The report showed that more than half of the top 20 global reinsurers maintained or reduced their natural catastrophe exposures during the January 2023 renewals. Less than half decided and managed to deploy more capital in January 2023.

Catastrophe budget expectations were exceeded as S&P Global said that the estimated insured losses from 2022 of $125bn were well above the long-term average expectation for the insurance industry.

Of the top 20 global reinsurers, the ratings agency noted that a majority was stabilizing or contracting their natural catastrophe exposures in January 2023. This was attributed to market volatility and uncertainty throughout 2022, and consequently limited availability of capital to be deployed.

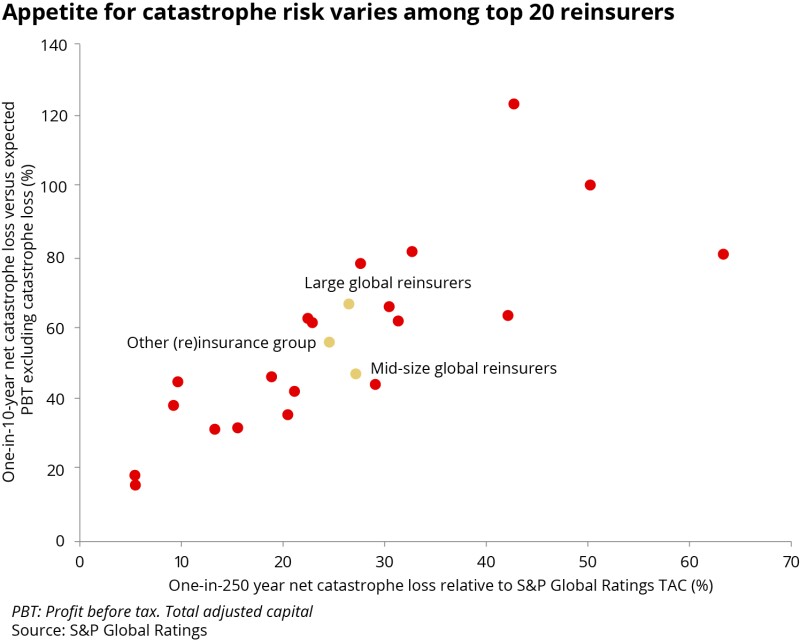

The report noted that while many reinsurers focused on maintaining a reasonable level of volatility on their balance sheet, so they could benefit from better returns without taking on more risk, others have already started to put more capital at risk in January 2023 and increased absolute net exposure by about 14% on average.

As a result, the average capital at risk has remained almost unchanged across the top 20 group of reinsurers.

The report noted that S&P Global expects the property catastrophe business to contribute about 2.5 percentage points to return on equity (RoE) for the top 20 if natural catastrophe losses remain within the reinsurers' annual budget.

Currently, insured losses are tracking above the historical average, the report said.

The example is given is Munich Re, which reported global natural catastrophe insured losses of $43bn for the first six months of 2023, compared with a 10-year average of $34bn.

The ratings agency expects, however, that primary insurers in 2023 will absorb a higher share of these losses compared with prior years, thereby having less effect on the top 20 global reinsurers' budgets.

