Until now, the company has always folded in cyber with its executive risks division, obscuring the performance of the cyber book.

The result is a rare moment of clarity on cyber underwriting performance, for a sector which is frustratingly opaque on how well it is really performing.

US statutory data exists on the class, but this does not capture non-US business, and no other company, public or private, publishes the results of their cyber book – even though it is a growing and increasingly integral part of the P&C market.

As one of the market leaders with substantial market share, Beazley’s results can provide a lens on cyber market performance, although it should be said that individual carrier performance is likely to vary wildly.

Below are some highlights from Beazley’s cyber disclosure.

An H1 combined ratio of 74%

The combined ratio result for the first six months of the year was 74%, an improvement of 22 points on the comparable year-ago period.

It should be noted that Beazley was one of the first out of the gates in addressing the ransomware challenge, (see our coverage, "Beazley and the wrestle with ransomware" from February 2021)

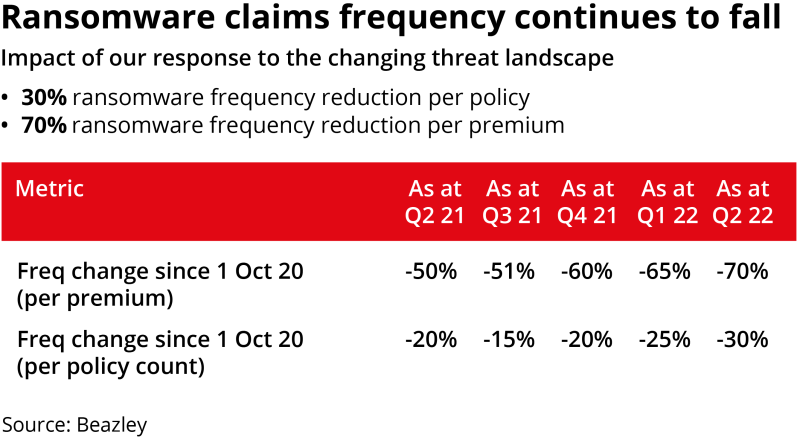

Beazley says the actions taken have reduced ransomware claims frequency by 30% per policy and by 70% by premium. Improvement in cyber pricing and risk selection has benefitted the attritional loss ratio by about 18 percentage points, according to CEO Adrian Cox.

It will also now be benefitting from the earn-through of substantial rate hikes, which were easily in the triple figures during 2021.

However, there are also some additional aspects which will have flattered the results – including the lack of a “cyber cat” type scenario, and the recent drop in ransomware attacks (a trend highlighted by other players in the cyber market).

Cox said on a call with investors: “The concern that had been echoing around the market about what the impact of the war might be has not so far manifested. But I think alongside that, we're increasingly confident that our cyber ecosystem is materially helping our risk selection.”

One of the notable evolutions of the cyber product to date has been that from a loss ratio perspective it is (currently) trending more closely to a short-tail, cat-type product, rather than its third-party, longer-tail roots. As a result the underwriting performance in this class is volatile.

The question is – is a mid-70s combined ratio a “good” year for cyber? And how bad can it really get?

Good years get better, bad years get worse

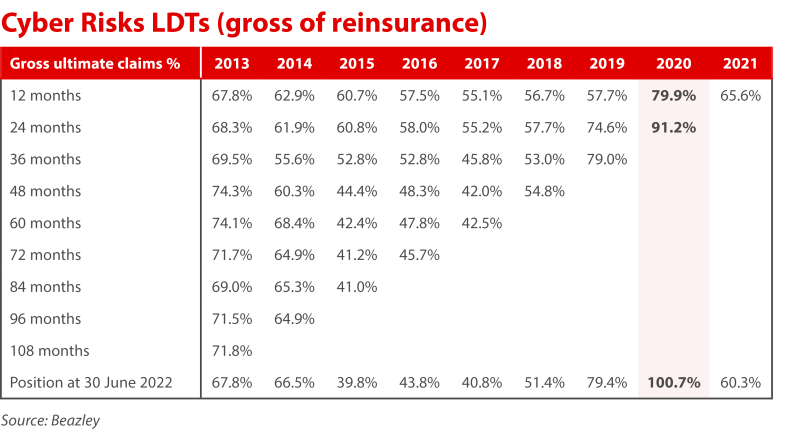

There is the old adage that good underwriting years get better, and bad underwriting years only get worse. Beazley’s loss triangles for cyber show just that.

The gross loss triangle shows a substantial deterioration in the loss pick for the 2020 underwriting year – the year where the market felt the full force of the ransomware surge, and before remedial actions started to take effect.

