesting over a set period of years.

The flipside of this though is that the joint-venture structure – geared as it is towards an eventual liquidity event – could attract staff more motivated towards a big pay day at that stage, rather than brokers looking to make a longer-term commitment.

Once WTW has bought the business and earn-out periods for staff have ended, it faces the risk of damaging talent flight.

To counter that risk, it must work hard to win over the hearts and minds of its staff to secure buy-in beyond the eventual equity payday. Given the distance from which WTW will interact with the business during the build phase, WTW’s senior management must give careful thought to how it will retain staff in the natural instability that will occur after the takeover.

Putting these specific issues aside, there are wider talent issues at play that will create hiring challenges.

Reinsurance broking suffers from a lack of strong, proven leaders. This is in part due to the generational cliff edge widely believed to exist between today’s senior staff – many of whom are in their 50s or older – and a missing generation of leaders behind them.

A wave of staff dislocation following M&A deals, including Marsh McLennan’s takeover of JLT and Howden’s purchase of TigerRisk, as well as the scaling-up of challengers such as Lockton Re, also means many industry participants looking for new opportunities have already switched firms, making them less inclined to move again so soon.

Timing: Cyclical tailwinds are winding down

Another issue that Bain and WTW will face in building their reinsurance business is the point at which they are entering the reinsurance market cycle.

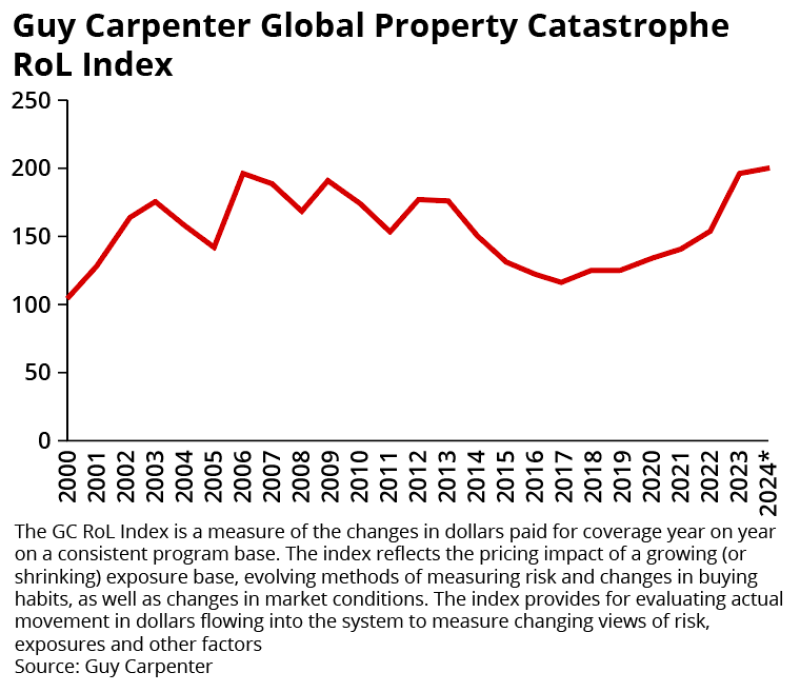

From 2019, reinsurance brokers have benefited from supportive conditions, not least growth via rate increases and increased limit purchasing driven by inflation.

Clients have also been keen to parcel out at least some of their business to challenger brokers in a bid to reduce the concentration they had with the largest three intermediaries.

The peaking of the pricing cycle, however, means these tailwinds will fall away. WTW and Bain’s start-up will not receive the same level of uplift from rate increases. The reversal of those tailwinds will also mean existing brokers must rely on winning business to grow, increasing the competition WTW and Bain will face.

The long-term logic

Even though WTW and Bain face a steep climb to create their reinsurance unit, there are a number of ways WTW stands to gain from the enterprise in the long term.

The first relates to its margin, which has trailed that of its rivals for several years. In 2023, its adjusted operating margin was 22%, behind Marsh McLennan at 29% and Aon at 33.8%.

Part of that problem is WTW’s lack of a reinsurance operation. Scaled, optimised reinsurance operations can run at 35%-45% operating margins.

The profitable, symbiotic relationship between a retail and a reinsurance business within the same company is also well known.

To be considered a full-service, global broker, WTW must also address some of the gaps in its offering. These include an MGA operation and a US mid-market unit, but it also needs a reinsurance division in order to truly compete with its two largest rivals.

These long-term strategic needs outweigh the near-term concerns around market cycle timing. The reward for WTW and Bain’s efforts could be huge – but the degree of success or otherwise will depend on execution.