The boat shoe is on the other foot in this year’s pre-renewal conversations that will open the Monte Carlo Rendez-Vous.

After five years of disappointing returns, reinsurers have benefitted from a decisive market turn in catastrophe risk – and the shift upwards in retentions that they enforced in 2023 renewals has left many insurers bearing the brunt of this year’s cat loss activity.

Even though market conditions are far calmer than the turmoil that erupted in Q4 2022 through to January, the reinsurance market equilibrium is still finely balanced – indeed vulnerable to any further shock.

All parties’ minds will be on what storm systems may emerge from the turbocharged warm waters of the Atlantic throughout the rest of hurricane season.

As we explore, there are still a number of dynamics that will be troubling reinsurers, and which will give them impetus to push to prolong favourable cat market conditions into 2024. Much of the hard work on attachment points and changes to terms and conditions has already been done, meaning this year may be more of a straight price battle over whether rates are boosted by incremental gains or come closer to flat. Outside the cat market, the disquiet over casualty rate adequacy may begin to be more audible.

These factors include:

Concern over long-tail lines due to the US tort environment

Inflation still being an underlying pressure despite signs of easing

High run-rate of minor-scale cat losses

Demand still emerging for cat cover driven by inflation and model change

Altogether, the picture that reinsurers will be pushing is that it is too early for them to have secured payback. After years of negative returns or returns short of cost of capital, this year will not be enough to have made good prior-year losses in a higher return environment where investors are looking for strong absolute yields.

Some metrics suggest the industry is making partial progress on its redemption arc from these struggle years, with Bermudian returns on equity reaching 14%-23% for H1. Others point in the other direction however, with the media price-to-book multiples on half a dozen major reinsurers falling from 1.9x at the start of the year to 1.6x in the midst of the hurricane season.

Everest Re and RenaissanceRe comfortably raised fresh equity earlier this year – but PE capital unconvinced that 2023 start-ups would be able to hit their roughly 20% return hurdles.

Supply-demand balance: Still strained but more in sync

Last year’s Monte Carlo discussions revolved around ever-growing forecasts of the new demand – $10bn-$15bn or more of new limit – that would be coming into the market, driven by exposure inflation.

Those expectations were overturned by the hard market conditions at 1 January, although new bits and pieces of purchasing have been done as 2023 wore on. Most recently, Chubb has been in the market for a new $500mn top layer.

Guy Carpenter chairman David Priebe forecasts that new demand will not be material but in the range of 5% growth – which he classified as more of a normalised uplift. “It will correspond with growth of capital,” he said, projecting balanced supply-demand forces.

On the new capital side, generally the sentiment in the market has been a questioning one, with sources noting few signs of major incoming interest and particular scepticism over fresh start-ups.

With that said, on the cat bond market, volumes have been growing. Aon noted total cat bond limit had expanded by 10% or $3.6bn in the first half.

In terms of some of the factors driving demand, it is worth noting that, while discussion of inflation has become less frequent as upward pressure on prices eases, it is still expected to be both a driver of incremental purchasing and a focus for concern on managing loss costs.

Cat losses and the mix shift

Cat losses have not been a major problem for reinsurers to date in 2023, but the number of minor loss nicks will be adding up.

Generally, the spread of losses this year has been more heavily weighted to insurers – reflecting a trend that we have called the “upstreaming” of cat risk.

But even so, some of this year’s international loss events will have been more well reinsured. On top of the Turkish quake and New Zealand cyclones, Hawaii fires will also have inflicted losses.

Aon figures put H1 losses at $53bn, well ahead of long-term averages, and with around $5bn of Hawaiian losses, $600mn from Hurricane Hilary, and perhaps $5bn from Hurricane Idalia in just two months, the tally could be well on the way to $65bn, with much of the hurricane season still to go.

This dynamic underscores part of the rationale for this year’s cat reinsurance reset – that $100bn loss years are now the norm, not outliers.