The gross loss pick for the 2020 year as of 30 June is now 100.7% – 9.5 points worse than the estimate given six months ago, and 20.8 points worse than its initial loss pick for the underwriting year.

The majority of the deterioration has been absorbed by reinsurers (the net loss pick for the year stands at 78.5%, which is in fact a small improvement on the 24-month stage).

On the flip side, the 2021 underwriting year is already running at a loss pick of 60.3%, closer to pre-ransomware underwriting years and reflecting remedial work.

Of course, reserving is both a science and an art – and if there was ever a time to report a 12-point deterioration in a gross loss pick, it would be at the time you can report a 74% net combined ratio for the current half.

The extent of the deterioration may not be as extreme at other players, however it does highlight how the pain of the 2019 and 2020 underwriting years is not over for the market yet – and in the case of Beazley, at least, it is the reinsurers that are feeling the brunt of it.

Beazley aims to hit $1.3bn in cyber premium in 2022

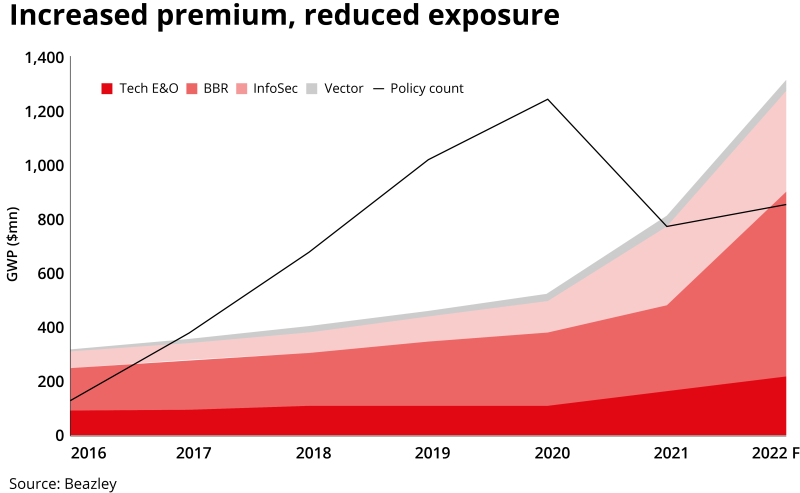

Management provided new projections on scaling up the cyber book during the analyst call, with an expectation the portfolio will hit $1.3bn in GWP by the end of the year. The carrier writes more business in the second half of the year.

As this publication previously reported, Beazley at 1 January secured a new cyber quota share which gave it headroom to grow the book to $1.4bn of premium, although there was no target for growth.

The below graphic from the presentation suggests this will be done largely through premium rate increase, with a small amount of exposure growth. (Note that in H1 cyber premium grew 77%, while the renewal rate change was 71%.)

It also shows the extent of dropped business as a result of the ransomware remediation.

The cyber book accounted for 19% of the Beazley portfolio at H1, and CEO Cox was keen to stress to analysts that his firm continues to pursue a diversified strategy.

Cox told analysts: “We are very determined that we don't become a cyber insurer that does other things as well, right? So it's very important to us that we maintain ourselves as a diversified, thriving specialty business.”

Next year’s business plan does not assume that cyber takes a bigger proportion of the whole, because “you can have too much of a good thing”, he said.

Cyber rate momentum is slowing

Beazley’s renewal rate for cyber was 71% in the first half, up 10 points on the 61% reported in the first six months of 2021.

However, although this marks a year-on-year acceleration, quarter on quarter the magnitude of rate increase is slowing. Beazley said at its Q1 results that rate increases for cyber were well over 100% in the first quarter – and will have moderated substantially to generate an average rate rise in the 70s over the six-month period.

This tallies with the latest pricing data from Marsh, which said that US cyber pricing increased 79% in Q2, compared to 110% in the prior quarter and 133% in December 2021. In the UK, the rate of increase moderated to 68%, compared to 102% in the first quarter.

This publication also reported in June that the market was likely past the pricing peak, and there was evidence of inverted towers as risk appetites change among market players. Clients are also starting to reach the limit of what they are willing to pay for a discretionary cover.

Cox gave analysts some rationale for why rate momentum is now diminishing.

“Other insurers are beginning to see attritional loss ratios start to reduce because their cyber underwriting has increased in sophistication,” he said. “And also, I think, generally speaking, a lot of the corporate world has started to [have better cyber risk management] than they had 12 months ago. So the risk environment is improving a little bit, plus the crossover criminals are distracted.”

The CEO did not give projections for where cyber pricing would go from here. However, with a 74% combined ratio for H1, it will be increasingly hard to make the case to brokers for further substantial rate hikes.