In the months leading up to (Re)Connect and the wider conference season, the keynote speeches, company announcements and panel discussions have become noticeably more urgent.

Climate and ESG has certainly made its way into the public forum this year in a way it hasn’t before, with activists pushing the industry to go faster and further on their climate agendas and the global Cop26 meeting fast coming around the corner in November.

But even that aside, the increasing frequency of severe weather events even since the start of the year has been impossible to ignore.

Both Winter Storm Uri and the European floods have been examples of “surprise” aggregation events which have landed unexpectedly on (re)insurance P&Ls, while Hurricane Ida’s northeastern deluge will add complexity to what some might describe as a more standard modelled loss.

For (re)insurers, the topic of climate risk represents a two-pronged challenge.

On the one side, the industry must establish and deliver on its own green credentials and be seen to be taking a proactive stance on driving a more sustainable future. Here, much debate has focused on the slow withdrawal of (re)insurance cover from fuels such as coal, but there is also a fresh volume of disclosure on how companies are reducing their own carbon emissions.

At the same time, the risk profile of weather-related risks which were thought to be well understood are generating losses which go against the models and challenging cat margins. Getting a better handle on cat exposures in the face of a changing climate has now moved from private conversations to a very public debate.

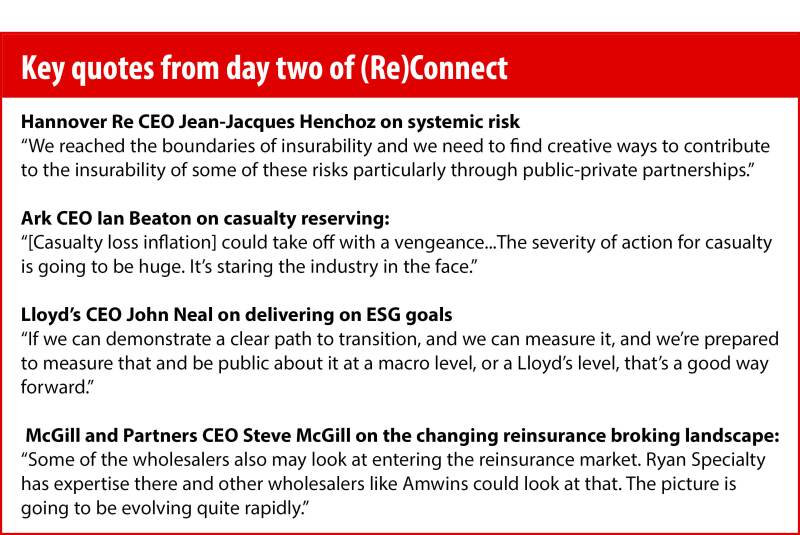

On the second day of the (Re)Connect conference, Hannover Re CEO Jean-Jacques Henchoz highlighted the balancing act between these two goals.

The executive said that the industry discussion around mitigating climate change had “totally dominated” the agenda, and reinsurance had a role to play in building a more resilient society in the face of more extreme weather.

“Whether we reach the goal of the Paris Agreement or not, adaptation will be the name of the game for our generation and the next couple of generations,” he said.

He argued that constructing and insuring more resilient buildings and applying pressure to prevent building on flood plains were key ways the reinsurance and ILS markets could help society adapt to climate change.

Lloyd’s CEO John Neal also took to the (Re)Connect platform to call to the industry to help clients with insuring their transition to net zero. He described climate as “an opportunity, not a threat” and said he hoped Lloyd’s would be able to reveal two new insurance products to support green energy this year.

In the same vein of Henchoz’s remarks, the Sustainable Markets Initiative (SMI) Insurance Task Force – representing some of the biggest names in insurance and chaired by Lloyd’s - also has a goal of encouraging a more resilient society with “build back better” clauses.

On the underwriting side, the frequency of cat events this year has been a common theme among (Re)Connect discussion so far, with many industry executives underlining that carriers cannot necessarily rely on models for accurate forecasting of loss events any more.

On a reinsurance panel, Everest Re CEO Juan Andrade and Hyperion X managing director for analytics David Flandro both questioned the efficacy of the models in use, and urged the industry to invest in the technology to improve these capabilities.

“The models we developed in the 90s are no longer fit for purpose – we've seen that with Ida,” Flandro said, adding that industry thinking on this front needed to be “nimbler” and more modern.

“We need to be challenging the assumptions behind the models,” he said.

(Re)Connect is running until Thursday and registration is free. The agenda is available online.