However, the unique pattern of losses may highlight a couple of regional weak points in the (re)insurance risk system. Events such as the New Zealand and Turkey losses – while not absolutely expensive given reinsurers’ roughly $520bn capital base – may prompt a rethinking of the true cost of non-peak major disasters (Istanbul or Wellington). This may in turn drive a returned focus on the “diworsification” critiques of low-margin international business that emerged in the early 2010s.

Within the US, the ongoing high convective storm losses are expected to compound issues for some of the small Midwest regional carriers, with less heft to handle higher reinsurance costs than their nationwide peers.

Could this keep nudging forward consolidation of the primary cedant base? The flight-to-quality theme is likely to leave reinsurers indifferent about this prospect, with many consolidating bets with the stronger insurers.

Casualty: A polarised market

In the US and international casualty excess-of-loss (XoL) treaty markets, the polarisation of views of risk seen at the mid-year renewals is set to continue.

As reported earlier this year, distinctly different takes on the real length of the tail in some casualty classes, reserving adequacy across the sector and whether or not reinsurers have truly accounted for inflation have created a disjointed marketplace.

Sources described two broad stances on casualty reinsurance.

Some carriers are bullish on the class, spurred on by the rate increases of the past two years and the prospect of more to come.

For the most part, bullish sources expect rate increases that comfortably exceed inflation on both US and international XoL casualty treaty business.

That said, it is important to note that even those with an optimistic outlook for casualty treaty are emphasising a commitment to underwriting discipline.

“We’re pleased with [our growth in casualty treaty], but it’s not as simple as property bad, casualty good,” one source said.

On the other hand though, there are a number of bearish players in the market, concerned that even the recent run of rate-on-rate increases are not enough to counter emerging negative prior-year development.

This cohort believes there is not as much margin in casualty reinsurance as evangelists for the sector like to think – and some are planning a mild retrenchment from casualty in 2024.

“We may be leaving the party a year early, but with the loss development trends we’re seeing, we’d rather protect the profit that we’ve already made,” a source said.

US casualty treaty sources pointed to a stronger signaling from reinsurers saying they are willing to walk away if the prices aren’t right – a significant development compared to two years ago when a majority of carriers were bullish about casualty and wanted to grow in the space.

Another added that the recent spate of loss portfolio transfer purchases across the industry, effectively ridding some carriers of problematic back years, is “masking reserving holes” for 2015-2019 that were expected to emerge by now.

There is particular concern around deterioration on financial lines business, in some cases concerning claims as far back as seven or eight years, which many had assumed would not worsen any further by this point.

“We’re having conversations about how long the tail really is [on those lines],” a source said.

Inflation also remains a key topic, particularly in XoL business where inflation can push losses up into higher layers than originally assumed. Several sources cited difficult conversations between cedants and reinsurers, in which reinsurers are still pressing for rate increases to counteract inflation but cedants – who renew policies on a constant, ongoing basis – feel they have already taken sufficient action to account for inflation in the underlying portfolios.

