While preventing and managing financial fraud may be a routine issue in the banking sector, the (re)insurance industry has not in recent years had many major problems with credit risk, particularly with what would have been seen as a very boring, vanilla instrument – letters of credit (LOCs).

Thus, recriminations over who faked the letters of credit involved and who did sufficient due diligence into their provision will continue for months to come, with FBI officials assisting with investigations, according to letters from one company caught up in the issue. Vesttoo has said it believes the source of fraud is external to the company.

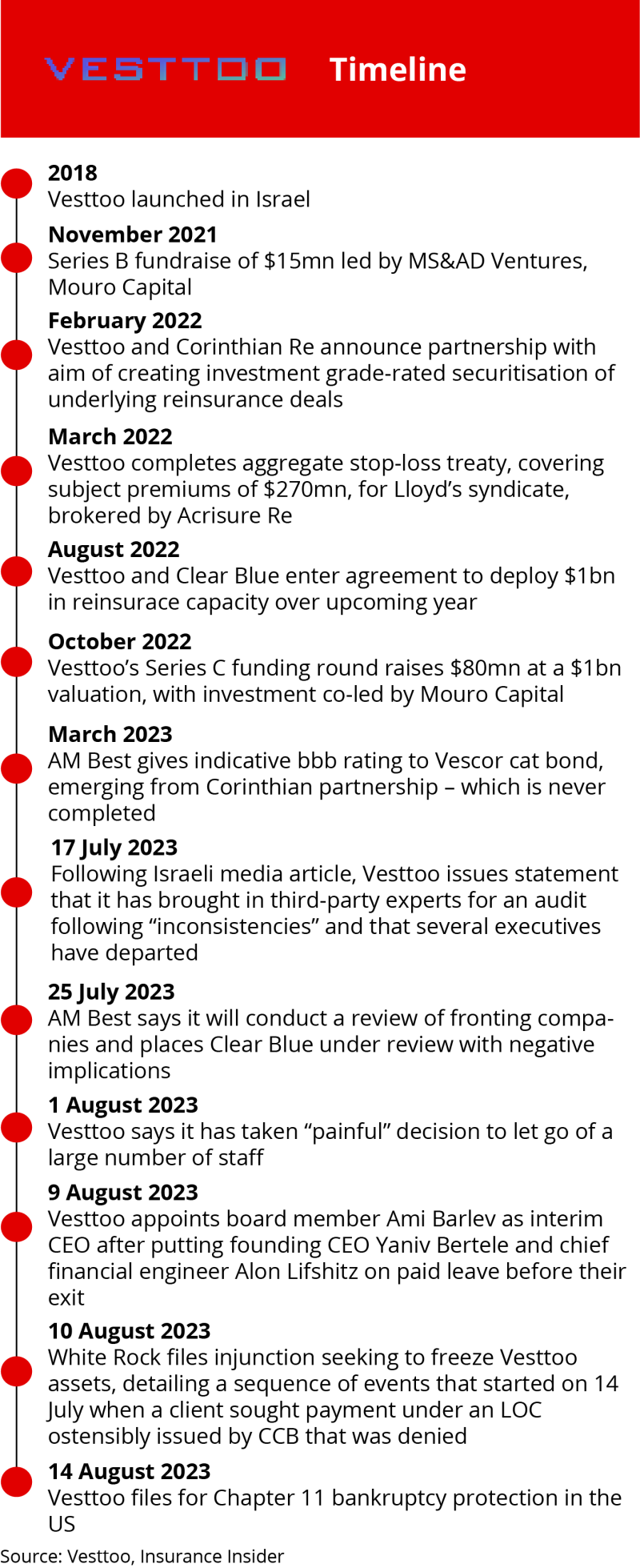

The story will continue to play out through the lens of bankruptcy court filings, but, for now, we recap some of the strands that brought the firm to where it is at present, as well as the implications for the rest of the industry that will unfold over the autumn.

Deal-making to date

One surprising aspect of Vesttoo’s operations that has emerged since the issue blew up is the breadth of segments it had deployed into after it really only began scaling up its (re)insurance allocations in the past couple of years.

As we have covered, it was a major supporter of intellectual property risks, a niche Aon has been leading to develop, and had also provided significant capacity for another emerging niche in the cyber field.

Vesttoo stated in an InsurTech report in mid-2022 that it had provided $150mn of capacity for cyber ILS transactions to date, including a $64mn transaction with At-Bay, fronted by Trisura. (At-Bay has subsequently said all its reinsurance is now fully placed with A-rated entities and that it had no relationship with Vesttoo.)

Vesttoo also transacted with major Lloyd’s names, including Beazley and Chaucer, and had been used by a variety of brokers, including Guy Carpenter, Acrisure and Howden Tiger.

But it didn’t just deal in esoteric risks, as it had indirect relationships with several homeowners’ and auto carriers via its fronting partners.