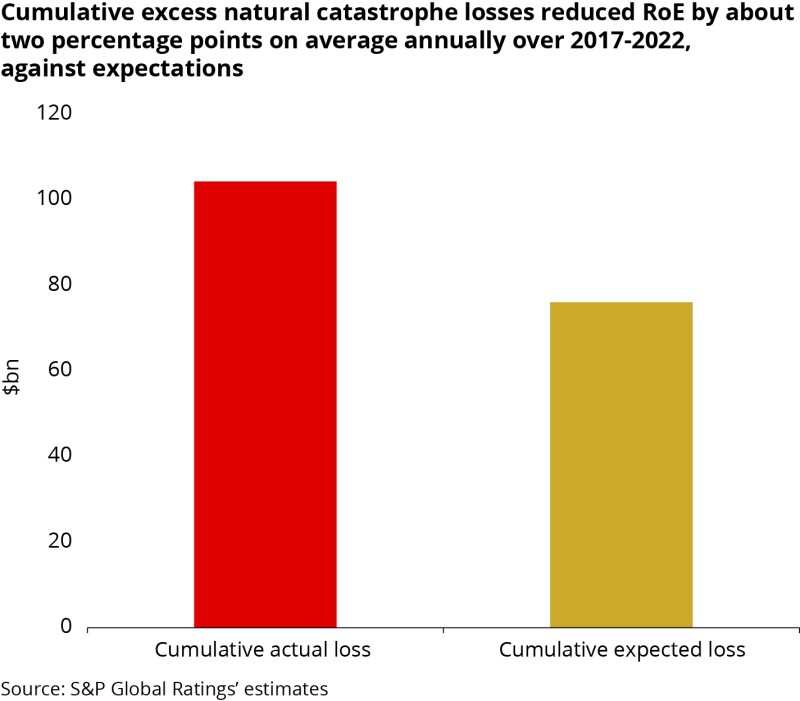

S&P Global estimates that the top 20 aggregate RoE would have been on average about two percentage points higher every year since 2017 had catastrophe losses been in line with budget expectations, according to the report.

Catastrophe budgets, however, are keeping up with nat cat losses, the report said, because many reinsurers, in addition to allowing for exposure growth and inflation, are continuing to factor a greater climate variability into their forecasts this year.

The top 20 global reinsurers now budget about $17.1bn for natural catastrophe losses in 2023, compared to $15.5bn in 2022 and $13bn in 2021, the report said.

This increased budget would broadly translate into an annual insured loss for the whole insurance industry of about $85bn, which aligns with the historical 10-year average, S&P predicted.

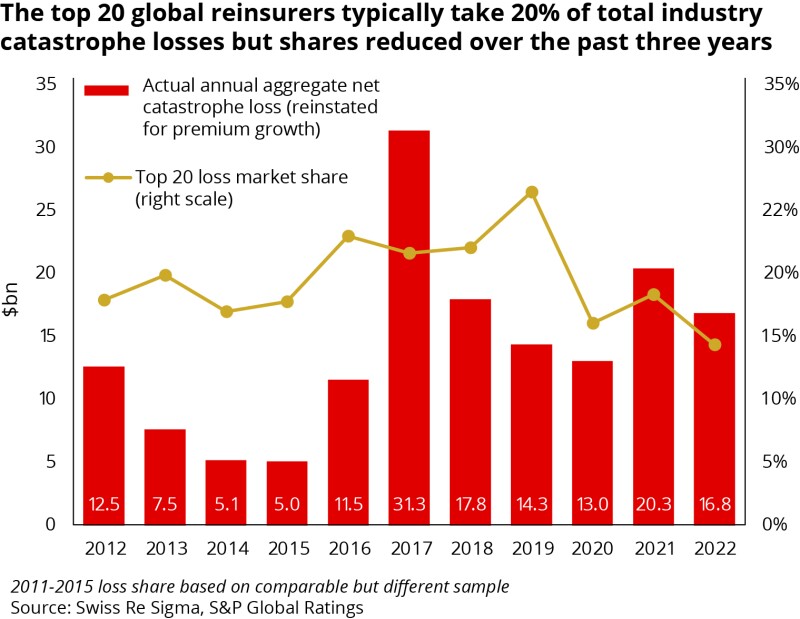

The ratings agency expects that reinsurers will continue to limit their frequency risk appetite and exposure to mid-sized events and continue reducing quota share and aggregate cover offering.

Concurrently, loss attachment points are likely to increase to mitigate rising inflation and cost trends, the report said.

Over the past three years, this led to loss share declining for the top 20 global reinsurers, below the S&P Global long-term estimate of 20%.

The report concluded that demand continues to rise, and the global reinsurance sector is more optimistic because of improved and more certain pricing conditions. The strong returns expected in 2023 and less turbulent conditions could lead more reinsurers to deploy more capital and grow their property cat book.

"An active second half of 2023, coupled with additional inflationary pressure, may nonetheless slow appetite for many to further grow their exposures to natural catastrophes."