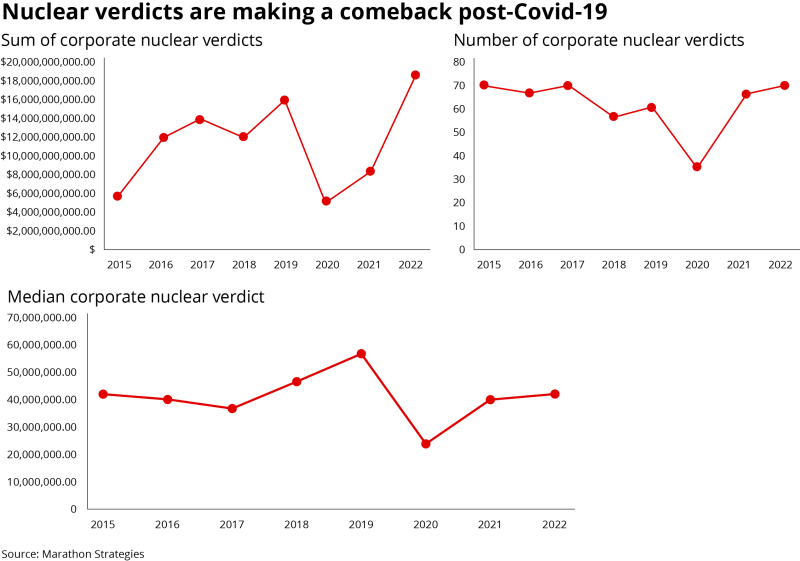

Social inflation in the US, as one source put it, “is not letting up” and remains a key factor in negotiations around US-based or exposed risk.

Sources said the backlog in the US cases created by the 2020 Covid-19 shutdown of the court system has not yet been cleared, and so cases that would normally have already been tried are still coming through.

This, along with the impact of economic and social inflation on jury awards, is making it even more difficult for reinsurers to take a view on prior-year loss trends.

There are also discussions around how to treat international portfolios that have exposure to US social inflation risk.

The 2021 collapse of the Champlain Towers South residential building in Florida is an oft-cited example in these negotiations. Although the disaster took place in the US, Stockholm-based security provider Securitas was found partly liable for the collapse by a Miami judge and the company paid out a $517mn settlement.

While some reinsurers are bullish on casualty in general, some lines are still a cause for concern, and here the majority of reinsurers plan to exercise caution.

In particular sources cited D&O, where rate reductions are rife in the primary market. Some reinsurers are refusing to write any standalone D&O reinsurance, preferring to bundle it into a treaty with other, more palatable lines.

Some Lloyd’s syndicates have also experienced difficulty in negotiations so far this year around the inclusion of cyber exposure in broader casualty treaties, and this is set to continue.

The imposition of tight exclusions around cyber war exposures imposed by Lloyd’s has meant that some reinsurers have stopped participating in casualty treaties where cyber war is included and supported by US and Bermuda reinsurers.

In the proportional US casualty market, there are distinct signs that reinsurers’ enthusiasm is waning.

In recent years, reinsurers have tolerated high ceding commission in exchange for a share of rising underlying rates.

In US primary casualty, for instance, rates have increased by at least 4% every quarter since Q1 2020, while in US financial and professional (FinPro) lines, rate increases between 20% and 30% were the norm throughout 2020-2021, according to the Marsh Global Insurance Market Index.

For the past four quarters, however, the primary rate outlook has been very different. On US casualty, rate increases have been limited to the low single digits, and on FinPro business rates are falling significantly.

In particular, reinsurers are increasing wary of D&O, where primary rate reductions are the greatest, and financial lines more generally – and this comes against a backdrop of worsening loss emergence on back-year business.

In US general liability, reinsurers writing quota share business are displaying more mixed sentiment. Rates remain in positive territory, but concerns abound that pricing will not keep pace with loss cost trends and inflation.

These trends therefore make proportional casualty treaty a less enticing prospect for reinsurers at current ceding commission levels.

Specifically, there is growing contention around the overriders – the proportion of ceding commissions above cedants’ costs – that some reinsurers believe have prevented them from fully benefitting from underlying rate increases.

At this stage, this dissatisfaction is manifesting in pressure to cut ceding commissions as they look to rebalance their fortunes with those of cedants.

Big picture challenges

More broadly speaking, 2023 can be seen as just the start of the reinsurance sector’s redemption arc. After years of depressed returns that sparked commentary around the sector’s limitations – its thrall to intermediaries, its limited size and captive market, etc – the community can now feel justly revived.

As we note above, RoEs are looking good. But there are still laggards who are being marked with more scepticism by the stock market. Also, the bar to outperform is high as rates have risen. Cat risk may have re-rated and gone some way to showing that reinsurers can manage $100bn loss years instead of underestimating climate risk, but the casualty discipline remains largely to be proven. The ILS market recovery is highly skewed and partial outside the cat bond segment.

Reinsurers cannot let their guard down if they want to truly regain the interest of the capital markets.