These included Porch, which has booked a charge related to doubtful recoverables, and Swyfft.

On the auto side, Root said it believed it could commute its exposure to the firm’s fronts if need be, with minimal impact.

By February 2022, Vesttoo documents seen by this publication were showing it originated $1.98bn in capacity, with a high number of relatively small-scale deals – 43% of the capacity having been deployed on deals of less than $30mn, and 6% at the $150mn+ end.

Sometimes, however, the figures used by the firm in discussing transactions made it difficult to establish how much risk was actually being transferred. For example, in the case of the Lloyd’s stop-loss it struck in 2022, the limit or coverage provided was $43mn, with the $270mn figure on which the deal was headlined related to subject premiums.

Court filings show the firm had revenues of approximately $110mn in 2022 compared with $30mn the year prior. The company's Ebitda for 2022 was estimated at $60mn compared with $20mn in 2021, and it estimated its running expenses at $360,000 per week.

How it did its deals

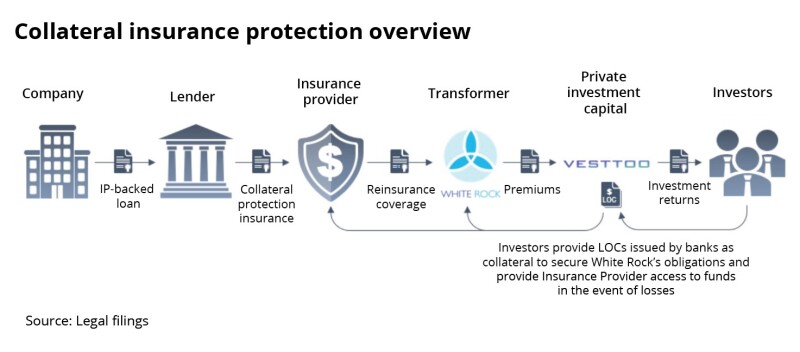

The number of links in the chain between investors behind Vesttoo and its cedants are one factor that has clouded this issue, as this publication has argued.

It had set up its own so-called transformer vehicles in Bermuda, which would have allowed it to write risks directly, but this is being liquidated without having done substantive business.

Instead, it used Aon’s White Rock transformer, as well as fronting companies such as Clear Blue and other collateralised reinsurers including Corinthian Re to access risk.

In turn, it would put up letters of credit to guarantee that the investors sitting behind Vesttoo would pay claims if need be – an unusual form of structuring for the ILS market, which typically relies more on cash-collateral.

The firm had plans to further splice and dice its portfolio into securities and different pools of risk, although targeted ILS deals never came to fruition. The firm had also been vague on its positioning in terms of whether it had any fund management oversight of vehicles enabling it to deploy capital from the Insurance-linked Program (ILP) vehicle it had set up, or whether it was simply an intermediary helping to transact deals.

It is understood the ILP vehicle had also not yet actually launched at the time the issues blew up, and that it had up to that point been transacting on a bespoke basis finding capital for specific deals. Ultimately, however, the failed link in the chain came down to what should have been a simple item, the LOCs.

There were several banking names linked to Vesttoo LOCs. According to White Rock filings, these include Santander, as well as China Construction Bank and Standard Chartered.

The industry’s exposure to China Construction Bank LOCs grew significantly last year according to AM Best analysis, although it is not possible to identify which of these LOCs were linked to Vesttoo and which were legitimate LOCs for other entities.

Alongside Clear Blue, other fronting companies and MGAs or carriers with exposure to the bank include Trisura and a Porch entity.

Clear-up and implications

Companies with exposure to Vesttoo have been busy sourcing replacement coverage over the summer, so the immediate credit risks from the issue may have been assuaged.

Fronting companies had said from the outset that the segment’s exposure would be offset by retained premiums.

Major partner Clear Blue has said it is “highly confident” it will be able to replace reinsurance and collateral provided by Vesttoo “within a reasonable period”.

Corinthian Re has told counterparties it has secured a letter of intent from an investor that would bring in up to $200mn, and that it was working to assist FBI officials with investigations into the alleged fraud.

But the fronting sector will be anxiously awaiting the outcome of the AM Best review into the segment for any systemic changes the ratings agency may apply in its treatment of the carriers, for which its A- rating is all-important. As sister title Inside P&C has argued, the underwriting risk borne by these entities has been overlooked, which should impact future valuation metrics.

In turn, their MGA partners could have their ability to deploy constrained if there is any shift that devalues their paper providers.

Brokers will also be seeking to avoid the risk of clients filing E&O actions against them, with Aon already having said this could be a possibility.

For Vesttoo’s equity investors, the prospect of having picked one of the sector’s unicorns has evaporated into a question of waiting for the bankruptcy proceedings to play out to determine whether any value is left.