Hurricane Otis was yet another event to add to the 2023 tally, as (re)insurers headed for Boston. The high cat loss toll means pricing pressure remains in this area, while cedants are exploring options to refine their programmes in 2024.

However, attractive pricing for cat reinsurers, and the greater certainty they have in comparison to this time a year ago, means growth is back on the agenda for many reinsurers and a more orderly supply-demand balance is in play.

In contrast, there is more divergence in appetites and perceptions on the casualty markets. There have been signs of increased pressure on ceding commissions, but specific experience is more likely to steer a wider range of near-term outcomes, unlike the market-wide cat changes that were effected this year.

Finally, an ongoing question for reinsurers is one around the outcome and direction of this hard market.

The Irma to Ian loss years of 2017 to 2022 – and increasingly, the soft market casualty years of the late 2010s – are still hanging over APCIA discussions.

Aggregate and frequency covers: too soon?

From the cedants’ perspective, broker sources have cited a greater concern among clients about securing cat frequency covers, after the availability of aggregate cover largely dried up in 2023.

But as conference season conversations got underway on the prospect of a return to aggregates for 2024 placements, there are signs that a number of reinsurers are reluctant to entertain this idea.

Higher retentions and a high-activity loss year for small-to-mid-sized events together mean insurers have taken a heavier burden from cat losses this year than reinsurers.

According to the National Oceanic and Atmospheric Administration, 24 separate billion-dollar weather and climate disasters were confirmed from Q1-Q3 2023, setting a record for the US after the country began compiling such data.

During the same time, severe convective storm losses in the US surpassed $50bn for the first time and generated 60% of global insured losses, Aon data showed.

One brokerage firm executive said that, in 2023, if clients were able to renew their aggregate protection at all, they were only able to place 50% of the expiring program.

“When these SCS events came along – and they did again – what used to be protected by aggregate reinsurance protection was now only 50% protected,” the source said.

In addition, another major question cedants will be asking is around the availability of capacity at lower ends of the program.

Top layers of towers are now receiving strong support from reinsurance capacity, but the lower ends of the tower remain challenging.

In that regard, a major task for reinsurance brokers in the upcoming season will be the reallocation of capital within the tower and whether they can “horse trade” reinsurers to provide coverage for lower ends by leveraging the allure of higher layers in the reinsurance tower.

However, it seems clear that higher retentions are here to stay.

On Everest’s Q3 earnings call, COO Jim Williamson said higher reinsurance deductibles had been a “necessary and appropriate” move.

He said there might be “some adjustments around the edges” for cedants that had not “landed in the right spot” on retentions, adding: “Fundamentally, I don’t see any change in terms of going backwards on retentions.”

Cat pricing momentum

There’s no doubt that the cat momentum persists in the reinsurance market. A more nuanced question heading into 1 January, however, would be if the peak hardening phase is behind us.

Last year’s renewal was described as a “war on all fronts” as reinsurers and cedants battled over pricing, terms and conditions, and structures.

During Q3 conference calls so far, several reinsurer executives have expressed confidence that the dynamic and pricing momentum will continue in 2024.

However, the renewal discussions are likely to focus on how far reinsurers can secure ongoing incremental improvements, or safeguards against inflation, rather than the major changes of this year.

One school of thought is that, while property cat pricing levels are unlikely to drop, they are expected to largely remain where they are, just as 1 July renewals were not vastly removed from 1 January.

While cedants may be willing to discuss terms and conditions, or aggregates, in a market where reinsurance supply still falls under demand, they also know they are paying among the highest reinsurance costs in history.

One reinsurer executive cited a case where a cedant with a strong balance sheet decided to form their own captive.

“We’re starting to see that trend where sophisticated buyers are not going to sit there – [they’re] not going to be just at the mercy of this,” the source said.

Casualty quota share pressure

US casualty quota shares are increasingly a subject for debate as concerns around social inflation lend urgency to pressure on ceding commissions.

Professional lines quota share treaties have seen cedes decline by an average of 2 points, while the movement for broader casualty lines has been relatively steady: flat or down by 1 point.

As a more dramatic move in H2 renewals, sources have told this publication that Chubb’s casualty quota share has lost around 4 points, due to prior-year reserve development.

One of the first reinsurers to publicly report in Q3, Everest Re, said improvement to ceding commissions should “strengthen considerably” in 2024.

The downward trend marks a successful reversal for reinsurers, after ceding commissions rose by 2-4 points annually from 2019 to 2022 when the primary market hardened.

At its peak, cedes on the best books ran close to or above the 40% mark.

Despite the reductions, cedes on the most desirable accounts still hover in the mid-30s, which does not satisfy reinsurers who are looking at how social inflation and prior loss developments on older business are coming back to haunt clients.

The post-pandemic resurge has already started, as the annual sum of corporate nuclear verdicts bounced back to $18bn in 2022, from $5bn in 2020 and $8bn in 2021, according to PR and research firm Marathon Strategies.

“The courts are opening up on the casualty side, and they’re opening up with vengeance,” one carrier executive said.

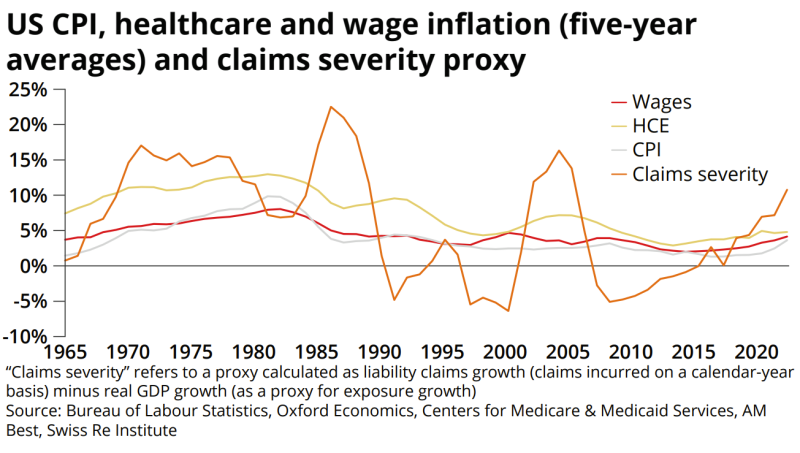

Swiss Re also noted in a recent report that, with the current rotation from economic goods to services inflation, attention is shifting back to liability lines, where wages and health care expenditures are the key drivers for claims severity.

More fundamentally, sources cite an inherent difficulty to model social inflation and jury verdicts for its pricing. Litigation funding is also a major concern, but in reality, even obtaining data on this practice is a struggle, as only a fraction of US courts have mandated or are in the process of mandating the disclosure of such involvement.

“That’s why to me, the casualty product is flawed right now,” a source said. “We can’t get our hands around what is a normal loss expectancy on a claim.”